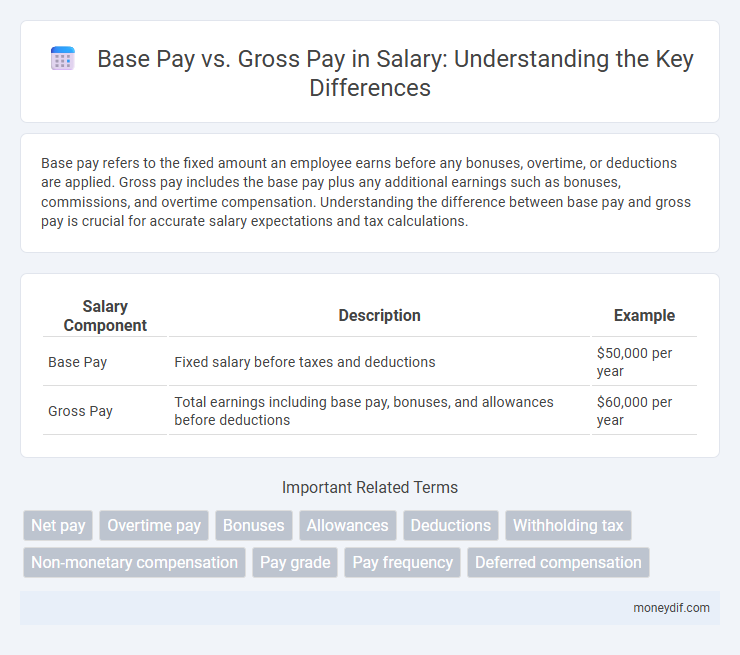

Base pay refers to the fixed amount an employee earns before any bonuses, overtime, or deductions are applied. Gross pay includes the base pay plus any additional earnings such as bonuses, commissions, and overtime compensation. Understanding the difference between base pay and gross pay is crucial for accurate salary expectations and tax calculations.

Table of Comparison

| Salary Component | Description | Example |

|---|---|---|

| Base Pay | Fixed salary before taxes and deductions | $50,000 per year |

| Gross Pay | Total earnings including base pay, bonuses, and allowances before deductions | $60,000 per year |

Understanding Base Pay: The Foundation of Your Salary

Base pay represents the core salary agreed upon between an employee and employer, excluding bonuses, overtime, and benefits. It serves as the foundation of gross pay, which encompasses total earnings before deductions such as taxes and retirement contributions. Understanding base pay is essential for evaluating job offers, salary negotiations, and financial planning.

Defining Gross Pay: What’s Included?

Gross pay includes the total earnings of an employee before any deductions, encompassing base pay, overtime, bonuses, and commissions. It represents the complete amount paid by the employer, reflecting all forms of compensation. Understanding gross pay is essential for accurate tax calculations and benefit assessments.

Key Differences Between Base Pay and Gross Pay

Base pay refers to the fixed salary an employee receives before any bonuses, overtime, or deductions, serving as the foundational compensation for job performance. Gross pay includes base pay plus additional earnings such as bonuses, commissions, overtime, and allowances before taxes and other deductions. Understanding the difference between base pay and gross pay is crucial for accurate salary negotiations and tax calculations.

Components That Make Up Gross Pay

Base pay is the fixed salary an employee earns before any additions or deductions. Gross pay includes base pay plus additional earnings such as overtime, bonuses, commissions, and allowances. Understanding these components is essential for accurate payroll processing and tax calculations.

Base Pay and Overtime: How They Relate

Base pay serves as the fixed amount an employee earns before any additional compensation, while overtime pay is calculated based on this base rate, typically at a higher multiplier such as 1.5 times the regular hourly wage. Understanding the relationship between base pay and overtime is crucial for accurate payroll calculations and compliance with labor laws. Businesses use base pay as the foundation to determine overtime earnings, ensuring employees receive fair compensation for extra hours worked.

Bonuses and Allowances: Are They Part of Your Gross Pay?

Bonuses and allowances are included in your gross pay, which represents the total earnings before deductions. Base pay refers to the fixed salary agreed upon, excluding variable components like bonuses or allowances. Understanding the distinction helps employees accurately assess their total compensation and tax obligations.

