The endowment effect causes individuals to overvalue assets simply because they own them, leading to inflated perceptions of wealth. Status quo bias results in a preference for maintaining current financial situations, often preventing beneficial changes or investments. Both cognitive biases can hinder optimal wealth management by fostering attachment to existing possessions and resisting beneficial financial decisions.

Table of Comparison

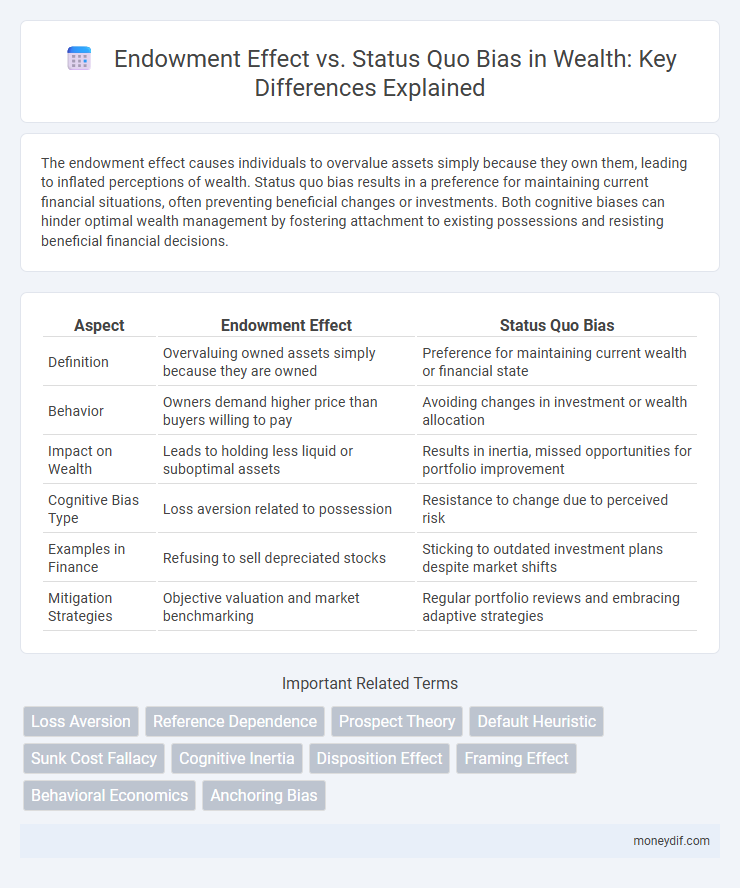

| Aspect | Endowment Effect | Status Quo Bias |

|---|---|---|

| Definition | Overvaluing owned assets simply because they are owned | Preference for maintaining current wealth or financial state |

| Behavior | Owners demand higher price than buyers willing to pay | Avoiding changes in investment or wealth allocation |

| Impact on Wealth | Leads to holding less liquid or suboptimal assets | Results in inertia, missed opportunities for portfolio improvement |

| Cognitive Bias Type | Loss aversion related to possession | Resistance to change due to perceived risk |

| Examples in Finance | Refusing to sell depreciated stocks | Sticking to outdated investment plans despite market shifts |

| Mitigation Strategies | Objective valuation and market benchmarking | Regular portfolio reviews and embracing adaptive strategies |

Understanding the Endowment Effect in Wealth Accumulation

The endowment effect significantly influences wealth accumulation by causing individuals to overvalue assets they own, leading to suboptimal investment decisions and reduced portfolio diversification. This cognitive bias results in holding onto possessions or investments longer than financially beneficial, impeding effective wealth growth. Understanding the endowment effect helps investors recognize irrational attachment to assets, enabling more strategic wealth management and improved financial outcomes.

Exploring the Status Quo Bias in Financial Decisions

Status Quo Bias in financial decisions leads investors to prefer maintaining current investment portfolios despite potentially better alternatives, driven by the discomfort of change and loss aversion. This cognitive bias results in missed opportunities for portfolio optimization and wealth accumulation by favoring familiar assets over new, potentially higher-yield investments. Understanding Status Quo Bias helps financial advisors design strategies that encourage clients to evaluate options objectively and overcome inertia in managing wealth.

Psychological Roots of Wealth Perception

The endowment effect and status quo bias both stem from deep psychological roots influencing wealth perception, where individuals assign higher value to owned assets and prefer maintaining current financial states. These biases are linked to loss aversion and emotional attachment, leading to resistance against change in investment or spending habits. Understanding these cognitive tendencies is crucial for optimizing wealth management strategies and improving decision-making outcomes.

How Endowment Effect Shapes Investment Choices

The Endowment Effect influences investment choices by causing investors to overvalue assets they already own, leading to reluctance in selling or diversifying portfolios. This cognitive bias amplifies attachment to current holdings, often resulting in suboptimal allocation of wealth and missed opportunities for better returns. Understanding the Endowment Effect enables investors to mitigate emotional biases and make more rational, value-driven investment decisions.

The Status Quo Bias and Portfolio Inertia

The Status Quo Bias causes investors to prefer maintaining their current portfolio allocations, leading to portfolio inertia despite changing market conditions or new investment opportunities. This behavioral tendency results in suboptimal wealth accumulation as individuals resist reallocating assets that could enhance returns or reduce risk. Overcoming portfolio inertia requires active decision-making and periodic portfolio review to align investments with evolving financial goals and market dynamics.

