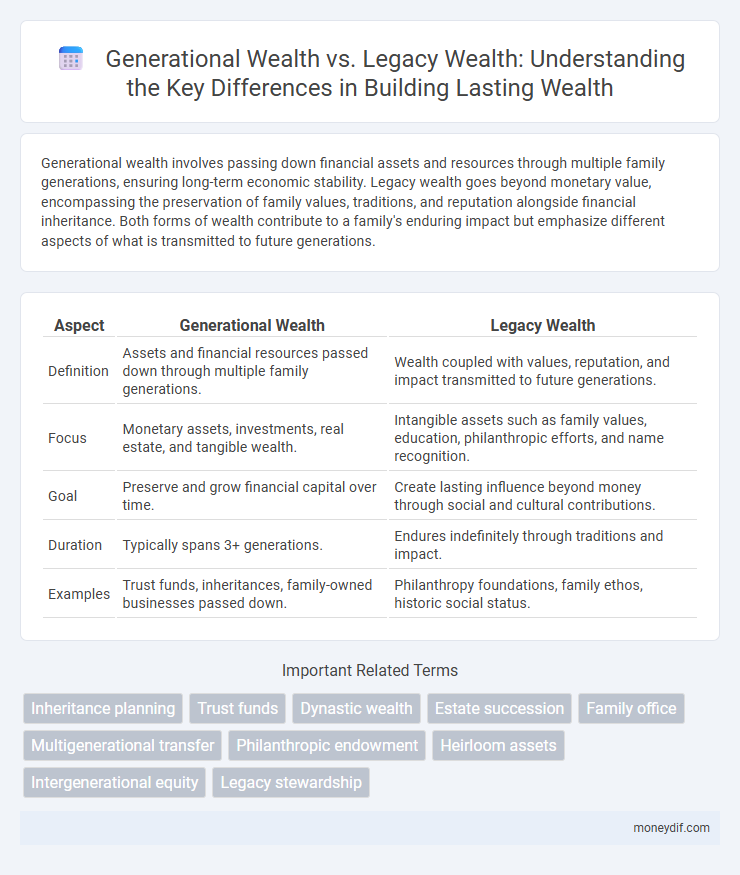

Generational wealth involves passing down financial assets and resources through multiple family generations, ensuring long-term economic stability. Legacy wealth goes beyond monetary value, encompassing the preservation of family values, traditions, and reputation alongside financial inheritance. Both forms of wealth contribute to a family's enduring impact but emphasize different aspects of what is transmitted to future generations.

Table of Comparison

| Aspect | Generational Wealth | Legacy Wealth |

|---|---|---|

| Definition | Assets and financial resources passed down through multiple family generations. | Wealth coupled with values, reputation, and impact transmitted to future generations. |

| Focus | Monetary assets, investments, real estate, and tangible wealth. | Intangible assets such as family values, education, philanthropic efforts, and name recognition. |

| Goal | Preserve and grow financial capital over time. | Create lasting influence beyond money through social and cultural contributions. |

| Duration | Typically spans 3+ generations. | Endures indefinitely through traditions and impact. |

| Examples | Trust funds, inheritances, family-owned businesses passed down. | Philanthropy foundations, family ethos, historic social status. |

Understanding Generational Wealth

Generational wealth refers to assets and financial resources passed down from one generation to another, ensuring long-term economic stability and opportunities for descendants. Understanding the difference between generational wealth and legacy wealth is crucial, as legacy wealth encompasses not only financial assets but also values, reputation, and cultural heritage transmitted alongside monetary inheritance. Effective management and education around generational wealth promote sustainable financial growth and empower future generations to build upon inherited prosperity.

Defining Legacy Wealth

Legacy wealth refers to assets and values intentionally preserved and transferred across multiple generations to sustain family prosperity and influence. Unlike generational wealth, which primarily focuses on financial inheritance, legacy wealth emphasizes the long-term impact, including cultural, educational, and philanthropic contributions. This holistic approach ensures that wealth supports enduring family identity and societal contributions beyond monetary value.

Key Differences Between Generational and Legacy Wealth

Generational wealth refers to assets and financial resources passed down directly from one generation to the next, emphasizing monetary inheritance and investments. Legacy wealth encompasses not only financial assets but also values, principles, and reputations that shape family identity and long-term impact. Key differences include generational wealth's focus on material transfer, whereas legacy wealth integrates both tangible assets and intangible cultural or ethical contributions.

