Wealth tax targets the net worth of individuals, taxing assets such as property, investments, and savings, whereas income tax is imposed on earnings from wages, salaries, and other income sources. Wealth tax aims to reduce economic inequality by redistributing accumulated wealth, while income tax primarily funds government operations and public services. Both taxes serve distinct purposes in fiscal policy, influencing financial behavior and resource allocation differently.

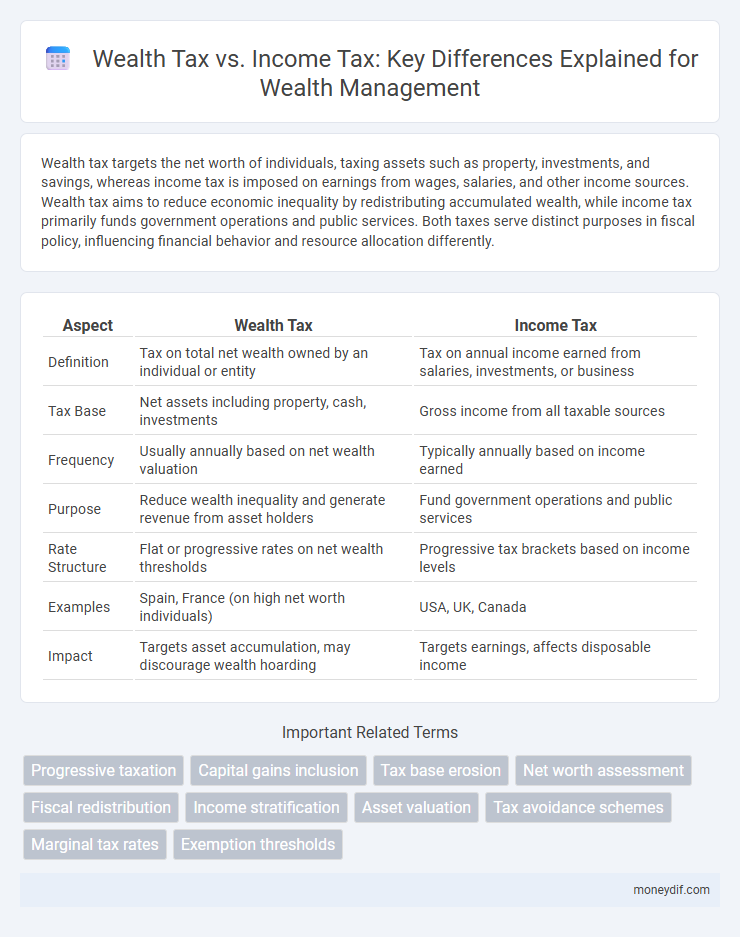

Table of Comparison

| Aspect | Wealth Tax | Income Tax |

|---|---|---|

| Definition | Tax on total net wealth owned by an individual or entity | Tax on annual income earned from salaries, investments, or business |

| Tax Base | Net assets including property, cash, investments | Gross income from all taxable sources |

| Frequency | Usually annually based on net wealth valuation | Typically annually based on income earned |

| Purpose | Reduce wealth inequality and generate revenue from asset holders | Fund government operations and public services |

| Rate Structure | Flat or progressive rates on net wealth thresholds | Progressive tax brackets based on income levels |

| Examples | Spain, France (on high net worth individuals) | USA, UK, Canada |

| Impact | Targets asset accumulation, may discourage wealth hoarding | Targets earnings, affects disposable income |

Understanding Wealth Tax: Definition and Purpose

Wealth tax is a government levy on the net value of an individual's assets, including real estate, investments, and savings, designed to redistribute wealth and reduce economic inequality. Unlike income tax, which is charged on yearly earnings, wealth tax targets accumulated wealth, aiming to ensure that the richest contribute a fair share to public finances. Its purpose is to promote social equity by addressing wealth concentration and funding essential public services.

Income Tax Explained: Key Features and Functions

Income tax is a government-imposed levy on individuals' or entities' earnings, designed to generate public revenue while promoting economic equity. It operates on a progressive scale, with rates increasing based on income levels, ensuring those with higher earnings contribute a larger share. Key functions include funding essential public services, redistributing wealth, and influencing economic behavior through deductions and credits.

Fundamental Differences Between Wealth Tax and Income Tax

Wealth tax is levied on the total value of an individual's accumulated assets, such as property, investments, and cash, whereas income tax is imposed on earnings generated within a specific period, including wages, salaries, and business profits. Wealth tax targets net worth and is usually assessed annually on the estimated market value, while income tax is calculated based on taxable income during the fiscal year with progressive rates applied. These fundamental differences influence taxpayer obligations, reporting requirements, and government revenue mechanisms in fiscal policy.

How Wealth Tax Impacts Asset Holders

Wealth tax imposes a direct levy on the net value of assets owned by individuals, including real estate, investments, and cash holdings, which can reduce the overall asset accumulation and liquidity of high-net-worth individuals. Unlike income tax, which targets annual earnings, wealth tax affects long-term capital retention and may incentivize asset diversification or relocation to tax-favorable jurisdictions. This tax framework impacts estate planning strategies as asset holders aim to minimize tax burdens while preserving wealth for future generations.

Income Tax Burden on Different Income Groups

Income tax burden varies significantly across different income groups, with higher earners often facing progressive tax rates that increase their overall contribution. Middle-income taxpayers typically allocate a larger proportion of their earnings to income tax compared to low-income groups, who may fall below taxable thresholds or qualify for credits. Understanding these disparities is crucial for evaluating tax policy fairness and the impact on household wealth accumulation.

