Carve-outs involve selling a partial stake in a subsidiary to outside investors while retaining control, allowing companies to raise capital without full divestiture. Spin-offs create a new independent company by distributing shares of the subsidiary to existing shareholders, enabling focused management and unlocking shareholder value. Investors often prefer spin-offs for their clarity in ownership, whereas carve-outs offer strategic flexibility and immediate funding benefits.

Table of Comparison

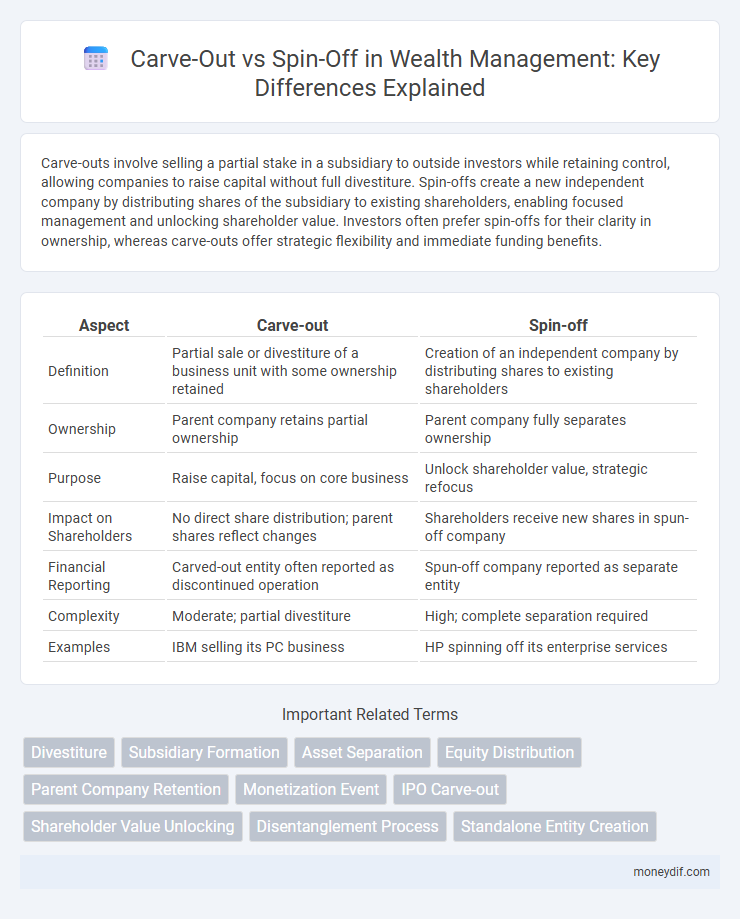

| Aspect | Carve-out | Spin-off |

|---|---|---|

| Definition | Partial sale or divestiture of a business unit with some ownership retained | Creation of an independent company by distributing shares to existing shareholders |

| Ownership | Parent company retains partial ownership | Parent company fully separates ownership |

| Purpose | Raise capital, focus on core business | Unlock shareholder value, strategic refocus |

| Impact on Shareholders | No direct share distribution; parent shares reflect changes | Shareholders receive new shares in spun-off company |

| Financial Reporting | Carved-out entity often reported as discontinued operation | Spun-off company reported as separate entity |

| Complexity | Moderate; partial divestiture | High; complete separation required |

| Examples | IBM selling its PC business | HP spinning off its enterprise services |

Understanding Carve-Outs and Spin-Offs

Carve-outs involve a company selling a portion of its business to outside investors while retaining control, allowing focused growth and capital infusion without full divestiture. Spin-offs occur when a parent company separates a subsidiary to form an independent entity, distributing shares to existing shareholders and unlocking value through operational independence. Understanding these mechanisms helps investors identify strategic restructuring aimed at optimizing business portfolios and maximizing shareholder wealth.

Key Differences Between Carve-Outs and Spin-Offs

Carve-outs involve a parent company selling a minority stake of a subsidiary to public investors while retaining control, whereas spin-offs distribute shares of the subsidiary to existing shareholders, creating an independent company. Carve-outs raise capital by partially divesting assets, often leading to strategic partnerships, while spin-offs unlock value by separating non-core operations without raising new funds. The primary distinction lies in ownership and control post-transaction, impacting investor relations and corporate focus.

Strategic Motivations for Carve-Outs

Carve-outs are driven by strategic motivations to unlock hidden value within a parent company by partially divesting underperforming or non-core business units while retaining significant ownership. This approach allows for focused management and operational improvements in the carved-out entity, enhancing its growth potential and market valuation. Companies often pursue carve-outs to raise capital, streamline portfolio complexity, and attract strategic investors without fully relinquishing control.

Strategic Motivations for Spin-Offs

Spin-offs enable companies to unlock shareholder value by creating independent entities that can focus on core competencies, attract dedicated management teams, and pursue tailored strategic opportunities. These separations often improve operational efficiency and market responsiveness, allowing the parent company and spin-off to optimize capital allocation and growth prospects. Investors typically benefit from clearer financial transparency and targeted investment options aligned with distinct business models.

Financial Impact on Parent Companies

Carve-outs often provide parent companies with immediate capital inflows and potential market valuation boosts by selling partial stakes in subsidiaries while maintaining control. Spin-offs typically result in the distribution of subsidiary shares to existing shareholders, creating independent entities that may enhance overall shareholder value but can lead to short-term earnings dilution for the parent. Both strategies influence the parent company's financial statements, affecting liquidity, debt ratios, and return on equity differently based on the transaction structure and market response.

