A generation-skipping trust transfers assets directly to grandchildren or later generations, effectively avoiding estate taxes for one intervening generation, while a dynasty trust is designed to preserve wealth across multiple generations indefinitely, minimizing transfer taxes over time. Both trust types offer significant estate tax advantages, but a dynasty trust provides long-term protection and control of family wealth beyond just skipping one generation. Choosing between the two depends on goals for wealth preservation duration and tax efficiency across generations.

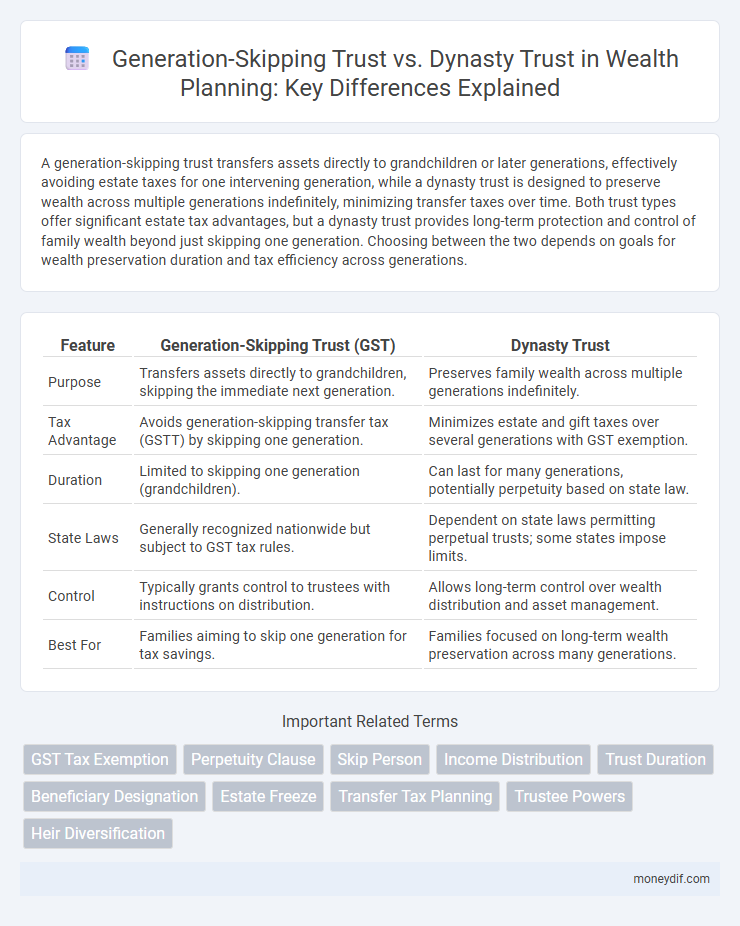

Table of Comparison

| Feature | Generation-Skipping Trust (GST) | Dynasty Trust |

|---|---|---|

| Purpose | Transfers assets directly to grandchildren, skipping the immediate next generation. | Preserves family wealth across multiple generations indefinitely. |

| Tax Advantage | Avoids generation-skipping transfer tax (GSTT) by skipping one generation. | Minimizes estate and gift taxes over several generations with GST exemption. |

| Duration | Limited to skipping one generation (grandchildren). | Can last for many generations, potentially perpetuity based on state law. |

| State Laws | Generally recognized nationwide but subject to GST tax rules. | Dependent on state laws permitting perpetual trusts; some states impose limits. |

| Control | Typically grants control to trustees with instructions on distribution. | Allows long-term control over wealth distribution and asset management. |

| Best For | Families aiming to skip one generation for tax savings. | Families focused on long-term wealth preservation across many generations. |

Understanding Generation-Skipping Trusts

Generation-skipping trusts (GSTs) are designed to transfer wealth directly to grandchildren or later generations, bypassing the immediate offspring to minimize estate taxes and preserve assets over multiple generations. These trusts utilize the Generation-Skipping Transfer Tax exemption to shield significant wealth from taxation, enabling long-term financial legacy planning. Understanding GSTs involves recognizing their role in estate planning strategies that protect assets from estate and gift taxes while providing financial security for future beneficiaries.