Global Perspectives: Countries Implementing Wealth and Income Taxes

Several countries implement both wealth tax and income tax to address different financial aspects of taxpayers. Wealth tax is prominent in nations like Spain, Norway, and Switzerland, targeting net assets above specific thresholds, while income tax remains a primary revenue source globally, applied progressively in countries such as the United States, Germany, and India. Fiscal policies combining both taxes aim to reduce economic inequality and generate sustainable government revenues through comprehensive taxation strategies.

Revenue Generation: Wealth Tax vs Income Tax

Wealth tax targets an individual's total net worth, including assets such as property, investments, and savings, generating revenue by taxing accumulated wealth over a threshold. Income tax focuses on annual earnings from salaries, business profits, and capital gains, providing a steady revenue stream linked to economic activity. Wealth tax revenue can be volatile and less predictable due to asset valuation fluctuations, whereas income tax typically yields more consistent government funding.

Economic Effects of Wealth Taxation

Wealth tax impacts economic behavior by redistributing asset ownership and potentially reducing wealth inequality, which can promote social mobility and economic growth. However, it may discourage investment and savings, leading to lower capital accumulation and slower economic expansion. Empirical studies suggest that moderate wealth taxation can finance public goods without significantly harming economic incentives, but excessively high rates risk capital flight and reduced entrepreneurial activity.

Equity and Fairness: Debating Wealth and Income Tax Policies

Wealth tax targets accumulated assets, aiming to reduce economic inequality by redistributing significant fortunes, while income tax focuses on earnings, capturing annual financial inflows to fund public services. Wealth tax proponents argue it addresses structural disparities and prevents the perpetuation of inherited wealth, promoting social equity, whereas critics claim it may discourage investment and be difficult to assess accurately. Income tax systems, often progressive, are praised for their transparency and reliability but can overlook hidden wealth, challenging the fairness of tax contributions across different economic strata.

The Future of Wealth and Income Taxation

Wealth tax and income tax structures are evolving as governments seek sustainable revenue sources amid growing economic inequality and changing asset compositions. Future wealth taxation may focus on digital assets, real estate, and financial investments to capture untapped capital, while income taxes could shift toward progressive brackets and capital gains adjustments. Policymakers must balance efficiency, equity, and administrative feasibility to ensure fair taxation in an increasingly complex wealth landscape.

Important Terms

Progressive taxation

Progressive taxation imposes higher tax rates on increased levels of wealth or income, with wealth tax targeting accumulated assets and income tax focusing on earnings over a period. Wealth tax addresses net worth disparities by taxing property, investments, and savings, while income tax adjusts liability based on annual monetary inflows, both aiming to reduce economic inequality through graduated fiscal measures.

Capital gains inclusion

Capital gains are typically subject to income tax rather than wealth tax, with taxation based on the profit realized from the sale of assets such as stocks, real estate, or businesses. Wealth tax applies to the net value of an individual's total assets, excluding unrealized capital gains, focusing on asset ownership rather than transaction-based income.

Tax base erosion

Wealth tax targets the net value of assets owned, potentially eroding the tax base by reducing accumulated wealth, while income tax erodes the tax base through taxation of earnings, affecting cash flow and labor incentives; balancing both taxes is crucial to minimizing base erosion and ensuring equitable fiscal revenue. Effective tax policy must address the interplay between wealth tax liabilities and income tax burdens to prevent double taxation and promote sustainable revenue streams.

Net worth assessment

Net worth assessment calculates an individual's total assets minus liabilities, providing a comprehensive measure of financial standing often used to determine wealth tax obligations, which targets accumulated wealth rather than annual earnings. Wealth tax is levied based on net worth, whereas income tax is imposed on the flow of income, making net worth assessment crucial for distinguishing between taxable wealth and taxable income.

Fiscal redistribution

Fiscal redistribution through wealth tax targets accumulated assets to reduce economic inequality more effectively than income tax, which primarily focuses on earnings and may fail to address wealth concentration. Implementing a wealth tax alongside income tax creates a comprehensive fiscal policy that balances immediate revenue generation with long-term equity enhancement.

Income stratification

Income stratification accentuates economic disparities where wealth tax targets accumulated assets of the richest, while income tax primarily affects earnings across broader population segments. Implementing a progressive wealth tax can reduce income inequality by redistributing capital concentration, whereas income tax rates often struggle to address entrenched wealth gaps effectively.

Asset valuation

Asset valuation plays a critical role in accurately determining liability under Wealth Tax, focusing on the net value of all owned assets, whereas Income Tax valuation centers on the income generated from these assets. Precise asset valuation ensures fair assessment, influencing strategies for tax compliance and financial planning across jurisdictions with distinct Wealth Tax and Income Tax regulations.

Tax avoidance schemes

Tax avoidance schemes often exploit differences between Wealth Tax and Income Tax regulations by transferring assets or income to reduce taxable wealth while minimizing reported income. These strategies leverage loopholes in asset valuation and income recognition rules to legally lower overall tax liability without evading tax obligations.

Marginal tax rates

Marginal tax rates on income tax increase progressively with higher earnings, directly impacting disposable income and labor incentives, whereas wealth tax applies a rate on net assets, targeting accumulated wealth irrespective of annual income. The wealth tax aims to reduce wealth inequality by taxing unrealized capital assets, while income tax focuses on taxing earned income streams within specified brackets.

Exemption thresholds

Exemption thresholds for Wealth Tax typically apply to the net value of assets owned, often set at substantial levels like $1 million, effectively excluding most individuals with moderate wealth from taxation. Income Tax exemption thresholds, however, are based on annual earnings--such as $12,400 in the U.S.--and are designed to exempt low-income earners from paying federal income tax.

Wealth Tax vs Income Tax Infographic

moneydif.com

moneydif.com