Old money signifies generational wealth passed down through established family lines, often accompanied by a legacy of tradition and social status. New money refers to wealth recently acquired, typically through entrepreneurship or innovation, which may lack the historical prestige but brings fresh influence and modern perspectives. The contrast between old and new money shapes social dynamics, investment strategies, and cultural capital in contemporary society.

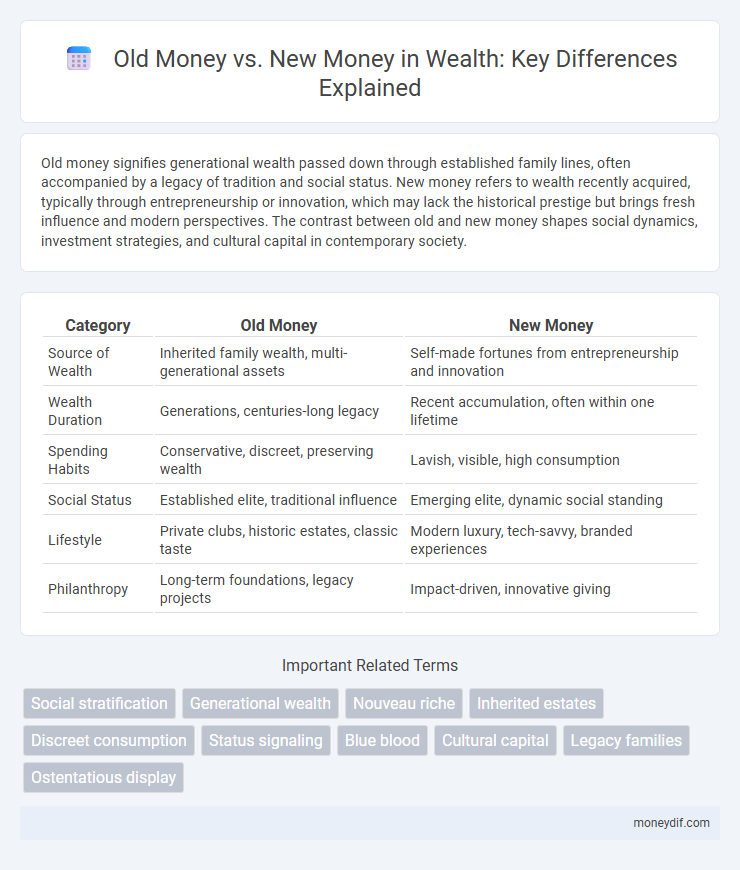

Table of Comparison

| Category | Old Money | New Money |

|---|---|---|

| Source of Wealth | Inherited family wealth, multi-generational assets | Self-made fortunes from entrepreneurship and innovation |

| Wealth Duration | Generations, centuries-long legacy | Recent accumulation, often within one lifetime |

| Spending Habits | Conservative, discreet, preserving wealth | Lavish, visible, high consumption |

| Social Status | Established elite, traditional influence | Emerging elite, dynamic social standing |

| Lifestyle | Private clubs, historic estates, classic taste | Modern luxury, tech-savvy, branded experiences |

| Philanthropy | Long-term foundations, legacy projects | Impact-driven, innovative giving |

Defining Old Money and New Money

Old money refers to families or individuals whose wealth has been inherited and maintained across multiple generations, often associated with established social status, traditional values, and discreet financial management. New money describes individuals or families who have recently acquired significant wealth through entrepreneurship, entertainment, or technology, marked by a more conspicuous lifestyle and modern spending habits. The distinction between old money and new money highlights differences in cultural capital, wealth origin, and social perceptions within elite socioeconomic circles.

Historical Roots of Wealth Accumulation

Old money refers to wealth accumulated over multiple generations, often rooted in land ownership, industrial ventures, and inherited assets established during early economic booms. New money arises from recent entrepreneurial success, technology, or entertainment industries, reflecting a shift in wealth accumulation from traditional sectors to modern innovation-driven economies. The historical roots of wealth accumulation highlight the contrast between established family fortunes tied to legacy and emerging fortunes driven by contemporary market opportunities.

Cultural Values and Social Status

Old money often emphasizes tradition, discretion, and legacy in cultural values, valuing established social networks and inherited prestige. New money tends to prioritize visible displays of wealth, entrepreneurial success, and innovation, reflecting a culture of ambition and self-made status. Social status for old money is linked to lineage and longstanding influence, while new money derives status from recent economic achievements and public recognition.

Education and Upbringing Differences

Old money families often emphasize traditional education pathways, attending elite private schools and Ivy League universities to instill values of legacy, discipline, and social responsibility. New money families tend to prioritize innovative and entrepreneurial skills, seeking specialized education in fields like technology, finance, or business management, reflecting a focus on wealth creation and adaptability. Upbringing in old money environments includes a deep-rooted exposure to cultural refinement and philanthropy, while new money emphasizes ambition, networking, and pragmatic financial acumen.

Spending Habits and Lifestyle Choices

Old money often emphasizes discreet spending habits, prioritizing quality, tradition, and long-term value in lifestyle choices such as classic art collections and exclusive private clubs. New money tends to display wealth more conspicuously, embracing luxury brands, lavish real estate, and cutting-edge technology to showcase status. These contrasting approaches reflect differing cultural attitudes toward wealth preservation and social signaling within elite circles.

