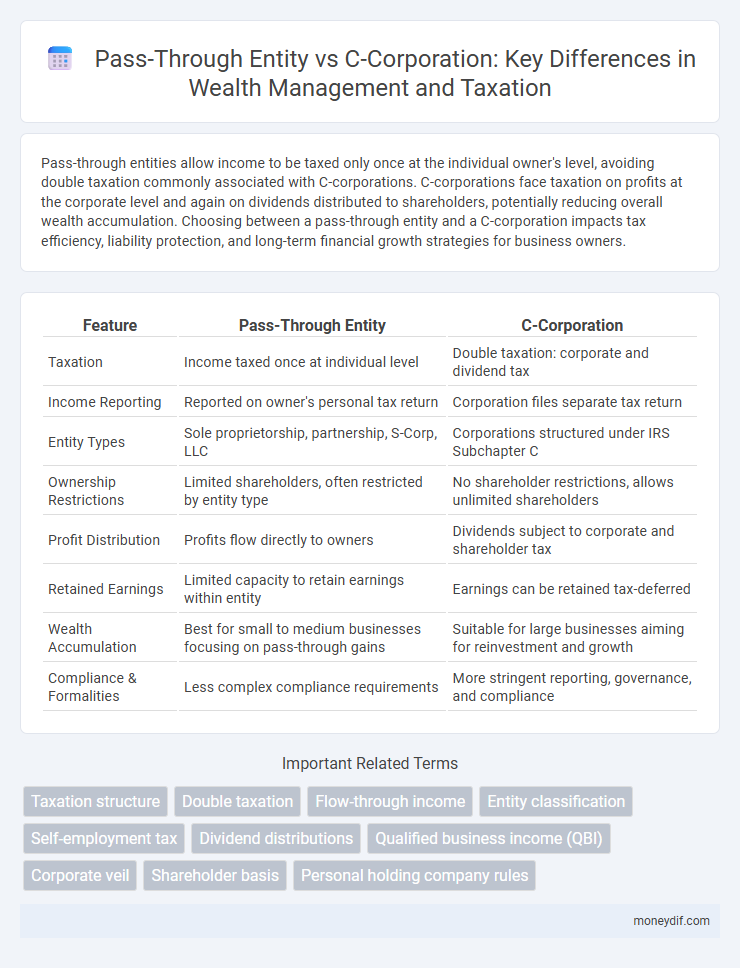

Pass-through entities allow income to be taxed only once at the individual owner's level, avoiding double taxation commonly associated with C-corporations. C-corporations face taxation on profits at the corporate level and again on dividends distributed to shareholders, potentially reducing overall wealth accumulation. Choosing between a pass-through entity and a C-corporation impacts tax efficiency, liability protection, and long-term financial growth strategies for business owners.

Table of Comparison

| Feature | Pass-Through Entity | C-Corporation |

|---|---|---|

| Taxation | Income taxed once at individual level | Double taxation: corporate and dividend tax |

| Income Reporting | Reported on owner's personal tax return | Corporation files separate tax return |

| Entity Types | Sole proprietorship, partnership, S-Corp, LLC | Corporations structured under IRS Subchapter C |

| Ownership Restrictions | Limited shareholders, often restricted by entity type | No shareholder restrictions, allows unlimited shareholders |

| Profit Distribution | Profits flow directly to owners | Dividends subject to corporate and shareholder tax |

| Retained Earnings | Limited capacity to retain earnings within entity | Earnings can be retained tax-deferred |

| Wealth Accumulation | Best for small to medium businesses focusing on pass-through gains | Suitable for large businesses aiming for reinvestment and growth |

| Compliance & Formalities | Less complex compliance requirements | More stringent reporting, governance, and compliance |

Understanding Pass-Through Entities in Wealth Management

Pass-through entities, such as S corporations, partnerships, and LLCs, allow income, losses, deductions, and credits to pass directly to shareholders or owners, avoiding double taxation common with C-corporations. These entities provide significant tax advantages in wealth management by enabling income to be reported on individual tax returns, often resulting in lower overall tax liability. Understanding the structural and tax benefits of pass-through entities is crucial for high-net-worth individuals seeking efficient wealth transfer and tax planning strategies.

