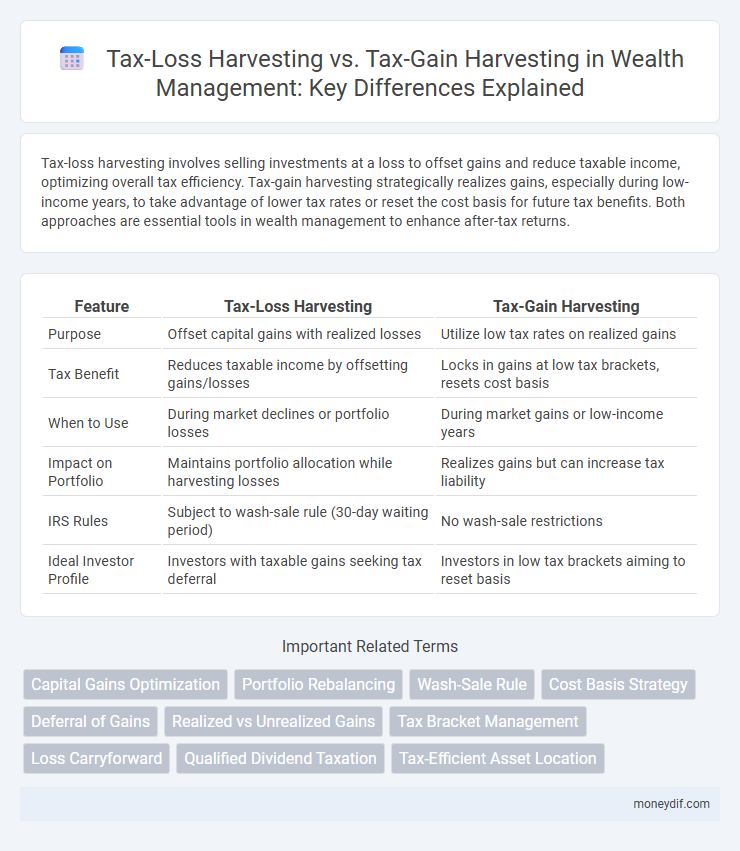

Tax-loss harvesting involves selling investments at a loss to offset gains and reduce taxable income, optimizing overall tax efficiency. Tax-gain harvesting strategically realizes gains, especially during low-income years, to take advantage of lower tax rates or reset the cost basis for future tax benefits. Both approaches are essential tools in wealth management to enhance after-tax returns.

Table of Comparison

| Feature | Tax-Loss Harvesting | Tax-Gain Harvesting |

|---|---|---|

| Purpose | Offset capital gains with realized losses | Utilize low tax rates on realized gains |

| Tax Benefit | Reduces taxable income by offsetting gains/losses | Locks in gains at low tax brackets, resets cost basis |

| When to Use | During market declines or portfolio losses | During market gains or low-income years |

| Impact on Portfolio | Maintains portfolio allocation while harvesting losses | Realizes gains but can increase tax liability |

| IRS Rules | Subject to wash-sale rule (30-day waiting period) | No wash-sale restrictions |

| Ideal Investor Profile | Investors with taxable gains seeking tax deferral | Investors in low tax brackets aiming to reset basis |

Introduction to Tax-Loss and Tax-Gain Harvesting

Tax-loss harvesting involves selling securities at a loss to offset capital gains tax liabilities, reducing overall tax burden while maintaining portfolio balance; tax-gain harvesting entails selling appreciated assets to realize gains up to the long-term capital gains tax threshold, which can reset the cost basis and potentially lower future taxes. Both strategies leverage timing of asset sales to optimize tax efficiency, crucial in wealth management and investment planning. Effective implementation requires understanding capital gains tax rates, holding periods, and individual financial goals to maximize after-tax returns.

Understanding the Basics: What is Tax-Loss Harvesting?

Tax-loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxable income, maximizing after-tax returns. This technique allows investors to use realized losses to counterbalance gains, potentially lowering their overall tax liability within a given fiscal year. Understanding tax-loss harvesting requires recognizing its role in portfolio management and tax optimization by converting paper losses into tax benefits.

