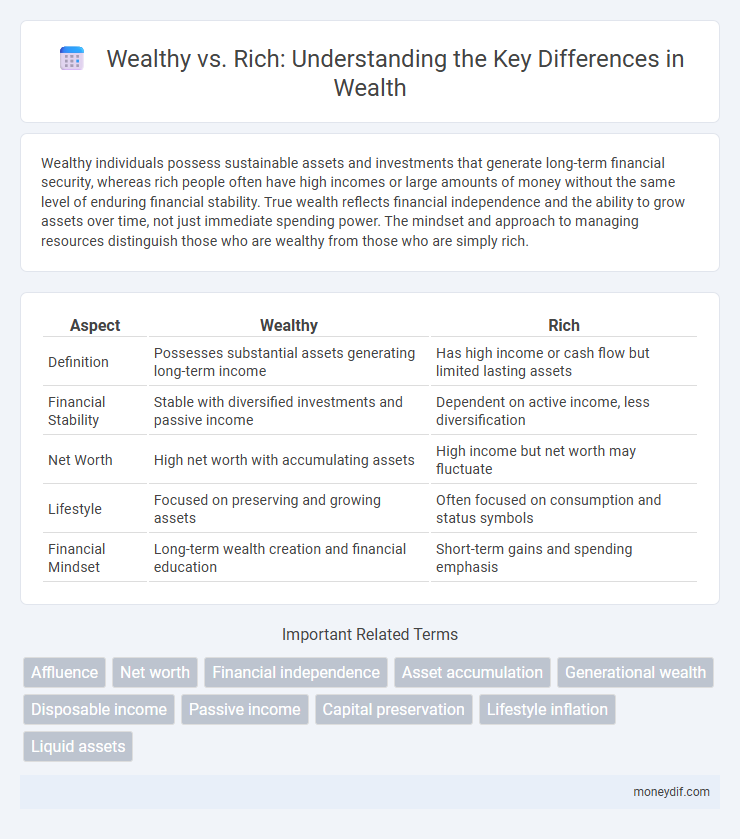

Wealthy individuals possess sustainable assets and investments that generate long-term financial security, whereas rich people often have high incomes or large amounts of money without the same level of enduring financial stability. True wealth reflects financial independence and the ability to grow assets over time, not just immediate spending power. The mindset and approach to managing resources distinguish those who are wealthy from those who are simply rich.

Table of Comparison

| Aspect | Wealthy | Rich |

|---|---|---|

| Definition | Possesses substantial assets generating long-term income | Has high income or cash flow but limited lasting assets |

| Financial Stability | Stable with diversified investments and passive income | Dependent on active income, less diversification |

| Net Worth | High net worth with accumulating assets | High income but net worth may fluctuate |

| Lifestyle | Focused on preserving and growing assets | Often focused on consumption and status symbols |

| Financial Mindset | Long-term wealth creation and financial education | Short-term gains and spending emphasis |

Defining Wealthy vs Rich: Key Differences

Wealthy individuals possess sustainable assets such as investments, real estate, and business ownership that generate ongoing income without reliance on a paycheck. Rich people may have high income or cash flow temporarily but often lack long-term financial security and asset accumulation. The key difference lies in wealth creation through passive income and net worth versus rich status driven mainly by earnings.

The Mindset of Wealthy Individuals

Wealthy individuals prioritize long-term financial security and generational prosperity over short-term gains, focusing on asset accumulation and diversified investments. Their mindset emphasizes disciplined spending, continuous learning, and strategic risk management, differentiating them from those who are merely rich. The wealthy adopt a growth-oriented perspective, valuing financial education and leveraging opportunities to build sustainable wealth rather than transient affluence.

How the Rich Build and Spend Money

The rich focus on building wealth through strategic investments, diversifying portfolios, and acquiring assets that generate passive income, rather than relying solely on earned income. They prioritize spending on value-driven opportunities, such as businesses, education, and long-term growth, rather than short-term luxury or consumer goods. Effective money management, disciplined saving, and continuous financial education are key factors that distinguish the spending habits of the wealthy from those who are simply rich.

Wealth Accumulation Strategies

Wealth accumulation strategies emphasize long-term asset growth through diversified investments, passive income streams, and prudent financial planning, distinguishing the wealthy from the merely rich. The wealthy prioritize sustainable wealth by leveraging compound interest, real estate holdings, and business equity rather than relying solely on high income or consumption. Building generational wealth involves comprehensive estate planning, tax optimization, and reinvestment strategies that create lasting financial security beyond immediate riches.

Income Sources: Wealthy vs Rich

Wealthy individuals often possess diversified income sources including investments in stocks, real estate, and business ventures, generating passive income that sustains long-term growth. Rich individuals typically rely heavily on a high salary or single primary income stream, which may not provide consistent wealth accumulation. Sustainable wealth is characterized by asset growth and income diversification rather than mere high earnings.

Long-Term Security: Wealth vs Richness

Wealth provides long-term financial security through diverse investments, estate planning, and passive income streams, ensuring sustained prosperity across generations. Richness often reflects high income or assets without guaranteed preservation or growth, risking rapid depletion during economic downturns. True wealth emphasizes stability and legacy, while being rich may prioritize immediate consumption and short-term gains.

