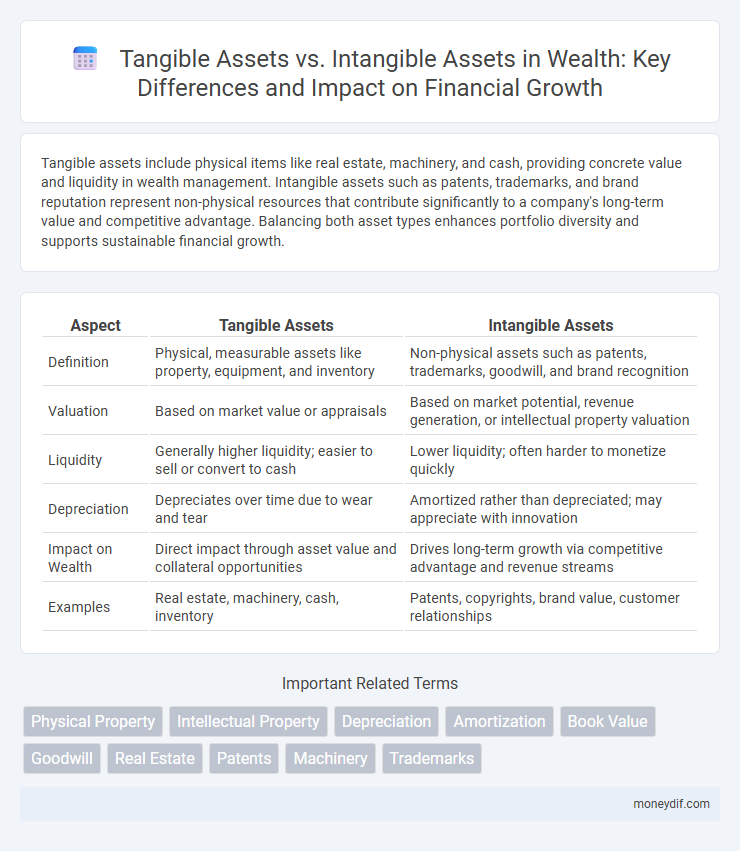

Tangible assets include physical items like real estate, machinery, and cash, providing concrete value and liquidity in wealth management. Intangible assets such as patents, trademarks, and brand reputation represent non-physical resources that contribute significantly to a company's long-term value and competitive advantage. Balancing both asset types enhances portfolio diversity and supports sustainable financial growth.

Table of Comparison

| Aspect | Tangible Assets | Intangible Assets |

|---|---|---|

| Definition | Physical, measurable assets like property, equipment, and inventory | Non-physical assets such as patents, trademarks, goodwill, and brand recognition |

| Valuation | Based on market value or appraisals | Based on market potential, revenue generation, or intellectual property valuation |

| Liquidity | Generally higher liquidity; easier to sell or convert to cash | Lower liquidity; often harder to monetize quickly |

| Depreciation | Depreciates over time due to wear and tear | Amortized rather than depreciated; may appreciate with innovation |

| Impact on Wealth | Direct impact through asset value and collateral opportunities | Drives long-term growth via competitive advantage and revenue streams |

| Examples | Real estate, machinery, cash, inventory | Patents, copyrights, brand value, customer relationships |

Defining Tangible and Intangible Assets

Tangible assets include physical items such as real estate, machinery, and inventory that hold measurable value and can be directly appraised. Intangible assets consist of non-physical resources like patents, trademarks, copyrights, and brand reputation, which contribute to a company's competitive advantage. Both asset types are crucial in wealth accumulation and financial reporting, with tangible assets offering liquidity and intangible assets driving long-term growth.

Key Differences Between Tangible and Intangible Assets

Tangible assets include physical items such as real estate, machinery, and inventory, which provide measurable value and can be used as collateral for loans. Intangible assets, like patents, trademarks, and goodwill, represent non-physical resources that contribute to a company's competitive advantage and intellectual property value. The key differences lie in liquidity, valuation methods, and depreciation, with tangible assets typically easier to appraise and intangible assets often requiring complex estimation techniques.

Examples of Tangible Assets in Wealth Management

Tangible assets in wealth management include physical items such as real estate properties, precious metals like gold and silver, and collectible art pieces, all of which hold intrinsic value and can be leveraged for financial stability. These assets provide a hedge against inflation and market volatility, offering investors a sense of security through their physical presence. Real estate investments, luxury vehicles, and valuable antiques are common tangible assets that contribute significantly to portfolio diversification and long-term wealth preservation.

Intangible Assets: Types and Significance

Intangible assets include intellectual property, brand reputation, patents, trademarks, copyrights, and goodwill, playing a pivotal role in enhancing a company's market value and competitive advantage. These assets contribute to long-term revenue generation by enabling innovation, customer loyalty, and strategic positioning in the marketplace. Valuing intangible assets accurately is essential for effective wealth management, mergers, acquisitions, and financial reporting.

Valuation Methods for Tangible vs Intangible Assets

Tangible assets are typically valued using cost-based methods such as historical cost or replacement cost, incorporating depreciation to reflect wear and tear. Intangible assets require income-based valuation methods like the discounted cash flow (DCF) approach or relief-from-royalty method to estimate future economic benefits accurately. Market-based approaches can also support valuation but are less common for intangibles due to limited comparables.

