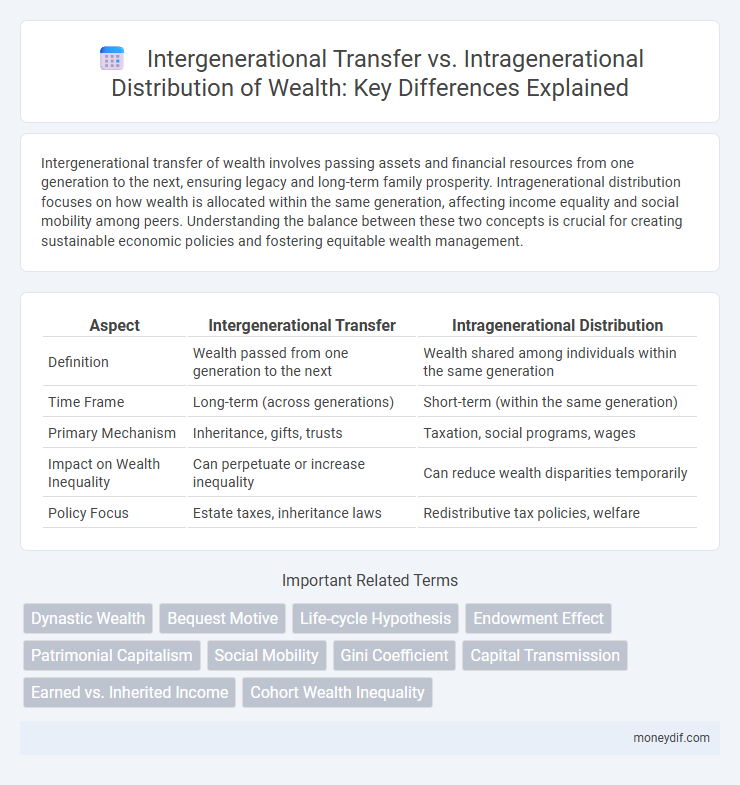

Intergenerational transfer of wealth involves passing assets and financial resources from one generation to the next, ensuring legacy and long-term family prosperity. Intragenerational distribution focuses on how wealth is allocated within the same generation, affecting income equality and social mobility among peers. Understanding the balance between these two concepts is crucial for creating sustainable economic policies and fostering equitable wealth management.

Table of Comparison

| Aspect | Intergenerational Transfer | Intragenerational Distribution |

|---|---|---|

| Definition | Wealth passed from one generation to the next | Wealth shared among individuals within the same generation |

| Time Frame | Long-term (across generations) | Short-term (within the same generation) |

| Primary Mechanism | Inheritance, gifts, trusts | Taxation, social programs, wages |

| Impact on Wealth Inequality | Can perpetuate or increase inequality | Can reduce wealth disparities temporarily |

| Policy Focus | Estate taxes, inheritance laws | Redistributive tax policies, welfare |

Defining Intergenerational Transfer of Wealth

Intergenerational transfer of wealth refers to the passing of assets, financial resources, and property from one generation to the next, often through inheritance, gifts, or trusts. This wealth transfer plays a crucial role in shaping economic disparities and long-term family financial security. Understanding the mechanisms and tax implications of intergenerational transfers is essential for effective wealth management and estate planning.

Understanding Intragenerational Wealth Distribution

Intragenerational wealth distribution examines how assets and income are shared among individuals within the same generation, highlighting disparities influenced by factors like education, occupation, and social policies. This distribution affects economic mobility and social inequality by determining the relative wealth positions of citizens at similar life stages. Understanding these patterns is crucial for designing interventions that promote equitable wealth accumulation and reduce socioeconomic gaps within a generation.

Key Mechanisms of Wealth Transmission Across Generations

Intergenerational wealth transfer primarily occurs through inheritance, gifts, and trusts that enable asset accumulation over time within families, preserving economic advantages across generations. Intragenerational distribution involves mechanisms such as income redistribution, social mobility, and taxation policies that affect wealth allocation among individuals within the same generation. Key transmission channels include capital gains, educational investments, and familial financial support, which collectively shape long-term wealth disparities and economic mobility patterns.

Social Impacts of Intragenerational Redistribution

Intragenerational redistribution significantly affects social equity by reallocating wealth among individuals within the same generation, reducing income disparities and enhancing access to essential services such as education and healthcare. This process fosters social cohesion and economic mobility by addressing immediate poverty and inequality issues, contrasting with intergenerational transfer, which primarily influences wealth accumulation over time. Policy mechanisms like progressive taxation and social welfare programs are critical for effective intragenerational redistribution, promoting a more inclusive and balanced society.

Policy Approaches: Taxation and Inheritance Laws

Policy approaches to wealth transfer emphasize taxation and inheritance laws to address disparities in intergenerational transfer and intragenerational distribution. Progressive estate taxes and inheritance regulations aim to limit wealth concentration passed across generations, promoting economic mobility and reducing inequality. Meanwhile, policies targeting intragenerational wealth focus on income redistribution through mechanisms such as wealth taxes and capital gains taxes to rebalance wealth within the same generation.

Inequality Amplification Through Generational Transfers

Intergenerational transfers of wealth significantly amplify inequality by consolidating assets within certain family lines, perpetuating economic disparities across generations. Unlike intragenerational distribution that redistributes wealth among contemporaries, these transfers compound advantages or disadvantages, leading to entrenched wealth gaps. Studies reveal that heirs from affluent families inherit substantial capital, reinforcing social stratification and limiting upward mobility for less wealthy groups.

