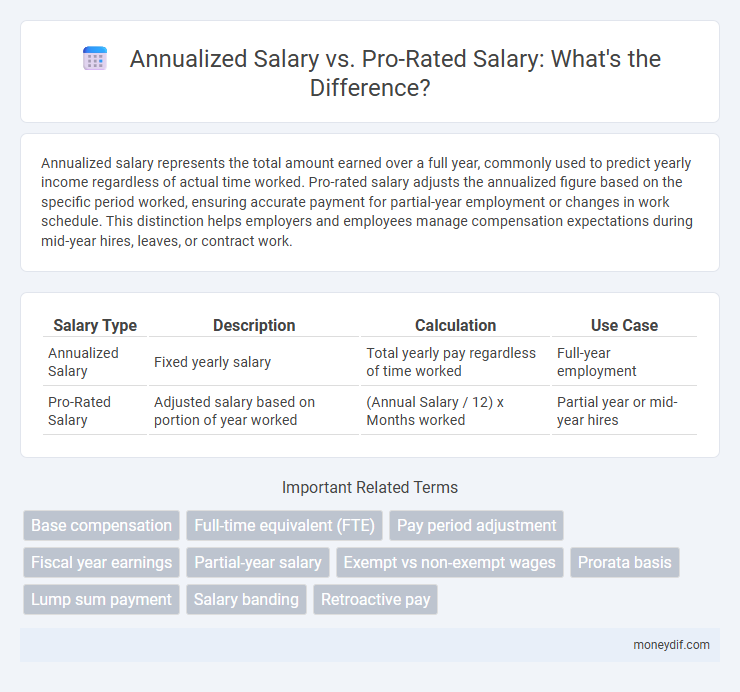

Annualized salary represents the total amount earned over a full year, commonly used to predict yearly income regardless of actual time worked. Pro-rated salary adjusts the annualized figure based on the specific period worked, ensuring accurate payment for partial-year employment or changes in work schedule. This distinction helps employers and employees manage compensation expectations during mid-year hires, leaves, or contract work.

Table of Comparison

| Salary Type | Description | Calculation | Use Case |

|---|---|---|---|

| Annualized Salary | Fixed yearly salary | Total yearly pay regardless of time worked | Full-year employment |

| Pro-Rated Salary | Adjusted salary based on portion of year worked | (Annual Salary / 12) x Months worked | Partial year or mid-year hires |

Understanding Annualized Salary: Definition and Importance

Annualized salary refers to the total amount an employee earns in a year, calculated by multiplying the regular pay period by the number of pay periods in a year. Understanding annualized salary is crucial for accurately comparing compensation packages, budgeting finances, and evaluating full-time equivalent earnings regardless of work schedule variations. This figure provides a clear, consistent metric for salary negotiations, tax calculations, and benefits eligibility assessment.

What is a Pro-Rated Salary? Explained

A pro-rated salary refers to the portion of an annual salary paid based on the actual time worked during a specific period, often used when an employee starts or leaves a job mid-year. It ensures fair compensation by calculating earnings proportionally to days or months worked rather than the full annual amount. This method is essential for maintaining payroll accuracy and aligning salary payments with actual employment duration.

Key Differences Between Annualized and Pro-Rated Salary

Annualized salary refers to the total amount an employee earns in a full year, typically expressed as a fixed yearly figure. Pro-rated salary calculates earnings based on the actual time worked, adjusting the annual figure for partial periods such as starting mid-year or taking unpaid leave. Understanding the key difference is essential for accurate payroll processing and budgeting, with annualized salary providing a standard expectation and pro-rated salary ensuring fair compensation for variable work durations.

Calculating Annualized Salary: Methods and Examples

Calculating annualized salary involves multiplying the employee's regular pay by the total number of pay periods in a year, providing a clear estimate of yearly earnings regardless of actual time worked. For example, if a monthly salary is $4,000, multiplying by 12 months results in an annualized salary of $48,000. This method contrasts with pro-rated salary, which adjusts earnings based on the exact duration of employment within a pay period.

How to Calculate a Pro-Rated Salary Step-by-Step

To calculate a pro-rated salary, first determine the employee's full annual salary and the total number of working days or months in the year. Next, identify the actual number of days or months the employee worked within the pay period. Multiply the full annual salary by the ratio of worked days or months to total days or months, resulting in the precise pro-rated salary amount owed.

