A guaranteed bonus is a predetermined amount promised as part of an employee's compensation, providing financial stability and clear expectations. In contrast, a discretionary bonus depends on employer evaluation and performance metrics, offering flexibility but less predictability. Employees often value guaranteed bonuses for consistent income, while discretionary bonuses can motivate higher performance and reward exceptional achievements.

Table of Comparison

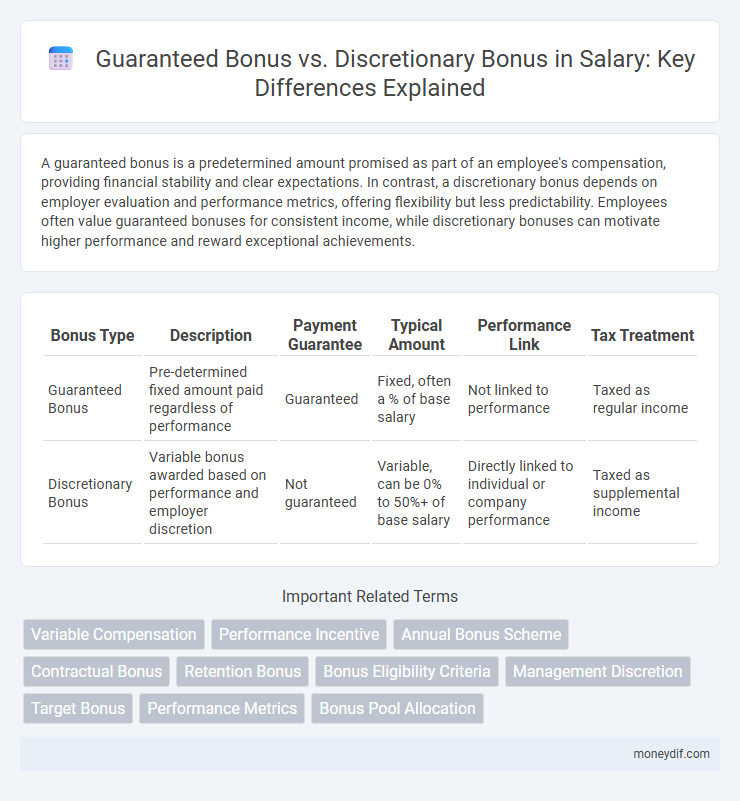

| Bonus Type | Description | Payment Guarantee | Typical Amount | Performance Link | Tax Treatment |

|---|---|---|---|---|---|

| Guaranteed Bonus | Pre-determined fixed amount paid regardless of performance | Guaranteed | Fixed, often a % of base salary | Not linked to performance | Taxed as regular income |

| Discretionary Bonus | Variable bonus awarded based on performance and employer discretion | Not guaranteed | Variable, can be 0% to 50%+ of base salary | Directly linked to individual or company performance | Taxed as supplemental income |

Understanding Guaranteed vs Discretionary Bonuses

Guaranteed bonuses are predetermined amounts promised to employees regardless of company performance, providing financial stability and predictability in total compensation. Discretionary bonuses, however, are variable payments awarded based on individual or company performance and are not contractually assured, allowing employers flexibility in rewarding exceptional contributions. Understanding the distinction between guaranteed and discretionary bonuses is vital for employees to evaluate overall salary expectations and negotiate compensation packages effectively.

Key Differences Between Bonus Types

Guaranteed bonuses are predetermined amounts included in an employee's compensation package, providing financial certainty regardless of company performance. Discretionary bonuses depend on employer judgment and company profits, often awarded for exceptional performance or achieving specific targets. Key differences include predictability, criteria for issuance, and impact on employee motivation, with guaranteed bonuses enhancing stability and discretionary bonuses encouraging merit-based rewards.

How Guaranteed Bonuses Work

Guaranteed bonuses are predetermined payments outlined in an employee's contract, ensuring a fixed additional amount added to their base salary regardless of company performance. These bonuses function as a form of salary enhancement or incentive, providing financial stability and predictability for employees. Unlike discretionary bonuses, guaranteed bonuses are legally enforceable and must be paid even if the employer's financial situation changes.

How Discretionary Bonuses Are Determined

Discretionary bonuses are determined based on employer judgment and performance metrics rather than predetermined criteria, allowing flexibility to reward employees for exceptional work or company success. These bonuses depend on factors like individual achievements, company profitability, and overall economic conditions, without guaranteed amounts. Employers assess qualitative and quantitative performance indicators to decide on the size and distribution of discretionary bonuses each fiscal period.

Advantages of Guaranteed Bonuses

Guaranteed bonuses provide employees with predictable and stable supplemental income, enhancing financial security and boosting morale. These bonuses are often tied to clear performance metrics, promoting transparency and fairness in reward distribution. Employers benefit from guaranteed bonuses by improving employee retention and fostering long-term loyalty.

