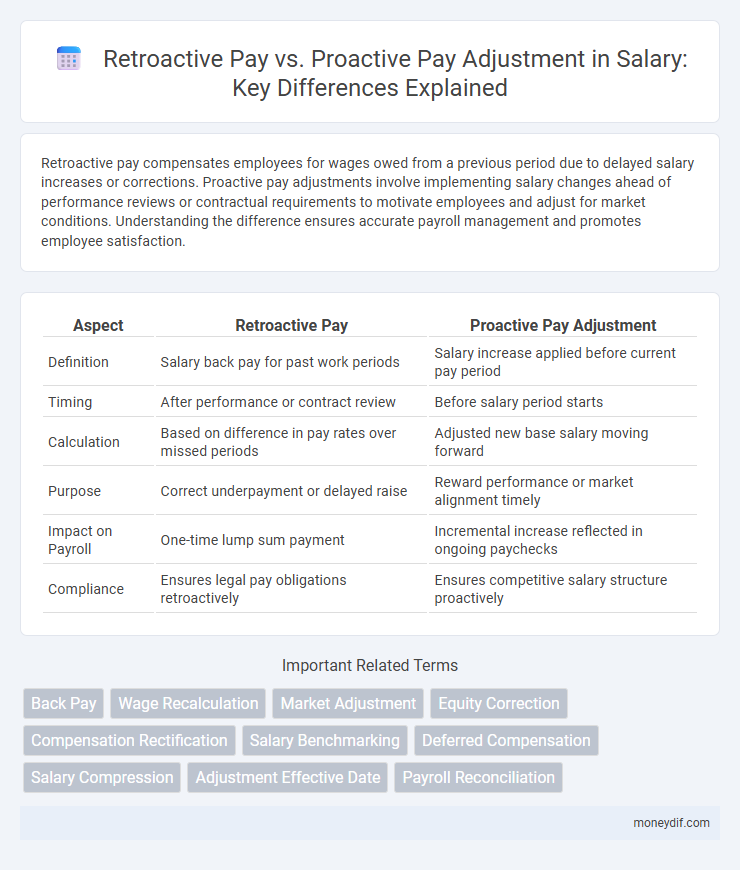

Retroactive pay compensates employees for wages owed from a previous period due to delayed salary increases or corrections. Proactive pay adjustments involve implementing salary changes ahead of performance reviews or contractual requirements to motivate employees and adjust for market conditions. Understanding the difference ensures accurate payroll management and promotes employee satisfaction.

Table of Comparison

| Aspect | Retroactive Pay | Proactive Pay Adjustment |

|---|---|---|

| Definition | Salary back pay for past work periods | Salary increase applied before current pay period |

| Timing | After performance or contract review | Before salary period starts |

| Calculation | Based on difference in pay rates over missed periods | Adjusted new base salary moving forward |

| Purpose | Correct underpayment or delayed raise | Reward performance or market alignment timely |

| Impact on Payroll | One-time lump sum payment | Incremental increase reflected in ongoing paychecks |

| Compliance | Ensures legal pay obligations retroactively | Ensures competitive salary structure proactively |

Understanding Retroactive Pay: Definition and Examples

Retroactive pay refers to compensation awarded for work already performed but not paid at the correct rate at the time of employment, often resulting from delayed wage increases or contract negotiations. Examples include back pay after a labor dispute resolution or adjustments following a pay scale revision that applies to previous pay periods. This ensures employees receive the full amount owed for past work, aligning actual wages with agreed terms.

What Is Proactive Pay Adjustment?

Proactive pay adjustment involves preemptively updating employee salaries based on performance evaluations, market trends, or cost-of-living increases before the official review period or salary discrepancies arise. This strategy helps organizations maintain competitive compensation, enhance employee satisfaction, and reduce turnover risks by aligning pay with evolving job responsibilities and industry standards. Unlike retroactive pay, proactive adjustments prevent delays in wage corrections and contribute to budget forecasting accuracy.

Key Differences Between Retroactive and Proactive Pay

Retroactive pay refers to compensation awarded for work previously completed, often due to delayed salary adjustments or contract negotiations, while proactive pay adjustments involve salary changes implemented before the pay period begins to reflect anticipated changes in job roles or market rates. Retroactive pay typically addresses past discrepancies or corrections, resulting in lump-sum payments, whereas proactive adjustments ensure continuous, timely salary alignment without back pay. Employers use retroactive pay to rectify underpayments, whereas proactive pay adjustments help maintain competitive compensation and employee satisfaction.

Legal Implications of Retroactive Pay

Retroactive pay involves compensating employees for work performed in a previous period, often due to delayed wage increases or contract disputes, which can trigger legal scrutiny related to wage and hour laws, back pay claims, and potential penalties for employers. Compliance with the Fair Labor Standards Act (FLSA) and state labor laws is critical to avoid lawsuits and enforce proper recordkeeping when issuing retroactive payments. Employers must ensure timely retroactive pay adjustments to mitigate the risk of litigation and financial liabilities associated with wage violations.