Overview of Dynasty Trusts

Dynasty trusts are long-term wealth planning tools designed to preserve family assets across multiple generations without incurring repeated estate taxes. Unlike generation-skipping trusts, which primarily aim to bypass one generation, dynasty trusts can theoretically last indefinitely, maximizing tax advantages and asset protection. These trusts leverage state laws that allow perpetual duration, ensuring sustained wealth accumulation and legacy preservation for descendants.

Key Differences Between Generation-Skipping and Dynasty Trusts

Generation-skipping trusts primarily focus on transferring assets directly to beneficiaries two or more generations younger than the grantor, minimizing estate taxes across generations. Dynasty trusts, designed to preserve wealth indefinitely, avoid estate taxes across multiple generations by allowing assets to grow and be distributed without triggering repeated taxation. The key difference lies in duration and scope, with generation-skipping trusts typically limited in term, while dynasty trusts aim for perpetual wealth preservation.

Tax Implications for Both Trust Types

Generation-skipping trusts (GSTs) are designed to bypass one or more generations of heirs to minimize estate taxes by avoiding taxation at each generational level, employing the generation-skipping transfer tax (GSTT) exemption. Dynasty trusts provide long-term wealth preservation by allowing assets to grow tax-free across multiple generations while leveraging the GSTT exemption to avoid federal estate and gift taxes indefinitely within perpetuity periods allowed by state laws. Both trust types require strategic allocation of the generation-skipping transfer tax exemption to optimize tax efficiency and maximize wealth transfer to future generations.

Asset Protection Features of Each Trust

Generation-skipping trusts (GSTs) provide robust asset protection by shielding assets from creditors of both the grantor's children and grandchildren, effectively preserving wealth across multiple generations. Dynasty trusts extend these protections indefinitely, often across centuries, preventing estate taxes and shielding assets from future creditors, divorces, or lawsuits within the family line. Both trusts serve as powerful tools in wealth preservation, but dynasty trusts offer superior long-term asset protection due to their perpetual duration and ability to bypass multiple estate tax events.

Benefits of a Generation-Skipping Trust

A Generation-Skipping Trust (GST) offers significant tax advantages by allowing assets to pass directly to grandchildren or later generations, effectively bypassing estate taxes in the immediate next generation. This trust type preserves wealth across multiple generations, ensuring that future beneficiaries receive larger inheritances free from repeated taxation. By minimizing estate tax liabilities and providing asset protection, GSTs enhance long-term family wealth transfer efficiency compared to standard trusts.

Advantages of a Dynasty Trust

A Dynasty Trust offers unparalleled advantages by enabling wealth preservation across multiple generations without incurring repeated estate taxes, effectively growing assets tax-efficiently over centuries. It provides creditor protection and safeguards family wealth from claims, divorces, and financial mismanagement, ensuring long-term financial security. This trust structure facilitates greater control over asset distribution while allowing beneficiaries to benefit from compounding growth and legacy planning.

Eligibility and Legal Requirements

Generation-skipping trusts (GSTs) require compliance with the Internal Revenue Code's generation-skipping transfer tax regulations, ensuring beneficiaries are at least two generations younger than the grantor to qualify. Dynasty trusts, designed to last indefinitely across multiple generations, must adhere to state-specific laws regarding perpetuities and allowable trust durations, with some jurisdictions permitting perpetual duration to maximize asset preservation. Eligibility for both trusts depends on selecting appropriate beneficiaries, meeting statutory definitions of skip persons for GSTs, and aligning trust structure with legal safeguards to minimize transfer taxes and protect wealth over time.

Choosing the Right Trust for Your Family Wealth Plan

Generation-skipping trusts (GST) and dynasty trusts both offer powerful strategies for preserving family wealth across multiple generations, but they differ in duration and tax implications. A GST provides tax advantages by bypassing estate taxes for one or more generations, while a dynasty trust can potentially last indefinitely, protecting assets from estate, gift, and generation-skipping transfer taxes over several centuries. Choosing the right trust depends on your family's long-term goals, state laws regarding trust duration, and the desired level of control and flexibility in wealth distribution.

Common Mistakes to Avoid When Setting Up Multi-Generational Trusts

Common mistakes when setting up multi-generational trusts, such as generation-skipping trusts (GST) and dynasty trusts, include failing to account for state-specific tax laws and not clearly defining beneficiary rights, which can lead to unintended tax consequences and family disputes. Overlooking the importance of periodic review and adjustment of trust provisions risks obsolescence due to changes in tax legislation and family circumstances. Ensuring proper legal guidance and comprehensive drafting helps avoid pitfalls like inadequate asset protection and improper alignment with client goals.

