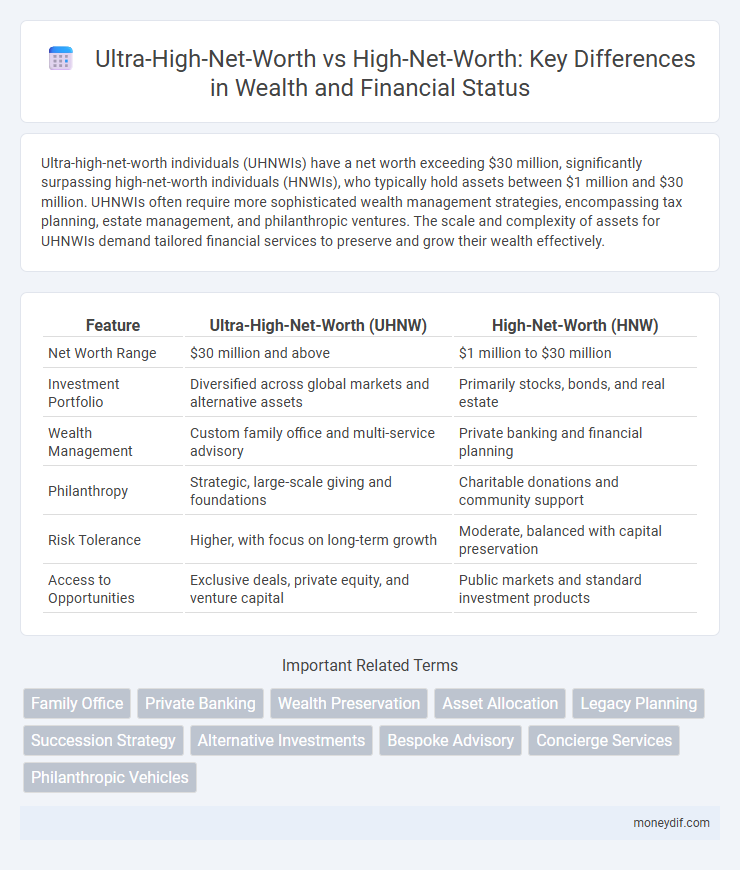

Ultra-high-net-worth individuals (UHNWIs) have a net worth exceeding $30 million, significantly surpassing high-net-worth individuals (HNWIs), who typically hold assets between $1 million and $30 million. UHNWIs often require more sophisticated wealth management strategies, encompassing tax planning, estate management, and philanthropic ventures. The scale and complexity of assets for UHNWIs demand tailored financial services to preserve and grow their wealth effectively.

Table of Comparison

| Feature | Ultra-High-Net-Worth (UHNW) | High-Net-Worth (HNW) |

|---|---|---|

| Net Worth Range | $30 million and above | $1 million to $30 million |

| Investment Portfolio | Diversified across global markets and alternative assets | Primarily stocks, bonds, and real estate |

| Wealth Management | Custom family office and multi-service advisory | Private banking and financial planning |

| Philanthropy | Strategic, large-scale giving and foundations | Charitable donations and community support |

| Risk Tolerance | Higher, with focus on long-term growth | Moderate, balanced with capital preservation |

| Access to Opportunities | Exclusive deals, private equity, and venture capital | Public markets and standard investment products |

Defining Ultra-High-Net-Worth and High-Net-Worth Individuals

Ultra-high-net-worth individuals (UHNWIs) possess investable assets exceeding $30 million, distinguishing them from high-net-worth individuals (HNWIs) who typically have assets ranging from $1 million to $30 million. UHNWIs often engage in complex wealth management strategies, including private equity, philanthropy, and legacy planning, whereas HNWIs focus more on growth and diversification of their investment portfolios. Understanding these distinctions is crucial for tailored financial services and wealth preservation across different tiers of affluence.

Key Financial Thresholds: UHNW vs HNW

Ultra-high-net-worth (UHNW) individuals typically possess financial assets exceeding $30 million, distinguishing them from high-net-worth (HNW) individuals whose assets range from $1 million to $30 million. UHNW status often grants access to exclusive wealth management services, private investment opportunities, and bespoke estate planning. These key financial thresholds influence the complexity of portfolio diversification, tax optimization strategies, and philanthropic endeavors tailored to each wealth segment.

Wealth Accumulation Strategies: Contrasting Approaches

Ultra-high-net-worth individuals (UHNWIs) typically prioritize diversified asset allocation across global markets, including private equity, hedge funds, and direct investments in businesses to achieve significant wealth accumulation. High-net-worth individuals (HNWIs) often focus on traditional investment vehicles such as stocks, bonds, and real estate, emphasizing steady growth and risk management. The contrasting approaches highlight UHNWIs' preference for complex, illiquid assets with higher return potential, while HNWIs pursue balanced portfolios aimed at capital preservation and moderate returns.

Investment Portfolios: Differences in Asset Allocation

Ultra-high-net-worth individuals typically allocate a larger portion of their investment portfolios to alternative assets such as private equity, hedge funds, and real estate compared to high-net-worth individuals who favor more traditional assets like stocks and bonds. UHNW portfolios emphasize diversification across global markets and niche investment vehicles to mitigate risk and enhance returns. In contrast, HNW portfolios often prioritize liquidity and stability, maintaining a higher allocation to fixed income and blue-chip equities.

Lifestyle Choices and Expenditure Patterns

Ultra-high-net-worth individuals (UHNWIs) typically allocate significantly larger portions of their wealth towards exclusive lifestyle choices such as luxury real estate, private aviation, and bespoke travel experiences, reflecting an emphasis on personalization and privacy. In contrast, high-net-worth individuals (HNWIs) tend to invest more in diversified portfolios and premium consumer goods, balancing luxury with financial growth and stability. Spending patterns of UHNWIs often include philanthropy and art acquisitions at a scale far exceeding those of HNWIs, indicating distinct priorities in wealth utilization.

