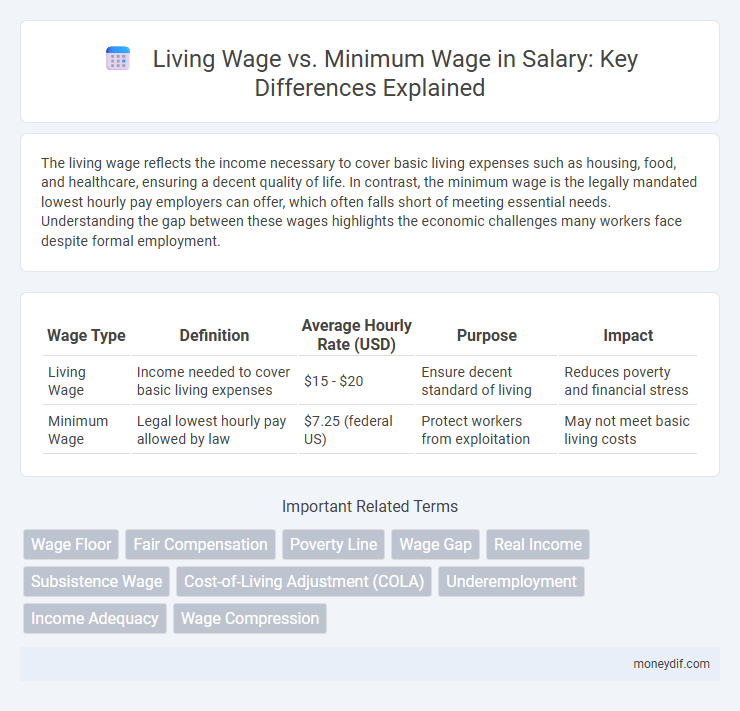

The living wage reflects the income necessary to cover basic living expenses such as housing, food, and healthcare, ensuring a decent quality of life. In contrast, the minimum wage is the legally mandated lowest hourly pay employers can offer, which often falls short of meeting essential needs. Understanding the gap between these wages highlights the economic challenges many workers face despite formal employment.

Table of Comparison

| Wage Type | Definition | Average Hourly Rate (USD) | Purpose | Impact |

|---|---|---|---|---|

| Living Wage | Income needed to cover basic living expenses | $15 - $20 | Ensure decent standard of living | Reduces poverty and financial stress |

| Minimum Wage | Legal lowest hourly pay allowed by law | $7.25 (federal US) | Protect workers from exploitation | May not meet basic living costs |

Defining Living Wage and Minimum Wage

Living wage represents the income necessary to cover basic living expenses, including housing, food, healthcare, and transportation, ensuring a decent standard of living. Minimum wage is the legally mandated lowest hourly pay that employers can offer workers, often set below the living wage threshold. Living wages vary by region to reflect local costs of living, while minimum wages are standardized by government regulations.

Historical Evolution of Wage Standards

The historical evolution of wage standards reveals that the minimum wage was initially established to prevent extreme exploitation and ensure a baseline income during the industrial revolution. Over time, the concept of a living wage emerged, emphasizing a pay rate sufficient to cover basic living expenses such as housing, food, and healthcare. Key legislative milestones, including the Fair Labor Standards Act (1938) and subsequent updates, reflect a gradual shift from minimum wage floors to more comprehensive living wage considerations.

Key Differences Between Living Wage and Minimum Wage

Living wage represents the income necessary to cover basic living expenses such as housing, food, healthcare, and transportation, ensuring a decent standard of living, whereas minimum wage is the legally mandated lowest hourly pay employers can offer, which often falls short of meeting these basic needs. The living wage varies geographically based on local costs of living, while minimum wage is set by federal or state governments and may not align with regional economic conditions. Understanding these distinctions is crucial for policy development aimed at reducing poverty and promoting economic stability among workers.

Economic Impacts of Raising the Minimum Wage

Raising the minimum wage stimulates consumer spending by increasing disposable income for low-wage workers, which can boost local economies and reduce poverty levels. However, it may also lead to higher business costs, potentially resulting in reduced hiring, increased automation, or price inflation for goods and services. Economic studies reveal mixed outcomes, with benefits like decreased income inequality often balanced against risks of job displacement in certain sectors.

