Pay compression occurs when there is little difference in pay between employees regardless of their experience or skills, often due to market rate adjustments or internal salary caps. Pay inversion happens when new hires receive higher salaries than existing employees in similar roles, causing dissatisfaction and retention challenges. Addressing these issues requires regular market salary analysis and transparent compensation strategies to maintain workforce equity.

Table of Comparison

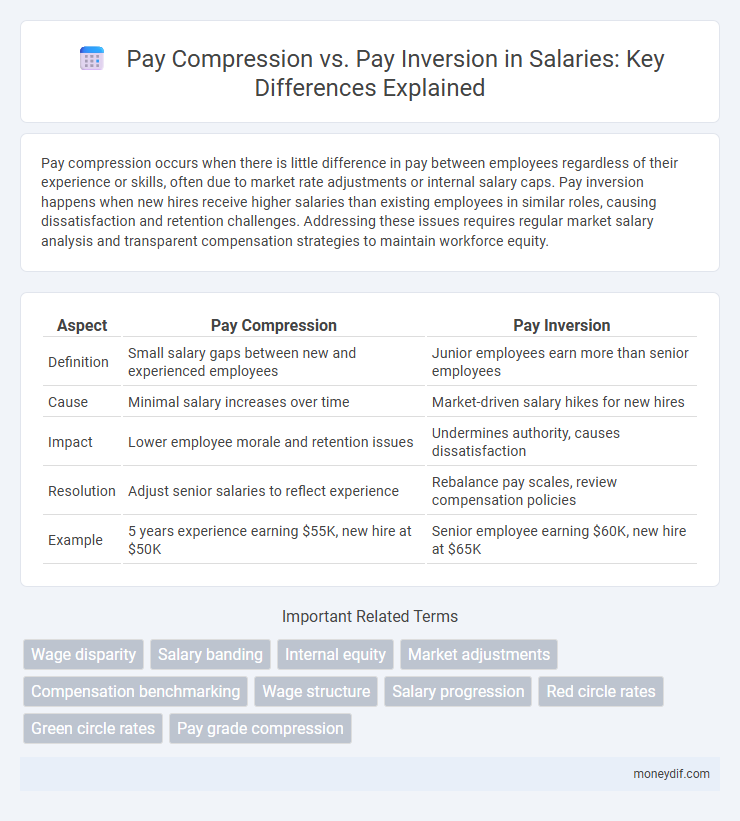

| Aspect | Pay Compression | Pay Inversion |

|---|---|---|

| Definition | Small salary gaps between new and experienced employees | Junior employees earn more than senior employees |

| Cause | Minimal salary increases over time | Market-driven salary hikes for new hires |

| Impact | Lower employee morale and retention issues | Undermines authority, causes dissatisfaction |

| Resolution | Adjust senior salaries to reflect experience | Rebalance pay scales, review compensation policies |

| Example | 5 years experience earning $55K, new hire at $50K | Senior employee earning $60K, new hire at $65K |

Understanding Pay Compression and Pay Inversion

Pay compression occurs when there is little difference in pay between employees regardless of their experience or tenure, often due to outdated salary structures or market rate adjustments. Pay inversion happens when new hires receive higher salaries than existing employees with more experience, typically driven by competitive recruitment in high-demand industries. Understanding these compensation issues is crucial for maintaining employee morale and ensuring equitable salary policies within organizations.

Key Differences Between Pay Compression and Pay Inversion

Pay compression occurs when there is minimal difference in salary between employees regardless of experience or seniority, often leading to dissatisfaction among veteran staff. Pay inversion arises when new hires receive higher salaries than existing employees in similar roles, creating internal equity challenges. The key difference lies in pay compression narrowing salary gaps based on tenure, while pay inversion reverses expected pay hierarchies by compensating newcomers more generously than long-serving employees.

Causes of Pay Compression in the Workplace

Pay compression in the workplace occurs primarily due to rapid external market salary increases that are not matched internally, causing minimal wage differences between new hires and experienced employees. Internal pay policies that fail to regularly adjust compensation for tenured staff relative to market rates also contribute significantly. Budget constraints and inconsistent performance evaluations further exacerbate this issue, leading to employee dissatisfaction and retention challenges.

Factors Leading to Pay Inversion

Rapid inflation, market salary adjustments, and internal salary freezes contribute significantly to pay inversion, where new hires earn more than veteran employees. Organizational budget constraints and delayed performance reviews exacerbate the disparity, undermining employee morale and retention. Competitive labor markets and skills shortages often force companies to offer higher starting pay, intensifying pay inversion challenges.