Benefits of Proactive Pay Adjustments for Employers

Proactive pay adjustments enable employers to maintain competitive salary structures, attracting and retaining top talent while reducing turnover costs. These adjustments improve employee morale and productivity by addressing compensation fairness before issues arise, fostering a motivated workforce. Implementing proactive pay strategies also helps organizations stay compliant with market trends and legal standards, minimizing risks of disputes or retroactive pay claims.

Common Scenarios for Retroactive Pay Adjustments

Retroactive pay adjustments commonly occur when an employer implements a salary increase or correction after the effective date, such as correcting payroll errors or honoring negotiated pay raises from collective bargaining agreements. Other scenarios include back pay awarded following legal disputes over wage violations or the implementation of delayed promotions and bonuses. These adjustments ensure employees receive the appropriate compensation for the period worked under revised pay terms.

Impact on Employee Satisfaction and Retention

Retroactive pay enhances employee satisfaction by addressing previous underpayments, fostering trust and a sense of fairness, which can improve retention rates. Proactive pay adjustments demonstrate a company's commitment to recognizing performance and market standards timely, boosting motivation and reducing turnover. Both strategies play crucial roles in maintaining a positive workplace environment and sustaining long-term employee loyalty.

Payroll Processing Challenges: Retroactive vs Proactive

Retroactive pay adjustments pose significant payroll processing challenges due to the need for recalculating wages for previous pay periods, often requiring complex back-pay computations and corrections in tax withholdings and benefits contributions. Proactive pay adjustments allow for smoother payroll implementation as salary changes are integrated in future pay cycles, reducing the risk of calculation errors and administrative burden. Organizations must maintain accurate payroll records and use robust software to efficiently handle both retroactive corrections and proactive pay updates.

Best Practices for Implementing Pay Adjustments

Implementing retroactive pay requires meticulous record-keeping and clear communication to address past payroll discrepancies transparently, ensuring legal compliance and employee trust. Proactive pay adjustments benefit from regular salary benchmarking and performance reviews to align compensation with market standards and organizational goals effectively. Establishing standardized protocols for both approaches enhances payroll accuracy, minimizes disputes, and supports equitable employee compensation management.

Choosing the Right Pay Adjustment Strategy

Choosing the right pay adjustment strategy depends on the company's financial stability, employee morale goals, and compliance requirements. Retroactive pay addresses past salary discrepancies and can boost employee trust but may strain budgets due to lump-sum payments. Proactive pay adjustments help maintain market competitiveness and prevent future pay gaps by regularly updating salaries based on performance and inflation projections.

Important Terms

Back Pay

Back Pay refers to the owed wages calculated retroactively for past work periods, whereas Proactive Pay Adjustment involves forward-looking salary changes implemented before future pay cycles.

Wage Recalculation

Wage recalculation involves adjusting employee pay retroactively to correct underpayments or proactively to update rates before the next payroll cycle.

Market Adjustment

Market adjustment adjusts employee salaries based on current market rates, with retroactive pay compensating workers for past underpayment and proactive pay adjustment aligning future wages to market standards.

Equity Correction

Equity correction ensures fair compensation by addressing pay disparities through retroactive pay, which compensates for past underpayments, or proactive pay adjustment, which corrects salaries moving forward without back pay. This process involves detailed wage audits to identify discrepancies and align employee pay with market standards or internal equity benchmarks.

Compensation Rectification

Compensation rectification involves retroactive pay adjustments to correct past underpayments and proactive pay adjustments to align future salaries with current standards.

Salary Benchmarking

Salary benchmarking reveals that retroactive pay addresses past compensation discrepancies, while proactive pay adjustments optimize future salary alignment with market standards.

Deferred Compensation

Deferred compensation plans allow employees to postpone portions of their income to future dates, offering tax advantages and financial planning benefits. Unlike retroactive pay, which adjusts for past pay discrepancies, proactive pay adjustments anticipate future salary changes, ensuring alignment with performance or market conditions before payroll processing.

Salary Compression

Salary compression occurs when retroactive pay increases fail to address pay equity, whereas proactive pay adjustments prevent compression by aligning salaries with current market and internal equity standards.

Adjustment Effective Date

The Adjustment Effective Date determines whether retroactive pay adjustments apply to prior pay periods or proactive pay adjustments affect future payroll cycles.

Payroll Reconciliation

Payroll reconciliation ensures accurate financial records by systematically comparing retroactive pay adjustments, which compensate for past underpayments, against proactive pay adjustments applied to prevent future discrepancies.

Retroactive Pay vs Proactive Pay Adjustment Infographic

moneydif.com

moneydif.com