Advantages of Discretionary Bonuses

Discretionary bonuses provide employers with flexibility to reward employees based on individual performance or company profitability, enhancing motivation and productivity. These bonuses allow for customized recognition, fostering a culture of meritocracy and encouraging ongoing effort beyond set targets. Unlike guaranteed bonuses, discretionary payments can be adjusted according to financial health, supporting better cash flow management for the business.

Impact on Employee Motivation and Retention

Guaranteed bonuses provide predictable financial rewards that boost employee motivation and foster long-term retention by reinforcing a sense of security and recognition. Discretionary bonuses, tied to individual or company performance, incentivize higher productivity and align employee efforts with organizational goals but may create uncertainty that affects morale. Balancing both bonus types can enhance motivation by offering stability and rewarding exceptional contributions, ultimately improving overall employee engagement and loyalty.

Legal and Contractual Implications

Guaranteed bonuses are contractually obligated payments that must be paid to employees as specified in employment agreements, providing legal protection and predictability. Discretionary bonuses, however, are awarded at the employer's discretion without prior contractual commitment, limiting legal enforceability and allowing flexibility in reward decisions. Understanding these distinctions is crucial for compliance with labor laws and mitigating risks of breach of contract claims.

Tax Considerations for Bonus Types

Guaranteed bonuses are treated as regular wages and subject to standard income tax withholding and Social Security contributions, ensuring predictable tax deductions for employees. Discretionary bonuses, while also taxable, are often withheld at a flat supplemental rate by employers, which may differ from the usual payroll tax rates. Understanding these tax distinctions helps employees better anticipate their net bonus income and optimize financial planning.

Choosing the Right Bonus Structure for Your Organization

Choosing the right bonus structure depends on your organization's financial stability and motivation goals; guaranteed bonuses provide predictable compensation that fosters employee loyalty, while discretionary bonuses offer flexibility to reward exceptional performance and align incentives with company success. Data from the WorldatWork 2023 Compensation Study indicates that 65% of companies favor discretionary bonuses to drive innovation and productivity. Tailoring the bonus system to your organizational culture and performance metrics ensures optimal employee engagement and retention.

Important Terms

Variable Compensation

Variable compensation encompasses both guaranteed bonuses, which are predetermined and contractually assured, and discretionary bonuses, awarded based on performance metrics or managerial judgment. Guaranteed bonuses provide financial stability by ensuring a fixed payout, whereas discretionary bonuses incentivize exceptional achievement and align employee goals with company success.

Performance Incentive

Performance incentives include guaranteed bonuses, which are fixed and contractually promised, and discretionary bonuses, which are variable and awarded based on individual or company performance evaluations.

Annual Bonus Scheme

Annual Bonus Schemes typically differentiate between Guaranteed Bonuses, fixed contractual payments regardless of performance, and Discretionary Bonuses, variable rewards based on individual or company performance metrics.

Contractual Bonus

Contractual bonuses are predefined and legally binding payments, whereas guaranteed bonuses are fixed amounts promised regardless of performance, and discretionary bonuses are variable rewards based on employer judgment and performance outcomes.

Retention Bonus

Retention bonuses are typically more aligned with guaranteed bonuses, providing employees with a predetermined incentive to remain with the company for a specified period, whereas discretionary bonuses are awarded based on performance or company profitability without a fixed commitment. Guaranteed retention bonuses ensure employee loyalty through contractual agreements, while discretionary bonuses offer flexibility to employers in rewarding contributions on an ad hoc basis.

Bonus Eligibility Criteria

Bonus eligibility criteria differentiate guaranteed bonuses, which are contractually assured based on predefined performance metrics, from discretionary bonuses awarded subjectively at management's judgment.

Management Discretion

Management discretion determines whether bonuses are classified as guaranteed, providing fixed employee compensation, or discretionary, allowing flexible, performance-based rewards.

Target Bonus

Target Bonus typically represents a predefined incentive aligned with performance metrics, distinguished from Guaranteed Bonus which is a fixed, assured payment irrespective of outcomes. Discretionary Bonus varies based on employer discretion, reflecting recognition of exceptional achievements beyond standard targets.

Performance Metrics

Guaranteed bonuses are performance metrics-based incentives that employees receive as a fixed component of their compensation, reflecting quantitative achievements such as sales targets, productivity levels, or project completions. Discretionary bonuses depend on qualitative assessments like managerial evaluations and company profitability, allowing flexibility in rewarding employees beyond predefined performance criteria.

Bonus Pool Allocation

Bonus Pool Allocation strategically balances Guaranteed Bonuses, which are fixed commitments, against Discretionary Bonuses, which are variable rewards based on performance and company profitability.

Guaranteed Bonus vs Discretionary Bonus Infographic

moneydif.com

moneydif.com