Wealth Management Challenges and Solutions

Ultra-high-net-worth individuals (UHNWIs) face more complex wealth management challenges than high-net-worth individuals (HNWIs), including multi-jurisdictional tax planning, diversified asset protection, and legacy preservation across generations. Tailored wealth management solutions for UHNWIs prioritize integrated estate planning, bespoke investment strategies, and advanced risk mitigation techniques that leverage private banking services and family office expertise. Effective communication and seamless coordination between legal, financial, and tax advisors are essential to navigate the intricacies of UHNW wealth preservation and growth.

Philanthropy: Giving Patterns Among HNW and UHNW

Ultra-high-net-worth (UHNW) individuals, typically possessing assets exceeding $30 million, contribute disproportionately more to philanthropy compared to high-net-worth (HNW) individuals with assets between $1 million and $30 million, often directing over 10% of their wealth to charitable causes. UHNW donors tend to favor strategic, large-scale investments in education, healthcare, and global development, leveraging foundations and impact investing to maximize social returns. High-net-worth donors exhibit more diverse giving patterns, frequently supporting local charities, religious organizations, and community initiatives with smaller, more frequent donations.

Succession Planning and Legacy Preservation

Ultra-high-net-worth individuals, typically possessing assets exceeding $30 million, face more complex succession planning and legacy preservation challenges than high-net-worth individuals with $1 million to $30 million in assets. Strategies for ultra-high-net-worth families often involve establishing multi-generational trusts, philanthropic foundations, and intricate tax optimization to protect and grow wealth across generations. High-net-worth individuals may prioritize simpler estate plans and life insurance policies to ensure smooth asset transfer and maintain family wealth continuity.

Global Distribution and Demographics

Ultra-high-net-worth individuals (UHNWIs), defined as those with investable assets exceeding $30 million, are predominantly concentrated in North America, Western Europe, and Asia-Pacific, with the United States, China, and Germany leading in population density. In contrast, high-net-worth individuals (HNWIs), possessing assets between $1 million and $30 million, show a more widespread global distribution, encompassing emerging markets like India, Brazil, and Southeast Asia. The demographic profile of UHNWIs skews older with a higher prevalence of entrepreneurs and inheritors, while HNWIs typically include a larger proportion of younger professionals and small business owners across diverse industries.

Emerging Trends in Ultra-High-Net-Worth and High-Net-Worth Wealth

Emerging trends in ultra-high-net-worth (UHNW) and high-net-worth (HNW) wealth reveal a growing shift toward diversified asset allocations, with increased investments in private equity, sustainable ventures, and digital assets like cryptocurrencies. UHNW individuals, typically possessing net assets exceeding $30 million, are leveraging advanced wealth management strategies that prioritize legacy planning and intergenerational wealth transfer. Meanwhile, HNW investors, with net assets between $1 million and $30 million, are expanding their portfolios beyond traditional equities and fixed income to include alternative investments and global real estate markets.

Important Terms

Family Office

Ultra-high-net-worth family offices manage assets exceeding $30 million, offering bespoke investment and wealth preservation strategies distinct from those tailored for high-net-worth families with assets between $1 million and $30 million.

Private Banking

Ultra-high-net-worth individuals typically require more personalized private banking services and complex wealth management strategies than high-net-worth clients due to their substantially larger asset bases exceeding $30 million.

Wealth Preservation

Wealth preservation strategies for ultra-high-net-worth individuals often involve advanced estate planning, tax optimization, and diversified asset protection, surpassing the more conventional approaches typical of high-net-worth counterparts. The complexity and scale of ultra-high-net-worth portfolios require bespoke financial instruments and global wealth management services to mitigate risks and ensure legacy continuity.

Asset Allocation

Ultra-high-net-worth individuals typically allocate a larger proportion of their assets to alternative investments and private equity compared to high-net-worth individuals, who favor more traditional asset classes like stocks and bonds.

Legacy Planning

Legacy planning for ultra-high-net-worth individuals involves complex multi-generational wealth transfer strategies that surpass the more straightforward asset allocation typically used by high-net-worth individuals.

Succession Strategy

Succession strategy for ultra-high-net-worth individuals involves complex estate planning, tax optimization, and wealth preservation across multiple generations, often requiring bespoke legal structures and trust arrangements. In contrast, high-net-worth succession planning focuses more on asset protection, efficient wealth transfer, and minimizing estate taxes with simpler financial instruments and clearer beneficiary designations.

Alternative Investments

Ultra-high-net-worth individuals typically allocate 20-30% of their portfolios to alternative investments, significantly higher than the 5-10% allocation favored by high-net-worth investors.

Bespoke Advisory

Bespoke advisory services for ultra-high-net-worth individuals focus on highly personalized wealth management strategies that surpass the tailored solutions typically offered to high-net-worth clients.

Concierge Services

Concierge services for ultra-high-net-worth individuals offer personalized, exclusive experiences and luxury asset management beyond the premium lifestyle enhancements typical for high-net-worth clients.

Philanthropic Vehicles

Philanthropic vehicles such as donor-advised funds and private foundations are tailored to ultra-high-net-worth individuals for maximizing tax efficiency and legacy impact, whereas high-net-worth individuals often utilize charitable trusts and direct giving for flexible, immediate philanthropy.

ultra-high-net-worth vs high-net-worth Infographic

moneydif.com

moneydif.com