Endowment Effect vs. Status Quo Bias: Key Differences

The endowment effect describes the phenomenon where individuals ascribe higher value to possessions simply because they own them, while status quo bias reflects a preference for retaining current conditions over change. Endowment effect tends to inflate perceived value of owned assets, impacting decisions like selling or trading, whereas status quo bias leads to inaction to avoid perceived losses from change. Recognizing these distinct cognitive biases helps investors and wealth managers better understand client behaviors in asset retention and portfolio adjustments.

Behavioral Economics: Impacts on Personal Wealth

The endowment effect causes individuals to overvalue assets simply because they own them, leading to suboptimal financial decisions like holding onto underperforming investments. Status quo bias reinforces reluctance to change current financial strategies, even when better opportunities exist, thereby limiting wealth growth. Behavioral economics reveals these cognitive biases significantly hinder effective wealth management and investment diversification.

Overcoming Cognitive Biases for Better Wealth Management

Endowment effect causes individuals to overvalue assets they own, leading to suboptimal financial decisions, while status quo bias prompts a preference for maintaining existing investments despite better alternatives. Recognizing these cognitive biases enables investors to reassess portfolio allocations objectively and adopt diversified strategies that enhance long-term wealth growth. Implementing behavioral finance techniques and seeking professional advice can mitigate the influence of these biases for improved wealth management outcomes.

Real-Life Wealth Scenarios: Endowment Effect and Status Quo Bias

The endowment effect causes individuals to overvalue their current assets, leading to reluctance in selling or trading wealth even when market conditions change, which often results in suboptimal financial decisions. Status quo bias reinforces this behavior by making people prefer maintaining their existing investment portfolios or financial habits despite better alternatives. In real-life wealth scenarios, these cognitive biases hinder portfolio diversification and prevent timely adjustments to assets like stocks, real estate, or retirement funds, ultimately impacting long-term wealth accumulation.

Strategies to Mitigate Biases in Wealth Building

Implementing strategies such as regular portfolio reviews and adopting predetermined investment plans can help mitigate the endowment effect and status quo bias in wealth building. Utilizing diverse asset allocation and seeking external financial advice encourages objective decision-making, reducing attachment to current holdings. Embracing behavioral finance tools and setting clear financial goals enhances awareness and counters irrational persistence, promoting more effective wealth growth.

Important Terms

Loss Aversion

Loss aversion, a key concept in behavioral economics, explains the tendency for individuals to prefer avoiding losses over acquiring equivalent gains, intensifying the endowment effect where ownership increases an item's perceived value. This cognitive bias also underpins status quo bias, driving resistance to change by overvaluing current conditions due to the fear of potential losses.

Reference Dependence

Reference dependence explains how individuals evaluate outcomes relative to a specific baseline, influencing the endowment effect where ownership increases perceived value. This contrasts with status quo bias, which reflects a preference for maintaining current conditions rather than changing them, despite similar underlying reference points.

Prospect Theory

Prospect Theory explains how individuals evaluate potential losses and gains, highlighting the Endowment Effect, where people ascribe higher value to owned items, and Status Quo Bias, the preference for maintaining current conditions over change. Both biases reflect loss aversion, a core principle of Prospect Theory, influencing decision-making by overweighting potential losses relative to equivalent gains.

Default Heuristic

The Default Heuristic influences decision-making by causing individuals to stick with pre-set options, often intensifying the Endowment Effect, where owners assign higher value to their possessions. This predisposition overlaps with Status Quo Bias, as both lead to a preference for current states over change, reinforcing resistance to altering defaults even when alternatives may offer greater benefits.

Sunk Cost Fallacy

The sunk cost fallacy often intertwines with the endowment effect, where individuals irrationally overvalue possessions simply because they own them, leading to continued investment despite losses. This behavior contrasts with status quo bias, which reflects a preference for maintaining current conditions without necessarily valuing owned items more, yet both biases contribute to resistance against change and perpetuation of suboptimal decisions.

Cognitive Inertia

Cognitive inertia amplifies the Endowment Effect by causing individuals to overvalue possessions, reinforcing resistance to change inherent in Status Quo Bias. This psychological rigidity maintains attachment to current assets and choices, even when alternative options may offer greater benefits.

Disposition Effect

The Disposition Effect demonstrates investors' tendency to sell winning assets prematurely while holding onto losers, influenced by the Endowment Effect where ownership increases perceived value, and the Status Quo Bias which drives preference for maintaining current holdings to avoid perceived loss. Both biases reinforce suboptimal financial decisions by prioritizing emotional attachment and comfort over rational portfolio adjustments.

Framing Effect

The Framing Effect influences decision-making by altering perceptions based on how choices are presented, significantly impacting the Endowment Effect where individuals overvalue owned items. This cognitive bias contrasts with Status Quo Bias, which drives people to prefer existing conditions, highlighting the nuanced interplay between ownership valuation and resistance to change.

Behavioral Economics

Behavioral economics reveals that the endowment effect causes individuals to ascribe higher value to items they own, while status quo bias leads to a preference for maintaining current conditions, both distorting rational decision-making. These biases affect market behaviors by causing resistance to change and overvaluation of personal possessions, impacting consumer choices and policy design.

Anchoring Bias

Anchoring bias influences decision-making by causing individuals to rely heavily on initial information, which intersects with the endowment effect as people assign higher value to owned items, reinforcing their attachment. This bias also relates to status quo bias, where individuals prefer existing conditions, as the initial anchor sets a reference point that makes change less appealing.

Endowment Effect vs Status Quo Bias Infographic

moneydif.com

moneydif.com