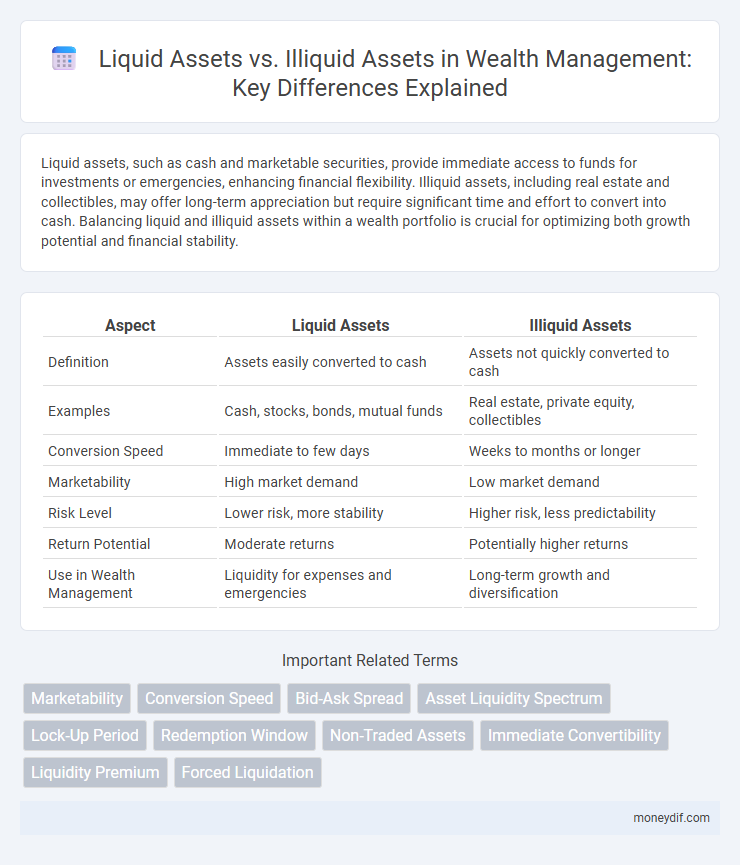

Liquid assets, such as cash and marketable securities, provide immediate access to funds for investments or emergencies, enhancing financial flexibility. Illiquid assets, including real estate and collectibles, may offer long-term appreciation but require significant time and effort to convert into cash. Balancing liquid and illiquid assets within a wealth portfolio is crucial for optimizing both growth potential and financial stability.

Table of Comparison

| Aspect | Liquid Assets | Illiquid Assets |

|---|---|---|

| Definition | Assets easily converted to cash | Assets not quickly converted to cash |

| Examples | Cash, stocks, bonds, mutual funds | Real estate, private equity, collectibles |

| Conversion Speed | Immediate to few days | Weeks to months or longer |

| Marketability | High market demand | Low market demand |

| Risk Level | Lower risk, more stability | Higher risk, less predictability |

| Return Potential | Moderate returns | Potentially higher returns |

| Use in Wealth Management | Liquidity for expenses and emergencies | Long-term growth and diversification |

Understanding Liquid Assets: Definition and Examples

Liquid assets are financial resources that can be quickly converted into cash without significant loss of value, such as savings accounts, stocks, and money market instruments. These assets provide immediate access to funds, making them essential for meeting short-term financial obligations and emergencies. Understanding liquid assets helps investors balance their portfolios between readily accessible cash and long-term investments.

What Are Illiquid Assets? Key Characteristics

Illiquid assets are investments or property that cannot be quickly sold or converted into cash without a significant loss in value, such as real estate, private equity, or collectibles. These assets typically require longer timeframes to liquidate due to limited market demand or complex transaction processes. Key characteristics include lower marketability, higher transaction costs, and potential valuation uncertainties compared to liquid assets like stocks or bonds.

Liquidity Spectrum: Where Assets Fall

Liquid assets such as cash, money market funds, and publicly traded stocks fall at the high end of the liquidity spectrum, allowing for quick conversion to cash without significant loss of value. Illiquid assets, including real estate, private equity, and collectibles, occupy the low end of the spectrum due to longer time frames and potential discounting during sale. Understanding the liquidity spectrum helps investors balance portfolio flexibility versus potential higher returns from less liquid investments.

Benefits of Holding Liquid Assets

Holding liquid assets provides immediate access to cash for emergencies, investment opportunities, or daily expenses, enhancing financial flexibility and security. Liquid assets, such as cash, marketable securities, and checking accounts, enable quick transactions without the risk of significant value loss. This ease of conversion supports better wealth management by allowing investors to respond swiftly to market changes and personal financial needs.

Advantages and Risks of Illiquid Assets

Illiquid assets, such as real estate and private equity, offer the advantage of potential high returns and portfolio diversification, enhancing long-term wealth growth. These assets, however, carry the risk of limited marketability, making it challenging to quickly convert them into cash without significant value loss. Investors must weigh the trade-off between higher returns and the potential liquidity constraints that illiquid assets impose on financial flexibility.

How Liquidity Impacts Wealth Management

Liquidity plays a crucial role in wealth management by determining how quickly assets can be converted into cash without significant loss of value. Liquid assets like stocks and bonds enable investors to respond swiftly to financial opportunities or emergencies, while illiquid assets such as real estate and private equity often require longer timeframes for conversion, impacting portfolio flexibility. Effective wealth management balances liquid and illiquid holdings to optimize both immediate financial needs and long-term growth potential.

