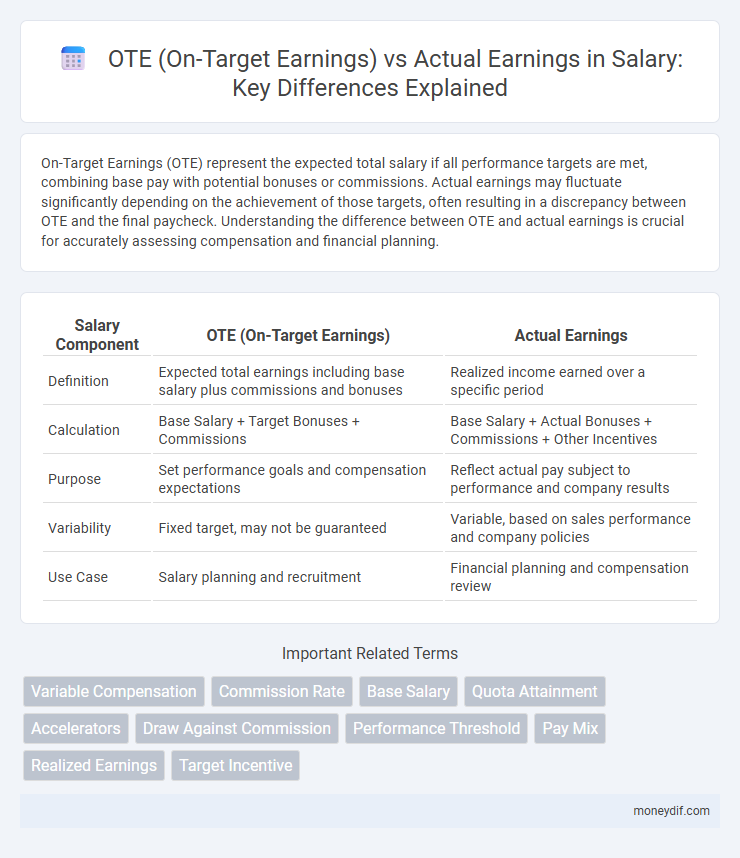

On-Target Earnings (OTE) represent the expected total salary if all performance targets are met, combining base pay with potential bonuses or commissions. Actual earnings may fluctuate significantly depending on the achievement of those targets, often resulting in a discrepancy between OTE and the final paycheck. Understanding the difference between OTE and actual earnings is crucial for accurately assessing compensation and financial planning.

Table of Comparison

| Salary Component | OTE (On-Target Earnings) | Actual Earnings |

|---|---|---|

| Definition | Expected total earnings including base salary plus commissions and bonuses | Realized income earned over a specific period |

| Calculation | Base Salary + Target Bonuses + Commissions | Base Salary + Actual Bonuses + Commissions + Other Incentives |

| Purpose | Set performance goals and compensation expectations | Reflect actual pay subject to performance and company results |

| Variability | Fixed target, may not be guaranteed | Variable, based on sales performance and company policies |

| Use Case | Salary planning and recruitment | Financial planning and compensation review |

Understanding OTE: What Does On-Target Earnings Mean?

On-Target Earnings (OTE) represents the total expected pay an employee can earn if performance targets are met, combining base salary with variable components like commissions and bonuses. Understanding OTE helps employees and employers clearly set realistic income expectations based on achievable sales or performance goals. Actual earnings may vary from OTE depending on actual performance, making OTE a predictive financial metric rather than a guaranteed salary figure.

Actual Earnings Explained: Calculating Your Real Income

Actual earnings reflect the real income received after bonuses, commissions, and other variable pay are included, providing a clear picture of total compensation beyond the On-Target Earnings (OTE) estimate. Calculating actual earnings requires summing base salary, performance incentives, and any additional benefits paid during the period. Tracking actual earnings helps employees gain accurate insight into their financial standing and supports better budgeting and career planning.

OTE vs Actual Earnings: Key Differences

On-Target Earnings (OTE) represent the expected total compensation, including base salary and variable incentives, assuming performance targets are met, while Actual Earnings reflect the real income received, which may be higher or lower depending on achieved results. OTE is a projection used for budgeting and goal-setting, whereas Actual Earnings provide a concrete figure after bonuses, commissions, and other variables are factored in. Understanding the gap between OTE and Actual Earnings is crucial for employees and employers in assessing performance outcomes and financial planning.

How Employers Calculate OTE in Salary Packages

Employers calculate On-Target Earnings (OTE) by combining a fixed base salary with variable components such as commissions, bonuses, and performance incentives expected upon meeting predefined targets. This calculation helps align employee motivation with business goals, projecting potential total compensation rather than guaranteed pay. Actual earnings may vary based on individual or company performance, but OTE provides a realistic benchmark during salary negotiations and compensation planning.