Building Generational Wealth: Strategies and Challenges

Building generational wealth involves accumulating assets that can be passed down to future family members, including investments in real estate, stocks, and business ventures. Strategies focus on long-term financial planning, tax-efficient wealth transfer, and educating heirs about wealth management to sustain prosperity across generations. Key challenges include market volatility, evolving tax laws, family dynamics, and maintaining asset value amid economic changes.

The Enduring Power of Legacy Wealth

Legacy wealth transcends generational wealth by embedding values, purpose, and long-term impact alongside financial assets. It ensures sustainable prosperity through strategic estate planning, philanthropic endeavors, and education that empowers future generations. The enduring power of legacy wealth lies in its ability to create a meaningful, lasting influence beyond mere monetary transfer.

Transfer of Values vs Transfer of Assets

Generational wealth emphasizes the transfer of financial assets such as real estate, investments, and savings to descendants, ensuring material security across generations. Legacy wealth prioritizes the transfer of core values, ethics, and financial wisdom that shape responsible stewardship and purposeful use of inherited assets. Balancing both asset transfer and value transmission strengthens long-term family prosperity and cultural identity.

Common Pitfalls in Preserving Wealth Across Generations

Common pitfalls in preserving generational versus legacy wealth include inadequate estate planning, which can lead to excessive tax burdens and asset dilution. Families often neglect financial education, resulting in poor money management and rapid asset depletion among heirs. Emotional conflicts and lack of clear communication about wealth values further undermine the long-term sustainability of inherited assets.

The Role of Education in Sustaining Wealth

Education plays a crucial role in sustaining generational wealth by equipping heirs with financial literacy and strategic investment skills, ensuring long-term asset growth and preservation. Legacy wealth extends beyond monetary inheritance by embedding values, knowledge, and social capital, which are transmitted through formal and informal education within families. Understanding wealth management, tax planning, and entrepreneurship through education enhances the ability to maintain and expand wealth across multiple generations.

Family Governance and Wealth Stewardship

Family governance structures play a critical role in sustaining generational wealth by establishing clear decision-making processes and aligning family values with financial goals. Wealth stewardship emphasizes responsible management and preservation of assets across generations, ensuring long-term growth and stability. Combining these approaches fosters a legacy wealth that transcends monetary value by embedding enduring principles of accountability and shared purpose within the family.

Planning for Future Generations: Estate and Legacy Considerations

Effective planning for future generations involves distinguishing between generational wealth, typically the transfer of financial assets and investments, and legacy wealth, which encompasses both tangible and intangible values passed down. Estate strategies should integrate tax-efficient trusts, philanthropic endeavors, and family governance structures to preserve wealth while fostering a lasting family mission. Prioritizing education and stewardship in legacy planning ensures that wealth supports not only material needs but also the enduring principles that define family identity.

Important Terms

Inheritance planning

Inheritance planning strategically structures asset distribution to preserve generational wealth while cultivating legacy wealth through values and long-term family impact.

Trust funds

Trust funds effectively preserve generational wealth by ensuring asset transfer across multiple family generations, while legacy wealth emphasizes values and non-financial inheritance.

Dynastic wealth

Dynastic wealth refers to assets passed down through multiple generations, emphasizing long-term legacy wealth preservation beyond immediate generational inheritance.

Estate succession

Estate succession involves the strategic transfer of assets, emphasizing generational wealth by preserving financial resources within family lines to ensure long-term economic stability. Legacy wealth focuses on intangible assets such as values, reputation, and philanthropic impact, shaping a family's enduring influence beyond monetary inheritance.

Family office

Family offices strategically manage generational wealth to preserve and grow financial assets while aligning legacy wealth with enduring family values and philanthropic goals.

Multigenerational transfer

Multigenerational transfer ensures the preservation of generational wealth by strategically converting financial assets into legacy wealth that benefits future generations.

Philanthropic endowment

Philanthropic endowments serve as a powerful tool to transition generational wealth into legacy wealth by funding sustainable social, educational, or environmental initiatives that endure beyond individual lifespans. This strategic allocation preserves family assets while embedding enduring values and community impact, distinguishing legacy wealth from mere financial inheritance.

Heirloom assets

Heirloom assets preserve generational wealth by maintaining tangible family valuables, while legacy wealth encompasses intangible inheritance such as values, reputation, and long-term financial security.

Intergenerational equity

Intergenerational equity ensures fair distribution of generational wealth and legacy wealth by balancing resource allocation and long-term financial sustainability across multiple family generations.

Legacy stewardship

Legacy stewardship involves managing generational wealth to preserve and grow legacy wealth across multiple family generations.

generational wealth vs legacy wealth Infographic

moneydif.com

moneydif.com