Effective wealth management hinges on understanding the distinction between asset allocation and asset diversification. Asset allocation involves strategically distributing investments across various asset classes to balance risk and return, while asset diversification focuses on spreading investments within an asset class to minimize exposure to any single investment. Combining both strategies enhances portfolio resilience and optimizes long-term financial growth.

Table of Comparison

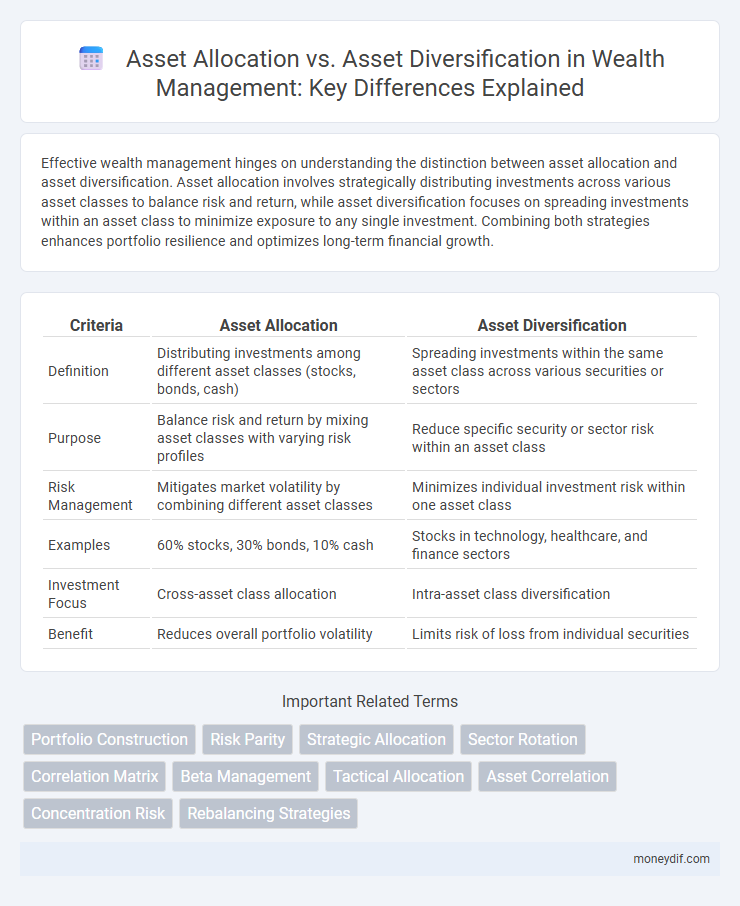

| Criteria | Asset Allocation | Asset Diversification |

|---|---|---|

| Definition | Distributing investments among different asset classes (stocks, bonds, cash) | Spreading investments within the same asset class across various securities or sectors |

| Purpose | Balance risk and return by mixing asset classes with varying risk profiles | Reduce specific security or sector risk within an asset class |

| Risk Management | Mitigates market volatility by combining different asset classes | Minimizes individual investment risk within one asset class |

| Examples | 60% stocks, 30% bonds, 10% cash | Stocks in technology, healthcare, and finance sectors |

| Investment Focus | Cross-asset class allocation | Intra-asset class diversification |

| Benefit | Reduces overall portfolio volatility | Limits risk of loss from individual securities |

Understanding Asset Allocation: Foundations of Wealth

Asset allocation involves strategically dividing investments among asset classes such as stocks, bonds, and real estate to balance risk and return according to an investor's financial goals and risk tolerance. This foundational approach underpins long-term wealth building by optimizing portfolio performance through market cycles, whereas asset diversification spreads investments within each asset class to reduce specific risks. Understanding asset allocation helps investors create a resilient portfolio structure that aligns with their wealth objectives and adapts to changing market conditions.

Key Principles of Asset Diversification

Asset diversification involves spreading investments across various asset classes such as stocks, bonds, real estate, and commodities to reduce risk and enhance portfolio stability. Key principles of asset diversification emphasize selecting uncorrelated assets to minimize the impact of market volatility and improve long-term returns. Diversifying also requires regular portfolio rebalancing to maintain the desired asset mix aligned with financial goals and risk tolerance.

Asset Allocation vs Asset Diversification: Core Differences

Asset allocation involves strategically distributing investments among various asset classes such as stocks, bonds, and cash to balance risk and return based on an investor's goals and risk tolerance. Asset diversification focuses on spreading investments within and across asset classes to minimize exposure to any single investment or risk factor. The core difference lies in asset allocation setting the overall investment framework, while diversification refines risk management within that framework.

The Role of Risk Management in Wealth Building

Effective asset allocation strategically distributes investments across diverse asset classes to balance potential returns with risk exposure, forming the foundation of wealth building. Asset diversification spreads investments within and across asset classes to minimize the impact of any single asset's poor performance, enhancing portfolio stability. Risk management integrates both practices by continuously assessing and adjusting allocations, reducing volatility and protecting capital over time.

Types of Asset Classes for Effective Allocation

Effective asset allocation involves distributing investments across major asset classes such as equities, fixed income, real estate, and cash equivalents to balance risk and reward. Incorporating asset diversification within these classes, including international stocks, government and corporate bonds, and alternative investments like commodities, enhances portfolio resilience. Understanding the unique risk-return profiles of each asset class is crucial for optimizing long-term wealth growth and mitigating market volatility.

