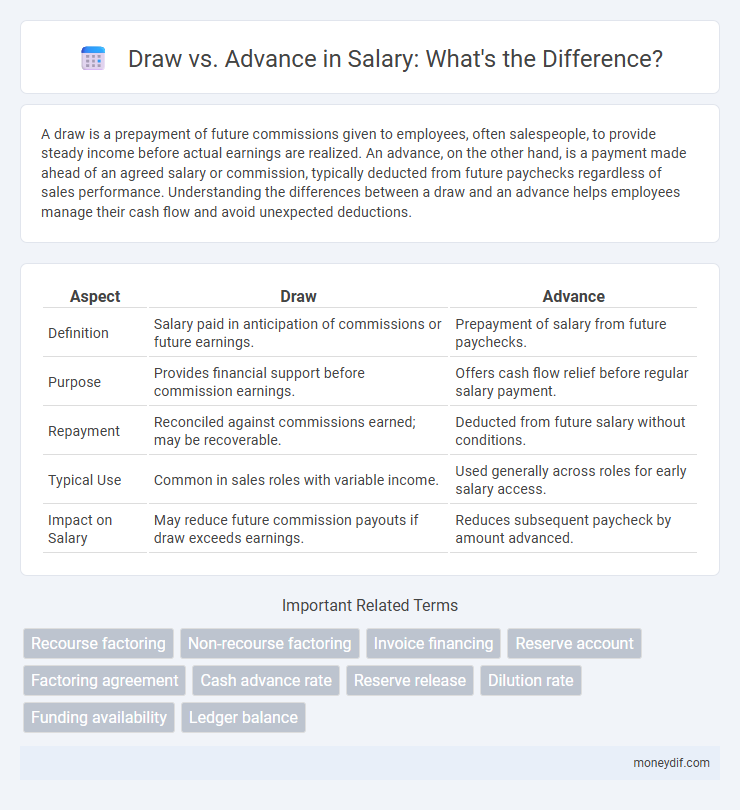

A draw is a prepayment of future commissions given to employees, often salespeople, to provide steady income before actual earnings are realized. An advance, on the other hand, is a payment made ahead of an agreed salary or commission, typically deducted from future paychecks regardless of sales performance. Understanding the differences between a draw and an advance helps employees manage their cash flow and avoid unexpected deductions.

Table of Comparison

| Aspect | Draw | Advance |

|---|---|---|

| Definition | Salary paid in anticipation of commissions or future earnings. | Prepayment of salary from future paychecks. |

| Purpose | Provides financial support before commission earnings. | Offers cash flow relief before regular salary payment. |

| Repayment | Reconciled against commissions earned; may be recoverable. | Deducted from future salary without conditions. |

| Typical Use | Common in sales roles with variable income. | Used generally across roles for early salary access. |

| Impact on Salary | May reduce future commission payouts if draw exceeds earnings. | Reduces subsequent paycheck by amount advanced. |

Draw vs Advance: Key Differences in Employee Compensation

Draw and advance represent distinct employee compensation methods with specific financial implications. A draw is a predetermined amount paid against future commissions, typically used in sales roles to guarantee steady income, while an advance is a lump sum given ahead of expected earnings and must be repaid regardless of future performance. The key difference lies in repayment terms: draws adjust based on earned commissions, whereas advances require reimbursement even if earnings fall short.

Understanding How Draws and Advances Impact Salary

Draws represent an agreed-upon amount of salary paid in advance against future commissions, helping stabilize income during fluctuating sales periods. Advances are loans provided to employees, deducted from upcoming earnings but requiring repayment if commissions fall short, potentially impacting net salary. Understanding the distinction ensures accurate salary forecasting and informs financial planning to manage cash flow effectively.

When to Choose a Draw Over an Advance for Payroll

Choosing a draw over an advance for payroll is ideal when employees require a predictable, regular payment that can be settled against future commissions or sales, ensuring consistent cash flow management. Draws are preferable when the intention is to balance earnings against anticipated revenue, reducing the risk of excess borrowing. Advances suit one-time, immediate cash needs but may disrupt budgeting without the structure of repayment tied to performance.

Tax Implications of Draws and Advances on Salary

Draws are treated as regular salary payments subject to income tax withholding, while advances function as loans and are not immediately taxable but must be repaid. Failure to reconcile an advance with subsequent earned salary can lead to tax complications or adjustments in taxable income. Employers must accurately track and report draws and advances to ensure compliance with tax regulations and avoid penalties.

