High-net-worth individuals (HNWIs) typically possess investable assets ranging from $1 million to $30 million, while ultra-high-net-worth individuals (UHNWIs) have assets exceeding $30 million, representing a more exclusive segment of wealth. The distinction influences wealth management strategies, tax planning, and investment opportunities tailored to the scale of their portfolios. Financial advisors prioritize specialized services for UHNWIs, focusing on legacy planning, philanthropy, and diversified global asset allocation.

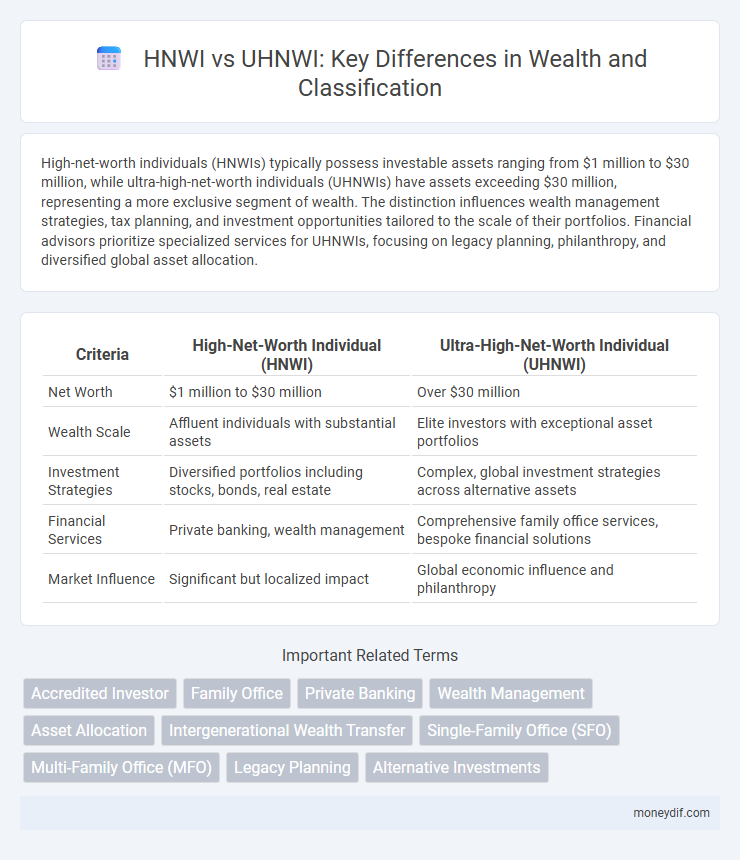

Table of Comparison

| Criteria | High-Net-Worth Individual (HNWI) | Ultra-High-Net-Worth Individual (UHNWI) |

|---|---|---|

| Net Worth | $1 million to $30 million | Over $30 million |

| Wealth Scale | Affluent individuals with substantial assets | Elite investors with exceptional asset portfolios |

| Investment Strategies | Diversified portfolios including stocks, bonds, real estate | Complex, global investment strategies across alternative assets |

| Financial Services | Private banking, wealth management | Comprehensive family office services, bespoke financial solutions |

| Market Influence | Significant but localized impact | Global economic influence and philanthropy |

Defining HNWI and UHNWI: Key Distinctions

High-net-worth individuals (HNWIs) are defined by possessing investable assets ranging from $1 million to $30 million, while ultra-high-net-worth individuals (UHNWIs) hold assets exceeding $30 million. The distinction is crucial for tailored wealth management strategies, as UHNWIs often require more complex financial planning and bespoke investment opportunities. Understanding these asset thresholds aids financial institutions in segmenting client services and optimizing portfolio allocations.

Wealth Thresholds: HNWI vs UHNWI Criteria

High-net-worth individuals (HNWIs) are typically defined as those possessing investable assets exceeding $1 million, excluding primary residence, while ultra-high-net-worth individuals (UHNWIs) hold investable assets over $30 million. The wealth threshold distinction is crucial for tailored wealth management services and bespoke investment opportunities, with UHNWIs often accessing exclusive private equity, hedge funds, and luxury asset portfolios. Understanding these criteria enables financial advisors to segment clients effectively and optimize portfolio strategies based on asset scale and risk tolerance.

