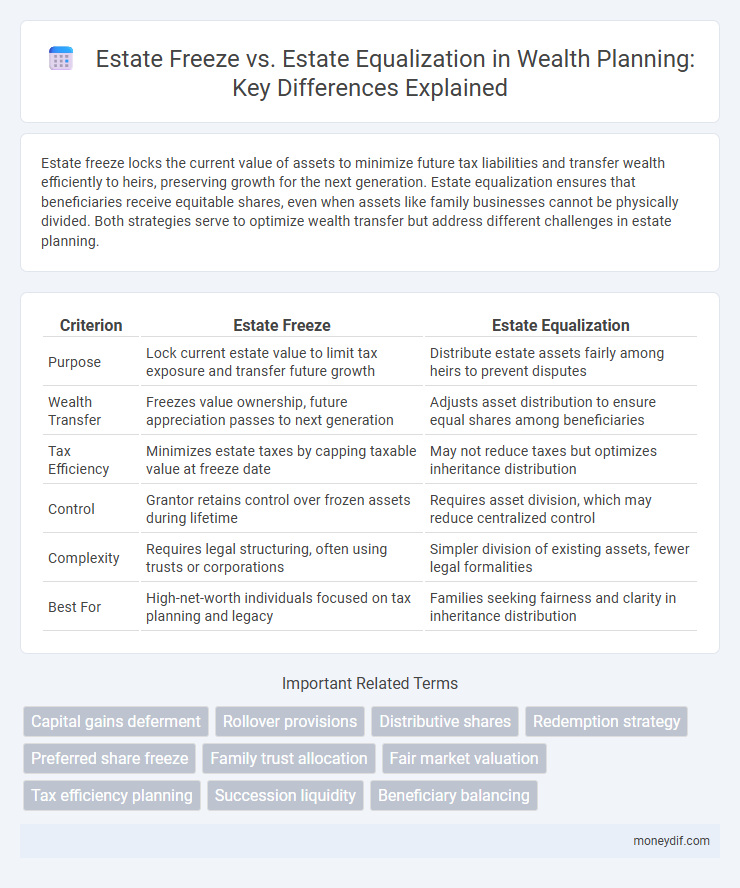

Estate freeze locks the current value of assets to minimize future tax liabilities and transfer wealth efficiently to heirs, preserving growth for the next generation. Estate equalization ensures that beneficiaries receive equitable shares, even when assets like family businesses cannot be physically divided. Both strategies serve to optimize wealth transfer but address different challenges in estate planning.

Table of Comparison

| Criterion | Estate Freeze | Estate Equalization |

|---|---|---|

| Purpose | Lock current estate value to limit tax exposure and transfer future growth | Distribute estate assets fairly among heirs to prevent disputes |

| Wealth Transfer | Freezes value ownership, future appreciation passes to next generation | Adjusts asset distribution to ensure equal shares among beneficiaries |

| Tax Efficiency | Minimizes estate taxes by capping taxable value at freeze date | May not reduce taxes but optimizes inheritance distribution |

| Control | Grantor retains control over frozen assets during lifetime | Requires asset division, which may reduce centralized control |

| Complexity | Requires legal structuring, often using trusts or corporations | Simpler division of existing assets, fewer legal formalities |

| Best For | High-net-worth individuals focused on tax planning and legacy | Families seeking fairness and clarity in inheritance distribution |

Understanding Estate Freeze: Key Concepts

Estate freeze involves locking the current value of an estate to minimize future tax liabilities, allowing wealth to pass to heirs at a potentially lower tax cost. This strategy often uses tools like trusts or preferred shares to shift future growth of assets to beneficiaries while retaining control. Understanding these key concepts aids in effective wealth preservation and tax planning.

What Is Estate Equalization?