The Pros and Cons of OTE-Based Compensation

OTE-based compensation offers clarity by combining base salary and expected bonuses, motivating employees to meet performance targets and align efforts with company goals. However, reliance on projected earnings can create discrepancies when actual earnings fall short, potentially leading to employee dissatisfaction and financial uncertainty. This structure benefits sales roles with variable payouts but may introduce budgeting challenges for employers due to fluctuating payout amounts.

Common Industries Using OTE Salary Structures

Common industries using OTE (On-Target Earnings) salary structures include sales, real estate, and financial services, where compensation combines a fixed base salary with performance-based commissions or bonuses. Actual earnings in these sectors often fluctuate based on achieving sales targets, market conditions, and individual productivity. This pay model incentivizes high performance, aligning employee rewards with business revenue goals while providing potential for substantial income above the base salary.

OTE and Commission: What Sales Professionals Should Know

On-Target Earnings (OTE) represent the expected total compensation, including base salary and commissions, that sales professionals aim to achieve if they meet predefined performance targets. Commission structures within OTE provide incentives directly tied to sales results, motivating employees to exceed quotas and maximize their income potential. Understanding the distinction between OTE and actual earnings is crucial, as actual earnings may vary based on performance fluctuations, market conditions, or company policies.

Evaluating Job Offers: OTE vs Guaranteed Salary

Evaluating job offers requires a careful comparison between OTE (On-Target Earnings) and guaranteed salary, as OTE represents potential total income including commissions and bonuses contingent on performance. Guaranteed salary provides a fixed, predictable amount, ensuring financial stability regardless of sales or targets achieved. Candidates should assess their risk tolerance and confidence in meeting performance metrics to determine the most advantageous compensation structure.

Potential Pitfalls: When Actual Earnings Fall Short of OTE

Discrepancies between OTE (On-Target Earnings) and actual earnings often arise due to overambitious sales targets or market fluctuations, leading to employee dissatisfaction and turnover. Unrealistic OTE figures can mislead candidates during recruitment, causing trust issues when commissions or bonuses underperform. Employers must calibrate OTE with historical data and achievable benchmarks to maintain motivation and retention in sales-driven roles.

Negotiating Your Compensation: Bridging the Gap Between OTE and Actual Income

Negotiating your compensation requires understanding the difference between OTE (On-Target Earnings) and actual earnings to bridge the income gap effectively. OTE represents the projected total income, including base salary and potential bonuses, while actual earnings may vary based on performance outcomes and company policies. Focusing on clear communication and realistic goal-setting during negotiations helps align expectations, ensuring a more predictable and satisfactory total compensation package.

Important Terms

Variable Compensation

Variable compensation directly impacts Actual earnings by fluctuating around the On-Target Earnings (OTE), which represents the expected total pay when performance goals are met.

Commission Rate

Commission rate directly influences the gap between OTE (On-Target Earnings) and actual earnings, where a higher commission rate typically drives actual earnings above the OTE benchmark.

Base Salary

Base salary forms the fixed component of total compensation, while OTE represents the expected earnings including variable incentives, which actual earnings may exceed or fall short of depending on performance.

Quota Attainment

Quota attainment measures the percentage of sales targets achieved, directly impacting actual earnings relative to the OTE (On-Target Earnings) for accurate performance-based compensation assessment.

Accelerators

Accelerators in sales compensation plans increase commission rates once sales representatives exceed their OTE (On-Target Earnings), directly boosting actual earnings beyond expected targets.

Draw Against Commission

Draw Against Commission is a payment structure where a salesperson receives an advance on future commissions, which is later deducted from their actual earnings, ensuring a minimum income regardless of sales performance. This method impacts OTE (On-Target Earnings) by providing financial stability upfront, but actual earnings may vary significantly depending on commission generated beyond the draw amount.

Performance Threshold

Performance threshold defines the minimum achievement level where Actual Earnings begin to align with On-Target Earnings (OTE) in compensation plans.

Pay Mix

Pay mix defines the proportion between base salary and variable components within an OTE (On-Target Earnings) structure, directly influencing employee motivation and compensation risk. Comparing OTE with actual earnings reveals performance alignment and helps organizations assess compensation effectiveness and sales quota attainment.

Realized Earnings

Realized earnings represent the actual income received by an employee, which may differ from the OTE (On-Target Earnings) due to variations in performance, commissions, bonuses, or other incentive pay components.

Target Incentive

Target Incentive directly influences On-Target Earnings (OTE) by setting the expected bonus amount, which, when combined with base salary, provides a benchmark to compare against actual earnings to assess performance-based compensation.

OTE (On-Target Earnings) vs Actual earnings Infographic

moneydif.com

moneydif.com