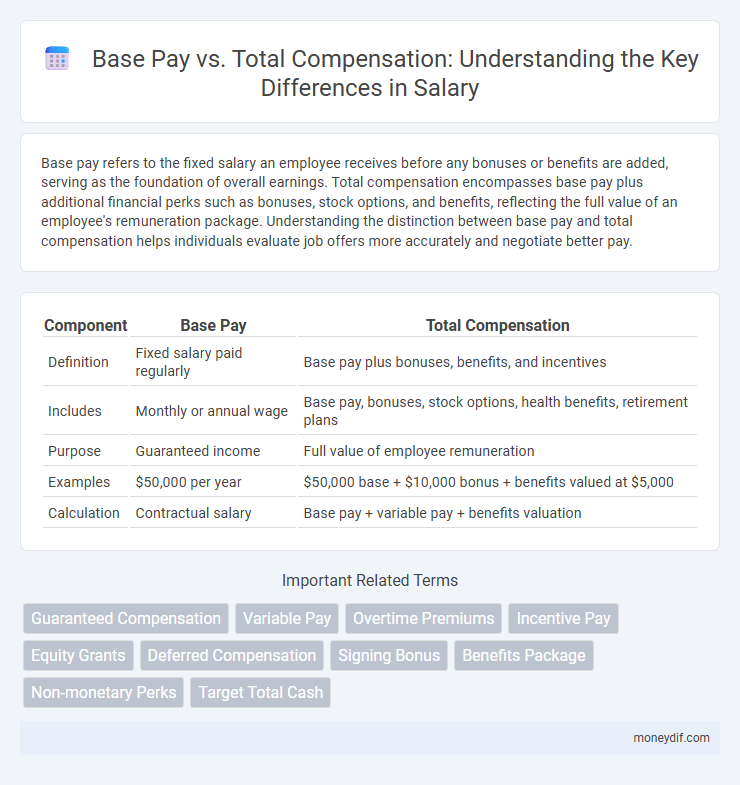

Base pay refers to the fixed salary an employee receives before any bonuses or benefits are added, serving as the foundation of overall earnings. Total compensation encompasses base pay plus additional financial perks such as bonuses, stock options, and benefits, reflecting the full value of an employee's remuneration package. Understanding the distinction between base pay and total compensation helps individuals evaluate job offers more accurately and negotiate better pay.

Table of Comparison

| Component | Base Pay | Total Compensation |

|---|---|---|

| Definition | Fixed salary paid regularly | Base pay plus bonuses, benefits, and incentives |

| Includes | Monthly or annual wage | Base pay, bonuses, stock options, health benefits, retirement plans |

| Purpose | Guaranteed income | Full value of employee remuneration |

| Examples | $50,000 per year | $50,000 base + $10,000 bonus + benefits valued at $5,000 |

| Calculation | Contractual salary | Base pay + variable pay + benefits valuation |

Understanding Base Pay

Base pay refers to the fixed salary an employee receives before bonuses, benefits, or other incentives are added. It serves as the foundational income and is typically expressed as an annual or hourly rate. Understanding base pay is crucial for evaluating job offers and comparing roles, as it directly impacts financial stability and budgeting.

What Constitutes Total Compensation

Total compensation encompasses base pay along with bonuses, incentives, stock options, and benefits such as health insurance, retirement contributions, and paid time off. These additional elements significantly impact the overall financial value an employee receives beyond just their salary. Understanding total compensation provides a clearer picture of the full economic worth of a job offer or employment package.

Key Differences Between Base Pay and Total Compensation

Base pay represents the fixed salary an employee receives before any bonuses, incentives, or benefits are added. Total compensation includes base pay plus additional financial rewards such as bonuses, stock options, health benefits, retirement contributions, and other perks. Understanding the distinction between base pay and total compensation is crucial for accurately evaluating job offers and overall employee value.

Components Included in Total Compensation Packages

Total compensation encompasses base pay, bonuses, stock options, benefits like health insurance, retirement contributions, and other perks such as paid time off or wellness programs. Base pay refers strictly to the fixed salary or hourly wage agreed upon in the employment contract. Understanding the full scope of total compensation is essential for accurate salary comparisons and evaluating overall financial benefits.