Important Terms

GST Tax Exemption

GST tax exemption is a crucial consideration in both generation-skipping trusts (GSTs) and dynasty trusts, as it allows transfer of wealth across multiple generations without incurring the generation-skipping transfer tax. Dynasty trusts leverage the GST tax exemption to preserve assets and avoid estate taxes for potentially unlimited generations, whereas generation-skipping trusts primarily focus on transferring assets directly to grandchildren or more remote descendants while minimizing tax consequences.

Perpetuity Clause

A perpetuity clause in generation-skipping trusts limits the duration to prevent violating the rule against perpetuities, typically capping the trust's lifespan to 21 years after the death of a measuring life. Dynasty trusts, by contrast, utilize state-specific rules or statutes that allow them to exist indefinitely, avoiding the rule against perpetuities and enabling multi-generational wealth preservation without triggering generation-skipping transfer taxes.

Skip Person

Skip Person refers to the beneficiary who is two or more generations below the grantor in a Generation-skipping trust, avoiding immediate estate taxation by transferring assets directly to grandchildren or further descendants. Dynasty trusts extend this concept by allowing wealth preservation across multiple generations without incurring repeated estate taxes, effectively managing assets beyond the Skip Person to benefit future heirs indefinitely.

Income Distribution

Income distribution in generation-skipping trusts allows beneficiaries two or more generations below the grantor to receive income, minimizing estate taxes across generations. Dynasty trusts, designed to last indefinitely, optimize wealth transfer by preserving income distribution without incurring generation-skipping transfer taxes over multiple generations.

Trust Duration

Trust duration varies significantly between generation-skipping trusts and dynasty trusts, with generation-skipping trusts designed to bypass one or more intermediate generations to minimize estate taxes, while dynasty trusts can continue indefinitely or for multiple generations depending on state laws regarding perpetuities. Understanding the nuances of the Rule Against Perpetuities and applicable state regulations is crucial when structuring these trusts to maximize tax benefits and asset protection over extended time horizons.

Beneficiary Designation

Generation-skipping trusts enable assets to pass directly to grandchildren or later generations, minimizing estate taxes across multiple generations by bypassing the immediate heirs, while dynasty trusts are structured to preserve wealth indefinitely by avoiding estate taxes through successive generations. Proper beneficiary designation in these trusts is crucial to ensure tax efficiency, asset protection, and adherence to the grantor's long-term wealth transfer goals.

Estate Freeze

Estate freeze strategies focus on transferring future asset appreciation to heirs while minimizing estate taxes. Generation-skipping trusts allow assets to bypass immediate descendants and pass directly to grandchildren or later generations, whereas dynasty trusts offer long-term wealth preservation across multiple generations, often limited by perpetuity laws.

Transfer Tax Planning

Transfer tax planning involves leveraging Generation-skipping trusts (GSTs) to minimize estate and gift taxes across multiple generations by skipping immediate descendants, while Dynasty trusts extend this benefit by allowing assets to grow tax-free over several generations without incurring repeated transfer taxes. Both trust structures utilize the GST tax exemption but Dynasty trusts often offer longer duration and broader asset protection benefits, making them highly effective tools for preserving wealth within families.

Trustee Powers

Trustee powers in generation-skipping trusts often include managing assets to benefit multiple skip-person beneficiaries across generations, with a focus on minimizing generation-skipping transfer (GST) tax liabilities. In dynasty trusts, trustees typically hold expansive powers to maintain and reinvest trust assets indefinitely, maximizing long-term wealth preservation and providing sustained benefit to multiple generations without estate tax exposure.

Heir Diversification

Heir diversification strategy involves spreading assets across multiple beneficiaries to reduce generational wealth concentration and minimize tax exposure, particularly in generation-skipping trusts which transfer wealth to grandchildren or further descendants while avoiding estate taxes at each generational level. Dynasty trusts extend this concept by preserving wealth across multiple generations indefinitely, offering creditor protection and estate tax advantages without repeated taxation, thereby optimizing long-term wealth preservation and diversification among heirs.

Generation-skipping trust vs Dynasty trust Infographic

moneydif.com

moneydif.com