Leveraged buyouts (LBOs) involve acquiring a company primarily through borrowed funds, using the target's assets as collateral, which allows investors to maximize returns with minimal initial capital. Management buyouts (MBOs) occur when existing company executives purchase the business, leveraging their insider knowledge and operational expertise to drive value creation. While both strategies aim for ownership transition, LBOs often focus on financial engineering, whereas MBOs emphasize continuity and strategic growth.

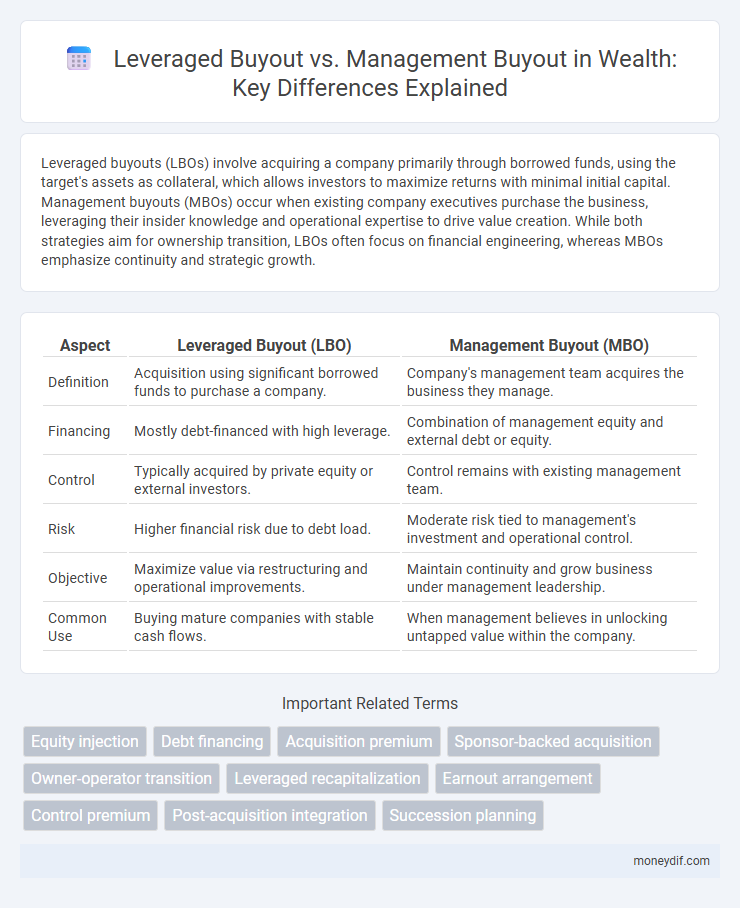

Table of Comparison

| Aspect | Leveraged Buyout (LBO) | Management Buyout (MBO) |

|---|---|---|

| Definition | Acquisition using significant borrowed funds to purchase a company. | Company's management team acquires the business they manage. |

| Financing | Mostly debt-financed with high leverage. | Combination of management equity and external debt or equity. |

| Control | Typically acquired by private equity or external investors. | Control remains with existing management team. |

| Risk | Higher financial risk due to debt load. | Moderate risk tied to management's investment and operational control. |

| Objective | Maximize value via restructuring and operational improvements. | Maintain continuity and grow business under management leadership. |

| Common Use | Buying mature companies with stable cash flows. | When management believes in unlocking untapped value within the company. |

Understanding Leveraged Buyouts (LBO)

Leveraged buyouts (LBOs) involve acquiring a company primarily through borrowed funds, using the target's assets as collateral to secure debt. This financial strategy enables investors to maximize returns by minimizing upfront equity investments while increasing potential risk due to the high leverage. LBOs are typically executed by private equity firms aiming to improve operational efficiency and strategically restructure the acquired company for profitable exit opportunities.