Lifestyle Choices and Financial Freedom

Wealthy individuals prioritize long-term financial freedom through strategic investments and sustainable lifestyle choices that enhance generational prosperity, while the rich often focus on immediate luxury and material possessions without ensuring lasting security. Wealth emphasizes cash flow, asset diversification, and passive income streams that support a lifestyle independent of active work. Financial freedom achieved by the wealthy allows for greater autonomy and intentional living beyond mere monetary accumulation.

Generational Wealth: Legacy and Impact

Generational wealth builds lasting financial stability by passing assets, investments, and valuable knowledge across multiple generations, ensuring a legacy beyond immediate riches. Unlike being simply rich, wealthy families emphasize sustainable growth, estate planning, and philanthropic impact to preserve and enhance wealth over time. This strategic approach fosters economic empowerment and societal influence that endure far beyond individual lifetimes.

Financial Habits of the Wealthy

Wealthy individuals consistently prioritize long-term financial growth through disciplined saving, diversified investments, and strategic asset management, distinguishing themselves from merely rich individuals who often emphasize high income or consumption. They focus on generating passive income streams, maintaining low debt levels, and reinvesting earnings to build sustainable wealth. Financial habits such as budgeting rigorously, continuous learning about market trends, and avoiding impulsive spending contribute significantly to their enduring financial stability.

Achieving Sustainable Wealth

Achieving sustainable wealth involves building long-term financial security through diversified investments, consistent saving habits, and mindful spending, rather than solely accumulating high income or assets. Wealthy individuals focus on generating passive income streams, preserving capital, and growing net worth sustainably, ensuring resilience against economic fluctuations. Rich individuals may possess substantial money temporarily, but sustainable wealth emphasizes enduring financial independence and legacy creation.

Important Terms

Affluence

Affluence represents a sustained state of substantial wealth marked by high net worth and consistent income, distinguishing it from being merely rich, which often refers to a temporary or surface-level accumulation of money. True affluence encompasses financial security, diversified assets, and generational wealth, highlighting stability rather than fluctuating wealth status.

Net worth

Net worth measures the total assets minus liabilities, serving as a key indicator of financial health that distinguishes wealthy individuals, who typically have substantial investments and diversified income streams, from the rich, who may possess high income but lower overall net worth. Wealth emphasizes long-term financial stability and generational wealth accumulation, while being rich often refers to immediate income or cash flow without necessarily reflecting lasting financial security.

Financial independence

Financial independence signifies having sufficient assets and income streams to cover living expenses without active employment, a state often associated with the wealthy who focus on long-term asset accumulation and investment strategies. In contrast, being rich typically describes high income or substantial monetary wealth that may not guarantee financial independence without sustainable financial management.

Asset accumulation

Asset accumulation distinguishes the wealthy from the rich by emphasizing long-term value creation through investments in real estate, stocks, businesses, and intellectual property, rather than mere high income or luxury spending. Wealthy individuals focus on generating passive income and growing net worth, while the rich often rely on high earnings without substantial asset growth.

Generational wealth

Generational wealth refers to the assets and financial resources passed down through multiple generations, creating lasting economic stability and opportunities beyond mere income or temporary affluence. Wealthy individuals focus on building and preserving generational wealth by investing in assets like real estate, businesses, and education, while those who are merely rich often prioritize short-term spending and consumption without long-term financial planning.

Disposable income

Disposable income represents the amount of money individuals have available after taxes and essential expenses, significantly influencing the financial behavior of both wealthy and rich populations. Wealthy individuals often have higher disposable incomes due to diversified investments and passive income streams, while the rich may rely more on earned income, resulting in varying levels of financial flexibility and spending power.

Passive income

Passive income streams, such as dividends, rental properties, and royalties, differentiate the wealthy from the rich by generating continuous cash flow without active work. Wealthy individuals prioritize building diversified passive income sources to achieve financial independence and long-term stability, whereas the rich often rely on earned income and visible assets.

Capital preservation

Capital preservation focuses on maintaining the principal investment, a strategy often prioritized by the wealthy who aim to sustain long-term financial stability. In contrast, the rich may prioritize accumulation and rapid growth, sometimes risking capital to increase wealth faster.

Lifestyle inflation

Lifestyle inflation occurs when individuals increase their spending as their income grows, often diminishing the ability to build lasting wealth; wealthy individuals tend to manage lifestyle inflation by maintaining disciplined saving habits and investing consistently, while the rich may experience rapid spending escalation that hampers long-term financial stability. Understanding the distinction between wealth accumulation and income level highlights the importance of controlling lifestyle inflation to achieve sustainable financial success.

Liquid assets

Liquid assets, such as cash, stocks, and bonds, provide individuals with immediate purchasing power and financial flexibility that often distinguishes the wealthy from the merely rich. Wealthy individuals typically hold a higher proportion of liquid assets, enabling them to seize investment opportunities and manage risks more effectively than those who are simply rich with mostly illiquid assets like real estate or luxury goods.

Wealthy vs Rich Infographic

moneydif.com

moneydif.com