Family offices provide comprehensive, personalized wealth management services tailored to high-net-worth families, including investment management, estate planning, and philanthropic guidance, ensuring multi-generational financial security. Private banking offers banking services such as lending, deposit accounts, and investment advice, primarily focused on individual clients rather than the entire family's holistic financial ecosystem. The choice between family office and private banking depends on the complexity of wealth, with family offices suited for those seeking customized, integrated solutions beyond traditional banking.

Table of Comparison

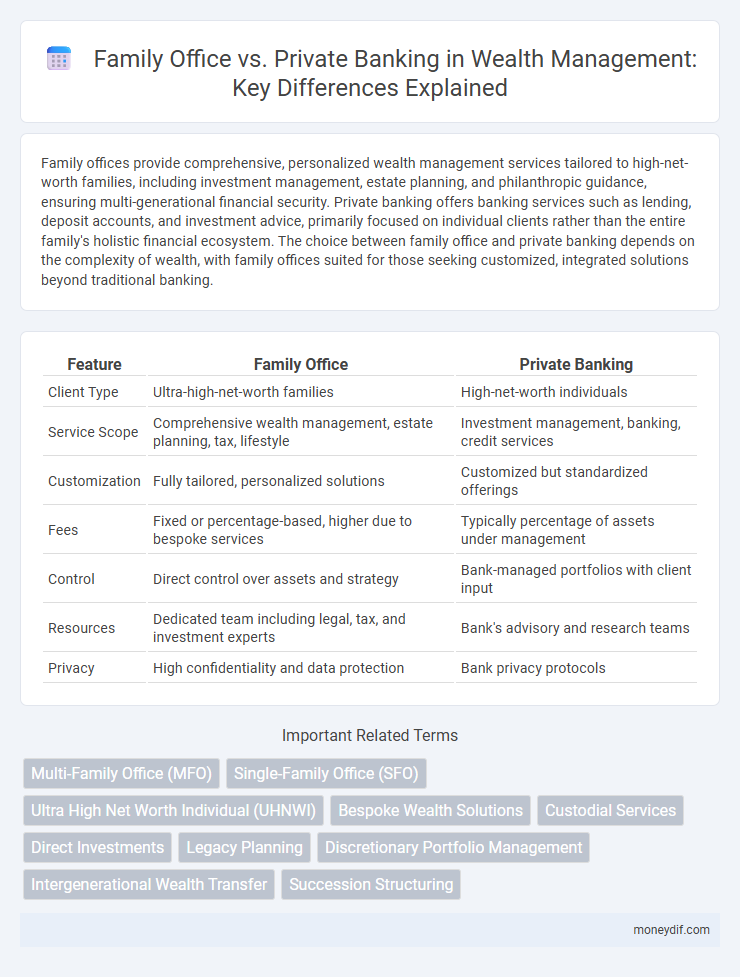

| Feature | Family Office | Private Banking |

|---|---|---|

| Client Type | Ultra-high-net-worth families | High-net-worth individuals |

| Service Scope | Comprehensive wealth management, estate planning, tax, lifestyle | Investment management, banking, credit services |

| Customization | Fully tailored, personalized solutions | Customized but standardized offerings |

| Fees | Fixed or percentage-based, higher due to bespoke services | Typically percentage of assets under management |

| Control | Direct control over assets and strategy | Bank-managed portfolios with client input |

| Resources | Dedicated team including legal, tax, and investment experts | Bank's advisory and research teams |

| Privacy | High confidentiality and data protection | Bank privacy protocols |

Understanding Family Offices and Private Banking

Family offices provide ultra-high-net-worth individuals with comprehensive wealth management services, including investment management, estate planning, tax advisory, and philanthropic guidance tailored to preserve and grow multi-generational wealth. Private banking offers personalized financial services such as credit facilities, investment products, and wealth planning primarily focused on individual clients with substantial assets, typically ranging from $1 million to $10 million in investable wealth. The key distinction lies in family offices delivering holistic, customized strategies for complex family needs, whereas private banking emphasizes efficient, scalable financial solutions for affluent individuals.

