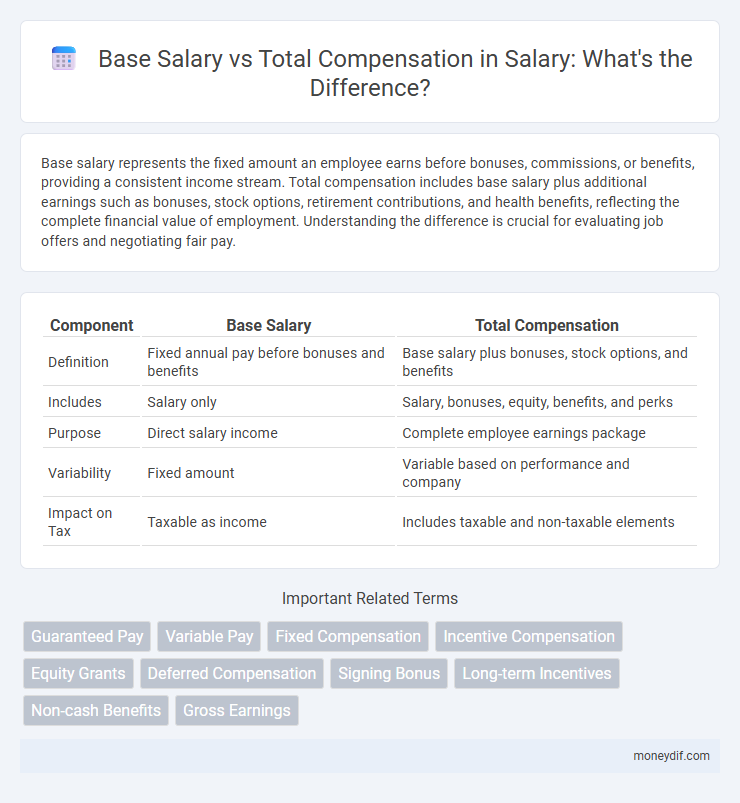

Base salary represents the fixed amount an employee earns before bonuses, commissions, or benefits, providing a consistent income stream. Total compensation includes base salary plus additional earnings such as bonuses, stock options, retirement contributions, and health benefits, reflecting the complete financial value of employment. Understanding the difference is crucial for evaluating job offers and negotiating fair pay.

Table of Comparison

| Component | Base Salary | Total Compensation |

|---|---|---|

| Definition | Fixed annual pay before bonuses and benefits | Base salary plus bonuses, stock options, and benefits |

| Includes | Salary only | Salary, bonuses, equity, benefits, and perks |

| Purpose | Direct salary income | Complete employee earnings package |

| Variability | Fixed amount | Variable based on performance and company |

| Impact on Tax | Taxable as income | Includes taxable and non-taxable elements |

Understanding Base Salary: Definition and Importance

Base salary represents the fixed amount an employee earns before bonuses, benefits, or other incentives, serving as the foundation for total compensation. It is crucial for budgeting personal finances and negotiating job offers because it reflects the guaranteed income from work. Understanding base salary helps employees evaluate job opportunities accurately and ensures clarity in compensation discussions.

What Constitutes Total Compensation?

Total compensation comprises base salary along with bonuses, stock options, benefits, and other financial incentives. This comprehensive package reflects the full value an employee receives beyond just the fixed wage. Understanding total compensation helps in assessing the true earning potential and long-term financial rewards of a job.

Components of Base Salary vs Total Compensation

Base salary represents the fixed annual income paid to an employee, excluding any additional benefits or incentives. Total compensation encompasses base salary plus bonuses, stock options, health benefits, retirement contributions, and other financial perks. Understanding the components of total compensation provides a comprehensive view of an employee's overall earning potential beyond just the base pay.

Key Differences Between Base Salary and Total Compensation

Base salary refers to the fixed amount an employee earns regularly before bonuses, benefits, or other incentives are included. Total compensation encompasses base salary plus additional financial rewards such as bonuses, stock options, health benefits, and retirement contributions. Understanding these distinctions helps employees evaluate job offers and negotiate effectively based on the complete value of their remuneration package.