Why Base Pay Alone Can Be Misleading

Base pay alone can be misleading because it excludes bonuses, benefits, stock options, and other forms of variable compensation that significantly impact total earnings. Employees with lower base salaries might receive substantial bonuses or equity awards, substantially increasing their overall financial reward. Evaluating total compensation provides a more accurate understanding of an employee's actual income and financial incentives.

The Importance of Non-Salary Benefits

Non-salary benefits such as health insurance, retirement plans, and paid time off often constitute a significant portion of total compensation, impacting overall job satisfaction and financial security. These non-monetary perks can enhance employee well-being and reduce personal expenses, sometimes surpassing the value of base pay alone. Understanding the full package of total compensation is crucial for making informed career decisions and negotiating effectively.

Negotiating Beyond Base Salary

Negotiating beyond base pay includes evaluating bonuses, stock options, benefits, and retirement plans to maximize total compensation. Understanding the full value of non-salary perks can lead to better financial outcomes and job satisfaction. Prioritizing a holistic compensation package reveals opportunities often overlooked in salary discussions.

How Employers Structure Compensation

Employers structure compensation by differentiating between base pay, which is the fixed salary agreed upon, and total compensation, encompassing bonuses, benefits, stock options, and other incentives. Understanding this structure helps employees evaluate the full value of their earnings beyond just the base salary figure. Comprehensive compensation packages align employee performance with company goals through variable pay elements tied to productivity and achievement.

Evaluating Job Offers: Base Pay vs Total Compensation

When evaluating job offers, consider both base pay and total compensation to get a comprehensive view of your earnings. Base pay is the fixed salary, while total compensation includes bonuses, benefits, stock options, and other perks that significantly impact your overall financial package. Assessing total compensation ensures you understand the full value of the offer beyond just the salary figure.

Making Informed Career Decisions

Understanding the distinction between base pay and total compensation is essential for making informed career decisions. Base pay represents the fixed salary received regularly, while total compensation includes bonuses, benefits, stock options, and other perks that significantly impact overall earnings. Evaluating both elements helps professionals negotiate better offers and choose roles that align with their financial goals.

Important Terms

Guaranteed Compensation

Guaranteed compensation consists of base pay and fixed benefits, forming the stable portion of total compensation excluding performance bonuses and variable incentives.

Variable Pay

Variable pay, comprising bonuses and incentives, supplements base pay to enhance total compensation and align employee performance with organizational goals.

Overtime Premiums

Overtime premiums significantly impact total compensation by providing additional earnings beyond base pay, typically calculated as a percentage above the standard hourly rate, such as 1.5 times the base pay. Employers must accurately factor overtime premiums into payroll to ensure compliance with labor laws and reflect true employee compensation costs.

Incentive Pay

Incentive pay significantly enhances total compensation by supplementing base pay with performance-based bonuses, commissions, or profit-sharing rewards.

Equity Grants

Equity grants significantly enhance total compensation beyond base pay by providing employees with ownership stakes that align their financial rewards with company performance.

Deferred Compensation

Deferred compensation is a portion of an employee's income earned in one period but paid out in the future, impacting the distinction between base pay and total compensation by increasing the latter without immediate cash flow. Understanding deferred compensation is essential for evaluating total remuneration packages, as it encompasses retirement plans, bonuses, and stock options beyond the fixed base salary.

Signing Bonus

A signing bonus boosts total compensation beyond base pay, providing immediate financial incentive that enhances overall earnings during employment.

Benefits Package

A comprehensive benefits package enhances total compensation by supplementing base pay with health insurance, retirement plans, bonuses, and paid time off, increasing overall employee value.

Non-monetary Perks

Non-monetary perks such as flexible work hours, professional development opportunities, and wellness programs enhance total compensation by providing value beyond base pay. These benefits improve employee satisfaction and retention, making the overall compensation package more competitive and attractive.

Target Total Cash

Target Total Cash includes base pay plus variable compensation, reflecting the total direct earnings an employee can expect.

Base Pay vs Total Compensation Infographic

moneydif.com

moneydif.com