Investment Strategies: Tradition vs Innovation

Old money investment strategies emphasize conservative portfolios with a focus on blue-chip stocks, real estate, and long-term wealth preservation through diversification and risk management. New money investors prioritize innovation-driven sectors such as technology startups, cryptocurrency, and venture capital, seeking high growth and disruptive opportunities. The contrast highlights a shift from stability and legacy wealth management to aggressive growth and dynamic market adaptation.

Philanthropy and Social Influence

Old money families often leverage longstanding philanthropic foundations to shape social policies and maintain elite networks, reinforcing their influence across generations. New money philanthropists tend to adopt innovative giving strategies, such as impact investing and tech-driven charitable initiatives, rapidly amplifying their social influence. Both forms of wealth significantly mold cultural and economic landscapes, though their approaches to philanthropy and power dynamics differ substantially.

Challenges Faced by Old Money and New Money

Old money families often face challenges related to maintaining privacy, preserving wealth across generations, and upholding legacy through philanthropy and social reputation. New money individuals frequently encounter scrutiny due to rapid wealth accumulation, pressure to establish credibility in traditional elite circles, and difficulties in managing sudden financial influx responsibly. Both groups struggle with balancing societal expectations and personal financial management amidst evolving economic landscapes.

Public Perception and Media Representation

Old money is often associated with tradition, exclusivity, and understated wealth, which media portray through depictions of historic estates, elite social clubs, and conservative fashion. New money is frequently characterized by flashy displays, entrepreneurial success, and rapid wealth accumulation, with media emphasizing luxury cars, modern mansions, and social media influence. Public perception tends to respect old money's established legacy while simultaneously glamorizing new money's innovation and visibility in popular culture.

Bridging the Gap: Lessons from Both Sides

Old money often emphasizes long-term wealth preservation, social capital, and established family values, while new money focuses on innovation, entrepreneurship, and rapid asset growth. Bridging the gap requires combining old money's stability and legacy knowledge with new money's agility and forward-thinking strategies. Integrating financial discipline with modern investment approaches creates a balanced wealth management model that sustains growth across generations.

Important Terms

Social stratification

Social stratification rooted in the distinction between old money and new money reflects entrenched class divisions, where inherited wealth from generations fosters social prestige and exclusive networks, contrasting with the upward mobility and entrepreneurial success characteristic of new money. Old money families often wield influence through established institutions and cultural capital, while new money seeks validation through conspicuous consumption and innovation within emerging industries.

Generational wealth

Generational wealth often distinguishes old money, characterized by inherited assets and long-established family estates, from new money, which typically arises from recent entrepreneurial success and rapidly accumulated capital. Old money emphasizes preserving wealth across multiple generations through trusts and investments, while new money focuses on wealth expansion and high-profile acquisitions.

Nouveau riche

Nouveau riche refers to individuals or families who have acquired substantial wealth within their own generation, contrasting with old money, which denotes inherited wealth passed down through multiple generations. The distinction often influences social status and cultural perceptions, where old money is associated with tradition and social refinement, while nouveau riche may be linked to conspicuous consumption and recent financial success.

Inherited estates

Inherited estates often symbolize old money, reflecting long-standing wealth preserved across generations with established social prestige and heritage properties. In contrast, new money typically involves recently acquired wealth from entrepreneurship or innovation, where estates may be modern acquisitions lacking the historical lineage of inherited assets.

Discreet consumption

Discreet consumption characterizes old money by emphasizing understated luxury and timeless quality, avoiding ostentatious displays of wealth often associated with new money. This contrast highlights prudent spending habits and an appreciation for heritage, as old money prefers investment in classic assets while new money tends towards more conspicuous and status-driven acquisitions.

Status signaling

Status signaling often distinguishes Old Money, characterized by inherited wealth, from New Money, associated with self-made affluence, through subtle cues like language, fashion, and social behaviors. Old Money tends to emphasize understated elegance and tradition, while New Money may exhibit more conspicuous consumption and brand visibility to assert social standing.

Blue blood

Blue blood refers to aristocratic lineage often associated with old money families who have inherited wealth and social status over generations, embodying tradition and exclusivity. In contrast, new money denotes individuals or families who have recently acquired wealth, typically emphasizing entrepreneurial success or innovation rather than heritage.

Cultural capital

Old money often accrues cultural capital through longstanding family traditions, prestigious education, and established social networks, reinforcing elite status across generations. New money accumulates cultural capital by acquiring luxury goods, engaging in exclusive social scenes, and investing in cultural institutions to signal wealth and gain social legitimacy.

Legacy families

Legacy families often maintain wealth through generations, preserving cultural heritage and social status linked to old money, characterized by established assets and traditional investments. New money, in contrast, typically emerges from recent entrepreneurial success, emphasizing dynamic innovation and rapid accumulation of wealth.

Ostentatious display

Ostentatious display often distinguishes new money from old money, with new money individuals showcasing wealth through flashy, conspicuous purchases such as luxury cars, designer clothing, and extravagant parties. In contrast, old money tends to embrace understated elegance, valuing discretion and heritage over overt displays of financial success.

Old money vs new money Infographic

moneydif.com

moneydif.com