How to Calculate Total Compensation

Calculating total compensation involves adding the base salary to additional financial benefits such as bonuses, stock options, health insurance, retirement contributions, and other perks. To determine total compensation accurately, gather detailed data on all monetary and non-monetary rewards provided by the employer within a fiscal year. This comprehensive approach ensures a complete understanding of an employee's overall earnings beyond just the base salary figure.

Benefits Beyond Base Salary: What’s Included

Benefits beyond base salary include health insurance, retirement plans, bonuses, stock options, and paid time off, which collectively enhance total compensation value. Employers often offer wellness programs, tuition reimbursement, and flexible work arrangements as part of their benefits package. Understanding these components is crucial for evaluating the complete financial and non-financial rewards of a job offer.

Negotiating Your Total Compensation Package

Negotiating your total compensation package involves understanding the distinction between base salary and overall benefits such as bonuses, stock options, health insurance, and retirement plans. Emphasizing non-salary components can significantly increase your overall earnings, especially in competitive industries like tech, finance, or healthcare. Employers often have flexibility in offering bonuses and equity, so leveraging these elements can enhance your total value beyond the base salary figure.

Pros and Cons: Base Salary vs Total Compensation

Base salary provides a stable and predictable income, making budgeting and financial planning easier, but it may not fully reflect the overall value an employee receives. Total compensation includes bonuses, benefits, stock options, and other incentives which can significantly increase overall earnings but can vary year-to-year and may lack consistency. Understanding both components is essential for evaluating job offers or negotiating salary packages effectively.

Impact of Total Compensation on Talent Retention

Total compensation, comprising base salary, bonuses, benefits, and stock options, significantly influences talent retention by providing a comprehensive value package that meets diverse employee needs. Companies offering competitive total compensation report higher retention rates, as employees perceive greater financial security and career growth opportunities beyond just base salary. Effective total compensation strategies reduce turnover costs and enhance employee loyalty in competitive job markets.

Making Informed Career Decisions: Salary vs Total Compensation

Evaluating base salary alone can be misleading when making career decisions because total compensation includes bonuses, stock options, benefits, and perks that significantly impact overall earnings. Understanding the full compensation package helps professionals compare job offers more accurately and negotiate better terms. Prioritizing total compensation over just base salary ensures a comprehensive view of financial and non-financial rewards, leading to smarter career choices.

Important Terms

Guaranteed Pay

Guaranteed pay refers to the fixed portion of an employee's compensation, typically reflected in the base salary, providing financial stability regardless of performance. Total compensation encompasses guaranteed pay plus variable elements such as bonuses, commissions, and benefits, representing the full financial value an employee receives.

Variable Pay

Variable pay constitutes a portion of total compensation that fluctuates based on performance, company profits, or specific targets, complementing the fixed base salary. While base salary provides stable income, variable pay incentivizes employees through bonuses, commissions, or profit-sharing, significantly influencing overall earnings and motivation.

Fixed Compensation

Fixed compensation primarily includes the base salary, which is the guaranteed portion of an employee's earnings excluding bonuses, commissions, or other variable incentives. Total compensation encompasses fixed compensation plus variable pay, benefits, stock options, and other non-cash rewards, providing a comprehensive measure of employee remuneration.

Incentive Compensation

Incentive compensation significantly boosts total compensation beyond base salary by rewarding performance with bonuses, commissions, or profit-sharing.

Equity Grants

Equity grants significantly enhance total compensation by providing ownership stakes that complement base salary, aligning employee incentives with company performance and long-term value creation.

Deferred Compensation

Deferred compensation allows employees to shift a portion of their base salary into future payments, effectively increasing total compensation through tax deferral and long-term savings.

Signing Bonus

A signing bonus can significantly enhance total compensation by providing immediate financial incentives beyond base salary, attracting top talent and offsetting lower initial salary offers.

Long-term Incentives

Long-term incentives significantly enhance total compensation by supplementing base salary with performance-based rewards that align employee goals with company growth.

Non-cash Benefits

Non-cash benefits such as health insurance, retirement plans, and stock options significantly enhance total compensation beyond base salary by providing long-term financial security and added value. These perks often represent a critical portion of an employee's overall remuneration package, influencing job satisfaction and retention rates.

Gross Earnings

Gross earnings include base salary plus additional components such as bonuses, commissions, and benefits, representing an employee's total compensation package.

base salary vs total compensation Infographic

moneydif.com

moneydif.com