Strategies to Diversify Your Investment Portfolio

Effective asset allocation involves strategically distributing investments across various asset classes such as stocks, bonds, and real estate to balance risk and return according to your financial goals. Asset diversification further spreads investments within these classes--like selecting different sectors, industries, or geographic regions--to minimize exposure to any single market fluctuation. Combining asset allocation with diversification strategies reduces portfolio volatility and enhances long-term wealth preservation by mitigating risks associated with economic downturns and market cycles.

The Impact of Market Cycles on Allocation and Diversification

Market cycles significantly influence asset allocation and diversification strategies by altering risk and return dynamics across various asset classes. During economic expansions, higher allocations to equities can leverage growth opportunities, while in downturns, diversification into bonds and alternative assets helps mitigate losses. Understanding cyclical trends allows investors to optimize portfolio resilience and capitalize on shifting market conditions.

Balancing Growth and Stability Through Asset Mix

Effective asset allocation strategically distributes investments across various asset classes, emphasizing a deliberate balance between growth opportunities and stability. Asset diversification complements this by spreading investments within each asset class to mitigate risk and enhance resilience against market volatility. Combining these approaches optimizes portfolio performance, preserving capital while pursuing long-term wealth accumulation.

Common Pitfalls in Asset Allocation and Diversification

Mistakes in asset allocation often stem from improper risk assessment and overconcentration in a single asset class, leading to increased portfolio volatility. Common pitfalls in diversification include holding assets that are highly correlated, which diminishes the risk-reducing benefits intended by spreading investments. Understanding the balance between asset allocation and genuine diversification is critical to optimizing portfolio performance and managing financial risk effectively.

Optimizing Your Wealth Strategy: Allocation & Diversification Combined

Optimizing your wealth strategy requires merging asset allocation and diversification to balance risk and return effectively. Asset allocation strategically divides investments across asset classes like stocks, bonds, and real estate, tailored to individual risk tolerance and financial goals. Diversification spreads investments within these classes, reducing exposure to any single asset's volatility and enhancing portfolio stability.

Important Terms

Portfolio Construction

Portfolio construction hinges on effective asset allocation to balance risk and return by strategically distributing investments across asset classes such as equities, bonds, and real estate. Asset diversification enhances this process by spreading investments within and across these classes to minimize unsystematic risk and optimize long-term portfolio performance.

Risk Parity

Risk Parity allocates capital based on the risk contribution of each asset, aiming for balanced portfolio volatility rather than equal dollar investments, which contrasts with traditional asset allocation focused on fixed weightings. Asset diversification reduces unsystematic risk by spreading investments across various asset classes, while Risk Parity emphasizes equalizing risk exposure to enhance risk-adjusted returns.

Strategic Allocation

Strategic allocation focuses on setting target percentages for different asset classes to optimize long-term risk-adjusted returns, while asset allocation broadly defines the distribution of investments across various asset categories. Asset diversification involves spreading investments within and across asset classes to reduce risk, complementing strategic allocation by enhancing portfolio stability.

Sector Rotation

Sector rotation focuses on reallocating investments among industry sectors based on economic cycles to exploit growth opportunities, contrasting with asset diversification, which spreads investments across various asset classes to minimize risk. Asset allocation balances exposure between equities, bonds, and cash, while sector rotation dynamically shifts sector weightings within the equity portion to enhance returns during different market phases.

Correlation Matrix

A correlation matrix quantifies the relationships between asset returns, enabling investors to identify low or negative correlations crucial for effective asset allocation. Utilizing this matrix supports asset diversification by highlighting assets that reduce portfolio risk through non-synchronous price movements.

Beta Management

Beta management focuses on controlling the systematic risk of a portfolio relative to the market, optimizing asset allocation to achieve desired sensitivity to market movements. In contrast, asset diversification spreads investments across various asset classes to minimize unsystematic risk, enhancing portfolio stability without necessarily targeting a specific beta level.

Tactical Allocation

Tactical allocation strategically adjusts asset allocation by actively shifting investment weights to capitalize on short- to medium-term market opportunities, differing from asset diversification which focuses on spreading investments across various asset classes to reduce risk. Unlike broad diversification, tactical allocation leverages market timing and asset valuation to enhance portfolio returns within the existing asset allocation framework.

Asset Correlation

Asset correlation measures how different assets move in relation to each other, playing a crucial role in optimizing asset allocation by balancing risk and return across a portfolio. Low or negative asset correlation enhances asset diversification, reducing overall portfolio volatility and improving risk management.

Concentration Risk

Concentration risk arises when a portfolio heavily invests in specific asset classes or securities, increasing vulnerability to market volatility within those sectors. Effective asset allocation and asset diversification mitigate concentration risk by spreading investments across various asset classes, industries, and geographies, enhancing portfolio stability and reducing potential losses.

Rebalancing Strategies

Rebalancing strategies focus on adjusting asset allocation to maintain target risk levels by periodically buying or selling assets, contrasting with asset diversification which spreads investments across various asset classes to reduce risk exposure. Effective rebalancing preserves portfolio balance and growth potential, while diversification ensures broader risk mitigation across sectors and asset types.

Asset Allocation vs Asset Diversification Infographic

moneydif.com

moneydif.com