What is Tax-Gain Harvesting and When Is It Relevant?

Tax-gain harvesting involves selling investments at a profit to realize capital gains, often to utilize lower tax rates on long-term gains or reset the cost basis for future tax planning. This strategy is particularly relevant when an investor is in a low tax bracket, expects to be in a higher bracket later, or aims to take advantage of step-up in basis rules. Tax-gain harvesting can also be effective for managing tax liabilities in years with unusually low income or when offsetting capital losses.

Key Differences Between Tax-Loss and Tax-Gain Strategies

Tax-loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income, while tax-gain harvesting entails selling investments at a profit to utilize lower tax brackets or reset the cost basis. The primary difference lies in timing and tax objectives: tax-loss harvesting aims to minimize current tax liabilities, whereas tax-gain harvesting seeks to manage future tax exposure through strategic realization of gains. Both strategies require careful portfolio management to optimize after-tax returns and comply with IRS regulations, including wash-sale rules.

Tax Implications: Short-Term vs Long-Term Capital Gains

Tax-loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income primarily by balancing short-term gains, which are taxed at higher ordinary income rates. Tax-gain harvesting, in contrast, realizes gains to reset the cost basis, often taking advantage of long-term capital gains rates that are significantly lower than short-term rates. Understanding the tax implications between short-term and long-term gains is crucial for optimizing after-tax wealth in investment portfolios.

When to Use Tax-Loss Harvesting in Your Portfolio

Tax-loss harvesting is most effective when your portfolio has investments with unrealized losses that can offset capital gains, reducing your overall tax liability. This strategy is particularly beneficial near the end of the tax year or when rebalancing your portfolio to maintain your target asset allocation. Investors with higher marginal tax rates or significant realized gains should prioritize tax-loss harvesting to optimize after-tax returns.

Strategic Scenarios for Tax-Gain Harvesting

Tax-gain harvesting strategically realizes capital gains during low-income years to maximize the use of lower tax brackets and reset the cost basis of investments, optimizing future tax liabilities. This approach is effective when anticipating higher tax rates or increased income in subsequent years, helping to minimize the overall tax burden. Implementing tax-gain harvesting requires careful analysis of long-term financial goals and portfolio rebalancing to achieve optimal after-tax returns.

Common Mistakes in Tax-Loss and Tax-Gain Harvesting

Common mistakes in tax-loss harvesting include selling securities solely to realize losses without considering portfolio rebalancing, which may lead to an unintended shift in investment risk. In tax-gain harvesting, a frequent error involves triggering capital gains without proper planning for the subsequent tax impact or the timing of buying back similar assets. Overlooking wash sale rules during tax-loss harvesting and ignoring the long-term tax implications in tax-gain harvesting can significantly reduce the potential tax benefits.

Best Practices for Maximizing After-Tax Returns

Tax-loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income, optimizing portfolio tax efficiency during market downturns. Tax-gain harvesting strategically sells appreciated assets to take advantage of lower long-term capital gains tax rates and reset cost basis, maximizing after-tax returns in favorable tax environments. Combining these practices with careful timing and adherence to IRS wash sale rules enhances wealth accumulation by minimizing tax liabilities and preserving investment growth.

Choosing the Right Harvesting Strategy for Your Wealth Goals

Tax-loss harvesting involves selling investments at a loss to offset capital gains, reducing taxable income and optimizing after-tax returns, while tax-gain harvesting entails selling investments at a gain to reset the cost basis and capitalize on lower tax rates during years with reduced income. Selecting the right harvesting strategy depends on factors like your current tax bracket, investment portfolio composition, and long-term wealth goals, balancing immediate tax benefits with future growth potential. Consulting with a financial advisor can ensure the chosen approach aligns with risk tolerance and maximizes overall wealth accumulation.