Estate equalization is a strategic wealth planning technique used to distribute assets fairly among heirs, particularly when certain beneficiaries receive non-liquid assets like family businesses or real estate. This approach aims to prevent disputes and ensure all heirs receive equivalent value, often by compensating some beneficiaries with cash or other divisible assets. Estate equalization helps maintain family harmony and preserves the overall value of the estate for future generations.

Objectives of Estate Freeze Strategies

Estate freeze strategies primarily aim to lock in the current value of an estate, minimizing future tax liabilities by transferring future growth to heirs. These strategies help preserve wealth by ensuring that appreciation occurs outside the original owner's estate, facilitating smoother wealth succession. Estate equalization, while related, focuses more on distributing assets fairly among beneficiaries rather than controlling tax exposure.

Goals of Estate Equalization in Wealth Planning

Estate equalization in wealth planning aims to distribute assets fairly among heirs to prevent family disputes and ensure each beneficiary receives an equitable share of the estate's value. This strategy often involves balancing asset types, such as real estate, business interests, or liquid investments, so that no heir is disadvantaged by illiquid or unevenly distributed property. Estate equalization supports long-term wealth preservation by promoting harmony and clarity in inheritance, aligning with broader goals of effective wealth transfer and tax efficiency.

Comparing Estate Freeze and Estate Equalization

Estate freeze secures the current value of an estate by transferring future growth to heirs, minimizing tax liabilities and preserving wealth within a family business. Estate equalization focuses on distributing assets fairly among beneficiaries, often through life insurance or liquid assets, to avoid conflicts and ensure equitable treatment. Comparing these strategies highlights that estate freeze prioritizes tax efficiency and business continuity while estate equalization emphasizes fairness and liquidity among heirs.

Tax Implications of Estate Freeze

Estate freeze involves fixing the current value of an estate to minimize future tax liabilities, allowing assets to grow in the hands of heirs with potentially lower tax burdens. This strategy prevents escalating capital gains taxes by locking in the value for the transferor while future appreciation accrues to the beneficiaries. In contrast, estate equalization primarily addresses the fair distribution of assets among heirs without specifically targeting tax optimization.

Tax Considerations in Estate Equalization

Estate equalization involves distributing assets among beneficiaries to minimize tax liabilities and ensure fair value allocation, typically employing life insurance policies to cover potential tax burdens on estates. Tax considerations focus on mitigating capital gains taxes triggered by asset transfers and avoiding unintended tax consequences arising from unequal distributions. Strategic use of tax-deferred accounts and charitable giving can further optimize the tax efficiency of estate equalization plans.

Advantages and Disadvantages of Estate Freeze

Estate freeze locks the current value of an estate, allowing future growth to benefit heirs and minimizing estate taxes upon death; however, it complicates asset management and may reduce flexibility in responding to changes in financial circumstances. It provides significant tax advantages by capping the estate's value for tax purposes while preserving control for the original owner, but risks undervaluing future appreciation and can create disputes among beneficiaries with unequal asset growth. Compared to estate equalization, which aims to distribute assets evenly among heirs, estate freeze prioritizes tax efficiency over immediate fairness, potentially leading to advantages in wealth preservation but challenges in family dynamics.

Pros and Cons of Estate Equalization

Estate equalization ensures fair asset distribution among heirs, preventing family disputes and maintaining harmony, especially in blended families. However, it can reduce flexibility in estate planning and may require liquid assets or selling parts of the estate to achieve equal shares, potentially causing financial strain. This approach simplifies inheritance tax planning but might limit the ability to tailor asset allocation based on individual heir needs or contributions.

Choosing the Right Strategy: Factors to Consider

Choosing between an estate freeze and estate equalization involves evaluating asset growth potential, family dynamics, and tax implications to effectively manage wealth transfer. An estate freeze locks the current value of assets for tax purposes, benefiting future generations by shifting growth, while estate equalization ensures fair distribution among heirs, especially when non-liquid assets like family businesses are involved. Key considerations include the type of assets, beneficiaries' financial needs, and long-term estate liquidity to minimize tax burdens and preserve family harmony.

