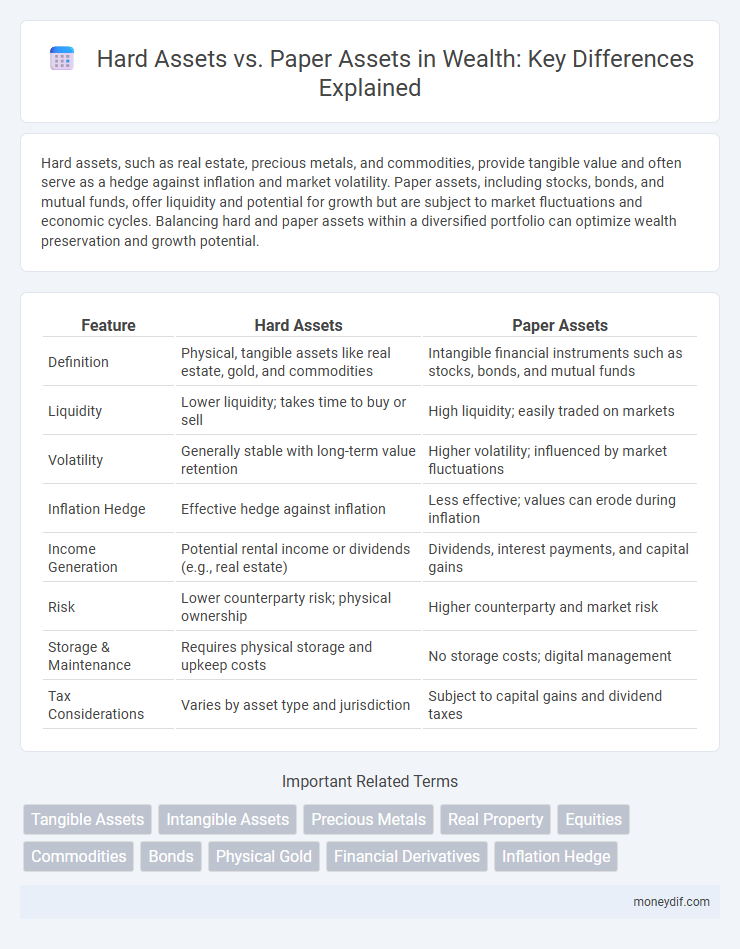

Hard assets, such as real estate, precious metals, and commodities, provide tangible value and often serve as a hedge against inflation and market volatility. Paper assets, including stocks, bonds, and mutual funds, offer liquidity and potential for growth but are subject to market fluctuations and economic cycles. Balancing hard and paper assets within a diversified portfolio can optimize wealth preservation and growth potential.

Table of Comparison

| Feature | Hard Assets | Paper Assets |

|---|---|---|

| Definition | Physical, tangible assets like real estate, gold, and commodities | Intangible financial instruments such as stocks, bonds, and mutual funds |

| Liquidity | Lower liquidity; takes time to buy or sell | High liquidity; easily traded on markets |

| Volatility | Generally stable with long-term value retention | Higher volatility; influenced by market fluctuations |

| Inflation Hedge | Effective hedge against inflation | Less effective; values can erode during inflation |

| Income Generation | Potential rental income or dividends (e.g., real estate) | Dividends, interest payments, and capital gains |

| Risk | Lower counterparty risk; physical ownership | Higher counterparty and market risk |

| Storage & Maintenance | Requires physical storage and upkeep costs | No storage costs; digital management |

| Tax Considerations | Varies by asset type and jurisdiction | Subject to capital gains and dividend taxes |

Understanding Hard Assets: Definition and Examples

Hard assets refer to tangible physical items of value such as real estate, precious metals like gold and silver, and commodities including oil and agricultural products. These assets provide intrinsic value, often acting as a hedge against inflation and economic uncertainty by maintaining purchasing power. Investors favor hard assets for their stability and ability to generate income through rentals or tangible product sales.

What Are Paper Assets? Key Characteristics

Paper assets represent financial instruments such as stocks, bonds, and mutual funds that derive value from legal contracts or claims rather than physical substance. These assets are highly liquid, easily tradable on financial markets, and can generate income through dividends or interest payments. Unlike hard assets, paper assets are subject to market volatility and regulatory changes, influencing their risk and return profiles.

Wealth Preservation: Hard Assets vs Paper Assets

Hard assets such as real estate, precious metals, and commodities provide tangible value and intrinsic security, making them essential for long-term wealth preservation against inflation and market volatility. Paper assets, including stocks and bonds, offer liquidity and growth potential but are more susceptible to market fluctuations and economic downturns, potentially eroding wealth during crises. Balancing a portfolio with both hard and paper assets enhances stability and ensures diversified protection of wealth over time.

Inflation Hedge: Which Asset Class Performs Better?

Hard assets such as real estate, precious metals, and commodities typically outperform paper assets like stocks and bonds during periods of high inflation due to their intrinsic value and limited supply. Inflation erodes the purchasing power of paper assets, whereas hard assets often appreciate or generate income that adjusts with inflation, offering a stronger hedge. Investors seeking to preserve wealth in inflationary environments favor diversification into hard assets for more reliable protection.

Liquidity Comparison: Hard Assets vs Paper Assets

Hard assets like real estate and precious metals offer tangible value but tend to have lower liquidity, often requiring significant time and transaction costs to convert into cash. Paper assets such as stocks and bonds provide higher liquidity, allowing rapid buying and selling on financial markets with minimal delay. The liquidity advantage of paper assets makes them more suitable for investors needing quick access to funds.