Important Terms

Capital Gains Optimization

Capital gains optimization involves strategically managing investments to minimize tax liabilities by balancing tax-loss harvesting, which offsets capital gains with realized losses, against tax-gain harvesting, which involves realizing gains to utilize lower tax brackets or reset cost basis. Employing both techniques effectively can enhance after-tax returns by reducing taxable income and optimizing timing of gains and losses aligned with individual tax situations.

Portfolio Rebalancing

Portfolio rebalancing involves adjusting asset allocations to maintain target investment strategies, where tax-loss harvesting strategically sells securities at a loss to offset taxable gains and reduce tax liability, while tax-gain harvesting realizes gains to utilize lower tax rates or reset cost basis. Efficient portfolio rebalancing leverages these harvesting methods to optimize after-tax returns by balancing realized gains and losses within the investor's tax situation.

Wash-Sale Rule

The Wash-Sale Rule disallows claiming a tax loss on the sale of a security if the same or substantially identical security is purchased within 30 days before or after the sale, impacting the effectiveness of tax-loss harvesting strategies. In contrast, tax-gain harvesting involves intentionally realizing gains to reset the cost basis and is not affected by the Wash-Sale Rule, allowing investors to manage capital gains and losses more strategically.

Cost Basis Strategy

Cost basis strategy involves managing the purchase price of investments to optimize tax outcomes by harvesting losses to offset capital gains and reduce taxable income or harvesting gains to utilize lower long-term capital gains tax rates and reset cost basis for future tax efficiency. Tax-loss harvesting strategically sells securities at a loss to offset gains, while tax-gain harvesting sells appreciated assets to benefit from favorable tax brackets and increase the cost basis, minimizing taxes on future gains.

Deferral of Gains

Deferral of gains through tax-loss harvesting involves selling securities at a loss to offset realized gains, thus minimizing immediate tax liabilities and allowing continued portfolio growth. In contrast, tax-gain harvesting intentionally realizes gains, potentially benefiting from lower long-term capital gains tax rates and resetting the asset's cost basis for future tax efficiency.

Realized vs Unrealized Gains

Realized gains trigger immediate taxation, making tax-loss harvesting effective by offsetting these gains with actual losses to reduce taxable income, while unrealized gains remain untaxed, allowing tax-gain harvesting to strategically realize gains in lower tax years for optimized tax liability management. Understanding the distinction between realized and unrealized gains is crucial for optimizing tax-loss harvesting and tax-gain harvesting strategies in portfolio management.

Tax Bracket Management

Tax bracket management strategically balances tax-loss harvesting, which offsets gains by selling securities at a loss, against tax-gain harvesting, where assets are sold to realize gains within lower tax brackets to reset cost basis. Effective integration of these strategies minimizes overall tax liability by optimizing capital gains and losses in alignment with current and projected income levels.

Loss Carryforward

Loss carryforward allows taxpayers to apply unused capital losses from previous years to offset future taxable gains, optimizing tax liability across periods. Tax-loss harvesting strategically realizes losses to reduce current taxes while tax-gain harvesting realizes gains to utilize low tax rates or reset cost basis, both leveraging loss carryforward rules for maximum tax efficiency.

Qualified Dividend Taxation

Qualified dividend taxation benefits from lower tax rates compared to ordinary income, making it essential to consider tax-loss harvesting strategies to offset gains and reduce taxable income. Tax-gain harvesting, in contrast, may trigger higher tax liabilities on qualified dividends but can be advantageous for resetting cost basis and optimizing long-term tax planning.

Tax-Efficient Asset Location

Tax-efficient asset location involves strategically placing investments across taxable and tax-advantaged accounts to minimize tax liabilities, leveraging tax-loss harvesting to offset capital gains by selling securities at a loss and tax-gain harvesting to realize gains at favorable tax rates or reset cost basis. Effective implementation balances these strategies to optimize after-tax returns, considering factors like investment time horizon, tax brackets, and future tax policy expectations.

Tax-loss harvesting vs Tax-gain harvesting Infographic

moneydif.com

moneydif.com