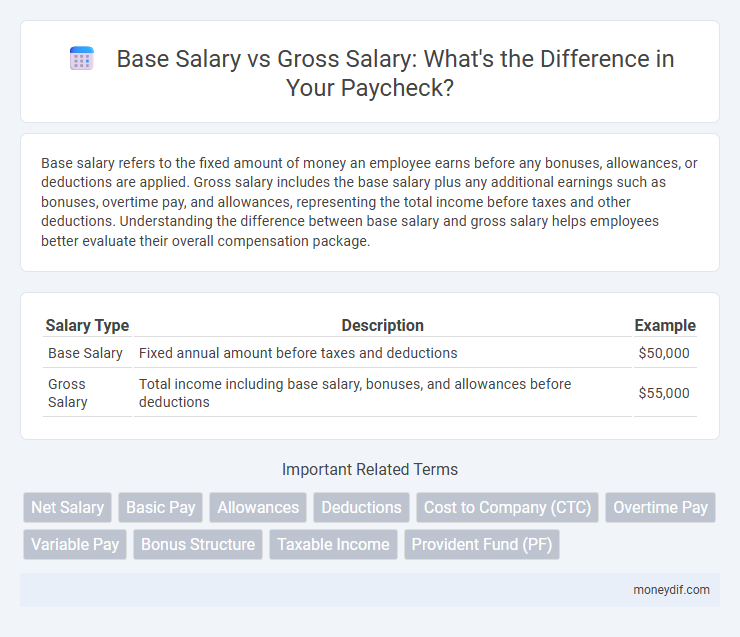

Base salary refers to the fixed amount of money an employee earns before any bonuses, allowances, or deductions are applied. Gross salary includes the base salary plus any additional earnings such as bonuses, overtime pay, and allowances, representing the total income before taxes and other deductions. Understanding the difference between base salary and gross salary helps employees better evaluate their overall compensation package.

Table of Comparison

| Salary Type | Description | Example |

|---|---|---|

| Base Salary | Fixed annual amount before taxes and deductions | $50,000 |

| Gross Salary | Total income including base salary, bonuses, and allowances before deductions | $55,000 |

Understanding Base Salary: Definition and Importance

Base salary represents the fixed amount of compensation an employee receives before bonuses, benefits, or deductions, forming the core of total earnings. Understanding base salary is essential for evaluating job offers, negotiating pay, and assessing financial stability. Unlike gross salary, which includes additional income components, the base salary provides a clear benchmark for salary comparisons across industries.

What Constitutes Gross Salary?

Gross salary includes the base salary along with additional components such as bonuses, overtime pay, allowances, and any other monetary benefits before deductions like taxes and social security contributions. It represents the total earnings an employee receives from their employer, reflecting the full compensation package. Understanding gross salary is essential for accurate financial planning and tax calculations.

Key Differences Between Base Salary and Gross Salary

Base salary refers to the fixed amount of money an employee receives before any bonuses, overtime, or deductions, serving as the core component of compensation. Gross salary encompasses the total earnings before taxes and other deductions, including base salary plus additional financial benefits such as allowances, bonuses, and overtime pay. Understanding the distinction between base salary and gross salary is essential for accurate payroll calculation and financial planning.

Components Included in Gross Salary

Gross salary includes the base salary along with additional components such as bonuses, allowances, overtime pay, and benefits like health insurance contributions and retirement fund contributions. These components collectively increase the total earnings an employee receives before deductions like taxes and social security contributions. Understanding the distinction between base and gross salary helps employees evaluate their total compensation package accurately.

How Deductions Affect Base and Gross Salaries

Base salary represents the fixed amount an employee earns before any deductions, while gross salary includes the base salary plus all additional earnings such as bonuses and allowances. Deductions for taxes, social security, and retirement contributions are subtracted from the gross salary, reducing the final take-home pay. Understanding how these deductions affect the transition from gross to net salary is crucial for accurate financial planning.

