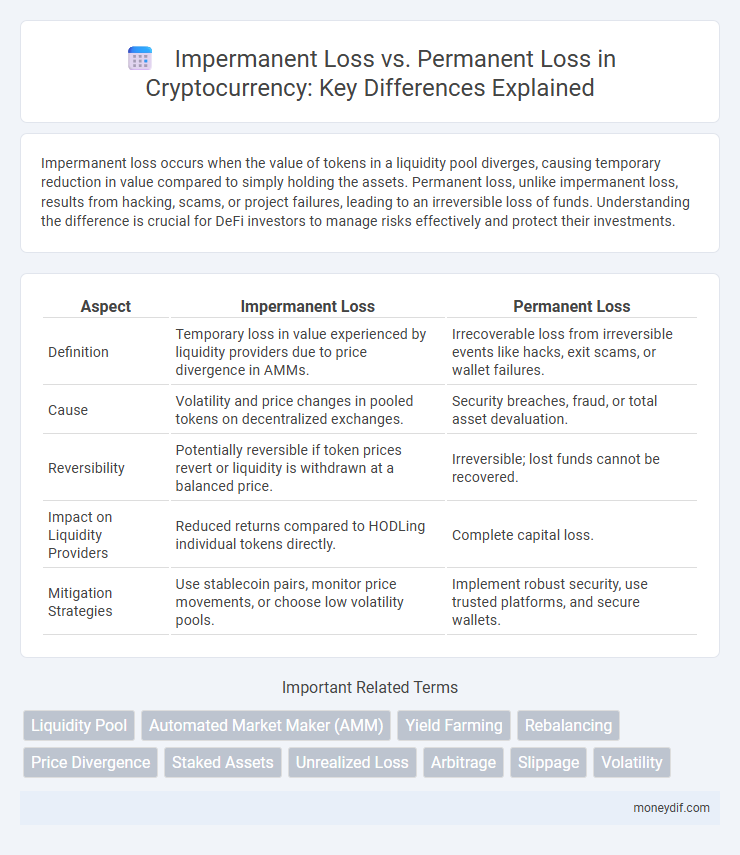

Impermanent loss occurs when the value of tokens in a liquidity pool diverges, causing temporary reduction in value compared to simply holding the assets. Permanent loss, unlike impermanent loss, results from hacking, scams, or project failures, leading to an irreversible loss of funds. Understanding the difference is crucial for DeFi investors to manage risks effectively and protect their investments.

Table of Comparison

| Aspect | Impermanent Loss | Permanent Loss |

|---|---|---|

| Definition | Temporary loss in value experienced by liquidity providers due to price divergence in AMMs. | Irrecoverable loss from irreversible events like hacks, exit scams, or wallet failures. |

| Cause | Volatility and price changes in pooled tokens on decentralized exchanges. | Security breaches, fraud, or total asset devaluation. |

| Reversibility | Potentially reversible if token prices revert or liquidity is withdrawn at a balanced price. | Irreversible; lost funds cannot be recovered. |

| Impact on Liquidity Providers | Reduced returns compared to HODLing individual tokens directly. | Complete capital loss. |

| Mitigation Strategies | Use stablecoin pairs, monitor price movements, or choose low volatility pools. | Implement robust security, use trusted platforms, and secure wallets. |

Understanding Impermanent Loss in Cryptocurrency

Impermanent loss occurs in cryptocurrency liquidity pools when the price of deposited tokens changes compared to when they were deposited, causing a temporary decrease in value relative to holding the tokens outside the pool. This loss is "impermanent" because it can be reversed if token prices return to their original state, unlike permanent loss which results from irreversible events such as token theft or smart contract failure. Understanding impermanent loss is crucial for liquidity providers to gauge potential risks and optimize their strategies in decentralized finance (DeFi) platforms.

Defining Permanent Loss in Crypto Investments

Permanent loss in cryptocurrency investments refers to the irreversible reduction in asset value due to events such as hacks, scams, exchange collapses, or firmware bugs that result in a total loss of funds. Unlike impermanent loss, which arises from price volatility in liquidity pools and can be recovered when prices return to initial levels, permanent loss leads to the complete disappearance of invested capital. Understanding the distinction between impermanent and permanent loss is critical for risk management and portfolio protection in DeFi and crypto trading.

Key Differences: Impermanent Loss vs. Permanent Loss

Impermanent loss occurs when the value of assets in a liquidity pool diverges from simply holding them due to price fluctuations, typically reversible upon asset price recovery. Permanent loss, often linked to hacks, mistakes, or fundamental asset devaluation, results in irreversible capital reduction. Impermanent loss primarily affects liquidity providers in automated market makers, while permanent loss impacts a broader range of crypto investors and holders.

Causes of Impermanent Loss in Liquidity Pools

Impermanent loss in liquidity pools arises primarily from price volatility between paired assets during market fluctuations, causing divergence in asset values compared to holding them separately. Automated Market Maker (AMM) algorithms, such as those used in Uniswap or SushiSwap, adjust token ratios in response to trades, which can lead to reduced asset value relative to holding. This loss remains temporary as it is influenced by price changes and may be recovered if asset prices return to initial levels, distinguishing it from permanent losses caused by external factors like smart contract hacks or impermanent withdrawal strategies.