The Role of Education and Upward Mobility

Education significantly influences intergenerational wealth transfer by equipping individuals with skills and knowledge that enhance earning potential and financial literacy. It fosters upward mobility within intragenerational wealth distribution by enabling people to improve their economic status beyond their initial conditions. Access to quality education reduces wealth disparities, promoting a more equitable distribution and sustainable economic growth across generations.

Wealth Concentration: Generational vs. Intragenerational Factors

Wealth concentration is significantly influenced by intergenerational transfers, where assets like real estate, investments, and business equity pass from one generation to the next, perpetuating economic disparities. In contrast, intragenerational distribution reflects wealth shifts within a single generation, affected by factors such as income inequality, labor market dynamics, and consumption patterns. Analyzing these dynamics reveals that intergenerational transfers often have a more enduring impact on long-term wealth concentration than intragenerational fluctuations.

Case Studies: Global Perspectives on Wealth Distribution

Intergenerational transfer of wealth significantly shapes economic inequality, with case studies from the United States, Germany, and Japan highlighting how inheritance and gifts perpetuate wealth concentration across generations. In contrast, intragenerational wealth distribution examines disparities within the same generation, revealing how education, income, and social policies influence wealth accumulation in countries like Sweden and Brazil. Global perspectives demonstrate that policy interventions targeting either inheritance taxes or income redistribution yield varied outcomes depending on cultural, legal, and economic contexts.

Future Trends in Wealth Transfer and Distribution

Future trends in wealth transfer emphasize the growing impact of intergenerational inheritance as Baby Boomers pass assets to Millennials and Gen Z, with estimates projecting over $84 trillion to shift by 2045. Intragenerational distribution gains significance due to increasing income inequality and wealth concentration within generations, prompting policy debates on taxation and social welfare reforms. Technological advancements and financial innovation further influence how wealth is managed, transferred, and redistributed across and within generations.

Important Terms

Dynastic Wealth

Dynastic wealth refers to the accumulation and preservation of assets passed down through multiple generations, emphasizing intergenerational transfer mechanisms such as inheritance, trusts, and estate planning. In contrast, intragenerational distribution focuses on the allocation of wealth within the same generation, often through wealth-sharing practices, philanthropic efforts, or redistributive policies.

Bequest Motive

The bequest motive drives individuals to allocate wealth for intergenerational transfer, ensuring financial security for descendants and preserving family legacy. In contrast, intragenerational distribution focuses on wealth allocation within the same generation, addressing immediate economic needs and consumption disparities.

Life-cycle Hypothesis

The Life-cycle Hypothesis explains consumption and saving patterns based on individuals planning over their lifetime, highlighting how intergenerational transfers, such as bequests, influence wealth redistribution across generations. In contrast, intragenerational distribution examines resource allocation among individuals within the same generation, focusing on income variability, social welfare policies, and economic inequalities impacting consumption and savings behavior.

Endowment Effect

The Endowment Effect influences Intergenerational Transfer by causing individuals to overvalue assets they own, leading to unequal wealth distribution across generations. This cognitive bias contrasts with Intragenerational Distribution, where valuation disparities among peers affect resource allocation within the same generation.

Patrimonial Capitalism

Patrimonial capitalism emphasizes wealth accumulation through inheritance, significantly impacting intergenerational transfer by perpetuating economic inequality between generations. This contrasts with intragenerational distribution, which focuses on redistributing resources within the same generation to address income disparities and promote social mobility.

Social Mobility

Social mobility reflects shifts in economic status across generations through intergenerational transfer of wealth, education, and social capital, while intragenerational distribution focuses on income and resource allocation changes within an individual's lifetime. Understanding patterns of social mobility requires analyzing both the enduring impact of family background and the dynamic economic opportunities that influence individual upward or downward movement.

Gini Coefficient

The Gini Coefficient measures income inequality and reveals that intergenerational transfers, such as inheritance and educational opportunities, significantly impact long-term wealth distribution, while intragenerational distribution reflects income disparities within the same generation due to wages, taxes, and social policies. Studies show that intergenerational transfers often exacerbate inequality by concentrating wealth across generations, whereas intragenerational factors can either mitigate or deepen economic disparities within a given population.

Capital Transmission

Capital transmission shapes economic inequality by enabling intergenerational transfer of wealth, where assets and financial resources pass from parents to offspring, reinforcing long-term economic advantages. Intragenerational distribution involves the allocation of capital within the same generation, impacting social mobility and income inequality through mechanisms such as labor income, investments, and taxation policies.

Earned vs. Inherited Income

Earned income refers to wages and salaries generated through an individual's labor, contrasting with inherited income, which is wealth passed down through intergenerational transfers such as inheritances or trusts. Intergenerational transfer impacts wealth accumulation across generations, while intragenerational distribution examines how earned and inherited incomes are allocated within the same generation, influencing economic inequality.

Cohort Wealth Inequality

Cohort wealth inequality intensifies due to disparities in intergenerational transfers, where affluent families pass substantial wealth across generations, amplifying economic advantages. Conversely, intragenerational wealth distribution reflects income and asset accumulation differences within the same generation, but its impact on long-term inequality remains less pronounced than intergenerational transfer mechanisms.

Intergenerational Transfer vs Intragenerational Distribution Infographic

moneydif.com

moneydif.com