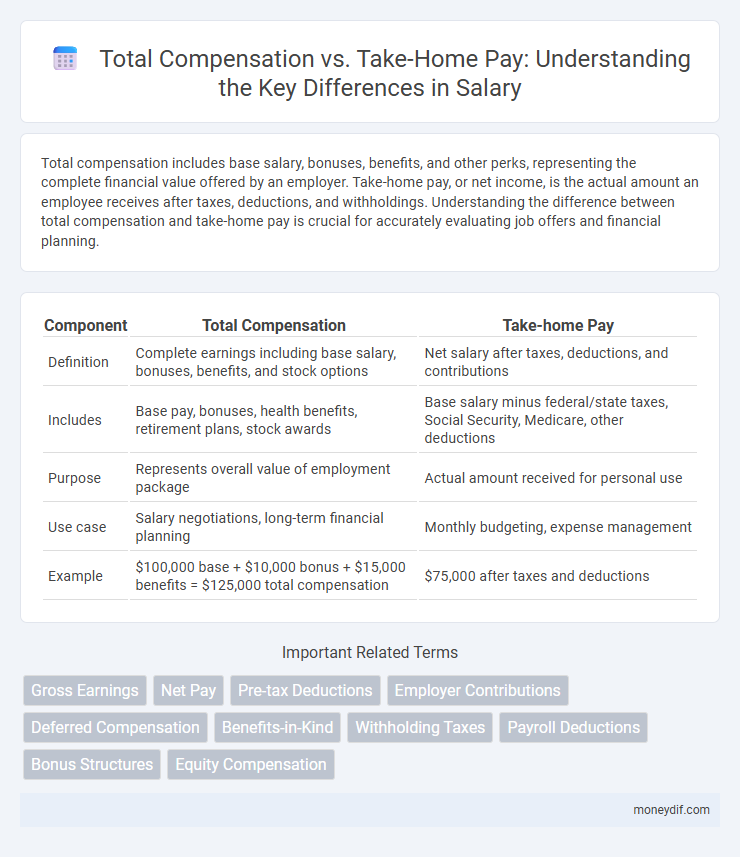

Total compensation includes base salary, bonuses, benefits, and other perks, representing the complete financial value offered by an employer. Take-home pay, or net income, is the actual amount an employee receives after taxes, deductions, and withholdings. Understanding the difference between total compensation and take-home pay is crucial for accurately evaluating job offers and financial planning.

Table of Comparison

| Component | Total Compensation | Take-home Pay |

|---|---|---|

| Definition | Complete earnings including base salary, bonuses, benefits, and stock options | Net salary after taxes, deductions, and contributions |

| Includes | Base pay, bonuses, health benefits, retirement plans, stock awards | Base salary minus federal/state taxes, Social Security, Medicare, other deductions |

| Purpose | Represents overall value of employment package | Actual amount received for personal use |

| Use case | Salary negotiations, long-term financial planning | Monthly budgeting, expense management |

| Example | $100,000 base + $10,000 bonus + $15,000 benefits = $125,000 total compensation | $75,000 after taxes and deductions |

Understanding Total Compensation

Total compensation encompasses an employee's base salary, bonuses, benefits, and any other financial perks provided by the employer, reflecting the full value of the job offer. Understanding total compensation is crucial for accurately evaluating job opportunities and making informed career decisions beyond just take-home pay. Benefits such as health insurance, retirement contributions, and stock options significantly impact the overall financial package and long-term wealth accumulation.

What Constitutes Take-home Pay?

Take-home pay refers to the net amount an employee receives after all deductions such as taxes, social security contributions, and retirement plan contributions are subtracted from the gross salary. It excludes non-cash benefits and employer-paid expenses included in total compensation like health insurance premiums or stock options. Understanding the distinction between total compensation and take-home pay helps employees accurately assess their actual disposable income.

Key Differences Between Total Compensation and Take-home Pay

Total compensation includes base salary, bonuses, benefits, and other financial perks, reflecting the complete earnings package from an employer. Take-home pay represents the net amount after taxes, retirement contributions, and deductions, available for personal use. Understanding these distinctions is crucial for accurately evaluating job offers and financial planning.