Defining Management Buyouts (MBO)

Management buyouts (MBOs) involve the existing management team acquiring a significant portion or all of the company's shares, often using a mix of personal funds and external financing such as private equity or leveraged debt. This approach aligns the interests of management and owners, fostering operational continuity and strategic growth. MBOs typically target companies with stable cash flows and strong internal leadership poised to drive value creation post-acquisition.

Key Differences: LBO vs MBO

A leveraged buyout (LBO) involves acquiring a company primarily through borrowed funds with the assets of the acquired company serving as collateral, typically executed by private equity firms. In contrast, a management buyout (MBO) occurs when the existing management team purchases the company, often using a mix of equity and debt, aiming to gain control and align operational goals with ownership. Key differences include the buyer identity, source of financing, and strategic objectives, where LBOs focus on financial engineering and value extraction, while MBOs emphasize continuity and insider control.

Advantages of Leveraged Buyouts

Leveraged buyouts (LBOs) offer significant advantages such as enabling investors to acquire large companies with relatively small equity contributions by using substantial debt financing, which can amplify returns on investment. LBOs also provide tax benefits because interest payments on the debt are tax-deductible, reducing the overall cost of capital. These buyouts create strong incentives for management to improve operational efficiency and increase the company's value, aligning interests between investors and executives.

Benefits of Management Buyouts

Management buyouts (MBOs) enable existing management teams to acquire a company, aligning ownership and operational incentives, which often leads to improved company performance and strategic decision-making. MBOs maintain continuity in leadership, preserving institutional knowledge and fostering employee confidence during transitions. This alignment typically results in more efficient use of resources, faster decision-making, and increased motivation to drive long-term business growth.

Risks and Challenges of LBOs

Leveraged buyouts (LBOs) pose significant financial risks due to high debt levels that can strain cash flow and potentially lead to default during economic downturns. The complexity of structuring an LBO involves challenges such as accurate valuation, integration of acquired assets, and managing creditor expectations. Unlike management buyouts (MBOs), LBOs often require external financing sources, increasing vulnerability to interest rate fluctuations and market volatility.

Potential Pitfalls in MBOs

Management Buyouts (MBOs) often face potential pitfalls such as overestimating future cash flows, leading to excessive debt burdens that jeopardize company stability. Conflicts of interest may arise between existing management and investors, complicating decision-making and risk management. Limited diversification of management teams can result in operational blind spots, increasing the likelihood of strategic missteps post-buyout.

Financing Structures: LBO vs MBO

Leveraged buyouts (LBOs) typically use a high proportion of debt financing to acquire a company, leveraging its assets and future cash flows to secure loans, thereby maximizing returns while increasing financial risk. Management buyouts (MBOs) rely on a combination of debt, equity contributions from the internal management team, and occasionally external investors, aligning incentives by giving managers significant ownership stakes. The financing structure of an LBO emphasizes external debt and aggressive leverage, whereas an MBO balances debt with managerial equity participation to ensure smoother operational control post-acquisition.

Wealth Creation Opportunities for Stakeholders

Leveraged buyouts (LBOs) create wealth by using significant debt to finance acquisitions, amplifying returns for equity holders when the acquired company's cash flow supports debt repayment and operational improvements. Management buyouts (MBOs) align management's interests with ownership, incentivizing strategic decisions that drive long-term value creation and increased equity stakes for key stakeholders. Both LBOs and MBOs offer substantial wealth creation opportunities, with LBOs leveraging financial engineering and MBOs focusing on deep operational expertise and governance alignment.

Choosing the Right Buyout Strategy

Selecting the right buyout strategy hinges on the company's financial health and control objectives, where leveraged buyouts (LBOs) utilize significant debt to amplify returns, suitable for firms with stable cash flows. Management buyouts (MBOs) prioritize internal leadership acquiring ownership, fostering alignment and operational continuity, often favored in companies with strong management teams. Evaluating capital structure, risk tolerance, and long-term growth potential guides the decision between leveraging external financing or empowering internal stakeholders.