Important Terms

Capital gains deferment

Capital gains deferment strategies are critical in distinguishing estate freeze from estate equalization, as estate freeze locks in the current value of assets for tax purposes, allowing future appreciation to be transferred to heirs without immediate capital gains tax. Estate equalization focuses on fairly distributing net estate value among beneficiaries, often requiring capital gains realization to balance inheritances but potentially triggering immediate tax liabilities.

Rollover provisions

Rollover provisions in tax law allow for the deferral of capital gains taxes during an estate freeze by transferring assets at their current value to the next generation, thereby locking in the taxable amount and facilitating future estate growth. In contrast, estate equalization uses rollover provisions to distribute assets more evenly among beneficiaries, minimizing tax liabilities while preserving the estate's overall value.

Distributive shares

Distributive shares refer to the portion of income or assets allocated to beneficiaries from a trust or estate, playing a crucial role in estate freeze strategies where future growth is locked in by transferring interests to heirs. In estate equalization, distributive shares ensure fair distribution among beneficiaries, balancing inheritances when assets like family businesses are retained by specific heirs.

Redemption strategy

Redemption strategy in estate planning involves repurchasing shares or assets from heirs to facilitate an estate freeze, effectively locking in the current value of assets for tax purposes. This approach contrasts with estate equalization, where assets are distributed evenly among beneficiaries to prevent disputes but may trigger higher tax liabilities due to asset revaluation.

Preferred share freeze

Preferred share freeze allows shareholders to lock in the current value of their shares, facilitating estate freeze strategies that limit future growth to new common shares while preserving wealth for heirs. Estate equalization uses preferred shares to balance inheritance among beneficiaries by allocating frozen shares to one heir and growth shares to others, ensuring fair distribution of estate value.

Family trust allocation

Family trust allocation strategically manages asset distribution among beneficiaries while balancing the benefits of estate freeze and estate equalization; an estate freeze locks the current value of assets for tax efficiency, allowing future appreciation to accrue within the trust, whereas estate equalization ensures fair distribution among heirs by adjusting allocations to offset unequal inheritance values. Properly structured family trusts optimize tax planning and maintain family harmony by aligning asset growth with equitable beneficiary interests.

Fair market valuation

Fair market valuation is crucial in estate planning strategies such as estate freeze and estate equalization, providing an objective basis to determine asset values for tax and ownership purposes. In an estate freeze, fair market valuation locks the current value of assets to minimize future tax liabilities, while in estate equalization, it ensures equitable distribution of assets among heirs based on their current market worth.

Tax efficiency planning

Tax efficiency planning through estate freeze minimizes capital gains tax by locking the current value of assets, allowing future appreciation to pass to beneficiaries at a lower tax cost, while estate equalization ensures fair distribution among heirs by balancing varying asset values, which may involve strategic use of trusts or life insurance to achieve tax-effective wealth transfer. Combining estate freeze with estate equalization optimizes tax liabilities and preserves family harmony by aligning asset growth with equitable inheritance outcomes.

Succession liquidity

Succession liquidity addresses the challenge of ensuring sufficient cash flow to cover taxes and expenses upon estate transfer, making estate freeze a strategic tool to limit asset growth and future tax liabilities while estate equalization focuses on distributing assets fairly among heirs. Proper estate planning integrates these concepts, balancing liquidity needs with succession goals to minimize financial strain and family disputes.

Beneficiary balancing

Beneficiary balancing ensures fair asset distribution among heirs, especially vital when comparing estate freeze strategies that lock in asset values to minimize tax liabilities against estate equalization techniques designed to allocate equivalent net worth despite differing asset types. Implementing beneficiary balancing effectively mitigates family disputes and tax inefficiencies by harmonizing the legacy while accommodating varying asset growth and liquidity profiles.

Estate freeze vs estate equalization Infographic

moneydif.com

moneydif.com