Salary vs. Benefits: Breaking Down Your Earnings

Total compensation encompasses base salary, bonuses, benefits, and other perks, providing a comprehensive view of your earnings beyond just take-home pay. Salary constitutes the direct payment received, while benefits such as health insurance, retirement contributions, and paid time off add significant value to your overall compensation package. Understanding the distinction between salary and benefits helps employees evaluate job offers more accurately and negotiate better terms aligned with their financial goals.

Taxes and Deductions: Impact on Take-home Pay

Taxes and deductions significantly reduce total compensation, directly impacting take-home pay. Mandatory withholdings such as federal, state, and local income taxes, along with Social Security and Medicare contributions, lower the net salary received. Understanding these deductions helps employees accurately assess their actual earnings and plan financial decisions effectively.

Hidden Perks: Evaluating Non-salary Compensation

Total compensation includes not only your base salary but also bonuses, stock options, health insurance, retirement contributions, and other non-salary benefits that significantly impact overall earnings. Evaluating these hidden perks is crucial for understanding the true value of a job offer beyond take-home pay. Benefits like flexible work schedules, professional development opportunities, and wellness programs often provide long-term financial and personal advantages that should be factored into compensation decisions.

How to Calculate Your Real Take-home Pay

To calculate your real take-home pay, start with your total compensation, which includes base salary, bonuses, and benefits. Subtract mandatory deductions such as federal, state, and local taxes, Social Security, and Medicare contributions. Account for additional withholdings like retirement plan contributions and health insurance premiums to determine the actual amount deposited into your bank account each pay period.

The Importance of Benefits in Total Compensation

Total compensation encompasses not only base salary but also benefits such as health insurance, retirement contributions, and bonuses, which significantly enhance overall financial value. These benefits often provide substantial cost savings and security that take-home pay alone does not cover, influencing employee satisfaction and retention. Understanding the full value of benefits is essential for accurately assessing job offers and long-term earning potential.

Negotiating Compensation: Focusing Beyond Salary

When negotiating compensation, consider total compensation, which includes salary, bonuses, benefits, stock options, and retirement contributions, rather than focusing solely on take-home pay. Evaluating the entire package ensures a better understanding of your overall financial and career value. Prioritizing aspects like health insurance coverage, paid time off, and professional development opportunities can significantly enhance long-term wealth and job satisfaction.

Making Informed Career Decisions: Total Compensation Analysis

Total compensation includes base salary, bonuses, benefits, stock options, and other perks, providing a comprehensive view of an employee's earning potential. Take-home pay reflects the net salary after taxes, deductions, and contributions, indicating the actual cash available for personal use. Analyzing total compensation versus take-home pay enables individuals to make informed career decisions by weighing immediate financial needs against long-term benefits and overall value.

Important Terms

Gross Earnings

Gross earnings represent the total income earned by an employee before deductions such as taxes, social security, and retirement contributions, serving as the foundation for calculating total compensation. Total compensation includes gross earnings plus employer-paid benefits and bonuses, while take-home pay refers to the net amount received after all mandatory and voluntary deductions have been subtracted from gross earnings.

Net Pay

Net pay represents the actual take-home pay after deducting taxes, benefits, and other withholdings from the total compensation package.

Pre-tax Deductions

Pre-tax deductions reduce taxable income, thereby lowering tax liability and increasing take-home pay within the total compensation package.

Employer Contributions

Employer contributions, including benefits and taxes, significantly increase total compensation beyond the employee's take-home pay, reflecting the full cost of employment to the company.

Deferred Compensation

Deferred compensation reduces immediate take-home pay while increasing total compensation by deferring income to future periods, often for tax advantages and long-term savings.

Benefits-in-Kind

Benefits-in-Kind increase total compensation by providing non-cash perks, which do not directly enhance take-home pay but improve overall employee value.

Withholding Taxes

Withholding taxes directly reduce total compensation, determining the difference between gross earnings and the take-home pay employees receive.

Payroll Deductions

Payroll deductions significantly reduce total compensation, directly impacting the amount of take-home pay received by employees.

Bonus Structures

Bonus structures significantly impact total compensation by enhancing overall earnings but may differ from take-home pay due to tax withholdings and benefit deductions.

Equity Compensation

Equity compensation significantly impacts total compensation by increasing overall value but often represents unrealized gains that do not directly translate to immediate take-home pay.

Total Compensation vs Take-home Pay Infographic

moneydif.com

moneydif.com