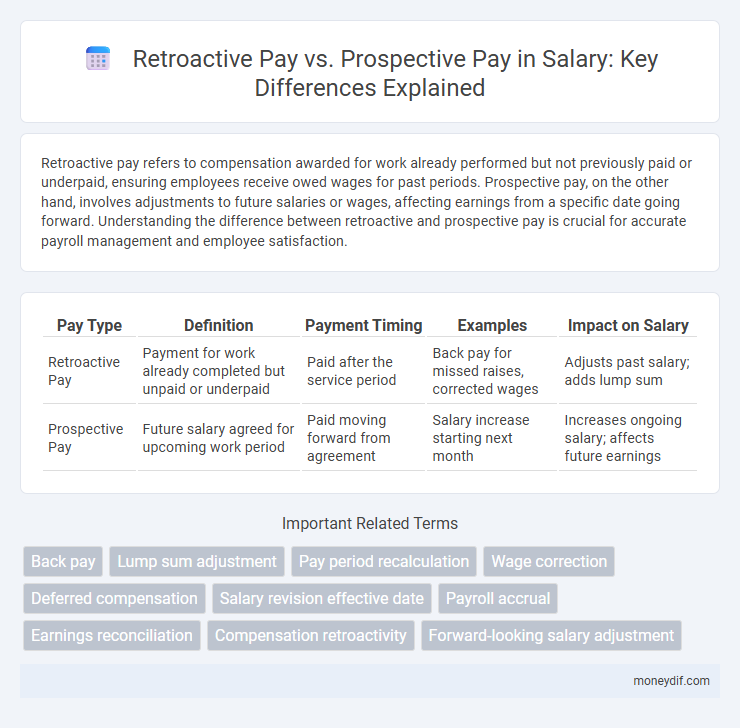

Retroactive pay refers to compensation awarded for work already performed but not previously paid or underpaid, ensuring employees receive owed wages for past periods. Prospective pay, on the other hand, involves adjustments to future salaries or wages, affecting earnings from a specific date going forward. Understanding the difference between retroactive and prospective pay is crucial for accurate payroll management and employee satisfaction.

Table of Comparison

| Pay Type | Definition | Payment Timing | Examples | Impact on Salary |

|---|---|---|---|---|

| Retroactive Pay | Payment for work already completed but unpaid or underpaid | Paid after the service period | Back pay for missed raises, corrected wages | Adjusts past salary; adds lump sum |

| Prospective Pay | Future salary agreed for upcoming work period | Paid moving forward from agreement | Salary increase starting next month | Increases ongoing salary; affects future earnings |

Retroactive Pay vs Prospective Pay: Key Differences

Retroactive pay refers to compensation awarded for work already performed, often resulting from salary adjustments due to contract negotiations or error corrections, while prospective pay applies to wages set for future work periods. Key differences include the timing of payment and legal implications, as retroactive pay typically involves a lump-sum payment covering past due amounts, whereas prospective pay affects ongoing salary levels moving forward. Understanding these distinctions is crucial for accurate payroll management and compliance with employment laws.

Defining Retroactive Pay in Salary Management

Retroactive pay refers to the compensation awarded to an employee for work performed in a previous pay period that was not paid at the correct rate initially. It often occurs due to delayed salary adjustments, contract renegotiations, or wage disputes and ensures employees receive the full amount owed for past work. Accurate calculation and timely distribution of retroactive pay are essential components of effective salary management to maintain compliance and employee satisfaction.

Understanding Prospective Pay and Its Application

Prospective pay refers to salary adjustments applied to future earnings based on promotions, raises, or contract changes effective from a specific date onward. This type of pay does not affect past wages but influences compensation moving forward, ensuring employees receive the agreed amount for work performed after the adjustment date. Employers use prospective pay adjustments to maintain payroll accuracy and compliance with updated compensation agreements.

When Is Retroactive Pay Required?

Retroactive pay is required when an employee's wages were previously underpaid due to errors, delayed contract negotiations, or revised pay agreements that take effect from an earlier date. Employers must calculate back pay for the exact period affected, ensuring compliance with labor laws and contractual obligations. This adjustment legally compensates workers for lost earnings during the retroactive timeframe.