Wealth Creation for Shareholders

Carve-outs enable companies to unlock hidden value by selling a minority stake in a subsidiary, providing immediate liquidity and focused growth opportunities that can enhance shareholder wealth. Spin-offs create independent entities from existing divisions, allowing market-driven valuations and operational efficiencies that often lead to substantial wealth creation for shareholders. Both strategies optimize capital allocation and unlock shareholder value by fostering focused management teams and clearer business strategies.

Tax Implications of Carve-Outs vs Spin-Offs

Carve-outs typically involve the sale of a business segment, triggering immediate tax liabilities as gains are recognized by the parent company, whereas spin-offs often qualify as tax-free reorganizations under IRS Code Section 355, allowing shareholders to receive new shares without triggering taxable events. In carve-outs, the parent company may face capital gains taxes, and the proceeds can be subject to corporate or individual tax depending on the structure, while spin-offs preserve shareholder value by deferring taxes until the new shares are sold. Understanding these distinctions is crucial for wealth management strategies aiming to optimize tax efficiency in corporate restructuring transactions.

Market Reactions and Performance Outcomes

Carve-outs often generate positive market reactions due to enhanced transparency and focused management, leading to improved financial performance and shareholder value in wealth portfolios. Spin-offs typically unlock hidden asset value by creating independent entities, resulting in significant abnormal returns and longer-term operational efficiency gains. Empirical studies show carve-outs provide more immediate liquidity benefits, while spin-offs yield sustained performance improvements, influencing strategic wealth allocation decisions.

Risks and Challenges in Carve-Outs and Spin-Offs

Carve-outs pose risks such as integration complexities, valuation difficulties, and potential cultural clashes between the parent company and the carved-out entity. Spin-offs challenge organizations with maintaining operational independence, ensuring clear governance structures, and managing investor perceptions. Both transactions require meticulous financial transparency and strategic alignment to mitigate market volatility and stakeholder concerns.

Choosing Between a Carve-Out and a Spin-Off for Wealth Optimization

Choosing between a carve-out and a spin-off depends on the strategic goals for wealth optimization, where a carve-out involves selling a minority stake to raise capital without full separation, preserving some control and generating immediate liquidity. A spin-off creates an independent company by distributing shares to existing shareholders, unlocking value through focused management and potential market valuation uplift. Investors seeking to maximize wealth should analyze tax implications, market conditions, and long-term growth prospects to determine the optimal structure for asset separation.

Important Terms

Divestiture

Divestiture involves the sale or disposal of a business unit, often executed through carve-outs where a portion of the company is separated and sold while maintaining partial ownership. In contrast, spin-offs create an independent company by distributing shares of the subsidiary to existing shareholders, ensuring complete operational and financial separation.

Subsidiary Formation

Subsidiary formation involves establishing a new company controlled by a parent firm, often executed through carve-outs where specific assets or divisions are sold or transferred to create an independent entity. Spin-offs, in contrast, distribute new shares of the subsidiary to existing shareholders without altering ownership, enabling tax-efficient separation and focused strategic management.

Asset Separation

Asset separation in corporate restructuring involves dividing company assets strategically for carve-outs or spin-offs, where carve-outs sell a subsidiary or business unit to external investors, and spin-offs create an independent company by distributing shares to existing shareholders. Distinguishing these methods is crucial for optimizing tax implications, operational focus, and shareholder value.

Equity Distribution

Equity distribution in carve-outs typically involves selling a minority stake of a subsidiary to external investors while the parent retains majority ownership, maintaining significant control and potential financial benefits. In spin-offs, the parent company distributes 100% equity of the subsidiary directly to its existing shareholders, creating an independent publicly traded company without raising new capital.

Parent Company Retention

Parent company retention in carve-out transactions typically involves retaining significant ownership and operational control over the carved-out entity, enabling strategic alignment and financial benefits. In contrast, spin-offs usually result in complete separation, where the parent company distributes shares to existing shareholders, relinquishing direct control and allowing the new independent entity to operate autonomously.

Monetization Event

A Monetization Event in the context of carve-outs involves selling a business unit or assets to generate liquidity, often maximizing shareholder value through outright divestiture. In contrast, a spin-off creates an independent publicly traded company by distributing shares to existing shareholders, unlocking value while maintaining partial business continuity.

IPO Carve-out

An IPO carve-out involves a parent company selling a minority stake of a subsidiary to public investors while maintaining control, optimizing capital structure and unlocking shareholder value. Unlike a spin-off, which creates an independent, fully separated company for existing shareholders, a carve-out retains partial ownership, enabling strategic flexibility and potential future monetization.

Shareholder Value Unlocking

Shareholder value unlocking through carve-outs often involves partial divestiture of a business unit to raise capital while maintaining some control, maximizing value by attracting targeted investors and improving operational focus. Spin-offs, by creating independent companies with separate management and financial structures, unlock shareholder value by enabling clearer strategic direction, enhanced market valuation, and focused resource allocation for each entity.

Disentanglement Process

The disentanglement process in corporate restructuring involves separating specific assets, liabilities, and operations to create a clear and independent business unit, essential for both carve-outs and spin-offs. While carve-outs focus on selling or spinning off a partial ownership stake often retaining some control, spin-offs involve creating a completely independent company by distributing shares to existing shareholders, requiring thorough financial and operational disentanglement to ensure standalone viability.

Standalone Entity Creation

Standalone entity creation involves establishing an independent company by separating assets and operations from the parent organization, a process central to both carve-outs and spin-offs. Carve-outs transfer a business unit's partial ownership through a public offering while retaining some control, whereas spin-offs distribute full ownership of a newly formed standalone entity to existing shareholders, completely separating it from the parent.

Carve-out vs Spin-off Infographic

moneydif.com

moneydif.com