What Defines a C-Corporation Structure?

A C-corporation is a legal business structure characterized by its ability to issue multiple classes of stock and unlimited shareholders, including foreign investors. This entity type is subject to corporate income tax at the federal level, resulting in potential double taxation when dividends are distributed to shareholders. Compared to pass-through entities, C-corporations offer enhanced liability protection and greater access to capital markets, making them suitable for large-scale businesses with complex ownership needs.

Tax Implications: Pass-Through Entities vs. C-Corporations

Pass-through entities such as S-corporations, partnerships, and LLCs enable business income to be taxed only once at the individual owner's tax rate, avoiding the double taxation faced by C-corporations. C-corporations are subject to corporate income tax at rates up to 21%, and dividends distributed to shareholders are taxed again at the individual level, leading to potential tax inefficiency. Pass-through entities often provide significant tax advantages for small to medium-sized businesses by enabling income flow-through with deductions and credits applied directly to personal tax returns.

Wealth Accumulation Strategies by Entity Type

Pass-through entities, such as S-corporations and LLCs, enable wealth accumulation by allowing business profits to be taxed only once at the individual owner's rate, fostering efficient tax planning and reinvestment. C-corporations face double taxation on earnings, but benefit from lower corporate tax rates and greater opportunities for retained earnings growth and access to equity financing. Strategic wealth accumulation depends on balancing immediate tax impacts with long-term growth potential inherent to each entity type.

Liability Protection: Comparing Pass-Throughs and C-Corporations

Pass-through entities like S-corporations and LLCs offer liability protection by separating personal assets from business debts and lawsuits, similar to C-corporations, which provide strong liability shields for shareholders. In a C-corporation, liability protection extends to isolating corporate obligations from shareholder assets, with the added complexity of double taxation on profits. Pass-through entities combine liability protection with simplified tax benefits by reporting income on individual tax returns, avoiding corporate tax layers while maintaining limited personal liability.

Impact on Personal Income and Wealth Building

Pass-through entities such as S-corporations and LLCs allow business income to be reported directly on personal tax returns, avoiding double taxation and potentially lowering overall tax liability. C-corporations face corporate income tax, and dividends distributed to shareholders are taxed again on personal income, which can reduce the net wealth accumulated from business profits. Choosing a pass-through entity may enhance wealth building by preserving more earnings for reinvestment or personal use, while C-corporations offer benefits like retained earnings for growth but with higher personal tax implications.

Succession Planning and Estate Considerations

Pass-through entities like S-corporations and LLCs offer significant advantages in succession planning by allowing income and losses to pass directly to owners, potentially reducing estate tax burdens and simplifying asset transfer. C-corporations face double taxation, impacting the value of shares transferred during estate settlement and complicating wealth transfer strategies. Strategic use of buy-sell agreements and valuation discounts in pass-through entities can optimize estate tax outcomes and ensure smoother generational wealth transition.

Access to Capital and Investor Preferences

Pass-through entities offer limited access to capital primarily through personal networks and private funding, making them less attractive for large-scale investors seeking liquidity and diverse financing options. C-corporations facilitate greater capital access by issuing multiple classes of stock and attracting institutional investors, venture capitalists, and public markets. Investor preferences often lean toward C-corporations due to their scalability, governance structure, and potential for significant equity appreciation.

Flexibility and Administrative Costs

Pass-through entities such as S-corporations and LLCs offer greater flexibility in management and profit distribution compared to C-corporations, which are subject to stricter corporate formalities and shareholder regulations. Administrative costs are typically lower for pass-through entities due to less complex tax filing requirements and fewer regulatory obligations. C-corporations face higher administrative burdens, including double taxation and mandatory corporate governance, increasing overall compliance expenses.