Legal Considerations: Draw vs Advance in Salary Agreements

Legal considerations in salary agreements distinguish between a draw and an advance based on repayment obligations and tax implications. A draw is typically a prepayment of commissions earned, requiring reconciliation against future earnings without immediate repayment, while an advance is a loan against future income, legally binding the employee to repay regardless of commissions earned. Employment contracts must clearly outline these terms to avoid disputes and ensure compliance with labor laws and tax regulations.

Pros and Cons of Salary Draws and Advances

Salary draws provide employees with a fixed payment against future earnings, offering predictable cash flow and reducing financial stress during slow income periods; however, they can result in lower future paychecks and potential budgeting challenges. Advances on salary give immediate access to funds before the payday, aiding urgent expenses and improving liquidity, but may lead to reduced take-home pay later and potential dependency on early payouts. Employers benefit from salary draws by smoothing payroll expenses, while salary advances require careful management to avoid cash flow disruption.

How Draws and Advances Affect Take-Home Pay

Draws are prepayments against future commissions or earnings and reduce the immediate take-home pay by offsetting future income, whereas advances are loans from the employer that increase current take-home pay but must be repaid, often through payroll deductions. Unlike advances, draws are typically reconciled with actual earnings, impacting the final paycheck without creating debt. Understanding the distinction between draws and advances is crucial for accurate financial planning and managing net income fluctuations.

Best Practices for Managing Draws and Advances in Payroll

Effective management of draws and advances in payroll involves clear documentation and setting predefined limits to prevent budget disruptions. Employers should reconcile draws against earned commissions or salaries regularly to maintain accurate financial records and avoid overpayments. Transparent communication with employees about repayment terms and schedules ensures accountability and minimizes payroll discrepancies.

Common Pitfalls with Salary Draws vs Advances

Salary draws often lead to confusion when employees mistake them for advances, causing payroll inaccuracies and disputes over repayment terms. Employers may face cash flow challenges by issuing draws without clear agreements, resulting in difficulties reconciling negative balances if earnings fall short. Clear documentation and understanding of draw limits versus advance repayments are essential to prevent common pitfalls in salary management.

Employer Guidelines: Implementing Draws and Advances Responsibly

Employers implementing draws and advances must establish clear guidelines to ensure financial stability and legal compliance. Draws, considered as prepayments on commissions, require regular reconciliation to avoid negative balances, while advances, typically loans against future earnings, should have clear repayment terms outlined in employment contracts. Maintaining transparent communication and accurate record-keeping helps prevent disputes and supports responsible cash flow management within the organization.

Important Terms

Recourse factoring

Recourse factoring involves the seller retaining the credit risk and agreeing to buy back unpaid invoices, distinguishing it from non-recourse options. The key difference between draw and advance in this context lies in draw representing the amount factored against receivables, while advance refers to the initial percentage of the invoice value provided upfront by the factor.

Non-recourse factoring

Non-recourse factoring involves the factor bearing the risk of non-payment, with advances typically representing the initial payment made to the seller before the buyer's payment is received.

Invoice financing

Invoice financing offers businesses the option to either draw funds against outstanding invoices or receive an advance payment, enhancing cash flow management flexibility.

Reserve account

Reserve accounts reduce risk by withholding funds as a safety buffer, contrasting with advances that provide immediate liquidity against future income.

Factoring agreement

A factoring agreement allows businesses to sell invoices for immediate cash advances while managing draw provisions that regulate the timing and amount of funds disbursed.

Cash advance rate

The cash advance rate typically applies to the amount drawn from a credit line rather than the total advance amount, affecting interest calculations and fees.

Reserve release

Reserve release impacts project cash flow by reducing held-back funds once specific milestones are verified, contrasting with draws versus advances where funds are either requested based on completed work or provided upfront for anticipated expenses. Accurate management of reserve releases ensures timely payments and minimizes financing costs, aligning with contract terms and progress billing requirements.

Dilution rate

Dilution rate in hydrology refers to the rate at which solutes or contaminants are diluted in groundwater or surface water systems, significantly influenced by the balance between drawdown and groundwater advance. A higher draw relative to advance accelerates dilution by increasing flow velocity and mixing, thereby reducing contaminant concentration more effectively.

Funding availability

Funding availability significantly depends on the distinction between draw schedules, which release funds based on completed work milestones, and advances, which provide upfront capital before project initiation.

Ledger balance

Ledger balance represents the actual available funds in an account, influencing decisions between utilizing a draw, which reduces the balance, and an advance, which provides upfront funds against future income.

Draw vs Advance Infographic

moneydif.com

moneydif.com