Signs Your Organization Faces Pay Compression

Pay compression occurs when the salary difference between experienced employees and new hires is minimal, causing dissatisfaction among long-term staff. Signs your organization faces pay compression include difficulty retaining top talent, increased turnover rates, and frequent employee complaints about unfair pay. Another indicator is when salary surveys reveal salaries for new employees surpass or closely match those of seasoned employees performing similar roles.

The Impact of Pay Inversion on Employee Morale

Pay inversion occurs when new hires receive higher salaries than existing employees, causing significant dissatisfaction among long-term staff. This salary disparity undermines employee morale, leading to decreased productivity and increased turnover rates. Addressing pay inversion through transparent compensation policies is critical to maintaining workforce motivation and retention.

Addressing Pay Compression: Effective Strategies

Addressing pay compression involves implementing transparent salary structures and regularly reviewing market data to maintain competitive and equitable compensation. Establishing clear pay grades with defined salary bands helps prevent overlaps between new hires and experienced employees. Leveraging performance-based incentives and career development opportunities ensures alignment of pay with skills and contributions, reducing potential dissatisfaction.

Solving Pay Inversion Issues: Best Practices

Addressing pay inversion requires implementing transparent salary structures and regularly benchmarking roles against industry standards to maintain internal equity. Conducting salary audits combined with adjusting compensation bands ensures experienced employees receive competitive pay reflecting their tenure and skills. Effective communication and consistent performance evaluations foster trust and reduce turnover linked to pay disparities.

Legal and Ethical Considerations in Pay Structures

Pay compression occurs when there is little difference in pay between employees regardless of experience or seniority, often leading to legal risks related to wage discrimination claims and employee dissatisfaction that may affect retention. Pay inversion happens when new hires are paid more than existing employees, raising ethical concerns about fairness and equity and potential violations of contractual agreements or labor laws. Employers must carefully design pay structures to ensure compliance with Equal Pay Act provisions and avoid fostering workplace inequity that could result in legal disputes or decreased morale.

Future Trends in Compensation Management

Future trends in compensation management emphasize addressing pay compression and pay inversion to maintain equitable salary structures and enhance employee retention. Advanced analytics and AI-driven compensation tools enable organizations to identify disparities early, ensuring competitive pay aligned with market standards. Integration of real-time market data will become essential, allowing dynamic adjustments that prevent compression and inversion while promoting fairness and transparency.

Important Terms

Wage disparity

Wage disparity is influenced by pay compression, where pay differences between junior and senior employees narrow, and pay inversion, where new hires earn more than experienced staff, both disrupting equitable compensation structures.

Salary banding

Salary banding helps mitigate pay compression by establishing clear pay ranges that prevent experienced employees from earning less than new hires, thereby reducing the risk of pay inversion.

Internal equity

Internal equity ensures fair compensation structures by maintaining consistent pay differentials among employees with comparable skills and experience. Pay compression occurs when new hires' salaries approach those of longer-tenured employees, while pay inversion happens when newer employees receive higher pay than existing staff, both undermining internal equity and potentially reducing employee morale.

Market adjustments

Market adjustments correct pay compression caused by minimal salary differences among employees with similar roles and address pay inversion where newer hires receive higher salaries than longer-tenured employees.

Compensation benchmarking

Compensation benchmarking helps organizations analyze salary data to identify pay compression, where new hires earn nearly the same as experienced employees, and pay inversion, where new employees receive higher salaries than current staff in similar roles. Understanding these disparities enables companies to maintain equitable pay structures, improve employee retention, and align compensation with market standards.

Wage structure

Pay compression occurs when salary differences between inexperienced and experienced employees narrow, while pay inversion happens when new hires earn more than longer-tenured staff, both disrupting effective wage structures.

Salary progression

Salary progression often stagnates when pay compression reduces wage differentials between new and experienced employees, while pay inversion occurs when new hires receive higher salaries than tenured staff, undermining motivation and retention.

Red circle rates

Red circle rates occur when an employee's pay is frozen or maintained despite market adjustments, often to address pay compression, where new hires earn nearly the same as experienced staff. This strategy prevents pay inversion, a situation where less experienced employees receive higher salaries than longer-tenured employees, protecting internal salary equity.

Green circle rates

Green circle rates occur when an employee's salary is below the minimum pay range for their position, often causing pay compression where less-experienced employees earn nearly as much as senior staff. This situation can exacerbate pay inversion, where new hires receive higher salaries than longer-tenured employees, undermining internal pay equity and employee morale.

Pay grade compression

Pay grade compression occurs when differences between adjacent pay grades narrow significantly, leading to pay compression, while pay inversion happens when newer employees earn more than longer-tenured staff, both negatively impacting employee motivation and retention.

Pay compression vs Pay inversion Infographic

moneydif.com

moneydif.com