When to Use an Annualized Salary vs. a Pro-Rated Salary

Annualized salary is best used when an employee works a full year, providing a fixed amount that reflects the total earnings over 12 months. Pro-rated salary applies when an employee starts mid-year or works part-time, adjusting the annual salary proportionally to reflect actual work periods. Choosing between annualized and pro-rated salaries depends on employment duration and hours worked to ensure accurate compensation.

Pros and Cons of Annualized Salary for Employees

Annualized salary guarantees a fixed income throughout the year, providing financial stability even during periods of reduced work hours or layoffs. Employees benefit from predictable monthly payments, simplifying budgeting and long-term financial planning. However, this system may disadvantage those who work overtime or extra hours since annualized pay typically does not increase with additional work beyond the set salary.

Advantages and Drawbacks of Pro-Rated Salary

Pro-rated salary offers the advantage of precise compensation aligned with actual time worked, making it ideal for part-time or temporary employment. However, a drawback is the potential for lower overall income compared to annualized salary, which may affect financial stability and benefits tied to full-time status. Pro-rated salary can also complicate budgeting and tax calculations due to fluctuating pay periods.

Common Scenarios: Annualized vs. Pro-Rated Salary in Practice

Annualized salary represents the total pay an employee earns over one year, typically divided into regular pay periods, while pro-rated salary calculates earnings based on the actual time worked within that year. Common scenarios for pro-rated salary include employees starting mid-year, part-time staff, or those taking unpaid leave, ensuring fair compensation aligned with their service duration. Understanding the distinction helps employers and employees clearly manage payroll expectations during hiring, termination, or contract changes.

Annualized Salary vs. Pro-Rated Salary: Which Is Right for You?

Annualized salary represents the total yearly earnings before deductions, providing a clear view of your full-time income potential. Pro-rated salary calculates earnings based on the actual time worked, ideal for part-time roles or mid-year hire scenarios. Choosing between annualized and pro-rated salary depends on your employment status and whether you seek a consistent annual figure or pay aligned with actual working periods.

Important Terms

Base compensation

Base compensation typically refers to the fixed salary an employee earns annually, serving as the foundation for total earnings calculations. Annualized salary represents the full-year pay regardless of employment duration, while pro-rated salary adjusts this amount proportionally based on the actual time worked within the year.

Full-time equivalent (FTE)

Full-time equivalent (FTE) measures employee workload as a fraction of full-time hours, crucial for comparing annualized salary, which assumes a full year of work, against pro-rated salary, which adjusts pay based on actual hours or service duration. Understanding FTE enables accurate budgeting and payroll calculations by aligning compensation with the proportion of time worked.

Pay period adjustment

Pay period adjustment ensures accurate compensation by aligning annualized salary with pro-rated salary based on actual employment duration within the pay period.

Fiscal year earnings

Fiscal year earnings reflect the total income based on either an annualized salary, calculated as a full year's pay regardless of actual months worked, or a pro-rated salary, adjusted proportionally to the actual period of employment within the fiscal year.

Partial-year salary

Partial-year salary is calculated by either annualizing the employee's salary to reflect a full year or pro-rating the actual salary earned during the employment period based on the specific number of months or days worked.

Exempt vs non-exempt wages

Exempt wages typically apply to salaried employees paid an annualized salary regardless of hours worked, while non-exempt wages are often hourly or pro-rated based on actual hours worked, affecting overtime eligibility and wage calculation.

Prorata basis

Prorata basis calculates an employee's salary proportionate to the time worked within a billing period, often used for part-time or mid-year hires, differing from annualized salary which reflects the total expected earnings over a full year. Pro-rated salary adjusts the annualized salary based on actual days or months worked, ensuring accurate compensation aligned with employment duration.

Lump sum payment

Lump sum payments are typically calculated based on an employee's annualized salary but adjusted proportionally when using a pro-rated salary to reflect the exact period worked.

Salary banding

Salary banding categorizes compensation ranges based on annualized salary figures, while pro-rated salary adjusts pay proportionally according to actual time worked within a pay period or employment duration.

Retroactive pay

Retroactive pay occurs when an employee receives compensation for a previous period based on adjustments to their annualized salary rather than their pro-rated salary, ensuring full salary entitlements are met despite prior underpayment. Differences between annualized and pro-rated salary calculations affect the retroactive amount, with annualized salary reflecting the total yearly earnings while pro-rated salary accounts for actual time worked within that period.

annualized salary vs pro-rated salary Infographic

moneydif.com

moneydif.com