Tax Implications: Base Pay vs. Gross Pay

Base pay represents the fixed amount earned before deductions, while gross pay includes base pay plus additional earnings like bonuses and overtime, impacting taxable income. Tax implications arise because gross pay determines the total income subject to federal, state, and local taxes, influencing withholding amounts and tax brackets. Understanding the difference between base pay and gross pay is essential for accurate tax planning and maximizing net income.

How to Calculate Base Pay and Gross Pay

Base pay is calculated by multiplying the employee's hourly wage or annual salary by the total hours worked or the period of employment. Gross pay encompasses base pay plus any additional earnings such as overtime, bonuses, commissions, and allowances before deductions. Accurate calculation of gross pay requires summing all compensation components before taxes and benefits are withheld.

Impact on Employee Benefits: Base vs. Gross Pay

Base pay directly influences employee benefits like retirement contributions and bonuses, as these are often calculated as a percentage of base salary. Gross pay includes additional earnings such as overtime and allowances, which typically do not affect benefit calculations. Understanding the distinction between base and gross pay is crucial for accurately estimating total compensation and benefits eligibility.

Negotiating Salary: Focusing on Base Pay or Gross Pay

When negotiating salary, prioritizing base pay ensures a stable and predictable income, directly impacting benefits like retirement contributions and bonuses often calculated on this amount. Gross pay includes base salary plus additional earnings such as overtime, bonuses, and allowances, which can fluctuate and affect overall tax liabilities. Understanding the distinction between base pay and gross pay enables employees to negotiate more effectively, aligning compensation expectations with financial goals and tax implications.

Important Terms

Net pay

Net pay is the amount an employee receives after all deductions are subtracted from the gross pay, which includes base pay plus additional earnings such as bonuses and overtime.

Overtime pay

Overtime pay is calculated based on base pay, which represents the employee's regular hourly wage excluding bonuses and benefits, whereas gross pay includes both base pay and additional earnings like overtime, bonuses, and allowances. Understanding the distinction between base pay and gross pay is essential for accurately determining overtime compensation rates and ensuring compliance with labor laws.

Bonuses

Bonuses are typically calculated based on base pay, which excludes overtime and additional earnings, whereas gross pay includes base pay plus bonuses, overtime, and other compensation. Understanding the distinction between base pay and gross pay is essential for accurately assessing overall earnings and tax liabilities.

Allowances

Allowances increase gross pay by adding non-base pay components such as housing, transportation, and meals to the base pay.

Deductions

Deductions reduce the gross pay, which includes base pay plus additional earnings like bonuses and overtime, resulting in the net pay employees receive. Common deductions include taxes, retirement contributions, health insurance premiums, and other voluntary or mandatory withholdings.

Withholding tax

Withholding tax is calculated based on gross pay, which includes base pay plus all additional earnings such as bonuses and allowances, ensuring accurate tax deductions. Relying solely on base pay for withholding tax can lead to under-taxation, as it excludes other taxable components of an employee's total compensation.

Non-monetary compensation

Non-monetary compensation includes benefits such as health insurance, paid time off, and retirement plans that supplement an employee's base pay, which is the guaranteed salary excluding bonuses and incentives. Gross pay encompasses base pay plus all additional earnings and non-monetary benefits valued as part of the total compensation package, offering a comprehensive view of employee remuneration.

Pay grade

Pay grade determines the base pay, which is the fixed salary before bonuses and deductions; gross pay includes base pay plus overtime, allowances, and bonuses. Understanding the distinction helps employees evaluate total compensation within a specific pay grade.

Pay frequency

Pay frequency determines the regularity of paycheck issuance, impacting the calculation of base pay and the resulting gross pay, which includes additional earnings and deductions within each pay period.

Deferred compensation

Deferred compensation refers to a portion of an employee's earnings, often excluded from base pay, that is set aside for payment at a later date, impacting the calculation of gross pay. Understanding the distinction between base pay, which is the fixed salary, and gross pay, which includes bonuses, overtime, and deferred amounts, is crucial for accurate financial planning and tax reporting.

Base pay vs Gross pay Infographic

moneydif.com

moneydif.com