Impact on Net Worth: Tangible vs Intangible Assets

Tangible assets such as real estate, vehicles, and machinery contribute directly and visibly to net worth by providing measurable market value and collateral for loans, often enhancing financial stability. Intangible assets like patents, trademarks, and brand reputation impact net worth more indirectly, adding value through potential revenue generation and competitive advantage, though they can be harder to quantify and may fluctuate significantly. Understanding the balance between tangible and intangible assets is crucial for accurate wealth assessment and strategic financial planning.

Risks and Advantages of Tangible Assets

Tangible assets, such as real estate, equipment, and precious metals, offer the advantage of physical presence and intrinsic value, providing a sense of security and collateral for loans. These assets are less volatile than intangible assets and are less susceptible to market speculation, reducing investment risk. However, tangible assets face risks like depreciation, maintenance costs, and limited liquidity, which can impact their overall return on investment.

Strategic Importance of Intangible Assets for Investors

Intangible assets such as intellectual property, brand reputation, and proprietary technology often drive long-term value creation and competitive advantage for investors. Unlike tangible assets, these non-physical resources can yield higher returns through innovation, customer loyalty, and market differentiation. Recognizing the strategic importance of intangible assets enables investors to identify growth opportunities and assess a company's true potential beyond its balance sheet.

Tangible and Intangible Assets in Portfolio Diversification

Tangible assets such as real estate, precious metals, and physical collectibles offer portfolio diversification by providing intrinsic value and hedging against inflation and market volatility. Intangible assets, including patents, trademarks, and brand reputation, contribute to portfolio growth through potential appreciation and income generation without requiring physical storage or maintenance. Balancing tangible and intangible assets enhances risk management by combining stability with growth opportunities in a diversified wealth portfolio.

Future Trends: The Evolving Role of Intangible Assets in Wealth

Intangible assets such as intellectual property, brand equity, and digital innovations are increasingly driving wealth creation in the modern economy, surpassing traditional tangible assets like real estate and machinery in value. The rise of technology, data analytics, and intellectual capital is shifting investment focus toward intangible resources that fuel competitive advantage and sustainable growth. Future wealth strategies prioritize acquiring, managing, and leveraging intangible assets to maximize market valuation and long-term financial resilience.

Important Terms

Physical Property

Physical property refers to tangible assets characterized by their measurable and touchable nature, including real estate, machinery, and equipment. Intangible assets lack physical substance but hold value through intellectual rights, trademarks, patents, or brand recognition critical for business valuation and operational advantage.

Intellectual Property

Intellectual property (IP) represents a key category of intangible assets, encompassing creations such as patents, copyrights, trademarks, and trade secrets, which provide exclusive legal rights and competitive advantage without physical form. Unlike tangible assets like machinery, buildings, or inventory, IP generates value through innovation and brand recognition, playing a crucial role in business valuation and long-term strategic growth.

Depreciation

Depreciation applies primarily to tangible assets such as machinery, buildings, and equipment, systematically allocating their cost over useful life to reflect wear and tear. Intangible assets like patents or trademarks undergo amortization instead, which similarly spreads their cost but is distinct in accounting treatment and applicable asset types.

Amortization

Amortization applies to intangible assets such as patents, copyrights, and trademarks, systematically allocating their cost over their useful life, whereas tangible assets are depreciated due to their physical nature and wear over time. Understanding the distinction between amortization for intangible assets and depreciation for tangible assets is crucial for accurate financial reporting and tax compliance.

Book Value

Book value represents the net asset value of a company calculated as total tangible assets minus liabilities, reflecting physical items like machinery, buildings, and inventory. Intangible assets such as patents, trademarks, and goodwill are often excluded or separately reported, creating a distinction that affects the accuracy of book value as a measure of a company's true worth.

Goodwill

Goodwill is an intangible asset that arises when a company acquires another business for a price exceeding the fair value of its tangible assets, such as property, equipment, and inventory. It reflects non-physical elements like brand reputation, customer relationships, and intellectual property that cannot be separately identified or valued like tangible assets.

Real Estate

Real estate primarily constitutes tangible assets, including physical properties like land and buildings, which can be appraised and leveraged for financial gain. In contrast, intangible assets in real estate encompass non-physical elements such as brand reputation, leases, and intellectual property rights associated with property management or development companies.

Patents

Patents are classified as intangible assets because they represent legal rights to intellectual property rather than physical objects. Unlike tangible assets such as machinery or buildings, patents provide exclusive commercial advantages through innovation protection and can significantly enhance a company's valuation and competitive edge.

Machinery

Machinery is classified as a tangible asset due to its physical presence and measurable value, essential for production processes and capital investment analysis. Unlike intangible assets such as patents or trademarks, machinery can be depreciated over its useful life, impacting financial statements and tax considerations.

Trademarks

Trademarks are classified as intangible assets because they represent brand identity and legal rights without physical substance, while tangible assets consist of physical items like machinery or property. Unlike tangible assets, trademarks provide long-term value through brand recognition, customer loyalty, and exclusive market positioning.

Tangible Assets vs Intangible Assets Infographic

moneydif.com

moneydif.com