Choosing the Right Entity for Maximizing Wealth

Choosing between a pass-through entity and a C-corporation significantly impacts wealth maximization due to differences in tax treatment and profit distribution. Pass-through entities, such as S-corporations and LLCs, avoid double taxation by allowing income to flow directly to owners' personal tax returns, enhancing after-tax wealth accumulation. C-corporations face corporate tax rates and potential double taxation on dividends but benefit from retained earnings growth, making entity selection crucial for optimizing long-term wealth strategies.

Important Terms

Taxation structure

Pass-through entities, such as S-corporations and LLCs, avoid double taxation by allowing income to be reported on individual tax returns, while C-corporations face corporate income tax and potential double taxation on dividends distributed to shareholders. The choice between pass-through taxation and C-corporation structure significantly impacts tax liability, compliance costs, and shareholder income treatment under IRS regulations.

Double taxation

Pass-through entities such as S-corporations and partnerships avoid double taxation by reporting income on owners' individual tax returns, while C-corporations face double taxation through corporate income tax and shareholder dividend taxation. This distinction significantly impacts the overall tax burden and influences business structure decisions based on profitability and distribution plans.

Flow-through income

Flow-through income allows pass-through entities such as S-corporations, partnerships, and LLCs to report business profits directly on owners' individual tax returns, avoiding double taxation faced by C-corporations. Unlike C-corporations, which pay corporate income tax independently and distribute after-tax dividends to shareholders, pass-through entities enable income to flow directly to owners, resulting in potentially lower overall tax liability.

Entity classification

Pass-through entities such as S-corporations and LLCs allow income to be taxed at the individual owner level, avoiding double taxation, unlike C-corporations which are taxed separately at the corporate level and again on dividends. Choosing between a pass-through entity and a C-corporation impacts tax liabilities, regulatory compliance, and eligibility for certain business deductions.

Self-employment tax

Self-employment tax applies primarily to income earned from pass-through entities such as sole proprietorships, partnerships, and S-corporations, where business profits pass through to the owner's personal tax return and are subject to Social Security and Medicare taxes. In contrast, C-corporation owners are not subject to self-employment tax on dividends or salaries separately taxed as payroll expenses but faced with potential double taxation on corporate profits and dividends.

Dividend distributions

Pass-through entities, such as S-corporations and partnerships, distribute dividends as pass-through income, avoiding double taxation by reporting earnings directly to shareholders' individual tax returns. C-corporations pay dividends from after-tax profits, subjecting shareholders to double taxation at both the corporate and individual levels.

Qualified business income (QBI)

Qualified Business Income (QBI) deduction allows owners of pass-through entities, such as S-corporations, partnerships, and sole proprietorships, to deduct up to 20% of their QBI from taxable income, providing significant tax savings compared to C-corporations. C-corporations are not eligible for the QBI deduction, as their income is taxed at the corporate level with a flat rate of 21%, leading to potential double taxation on dividends distributed to shareholders.

Corporate veil

The corporate veil protects shareholders of pass-through entities, such as S-corporations and LLCs, from personal liability by legally separating personal assets from business debts. Unlike C-corporations, pass-through entities avoid double taxation by passing income directly to owners, but the corporate veil's strength may vary based on entity structure and jurisdictional factors.

Shareholder basis

Shareholder basis in a pass-through entity, such as an S corporation or partnership, reflects the shareholder's investment adjusted for income, losses, and distributions, directly impacting taxable gain or loss upon sale or liquidation. In contrast, a C-corporation shareholder basis is primarily the stock purchase price plus additional capital contributions, with corporate earnings taxed at the corporate level and dividends taxed separately, resulting in potential double taxation.

Personal holding company rules

Personal holding company (PHC) rules target C-corporations with more than 60% of income from passive sources and ownership by five or fewer individuals, imposing a special tax to discourage income accumulation. Pass-through entities like S-corporations and LLCs avoid PHC tax since their income is reported on individual returns, while C-corporations are directly subject to these rules if they meet the criteria.

Pass-through entity vs C-corporation Infographic

moneydif.com

moneydif.com