Key Differences Between Family Offices and Private Banking

Family offices provide highly personalized wealth management services tailored to ultra-high-net-worth families, encompassing investment management, estate planning, tax optimization, and concierge services under one roof. Private banking primarily offers financial products and services such as credit, deposit accounts, and investment advice to high-net-worth individuals, emphasizing personalized banking solutions rather than comprehensive wealth management. The key difference lies in the scope of services, with family offices delivering holistic, multi-generational wealth strategies, while private banks focus on individual client financial needs and banking products.

Services Offered: Family Office vs Private Banking

Family offices provide comprehensive wealth management services including estate planning, tax optimization, philanthropic advisory, and personalized investment strategies tailored to multi-generational families. Private banking focuses on individualized banking, lending, and investment products with emphasis on portfolio management, liquidity solutions, and credit facilities for high-net-worth individuals. Family offices offer a holistic and customized approach, while private banking typically delivers specialized financial services within a structured bank framework.

Wealth Management Strategies Compared

Family offices provide highly personalized wealth management strategies tailored to ultra-high-net-worth individuals, encompassing estate planning, tax optimization, philanthropy, and succession planning. Private banking offers customized investment solutions and credit services primarily focused on portfolio management and liquidity needs for high-net-worth clients. The comprehensive approach of family offices contrasts with the more standardized, product-driven services of private banking, emphasizing long-term wealth preservation and multigenerational legacy planning.

Personalized Solutions: Which Offers More?

Family offices provide highly personalized wealth management services tailored to the unique financial, tax, and legacy planning needs of ultra-high-net-worth families. Private banking offers customized financial products and advisory but often within a more standardized framework focused on investment and credit services. The family office model delivers deeper personalization through integration of multi-generational planning, lifestyle management, and direct control over investments.

Cost Structure and Fee Transparency

Family offices typically have a more transparent fee structure since they operate on a fixed or percentage-based management fee directly tied to the family's assets, avoiding the layers of commissions common in private banking. Private banks often charge a combination of asset management fees, transaction fees, and product commissions, leading to less clarity and potentially higher overall costs. The comprehensive service model of family offices justifies their higher fixed costs, while private banking offers more variable fees based on client activity.

Privacy and Confidentiality in Wealth Stewardship

Family offices offer unparalleled privacy and confidentiality in wealth stewardship by managing assets exclusively for a single family, eliminating conflicts of interest and minimizing information exposure. Private banking, while providing personalized services, often involves multiple clients, increasing the risk of data sharing and less controlled privacy measures. The dedicated structure of family offices ensures discreet handling of sensitive financial information, aligning with high-net-worth families' stringent privacy requirements.

Choosing the Right Model for Ultra-High-Net-Worth Individuals

Ultra-high-net-worth individuals must evaluate the strategic advantages of family offices versus private banking to optimize wealth management, estate planning, and legacy preservation. Family offices offer bespoke services, direct control, and comprehensive financial oversight tailored to multi-generational wealth, while private banking provides access to exclusive investment opportunities, credit facilities, and global financial advisory. Selecting the optimal model depends on the complexity of assets, desire for privacy, and the scope of personalized financial services required.

Succession Planning and Legacy Management

Family offices offer comprehensive succession planning and legacy management tailored to multigenerational wealth, ensuring cohesive wealth transfer and governance structures. Private banking provides personalized financial services but may lack the integrated approach and dedicated resources for complex family dynamics and long-term legacy preservation. Effective succession planning in family offices emphasizes legal structuring, philanthropy, and family education to sustain wealth across generations.

Trends Impacting Family Offices and Private Banking

Family offices are increasingly adopting technology-driven solutions such as AI-powered portfolio management and personalized wealth analytics to enhance decision-making, surpassing traditional private banking services. Regulatory changes and demand for sustainable investments drive customization and transparency within private banking, while family offices emphasize multigenerational wealth preservation and direct investment in alternative assets like private equity and real estate. The integration of digital platforms and impact investing trends are reshaping how both family offices and private banks deliver tailored financial solutions.

