Liquid net worth represents the portion of your total net worth that is readily accessible in cash or assets that can be quickly converted to cash without significant loss of value. While total net worth includes all assets such as real estate, investments, and personal property minus liabilities, liquid net worth provides a clearer picture of financial flexibility and immediate purchasing power. Prioritizing liquid net worth is essential for managing emergencies and seizing timely investment opportunities.

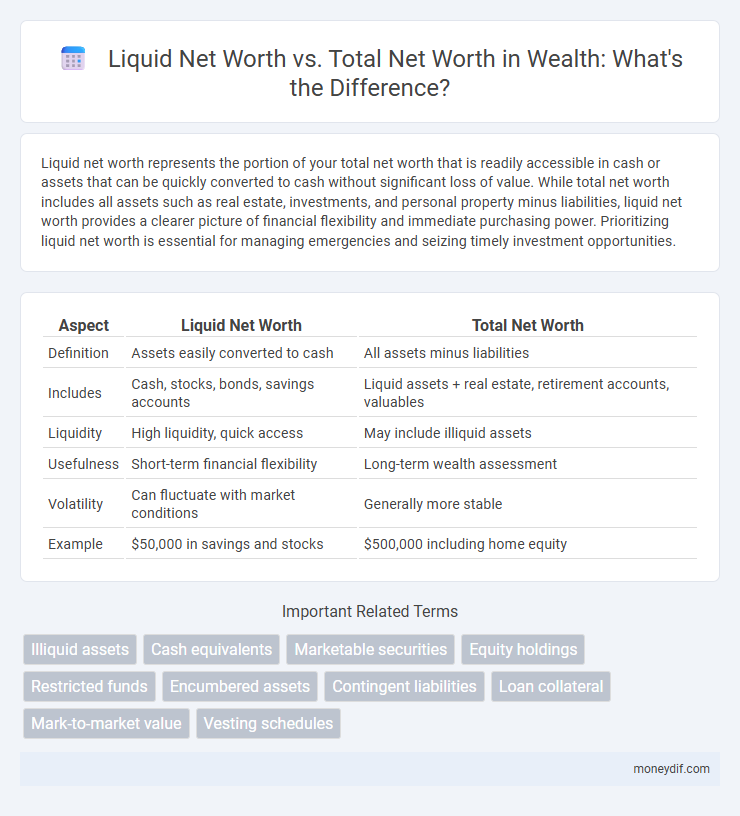

Table of Comparison

| Aspect | Liquid Net Worth | Total Net Worth |

|---|---|---|

| Definition | Assets easily converted to cash | All assets minus liabilities |

| Includes | Cash, stocks, bonds, savings accounts | Liquid assets + real estate, retirement accounts, valuables |

| Liquidity | High liquidity, quick access | May include illiquid assets |

| Usefulness | Short-term financial flexibility | Long-term wealth assessment |

| Volatility | Can fluctuate with market conditions | Generally more stable |

| Example | $50,000 in savings and stocks | $500,000 including home equity |

Understanding Net Worth: Liquid vs Total

Liquid net worth reflects the value of easily accessible assets such as cash, savings accounts, and marketable securities, providing a clear picture of immediate financial liquidity. Total net worth encompasses both liquid assets and illiquid holdings like real estate, retirement accounts, and private investments, representing the overall financial position. Understanding the distinction helps in effective financial planning, emergency preparedness, and accurate assessment of spending power.

Defining Liquid Net Worth

Liquid net worth represents the portion of an individual's total net worth that is readily accessible in cash or assets easily convertible to cash without significant loss of value. This includes cash, savings accounts, money market funds, and certain types of marketable securities, excluding illiquid assets like real estate or retirement accounts with withdrawal restrictions. Understanding liquid net worth is crucial for assessing short-term financial flexibility and emergency fund adequacy.

What Constitutes Total Net Worth?

Total net worth encompasses the entire value of an individual's assets, including liquid assets like cash and investments, as well as illiquid assets such as real estate, retirement accounts, and personal property. It subtracts all outstanding liabilities, offering a comprehensive snapshot of financial health. Understanding total net worth is crucial for accurate wealth assessment, estate planning, and long-term financial strategy development.

Key Differences Between Liquid and Total Net Worth

Liquid net worth represents the value of assets that can be quickly converted into cash without significant loss, such as checking accounts, savings accounts, and publicly traded stocks. Total net worth includes all assets, both liquid and illiquid, encompassing real estate, retirement accounts, and personal property, minus liabilities. Understanding the key differences between these measures helps individuals assess financial flexibility and long-term solvency accurately.