The Cost of Living and Its Influence on Wages

The cost of living directly impacts the gap between living wage and minimum wage, with living wage calculations factoring in essential expenses like housing, food, healthcare, and transportation. Minimum wage often falls short of covering these basic needs, leading to financial strain for low-income workers in high-cost areas. Adjusting wages to reflect living costs ensures that workers can maintain a decent standard of living without relying on government assistance or working multiple jobs.

Living Wage Calculations Across Regions

Living wage calculations vary significantly across regions due to differences in local cost of living, housing, healthcare, transportation, and food expenses. Organizations like the MIT Living Wage Calculator provide detailed regional data to determine the minimum income necessary for workers to meet basic needs without relying on government assistance. These region-specific living wage benchmarks often exceed federal and state minimum wage standards, emphasizing the gap between legal minimum income and actual cost of living requirements.

Employer Perspectives on Wage Policies

Employers recognize that implementing a living wage can improve employee productivity, reduce turnover rates, and enhance company reputation, outweighing the higher immediate labor costs compared to paying minimum wage. Many businesses view living wage policies as an investment in workforce stability and customer satisfaction, which ultimately supports sustainable growth. Employer perspectives increasingly prioritize fair compensation to attract skilled talent and comply with evolving regulatory standards.

Social and Community Effects of Wage Increases

Increasing the living wage rather than just the minimum wage enhances social equity by reducing poverty and income inequality in communities. Higher wages boost local economies through increased consumer spending and decrease reliance on social welfare programs, fostering community stability. Improved financial security also leads to better mental health and stronger family relationships, promoting overall societal well-being.

Policy Debates: Arguments For and Against Living Wage Laws

Living wage laws aim to set pay standards that meet basic living costs, often exceeding minimum wage requirements, to reduce poverty and improve worker well-being. Advocates argue these laws boost local economies and reduce reliance on social services, while opponents claim they may increase unemployment and burden small businesses. Policy debates focus on balancing fair wages with potential economic trade-offs to achieve sustainable labor market outcomes.

Future Trends in Wage Legislation

Future trends in wage legislation indicate a growing shift toward adopting living wage standards that surpass traditional minimum wage floors to better address cost-of-living disparities. Policymakers are increasingly integrating regional economic data and inflation metrics to set wages that ensure workers can meet basic living expenses without financial stress. Advances in automation and remote work are also influencing wage policies, prompting governments to reconsider minimum wage frameworks to reflect evolving labor market dynamics.

Important Terms

Wage Floor

A wage floor establishes the lowest legal pay employees can receive, with the minimum wage often set by government statutes, while the living wage calculates earnings needed to cover basic living expenses like housing, food, and healthcare. Unlike minimum wage, which may not keep pace with inflation or regional cost variations, the living wage aims to ensure workers maintain a decent standard of living aligned with local economic conditions.

Fair Compensation

Fair compensation ensures workers receive a living wage that covers basic needs and sustains a decent standard of living, unlike the minimum wage which often falls short of this standard.

Poverty Line

The poverty line defines the income threshold below which individuals cannot meet basic living standards, highlighting the gap between the living wage needed for a decent life and the often lower minimum wage set by law.

Wage Gap

The wage gap between living wage and minimum wage highlights the disparity where minimum wage often fails to meet the cost of basic living expenses.

Real Income

Real income measures purchasing power by adjusting nominal wages like minimum wage and living wage for inflation and cost of living differences.

Subsistence Wage

Subsistence wage refers to the minimum income required for an individual to meet basic survival needs such as food, shelter, and clothing, often considered lower than the living wage, which covers broader essentials including healthcare and education. Unlike the minimum wage set by law as the lowest legal pay, the living wage and subsistence wage reflect more accurate assessments of true cost-of-living expenses in specific regions.

Cost-of-Living Adjustment (COLA)

Cost-of-Living Adjustment (COLA) ensures wages keep pace with inflation, directly impacting the gap between minimum wage and living wage by addressing basic expense increases. While minimum wage sets the legal baseline, living wage reflects actual income needed for a decent standard of living, making COLA crucial for closing the disparity and improving economic well-being.

Underemployment

Underemployment exacerbates the gap between minimum wage earnings and a living wage, resulting in insufficient income to meet basic living expenses.

Income Adequacy

Income adequacy depends on whether the minimum wage meets or exceeds the living wage required to cover basic living expenses such as housing, food, healthcare, and transportation.

Wage Compression

Wage compression occurs when the living wage closely aligns with or surpasses the minimum wage, reducing pay differentials between entry-level and experienced workers.

Living Wage vs Minimum Wage Infographic

moneydif.com

moneydif.com