Scenarios for Using Prospective Pay

Prospective pay is commonly used when salary adjustments are made to reflect future work periods, such as promotions, merit increases, or changes in job responsibilities agreed upon before the payment period begins. This approach prevents overpayment for past work and aligns compensation with anticipated performance or position. Employers often implement prospective pay to ensure fair compensation while maintaining financial control and accurate payroll records.

Legal Implications of Retroactive and Prospective Pay

Retroactive pay involves compensating employees for work performed in the past but unpaid, often mandated by legal rulings or wage disputes, which can result in back pay claims and potential penalties for employers. Prospective pay refers to future salary adjustments agreed upon in contracts or collective bargaining agreements, generally not subject to penalties but legally binding once implemented. Employers must navigate labor laws and contract terms carefully to ensure compliance with retroactive pay requirements and avoid litigation or regulatory action.

Impact on Employees: Retroactive vs Prospective Pay

Retroactive pay financially compensates employees for previous periods of underpayment, directly addressing past discrepancies and boosting morale by validating their prior work. Prospective pay adjustments affect future wages, motivating employees through anticipated increases and aligning compensation with current performance or market rates. Both approaches influence employee satisfaction, but retroactive pay delivers immediate financial relief, while prospective pay fosters long-term engagement and retention.

Payroll Processing: Retroactive Pay Challenges

Payroll processing for retroactive pay often involves recalculating past salaries to address missed raises or corrections, leading to increased complexity and potential errors in payroll systems. This process requires meticulous record-keeping and adjustments to tax withholdings, benefits deductions, and compliance with labor laws to avoid fines or disputes. In contrast, prospective pay is simpler to manage as it applies only to future salary periods without retroactive adjustments, reducing processing time and minimizing administrative burden.

Prospective Pay: Advantages for Employers and Employees

Prospective pay ensures clear budgeting and financial planning for employers by establishing salary adjustments before the pay period begins. Employees benefit from motivation and increased job satisfaction knowing future compensation reflects their current performance or market conditions. This approach minimizes administrative complexity and potential disputes compared to retroactive pay adjustments.

Best Practices for Managing Salary Adjustments

Implement clear policies that distinguish retroactive pay, compensating employees for past work, from prospective pay, applied to future earnings to avoid confusion and legal discrepancies. Maintain accurate payroll records and timely communication to ensure transparency and employee trust during salary adjustments. Utilize payroll software capable of handling backdated salary changes efficiently to minimize errors and administrative workload.

Important Terms

Back pay

Back pay refers to the amount owed for work performed during a past period, typically calculated as retroactive pay, whereas prospective pay applies to future earnings negotiated in advance.

Lump sum adjustment

Lump sum adjustment involves retroactive pay covering past unpaid wages and prospective pay reflecting future salary changes.

Pay period recalculation

Pay period recalculation adjusts earnings by accurately distinguishing retroactive pay owed for past work periods from prospective pay for upcoming periods to ensure precise payroll accounting.

Wage correction

Wage correction involves adjusting employee compensation either through retroactive pay for past underpayments or prospective pay for future earnings corrections.

Deferred compensation

Deferred compensation plans allow employees to receive earned income at a later date, impacting whether retroactive pay, which compensates for past periods, or prospective pay, which applies to future work, is adjusted. Employers must clearly distinguish between retroactive pay owed for prior services and prospective pay commitments to ensure accurate tax treatment and compliance with compensation regulations.

Salary revision effective date

Salary revision effective dates determine whether employees receive retroactive pay for past service or prospective pay starting from the revision date.

Payroll accrual

Payroll accrual accurately records retroactive pay adjustments for past periods, ensuring liabilities reflect owed wages, while prospective pay affects future payroll calculations without prior period adjustments.

Earnings reconciliation

Earnings reconciliation ensures accurate payroll adjustments by comparing retroactive pay, which corrects past underpayments, with prospective pay, reflecting current and future wages.

Compensation retroactivity

Compensation retroactivity involves calculating retroactive pay adjustments for past periods where underpayment occurred, contrasting with prospective pay, which applies to future salary changes without backdating.

Forward-looking salary adjustment

Forward-looking salary adjustments ensure future earnings reflect current market value, while retroactive pay compensates for past underpayments and prospective pay applies to future periods only.

retroactive pay vs prospective pay Infographic

moneydif.com

moneydif.com