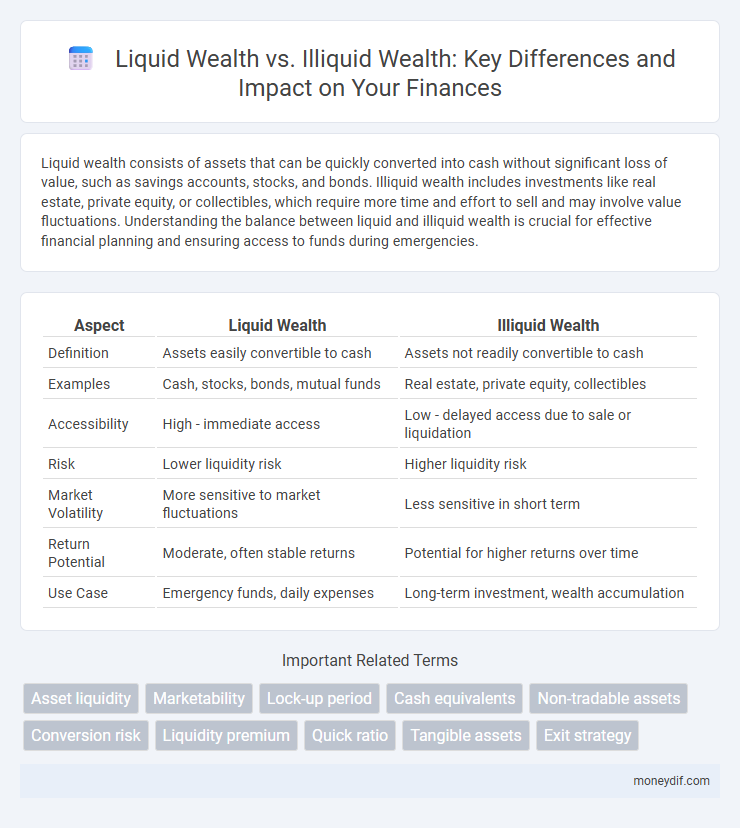

Liquid wealth consists of assets that can be quickly converted into cash without significant loss of value, such as savings accounts, stocks, and bonds. Illiquid wealth includes investments like real estate, private equity, or collectibles, which require more time and effort to sell and may involve value fluctuations. Understanding the balance between liquid and illiquid wealth is crucial for effective financial planning and ensuring access to funds during emergencies.

Table of Comparison

| Aspect | Liquid Wealth | Illiquid Wealth |

|---|---|---|

| Definition | Assets easily convertible to cash | Assets not readily convertible to cash |

| Examples | Cash, stocks, bonds, mutual funds | Real estate, private equity, collectibles |

| Accessibility | High - immediate access | Low - delayed access due to sale or liquidation |

| Risk | Lower liquidity risk | Higher liquidity risk |

| Market Volatility | More sensitive to market fluctuations | Less sensitive in short term |

| Return Potential | Moderate, often stable returns | Potential for higher returns over time |

| Use Case | Emergency funds, daily expenses | Long-term investment, wealth accumulation |

Defining Liquid Wealth and Illiquid Wealth

Liquid wealth refers to assets that can quickly and easily be converted into cash without significant loss of value, such as savings accounts, stocks, and bonds. Illiquid wealth consists of assets that cannot be promptly sold or exchanged for cash, including real estate, private equity, and collectibles. Understanding the distinction between liquid and illiquid wealth is crucial for effective financial planning and maintaining financial flexibility.

Key Differences Between Liquid and Illiquid Assets

Liquid assets such as cash, stocks, and money market instruments can be quickly converted to cash with minimal impact on their value, providing immediate financial flexibility and access to funds. Illiquid assets like real estate, private equity, and collectibles require longer time frames to sell and often involve higher transaction costs, limiting quick access to capital. Understanding these differences is crucial for wealth management strategies that balance liquidity needs with long-term investment goals.

Examples of Liquid Wealth

Cash, money market funds, and publicly traded stocks serve as prime examples of liquid wealth, offering swift conversion to cash without significant value loss. Savings accounts and government bonds also provide high liquidity, enabling easy access to funds. These liquid assets allow individuals to manage expenses and seize financial opportunities promptly.

Common Types of Illiquid Wealth

Common types of illiquid wealth include real estate properties, private equity investments, and collectibles such as art or rare coins. These assets typically require extended time frames to sell and often involve higher transaction costs compared to liquid assets like stocks or cash. Illiquid wealth can provide long-term value but poses challenges for quick access to funds during emergencies.

Pros and Cons of Liquid Wealth

Liquid wealth offers immediate access to funds, enabling swift financial decisions and emergency coverage without penalties or delays. The downside includes typically lower returns compared to illiquid assets, which can hinder long-term wealth accumulation and potential growth. Maintaining liquid wealth ensures flexibility but may sacrifice higher yields available from investments like real estate or private equity.

Advantages and Disadvantages of Illiquid Wealth

Illiquid wealth, such as real estate or private equity, offers long-term growth potential and less market volatility compared to liquid assets like stocks or cash. However, the major disadvantage lies in reduced accessibility and difficulty in converting these assets quickly into cash, which can limit flexibility during financial emergencies. Furthermore, illiquid wealth often involves higher transaction costs and complex valuation processes, impacting overall financial planning strategies.