Asset Allocation Trends Among HNWIs and UHNWIs

High-net-worth individuals (HNWIs) typically allocate assets with a balanced mix of equities, fixed income, real estate, and alternative investments, emphasizing risk management and steady growth. Ultra-high-net-worth individuals (UHNWIs) demonstrate a higher propensity for alternative assets such as private equity, hedge funds, and direct business investments, seeking enhanced diversification and higher returns. Both segments increasingly integrate ESG-focused investments, reflecting shifting priorities toward sustainable and impact-driven wealth management.

Geographic Distribution: Where HNWIs and UHNWIs Live

High-net-worth individuals (HNWIs) predominantly reside in North America, Europe, and Asia-Pacific regions, with significant concentrations in cities like New York, London, and Hong Kong due to business hubs and financial markets. Ultra-high-net-worth individuals (UHNWIs) are more globally dispersed but show growing presence in emerging markets such as China, India, and the Middle East, fueled by economic expansion and wealth creation. Urban centers with strong financial infrastructure, political stability, and luxury lifestyle amenities attract the majority of both HNWIs and UHNWIs worldwide.

Investment Strategies: Contrasts and Similarities

High-net-worth individuals (HNWIs) typically diversify their portfolios across stocks, bonds, and real estate, emphasizing balanced risk and steady growth, while ultra-high-net-worth individuals (UHNWIs) often access exclusive alternative investments such as private equity, hedge funds, and venture capital to enhance returns. Both HNWIs and UHNWIs prioritize wealth preservation and tax efficiency, frequently employing family offices or professional wealth management services. Despite differences in scale and asset classes, both groups focus on long-term growth and risk management tailored to their unique financial goals.

Private Banking Services for HNWI and UHNWI Clients

Private banking services for High-Net-Worth Individuals (HNWI) typically include personalized wealth management, investment advisory, and exclusive lending options tailored to assets ranging from $1 million to $30 million. Ultra-High-Net-Worth Individuals (UHNWI), with assets exceeding $30 million, demand more sophisticated services such as family office solutions, global estate planning, and bespoke investment opportunities. Both segments benefit from privacy, dedicated relationship managers, and access to exclusive financial products, but UHNWIs require enhanced customization and multi-generational wealth preservation strategies.

Family Office Solutions: HNWIs vs UHNWIs

Family office solutions for High-Net-Worth Individuals (HNWIs) typically include personalized wealth management, estate planning, and tax advisory services tailored to portfolios ranging from $1 million to $30 million. Ultra-High-Net-Worth Individuals (UHNWIs), with assets exceeding $30 million, require more sophisticated, multi-generational family office services encompassing complex investment strategies, philanthropy management, and risk mitigation. The distinction in family office services reflects the scale and complexity of wealth, demanding customized governance structures and exclusive access to alternative investments for UHNWIs.

Philanthropy and Social Impact: Giving Patterns

High-net-worth individuals (HNWIs), typically defined as those with investable assets between $1 million and $30 million, prioritize philanthropic giving through structured donations and community foundations, focusing on local and regional impact. Ultra-high-net-worth individuals (UHNWIs), possessing assets exceeding $30 million, engage in more strategic philanthropy, often leveraging donor-advised funds, family foundations, and impact investing to drive global change and influence systemic social issues. Data from the Wealth-X report reveals that UHNWIs allocate up to 15% of their wealth annually towards social impact initiatives, significantly surpassing the giving rates of HNWIs.

Risks and Challenges: Managing Large-Scale Wealth

High-net-worth individuals (HNWIs) face challenges such as market volatility and tax complexities, requiring diversified portfolios and expert advice to preserve wealth. Ultra-high-net-worth individuals (UHNWIs) encounter amplified risks, including heightened regulatory scrutiny, succession planning difficulties, and increased exposure to geopolitical fluctuations. Effective large-scale wealth management depends on tailored strategies, robust asset protection, and dynamic risk mitigation.

Future Outlook: Evolving Definitions and Market Trends

The future outlook for High-Net-Worth Individuals (HNWI) and Ultra-High-Net-Worth Individuals (UHNWI) reveals evolving definitions driven by rising global wealth and inflation, with thresholds for HNWI status now often exceeding $1 million in investable assets and UHNWI starting at $30 million. Market trends indicate accelerated asset accumulation in technology, real estate, and alternative investments, reshaping wealth management strategies to include digital assets and sustainable investing. Projections show a significant increase in the UHNWI population, particularly in emerging markets, emphasizing the need for tailored financial services that address complex estate planning and cross-border tax regulations.

Important Terms

Accredited Investor

Accredited investors include high-net-worth individuals (HNWIs) who typically have a net worth between $1 million and $30 million, qualifying them for certain private investment opportunities. Ultra-high-net-worth individuals (UHNWIs), possessing assets exceeding $30 million, often access exclusive investment vehicles and private equity deals beyond the scope of standard accredited investor criteria.