Impact of Allowances on Gross Salary Calculation

Base salary represents the fixed amount an employee earns before any additions, while gross salary includes the base salary plus various allowances such as housing, transport, and medical benefits. Allowances significantly increase the gross salary, directly impacting the taxable income and overall compensation package. Understanding how these allowances contribute to gross salary is crucial for accurate salary calculations and financial planning.

Base Salary vs Gross Salary: Which Matters More?

Base salary is the fixed amount an employee earns before any deductions or bonuses, serving as a critical benchmark for budgeting and financial planning. Gross salary includes the base salary plus additional earnings such as bonuses, overtime, and allowances, reflecting the total compensation before taxes and deductions. Understanding the difference is essential, but base salary often matters more for long-term financial stability and benefits calculations.

How Base Salary Influences Benefits and Bonuses

Base salary serves as the foundational figure for calculating various employee benefits and bonuses, directly impacting their overall compensation package. Many organizations determine bonuses, commissions, and retirement contributions as a percentage of the base salary, making it crucial for maximizing total earnings. Understanding the distinction between base salary and gross salary reveals how employers structure incentives, with gross salary encompassing base pay plus additional earnings such as bonuses and overtime.

Tax Implications: Base Salary vs Gross Salary

Base salary refers to the fixed amount an employee earns before any bonuses or benefits, while gross salary includes the base salary plus additional earnings like bonuses and allowances. Tax implications differ significantly between the two, as gross salary is the figure used by tax authorities to calculate income taxes and social security contributions. Understanding the distinction helps employees accurately estimate their tax liabilities and net income.

Frequently Asked Questions About Salary Structures

Base salary refers to the fixed amount an employee earns before any bonuses, overtime, or deductions, while gross salary includes the base salary plus additional earnings such as bonuses and allowances before taxes and other deductions. Understanding the difference between base and gross salary helps employees accurately evaluate their compensation package and plan their finances effectively. Common salary structure FAQs highlight that gross salary is essential for tax calculations, whereas base salary often determines benefits and pension contributions.

Important Terms

Net Salary

Net salary is the amount employees receive after deductions like taxes and social security are subtracted from their gross salary, which itself is the total base salary plus additional earnings.

Basic Pay

Basic pay is the fixed portion of an employee's base salary excluding allowances and bonuses, whereas gross salary includes basic pay plus all additional earnings before tax deductions.

Allowances

Allowances increase the gross salary by adding non-base salary components, enhancing overall employee compensation beyond the fixed base salary.

Deductions

Deductions reduce the gross salary, which includes the base salary plus allowances and bonuses, to calculate the net pay an employee receives. Common deductions include taxes, social security contributions, health insurance premiums, and retirement fund contributions.

Cost to Company (CTC)

Cost to Company (CTC) represents the total expense incurred by an employer, encompassing the base salary plus all additional benefits, allowances, and statutory contributions that form the gross salary.

Overtime Pay

Overtime pay is typically calculated based on the employee's base salary rather than the gross salary, ensuring accurate compensation for extra hours worked.

Variable Pay

Variable pay is a performance-based compensation component added to the base salary, influencing the total gross salary an employee receives.

Bonus Structure

Bonus structure typically varies based on base salary and gross salary, with many organizations calculating bonuses as a percentage of base salary to maintain consistency and predictability. In some cases, bonuses may be linked to gross salary to factor in additional earnings like commissions or overtime, influencing the overall compensation package and employee motivation.

Taxable Income

Taxable income is calculated by subtracting allowable deductions, such as certain benefits or contributions, from the gross salary, which includes the base salary plus bonuses and other earnings. The base salary forms the core component of taxable income, but the gross salary provides the full taxable amount before deductions are applied.

Provident Fund (PF)

Provident Fund (PF) contributions are typically calculated based on the base salary rather than the gross salary, impacting the total PF amount accumulated by employees.

base salary vs gross salary Infographic

moneydif.com

moneydif.com