Main Triggers of Permanent Loss in Crypto

Permanent loss in cryptocurrency primarily occurs due to exchange hacks, where assets are irretrievably stolen from centralized or decentralized platforms. Another critical trigger is regulatory crackdowns causing asset seizures, freezing, or forced liquidation, leading to irreversible loss of funds. Smart contract vulnerabilities exploited by malicious actors also result in permanent asset depletion beyond the temporary effects of impermanent loss in liquidity pools.

Risk Management: Minimizing Impermanent Loss

Effective risk management in cryptocurrency liquidity pools involves strategies to minimize impermanent loss, a temporary divergence in asset value caused by price volatility. Utilizing stablecoin pairs, diversifying assets, and employing automated market makers with dynamic fee structures can reduce exposure to impermanent loss. Monitoring market trends and employing timely withdrawal or rebalancing techniques further safeguard investments against significant value erosion.

Strategies to Avoid Permanent Loss in Crypto

Effective strategies to avoid permanent loss in cryptocurrency include thorough research on coins with strong fundamentals, maintaining diversifications across multiple assets, and timely portfolio rebalancing to adapt to market changes. Utilizing stop-loss orders and secure cold storage wallets can protect investments from sudden market crashes and hacking threats. Staying informed about project developments and regulatory changes helps investors make proactive decisions, minimizing the risk of irreversible losses.

Impact of Market Volatility on Both Loss Types

Market volatility significantly exacerbates impermanent loss by causing rapid price fluctuations between paired assets in liquidity pools, leading to potential temporary reductions in value for liquidity providers. In contrast, permanent loss results from irreversible asset devaluation or smart contract failures and remains unaffected by short-term market swings. Understanding the volatility-driven dynamics helps investors mitigate impermanent loss through strategic timing and pool selection while recognizing the inherent risks of permanent loss in cryptocurrency investments.

DeFi Protocols Most Affected by Impermanent Loss

DeFi protocols relying heavily on automated market makers (AMMs) such as Uniswap, SushiSwap, and Balancer are most susceptible to impermanent loss due to constant price fluctuations between paired tokens. Impermanent loss occurs when the value of deposited assets diverges compared to simply holding, impacting liquidity providers' returns, whereas permanent loss results from events like smart contract failures or hacks. Understanding impermanent loss dynamics is crucial for users in DeFi protocols with volatile token pairs to better manage risks and optimize yield strategies.

Comparing Recovery Options: Impermanent vs. Permanent Loss

Impermanent loss occurs when the value of tokens in a liquidity pool diverges from the initial deposit, often recoverable if token prices revert, while permanent loss refers to irreversible asset value drops due to hacks or smart contract failures. Impermanent loss can be mitigated by withdrawing liquidity at favorable market conditions or by employing impermanent loss protection protocols. Permanent loss recovery typically requires insurance claims, blockchain forensics, or accepting asset write-offs, as the original value cannot be restored through market movements.

Important Terms

Liquidity Pool

Liquidity pools in decentralized finance expose providers to impermanent loss due to price volatility, which contrasts with permanent loss resulting from smart contract vulnerabilities or hacks.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) incur impermanent loss when asset prices diverge temporarily, while permanent loss occurs if assets are withdrawn after sustained unfavorable price changes, leading to realized financial loss.

Yield Farming

Yield farming maximizes DeFi returns by staking assets but exposes users to impermanent loss from price volatility and potential permanent loss if liquidity withdrawals occur during severe market downturns.

Rebalancing

Rebalancing adjusts asset allocations in a portfolio to mitigate risks associated with impermanent loss, which occurs when the value of pooled tokens diverges temporarily in liquidity pools, whereas permanent loss involves irreversible reductions in asset value due to market downturns or liquidation events. Effective rebalancing strategies can help minimize impermanent loss by maintaining target proportions and preventing significant deviations that could convert temporary discrepancies into permanent losses.

Price Divergence

Price divergence between paired assets in a liquidity pool leads to impermanent loss, where temporary unrealized losses occur, whereas permanent loss results when diverged prices never return to their original ratio, causing irreversible financial impact on liquidity providers.

Staked Assets

Staked assets are primarily exposed to impermanent loss due to price volatility during staking, whereas permanent loss occurs if the underlying asset value depreciates significantly or the platform suffers a security breach.

Unrealized Loss

Unrealized loss refers to a temporary decline in asset value that contrasts with impermanent loss experienced in liquidity pools, while permanent loss signifies a realized, irreversible decrease in investment value.

Arbitrage

Arbitrage strategies can mitigate impermanent loss by exploiting price discrepancies across decentralized exchanges, whereas permanent loss occurs when asset prices diverge irreversibly, making arbitrage ineffective.

Slippage

Slippage refers to the difference between the expected and executed price of a trade, often occurring in volatile markets or low-liquidity pools, and can exacerbate impermanent loss by reducing returns during token price fluctuations. Permanent loss happens when funds are withdrawn from liquidity pools at a lower value than the initial deposit, often influenced by slippage during trading activities, whereas impermanent loss remains temporarily unrealized unless assets are removed.

Volatility

Volatility increases the risk of impermanent loss by causing temporary price fluctuations in liquidity pools, whereas permanent loss occurs when assets are withdrawn at a lower value than initially deposited regardless of price recovery.

Impermanent loss vs permanent loss Infographic

moneydif.com

moneydif.com