The Role of Liquidity in Financial Planning

Liquidity plays a crucial role in financial planning by ensuring that assets can be quickly converted into cash to meet immediate expenses or investment opportunities. Liquid wealth, such as savings accounts and stocks, provides flexibility and risk management, while illiquid wealth, including real estate and private equity, often offers higher returns but limits access to capital. Balancing liquid and illiquid assets allows individuals to optimize growth potential while maintaining sufficient cash flow for emergencies and short-term goals.

How to Balance Liquid and Illiquid Wealth

Balancing liquid and illiquid wealth requires strategic allocation to ensure financial flexibility while maximizing long-term growth. Maintaining an emergency fund in liquid assets like cash or money market accounts supports immediate needs, whereas investing in illiquid assets such as real estate, private equity, or collectibles can enhance portfolio diversification and potential returns. Regular portfolio reviews help optimize the liquidity ratio, aligning asset distribution with personal financial goals, risk tolerance, and market conditions.

Impact of Market Conditions on Asset Liquidity

Market conditions significantly influence the liquidity of assets, affecting how quickly liquid wealth can be converted into cash without substantial loss of value. During economic downturns or volatile markets, illiquid assets such as real estate, private equity, and collectibles often face reduced market demand, prolonging sale times and potential price declines. Conversely, liquid assets like stocks and bonds generally maintain higher tradability, allowing wealth holders to access funds more rapidly despite market fluctuations.

Strategies to Convert Illiquid Wealth into Liquid Assets

Converting illiquid wealth into liquid assets involves strategic approaches such as selling non-essential real estate, leveraging collateralized loans against illiquid holdings, or creating structured financial products like asset-backed securities. Private equity stakes and ownership in family businesses can be partially liquidated through secondary market transactions or recapitalization efforts. Employing these methods enhances portfolio flexibility, ensuring timely access to cash while maintaining long-term wealth growth potential.

Important Terms

Asset liquidity

Asset liquidity directly impacts the ease of converting liquid wealth, such as cash and marketable securities, into immediate spending power compared to illiquid wealth, which includes real estate and private equity that require longer timeframes and may incur significant transaction costs. High asset liquidity enhances financial flexibility and reduces risk during emergencies, while illiquid assets often contribute to long-term wealth accumulation despite limited accessibility.

Marketability

Marketability significantly impacts wealth management by determining how easily assets can be converted to cash; liquid wealth such as stocks and bonds offer high marketability with quick transaction capability, while illiquid wealth like real estate or private equity involves longer processes and higher transaction costs. Investors often balance portfolios by combining liquid assets for immediate needs and illiquid assets for long-term growth, optimizing liquidity risk and return potential.

Lock-up period

Lock-up periods restrict access to investments, converting liquid wealth into illiquid assets by limiting the ability to quickly convert holdings into cash. This constraint impacts investors' portfolio flexibility and influences decisions between maintaining liquid wealth for immediate needs versus committing to illiquid assets for potential long-term gains.

Cash equivalents

Cash equivalents, including Treasury bills, money market funds, and commercial paper, represent highly liquid assets readily convertible to cash with minimal risk of value fluctuation. These instruments contribute significantly to liquid wealth, contrasting with illiquid wealth such as real estate or private equity, which require longer time horizons and may incur value loss upon rapid liquidation.

Non-tradable assets

Non-tradable assets, such as personal residences and specialized equipment, contribute predominantly to illiquid wealth because they cannot be quickly converted into cash without significant loss of value. Liquid wealth includes assets like stocks, bonds, and cash equivalents, which are easily tradable and can be accessed rapidly for financial transactions.

Conversion risk

Conversion risk arises when illiquid wealth, such as real estate or private equity, cannot be quickly transformed into cash without significant loss in value compared to liquid wealth like stocks or bank deposits. This risk affects financial flexibility and portfolio management by limiting immediate access to funds during market volatility or urgent liquidity needs.

Liquidity premium

Liquidity premium represents the additional expected return investors demand for holding illiquid assets compared to liquid wealth, reflecting the compensation for reduced marketability and higher transaction costs. Illiquid wealth, such as real estate or private equity, typically requires a higher liquidity premium due to longer investment horizons and difficulty converting to cash quickly, whereas liquid wealth like cash or publicly traded stocks offers immediate access with minimal price concessions.

Quick ratio

The Quick Ratio measures a company's ability to meet short-term liabilities using its most liquid assets, excluding inventory and other illiquid wealth; it highlights the proportion of liquid wealth like cash, marketable securities, and receivables relative to current liabilities. A higher Quick Ratio indicates stronger immediate liquidity and financial health by focusing solely on assets readily convertible to cash without significant loss.

Tangible assets

Tangible assets such as real estate, machinery, and precious metals represent illiquid wealth due to their limited ability to be quickly converted into cash without significant value loss. In contrast, liquid wealth includes cash or assets like stocks and bonds that can be rapidly and easily traded in financial markets, providing greater financial flexibility.

Exit strategy

An effective exit strategy balances liquid wealth, which enables quick access to cash for opportunities or emergencies, against illiquid wealth, such as real estate or private equity, that often offers higher long-term returns but requires strategic planning for conversion into cash. Structuring the exit to optimize the mix between liquid and illiquid assets minimizes financial risk and maximizes value realization.

Liquid wealth vs illiquid wealth Infographic

moneydif.com

moneydif.com