Important Terms

Equity injection

Equity injection in a leveraged buyout (LBO) typically involves private equity firms contributing a minority portion of the purchase price, using substantial debt to finance the acquisition, while management buyouts (MBOs) feature company executives investing personal equity alongside external financing to gain controlling ownership. The proportion of equity injection in MBOs tends to be higher relative to LBOs due to management's direct financial commitment and alignment with the company's future performance.

Debt financing

Debt financing plays a crucial role in leveraged buyouts (LBOs), where significant borrowed capital acquires a company, often resulting in high leverage ratios to maximize returns. In contrast, management buyouts (MBOs) typically involve existing managers using debt to gain ownership, emphasizing internal control while balancing financial risk through careful debt structuring.

Acquisition premium

Acquisition premium in leveraged buyouts typically involves a higher valuation paid by an external financial sponsor using significant debt, reflecting anticipated synergies and exit profits. In management buyouts, the acquisition premium is often more conservative as internal management seeks sustainable control and operational improvements without overleveraging the company.

Sponsor-backed acquisition

Sponsor-backed acquisitions typically involve private equity firms using leveraged buyouts (LBOs) to acquire companies by employing significant debt to enhance returns, whereas management buyouts (MBOs) occur when a company's existing management team purchases the business, often with external financing support. Both strategies aim to improve operational efficiency and increase value, but sponsor-backed LBOs usually involve greater financial leverage and external control compared to the more internally driven MBOs.

Owner-operator transition

Owner-operator transition often involves choosing between a Leveraged Buyout (LBO), where external financing is used to acquire the business, and a Management Buyout (MBO), which is led by the existing management team using internal resources. Leveraged buyouts emphasize debt financing to maximize acquisition scale, while management buyouts rely on continuity and insider expertise to maintain operational stability.

Leveraged recapitalization

Leveraged recapitalization involves restructuring a company's debt and equity mix by issuing significant debt to repurchase shares or pay dividends, often enhancing financial leverage similarly seen in leveraged buyouts (LBOs), where an external party acquires a company primarily using borrowed funds. Unlike management buyouts (MBOs), where existing managers acquire a controlling interest, leveraged recapitalizations typically maintain current ownership while shifting capital structure to optimize tax benefits and shareholder returns.

Earnout arrangement

Earnout arrangements in leveraged buyouts (LBOs) often serve to bridge valuation gaps by linking seller compensation to future performance, aligning incentives between financial sponsors and sellers. In management buyouts (MBOs), earnouts incentivize existing management teams to meet growth targets post-acquisition, facilitating smoother transitions and performance-driven payouts.

Control premium

Control premium in leveraged buyouts (LBOs) typically reflects the additional value paid for acquiring majority control of a target company using significant debt financing, whereas in management buyouts (MBOs), the control premium often includes the strategic value attributed to existing management's inside knowledge and operational expertise in driving future growth. The quantification of control premium varies, with LBOs focusing more on financial leverage and restructuring potential, while MBOs emphasize alignment of management incentives and continuity in leadership.

Post-acquisition integration

Post-acquisition integration in leveraged buyouts (LBOs) typically focuses on aggressive cost-cutting and debt management to improve cash flow, while management buyouts (MBOs) emphasize leveraging existing leadership's operational knowledge to ensure smoother cultural alignment and strategic continuity. LBOs rely heavily on financial engineering to optimize returns, whereas MBOs prioritize retaining employee morale and sustaining long-term growth through internal leadership stability.

Succession planning

Succession planning in leveraged buyouts (LBOs) involves acquiring a company using significant debt, prioritizing financial restructuring and external leadership to ensure debt repayment, whereas management buyouts (MBOs) focus on internal leadership succession by empowering existing managers to purchase and operate the firm. The strategic approach in LBOs centers on maximizing financial leverage and operational efficiency, while MBOs emphasize preserving company culture and continuity through incumbent management's experience.

Leveraged buyout vs Management buyout Infographic

moneydif.com

moneydif.com