Liquid vs Illiquid Assets: Portfolio Diversification Strategy

Liquid assets, such as cash, stocks, and bonds, provide immediate access to funds and enhance portfolio flexibility during market fluctuations. Illiquid assets like real estate, private equity, and collectibles often yield higher returns but require longer holding periods and involve greater risk due to limited marketability. Balancing liquid and illiquid assets within a diversified portfolio mitigates risk, improves financial stability, and optimizes long-term wealth growth.

Assessing Liquidity Needs: Factors to Consider

Assessing liquidity needs requires evaluating the immediacy of cash requirements and the predictability of expenses to ensure sufficient liquid assets are available for short-term obligations. Consideration of income stability, emergency fund size, and investment horizon helps balance between liquid assets like cash and stocks versus illiquid assets such as real estate and private equity. Prioritizing access to cash while maintaining growth potential safeguards financial stability and facilitates timely response to unexpected financial demands.

Converting Illiquid Assets to Cash: Challenges and Processes

Converting illiquid assets such as real estate, private equity, or collectibles into cash involves significant challenges including lengthy transaction times, valuation difficulties, and market volatility. The process often requires finding specialized buyers, undergoing appraisals, and incurring higher transaction costs compared to liquid assets like stocks or bonds. Understanding these complexities is essential for effective wealth management and maintaining financial flexibility.

Choosing the Right Balance: Liquid and Illiquid Assets in Wealth Planning

Optimal wealth planning requires a strategic balance between liquid assets, such as cash and marketable securities, and illiquid assets like real estate and private equity. Liquid assets offer immediate access to funds for emergencies or investment opportunities, while illiquid assets typically provide higher returns and long-term growth potential. Prioritizing an allocation that aligns with individual financial goals and risk tolerance enhances portfolio resilience and maximizes wealth accumulation.

Important Terms

Marketability

Marketability reflects the ease with which an asset can be quickly converted into cash without significant loss of value, making liquid assets such as cash, stocks, and government bonds highly marketable. Illiquid assets like real estate, private equity, and specialized equipment generally have lower marketability due to longer transaction times and limited buyer pools.

Conversion Speed

Conversion speed refers to the ease and rapidity with which assets can be turned into cash without significant loss of value, with liquid assets such as cash, marketable securities, and high-quality bonds offering the fastest conversion due to high market demand and low transaction costs. Illiquid assets like real estate, private equity, and collectibles require extended timeframes and may incur valuation discounts during liquidation, making them slower to convert into cash.

Bid-Ask Spread

Bid-ask spreads are typically narrower for liquid assets such as large-cap stocks and government bonds, reflecting higher trading volumes and lower transaction costs, whereas illiquid assets like small-cap stocks or private equity exhibit wider spreads due to lower market participation and higher risk premiums. This difference in bid-ask spreads directly impacts trading efficiency and price transparency, influencing investor costs and market stability.

Asset Liquidity Spectrum

The Asset Liquidity Spectrum categorizes assets based on how quickly and easily they can be converted into cash, with liquid assets such as cash, stocks, and bonds offering rapid conversion and illiquid assets like real estate, private equity, and collectibles requiring longer timeframes or incurring higher transaction costs. Understanding this spectrum is crucial for portfolio management, risk assessment, and meeting short-term financial obligations.

Lock-Up Period

The lock-up period refers to a predetermined time during which investors cannot sell or withdraw their investment, significantly impacting liquidity. Liquid assets, such as stocks and bonds, can be quickly converted to cash with minimal value loss, whereas illiquid assets like real estate or private equity are often subject to lock-up periods, restricting access and delaying sale or redemption.

Redemption Window

Redemption windows provide investors in funds with the opportunity to convert illiquid assets into liquid cash by allowing periodic withdrawals, balancing the challenge of asset illiquidity and the demand for liquidity. These windows facilitate managing the mismatch between long-term, illiquid investments like private equity and the need for timely liquidation, reducing redemption risk and enhancing portfolio flexibility.

Non-Traded Assets

Non-traded assets, typically classified as illiquid assets, lack an active market for quick sale, contrasting with liquid assets such as stocks or cash equivalents that can be rapidly converted to cash without significant value loss. Understanding this distinction is crucial for portfolio management, as non-traded assets often carry higher risk and longer holding periods but can offer diversification benefits.

Immediate Convertibility

Immediate convertibility refers to the ability of liquid assets, such as cash or marketable securities, to be quickly converted into usable funds without significant loss of value, unlike illiquid assets like real estate or specialized equipment that require more time and may incur substantial transaction costs during conversion. High immediate convertibility of liquid assets enhances financial flexibility and short-term solvency for individuals and businesses.

Liquidity Premium

Liquidity premium reflects the higher expected return investors demand for holding illiquid assets compared to liquid assets, compensating for the difficulty in quickly converting illiquid assets into cash without significant loss of value. This premium arises because liquid assets, such as cash and government securities, offer immediate accessibility while illiquid assets like real estate or private equity require longer time horizons and bear higher transaction costs and market risk.

Forced Liquidation

Forced liquidation occurs when assets must be quickly sold to meet financial obligations, often resulting in significant losses, especially if the portfolio contains illiquid assets that cannot be easily converted to cash. Liquid assets, such as cash or marketable securities, allow for rapid sales with minimal price impact, whereas illiquid assets, like real estate or private equity, pose higher risks during forced liquidation due to limited market demand and longer selling periods.

Liquid assets vs Illiquid assets Infographic

moneydif.com

moneydif.com