Why Liquid Net Worth Matters for Financial Health

Liquid net worth represents the portion of total net worth that can be quickly accessed or converted into cash without significant loss in value, such as savings accounts, stocks, and bonds. Unlike total net worth, which includes illiquid assets like real estate and retirement accounts, liquid net worth provides a clearer picture of immediate financial flexibility and emergency preparedness. Maintaining a healthy liquid net worth ensures individuals can cover unexpected expenses, seize investment opportunities, and reduce reliance on high-interest debt, thereby enhancing overall financial stability.

Calculating Your Liquid Net Worth

Calculating your liquid net worth involves summing assets that can quickly be converted to cash without significant loss in value, such as cash, savings accounts, money market funds, and publicly traded stocks. This differs from total net worth, which includes illiquid assets like real estate, retirement accounts, and business ownership interests. Focusing on liquid net worth provides a clear picture of immediate financial flexibility and liquidity for wealth management decisions.

How to Assess Your Total Net Worth

Assessing your total net worth requires calculating the sum of all assets, including both liquid assets like cash, savings, and investments that can be quickly converted to cash, and illiquid assets such as real estate, retirement accounts, and personal property. Liquid net worth specifically measures the portion of your total net worth readily accessible for immediate use or emergencies, offering a snapshot of your financial flexibility. Regularly updating and categorizing these assets helps create a clear financial picture essential for effective wealth management and long-term planning.

The Importance of Liquidity in Wealth Management

Liquidity plays a critical role in wealth management by providing immediate access to cash or easily convertible assets, ensuring financial flexibility during emergencies or investment opportunities. While total net worth includes all assets such as real estate, retirement accounts, and private equity, liquid net worth focuses solely on cash and assets quickly convertible to cash without significant loss of value. High liquidity enhances an investor's ability to meet short-term obligations and reduces the risk of forced asset sales at unfavorable prices, promoting more effective wealth preservation and growth.

Strategies to Improve Your Liquid Net Worth

Maximizing liquid net worth involves prioritizing convertible assets like cash, stocks, and bonds that can be quickly accessed without impacting long-term investments such as real estate or retirement accounts. Implementing strategies like reallocating funds to high-yield savings accounts, increasing contributions to easily liquidated investment vehicles, and reducing unnecessary debt can enhance financial flexibility. Regularly reviewing asset allocation ensures an optimal balance between liquidity for emergencies and overall wealth growth.

Liquid Net Worth vs Total Net Worth: Which Should You Prioritize?

Liquid net worth represents assets that can be quickly converted into cash without significant loss of value, such as savings accounts, stocks, and bonds, while total net worth includes all assets minus liabilities, encompassing illiquid assets like real estate and retirement accounts. Prioritizing liquid net worth is crucial for maintaining financial flexibility and meeting short-term obligations or emergency expenses. However, a balanced approach that considers both liquid and total net worth supports sustainable wealth growth and long-term financial stability.

Important Terms

Illiquid assets

Illiquid assets significantly impact total net worth by limiting liquid net worth, reducing immediate access to cash for investments or expenses.

Cash equivalents

Cash equivalents, such as Treasury bills, money market funds, and commercial paper, are highly liquid assets included in liquid net worth, which reflects immediate financial accessibility. Liquid net worth contrasts with total net worth by excluding less liquid assets like real estate and equities, focusing solely on assets that can be quickly converted to cash without significant loss in value.

Marketable securities

Marketable securities represent a significant component of liquid net worth, distinguishing it from total net worth by providing assets that can be quickly converted to cash.

Equity holdings

Equity holdings typically represent a significant portion of liquid net worth, which directly influences the total net worth by providing readily marketable assets.

Restricted funds

Restricted funds represent assets legally or contractually designated for specific purposes, impacting liquid net worth but not total net worth; these funds cannot be readily accessed or converted into cash, thus reducing liquidity despite their inclusion in overall net worth calculations. Understanding the distinction between restricted funds and total net worth is crucial for accurate financial planning and assessing true available resources.

Encumbered assets

Encumbered assets reduce liquid net worth because they are pledged as collateral and cannot be quickly converted into cash, unlike unencumbered assets included in total net worth calculations. This distinction impacts financial liquidity assessments, where liquid net worth excludes encumbered assets to reflect readily accessible funds.

Contingent liabilities

Contingent liabilities impact total net worth but do not immediately affect liquid net worth until they materialize into actual obligations.

Loan collateral

Loan collateral requirements are typically based on liquid net worth rather than total net worth to ensure assets can be quickly converted to cash in case of default.

Mark-to-market value

Mark-to-market value reflects the current market valuation of assets, providing a more accurate liquid net worth estimate compared to total net worth, which includes illiquid or non-marketable assets.

Vesting schedules

Vesting schedules determine the timeline over which assets such as stock options or retirement benefits become fully owned, impacting liquid net worth by restricting immediate access to these assets. Total net worth includes both vested and unvested assets, reflecting the full value of ownership rights regardless of liquidity constraints.

liquid net worth vs total net worth Infographic

moneydif.com

moneydif.com