Important Terms

Multi-Family Office (MFO)

Multi-Family Offices (MFOs) offer comprehensive wealth management services tailored for multiple ultra-high-net-worth families, integrating investment management, estate planning, tax advisory, and philanthropy coordination, surpassing the typically transaction-focused Private Banking services. Unlike single Family Offices that serve one family exclusively, MFOs leverage shared resources and expertise to provide scalable, personalized financial solutions with higher fiduciary independence compared to Private Banks.

Single-Family Office (SFO)

Single-Family Offices (SFOs) provide tailored wealth management and comprehensive financial services exclusively for one wealthy family, contrasting with Private Banking that serves multiple high-net-worth clients with standardized offerings. Unlike Private Banking, SFOs offer customized investment strategies, estate planning, tax structuring, and concierge services designed to preserve and grow a family's multi-generational wealth.

Ultra High Net Worth Individual (UHNWI)

Ultra High Net Worth Individuals (UHNWIs) typically prefer Family Offices for comprehensive wealth management, estate planning, and personalized investment strategies, offering more tailored and integrated services than Private Banking. While Private Banking provides exclusive financial products and credit facilities, Family Offices deliver holistic management of complex assets, governance, and succession planning essential for multigenerational wealth preservation.

Bespoke Wealth Solutions

Bespoke Wealth Solutions cater to ultra-high-net-worth families by offering tailored, comprehensive services that encompass multi-generational wealth planning, investment management, and tax optimization, distinguishing them from Private Banking which primarily focuses on personalized banking and investment products for individual clients. Family Offices provide a holistic, centralized approach to wealth management including estate planning, philanthropy, and succession, whereas Private Banking typically offers more transactional, asset-specific financial services.

Custodial Services

Custodial services in a Family Office ensure comprehensive asset protection, tailored estate planning, and seamless wealth transfer for ultra-high-net-worth families, while Private Banking custodial solutions primarily focus on efficient transaction processing and asset safekeeping for individual clients. Family Offices offer customized, integrated custodial management aligned with multi-generational wealth objectives, contrasting with Private Banks' standardized custodial frameworks designed for personal investment needs.

Direct Investments

Direct investments through family offices offer bespoke portfolio management with concentrated exposure to private equity, real estate, and venture capital, providing higher control and bespoke deal flow. Private banking typically delivers diversified investment products and advisory services, emphasizing liquidity and risk management suitable for broad wealth preservation.

Legacy Planning

Legacy planning in the context of family offices focuses on comprehensive wealth preservation, estate structuring, and intergenerational transfer strategies tailored to ultra-high-net-worth families, offering bespoke governance and philanthropic integration. Private banking provides personalized financial services and investment management with an emphasis on wealth growth and protection, but typically lacks the holistic and multigenerational approach central to family office legacy planning.

Discretionary Portfolio Management

Discretionary Portfolio Management in Family Office settings offers highly personalized investment strategies tailored to multi-generational wealth preservation and complex asset allocation, surpassing the relatively standardized services provided by Private Banking. Family Offices emphasize bespoke governance, direct investment opportunities, and tax-efficient structures, whereas Private Banking primarily focuses on wealth accumulation and client relationship management through packaged financial products.

Intergenerational Wealth Transfer

Intergenerational wealth transfer involves strategically managing and passing assets across generations to preserve family legacy, where Family Offices offer personalized, comprehensive wealth management tailored to multigenerational needs, unlike Private Banking which delivers more standardized financial services focused primarily on individual clients. Family Offices provide bespoke estate planning, tax optimization, and governance structures crucial for seamless wealth succession, while Private Banking often emphasizes investment management and credit services with limited scope for holistic family wealth stewardship.

Succession Structuring

Succession structuring in family offices involves tailored estate planning, wealth preservation, and governance frameworks designed to maintain family legacy across generations, leveraging customized trust and holding company solutions. Private banking focuses on personalized financial services and investment management but often offers less comprehensive control over intergenerational wealth transfer and governance compared to family office models.

Family Office vs Private Banking Infographic

moneydif.com

moneydif.com