Diversification Strategies Using Both Assets

Diversifying a portfolio by combining hard assets, such as real estate and precious metals, with paper assets like stocks and bonds helps mitigate risk and enhance long-term wealth stability. Hard assets provide tangible value and hedge against inflation, while paper assets offer liquidity and growth potential. Balancing these asset types ensures a resilient investment strategy adaptable to varying market conditions.

Risk Factors: Hard Assets vs Paper Assets

Hard assets, including real estate, precious metals, and commodities, provide intrinsic value and generally exhibit lower volatility and inflation hedge properties, reducing exposure to market manipulation and currency devaluation risks. Paper assets such as stocks and bonds are susceptible to higher market fluctuations, regulatory changes, and credit risk, along with dependency on issuer performance and economic cycles. Diversifying between hard and paper assets mitigates risk by balancing tangible value preservation against liquidity and growth potential in financial markets.

Tax Implications for Hard and Paper Assets

Hard assets like real estate and precious metals often benefit from depreciation deductions and capital gains tax advantages, reducing overall tax liability. Paper assets such as stocks and bonds may be subject to higher short-term capital gains taxes and dividend income taxes, impacting net returns. Understanding specific tax treatments and holding periods is crucial for optimizing wealth preservation and growth strategies.

Historical Performance: Hard Assets versus Paper Assets

Hard assets such as real estate, gold, and commodities have historically provided a reliable hedge against inflation and currency devaluation, preserving wealth over long periods. Paper assets, including stocks and bonds, offer higher liquidity and potential for capital appreciation, yet are often subject to market volatility and economic cycles. Over multiple decades, diversified portfolios combining both hard and paper assets tend to achieve more stable growth while mitigating risks associated with each asset class.

Building a Balanced Portfolio With Hard and Paper Assets

Building a balanced portfolio involves combining hard assets like real estate, gold, and commodities with paper assets such as stocks, bonds, and mutual funds to mitigate risk and enhance wealth stability. Hard assets provide tangible value and protection against inflation, while paper assets offer liquidity and potential for growth through market appreciation. Diversifying across both asset classes optimizes long-term returns and preserves capital under varying economic conditions.

Important Terms

Tangible Assets

Tangible assets, also known as hard assets, include physical items such as real estate, machinery, and precious metals that have intrinsic value and can be directly utilized or sold. In contrast, paper assets like stocks, bonds, and derivatives represent ownership or claims without physical form, relying on market valuation and financial performance.

Intangible Assets

Intangible assets, unlike hard assets such as machinery or real estate, represent non-physical resources like patents, trademarks, and goodwill that contribute to a company's value. These assets differ from paper assets, which include financial instruments like stocks and bonds, by providing long-term competitive advantages without physical form.

Precious Metals

Precious metals such as gold and silver serve as tangible hard assets, providing intrinsic value and protection against inflation compared to paper assets like stocks and bonds that represent digital or contractual ownership without physical backing. Investors often prefer hard assets like precious metals during economic uncertainty due to their liquidity and ability to preserve wealth against currency devaluation and market volatility.

Real Property

Real property represents tangible hard assets, providing physical value through land and structures, whereas paper assets refer to financial instruments like stocks and bonds that derive value from contractual claims. Investing in real property offers stability and protection against inflation, distinguishing it from the volatile nature of paper assets reliant on market fluctuations.

Equities

Equities represent ownership in companies, often classified as paper assets because they derive value from financial markets rather than physical substance. Hard assets, such as real estate or commodities, provide tangible value and inflation hedging, while equities offer growth potential through capital appreciation and dividends, influenced by corporate performance and economic conditions.

Commodities

Commodities represent tangible hard assets like gold, oil, and agricultural products, providing intrinsic value and inflation hedging, unlike paper assets such as stocks and bonds that derive value from contractual claims. Investing in hard assets offers physical ownership and protection against market volatility, while paper assets depend on issuer solvency and market sentiment.

Bonds

Bonds represent debt instruments classified as paper assets, offering fixed income through interest payments without ownership in physical entities like hard assets such as real estate, gold, or commodities. Investors often choose bonds for portfolio diversification and liquidity, while hard assets provide tangible value and inflation protection but lack the predictable income streams typical of bonds.

Physical Gold

Physical gold represents a tangible hard asset that provides intrinsic value and protection against inflation, unlike paper assets such as stocks or bonds which are subject to market volatility and counterparty risk. Investors often prefer physical gold for portfolio diversification and as a hedge during economic uncertainty due to its liquidity and long-term preservation of wealth.

Financial Derivatives

Financial derivatives are contracts whose value is derived from underlying hard assets like commodities, real estate, or metals, contrasting with paper assets such as stocks and bonds that represent ownership or debt claims. These instruments enable hedging and speculation on price movements of tangible assets without the need for direct ownership, increasing market liquidity and risk management options.

Inflation Hedge

Hard assets such as real estate, precious metals, and commodities typically serve as a reliable inflation hedge because they retain intrinsic value and often appreciate during inflationary periods, unlike paper assets like stocks and bonds which can lose purchasing power as inflation rises. Investing in hard assets diversifies portfolios and protects wealth against currency devaluation and rising prices, whereas paper assets are more vulnerable to inflation-induced depreciation.

Hard Assets vs Paper Assets Infographic

moneydif.com

moneydif.com