Family Office

Family offices manage the complex financial, estate, and tax planning needs for high-net-worth individuals (HNWIs) with assets typically over $5 million, while ultra-high-net-worth individuals (UHNWIs) with assets exceeding $30 million require more specialized, bespoke family office services to preserve and grow multigenerational wealth. These offices provide tailored investment strategies, philanthropic planning, and risk management solutions specifically designed to address the distinct financial complexities faced by both HNWIs and UHNWIs.

Private Banking

Private Banking offers tailored financial services to High-net-worth-individuals (HNWIs) with investable assets typically between $1 million and $30 million, focusing on wealth management, estate planning, and tax optimization. Ultra-high-net-worth-individuals (UHNWIs) possess assets exceeding $30 million and require more complex banking solutions, including family office services, philanthropic advisory, and exclusive investment opportunities.

Wealth Management

Wealth management for High-net-worth individuals (HNWIs) typically focuses on portfolio diversification, tax optimization, and retirement planning, managing assets ranging from $1 million to $30 million. Ultra-high-net-worth individuals (UHNWIs), with assets exceeding $30 million, require more sophisticated strategies including estate planning, philanthropy advisory, and access to exclusive investment opportunities such as private equity and hedge funds.

Asset Allocation

Asset allocation strategies for High-net-worth individuals (HNWI) typically emphasize diversification across equities, fixed income, and alternative investments to balance growth and risk, while Ultra-high-net-worth individuals (UHNWI) often incorporate a larger proportion of private equity, real estate, and bespoke investment opportunities due to their greater capital and risk tolerance. The distinct financial goals and liquidity needs between HNWIs and UHNWIs necessitate tailored asset allocation frameworks that optimize portfolio performance and wealth preservation over longer time horizons.

Intergenerational Wealth Transfer

Intergenerational wealth transfer involves passing assets from High-net-worth individuals (HNWIs) with net worths typically between $1 million and $30 million to their descendants, while Ultra-high-net-worth individuals (UHNWIs), possessing assets exceeding $30 million, face more complex estate planning challenges due to larger portfolios and increased tax liabilities. Estate tax optimization, trust establishment, and philanthropic strategies are critical for UHNWIs to preserve and efficiently transfer wealth across generations compared to HNWIs who may employ simpler succession plans.

Single-Family Office (SFO)

A Single-Family Office (SFO) typically manages the wealth and financial affairs of High-net-worth Individuals (HNWIs) with assets exceeding $5 million but often caters more exclusively to Ultra-high-net-worth Individuals (UHNWIs) who possess assets above $30 million. SFOs provide tailored investment management, estate planning, tax optimization, and philanthropic coordination, addressing the complex financial needs that differentiate UHNWIs from HNWIs.

Multi-Family Office (MFO)

Multi-Family Offices (MFOs) specialize in managing wealth for High-Net-Worth Individuals (HNWIs) typically possessing assets between $5 million and $30 million, while Ultra-High-Net-Worth Individuals (UHNWIs) with assets exceeding $30 million often require more complex, tailored financial strategies involving estate planning, tax optimization, and philanthropic advisory. MFOs provide integrated services including investment management, risk mitigation, and legacy planning to address the unique financial needs and goals of both HNWIs and UHNWIs, leveraging economies of scale and expertise unavailable to single-family offices.

Legacy Planning

Legacy planning for High-net-worth individuals (HNWIs) focuses on wealth preservation and tax-efficient transfer strategies to ensure family prosperity across generations. Ultra-high-net-worth individuals (UHNWIs) require more complex estate planning solutions, incorporating philanthropic trusts, multinational tax considerations, and tailored investment vehicles to manage significantly larger and diversified asset portfolios.

Alternative Investments

Alternative investments, such as private equity, hedge funds, and real estate, attract high-net-worth individuals (HNWIs) with investable assets between $1 million and $30 million, while ultra-high-net-worth individuals (UHNWIs), possessing over $30 million, access exclusive opportunities including direct infrastructure projects and bespoke venture capital funds. These investment vehicles offer portfolio diversification, potential for higher returns, and reduced correlation with traditional assets, making them integral for wealth preservation and growth among affluent investors.

High-net-worth-individual (HNWI) vs ultra-high-net-worth-individual (UHNWI) Infographic

moneydif.com

moneydif.com