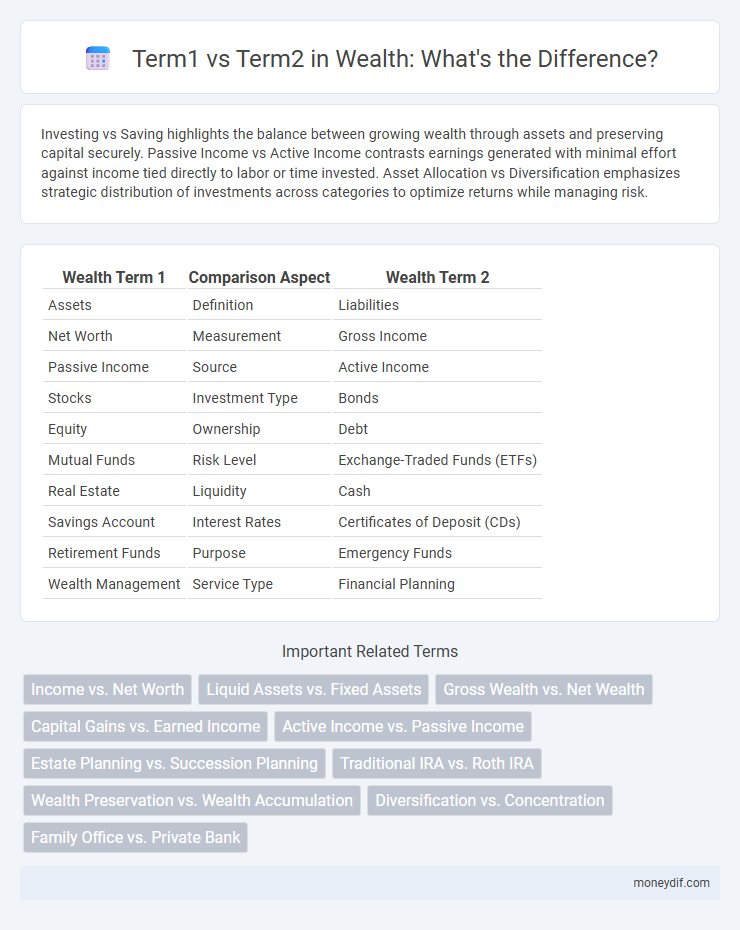

Investing vs Saving highlights the balance between growing wealth through assets and preserving capital securely. Passive Income vs Active Income contrasts earnings generated with minimal effort against income tied directly to labor or time invested. Asset Allocation vs Diversification emphasizes strategic distribution of investments across categories to optimize returns while managing risk.

Table of Comparison

| Wealth Term 1 | Comparison Aspect | Wealth Term 2 |

|---|---|---|

| Assets | Definition | Liabilities |

| Net Worth | Measurement | Gross Income |

| Passive Income | Source | Active Income |

| Stocks | Investment Type | Bonds |

| Equity | Ownership | Debt |

| Mutual Funds | Risk Level | Exchange-Traded Funds (ETFs) |

| Real Estate | Liquidity | Cash |

| Savings Account | Interest Rates | Certificates of Deposit (CDs) |

| Retirement Funds | Purpose | Emergency Funds |

| Wealth Management | Service Type | Financial Planning |

Active Income vs Passive Income

Active income involves earning money through direct labor or services, such as salaries, freelance work, or business operations, requiring ongoing effort and time investment. Passive income generates revenue with minimal daily involvement, including sources like rental properties, dividends, royalties, and interest from investments. Understanding the differences between active income, which depends on continuous work, and passive income, which accrues independently over time, is crucial for building sustainable wealth and financial freedom.

Stocks vs Real Estate

Stocks offer liquidity and the potential for high returns through capital appreciation and dividends, making them ideal for investors seeking active portfolio management. Real estate provides tangible asset value, steady rental income, and tax advantages, appealing to those prioritizing long-term wealth preservation and diversification. Both assets play complementary roles in wealth building by balancing risk, income stability, and inflation protection.

Traditional IRA vs Roth IRA

Traditional IRA contributions are often tax-deductible, reducing current taxable income, while withdrawals during retirement are taxed as ordinary income. Roth IRA contributions are made with after-tax dollars, allowing for tax-free qualified withdrawals and no required minimum distributions. Choosing between a Traditional IRA and Roth IRA depends on current versus expected future tax rates and individual retirement planning strategies.

Growth Investing vs Value Investing

Growth investing targets companies with significant potential for future earnings expansion, emphasizing capital appreciation through stocks of rapidly growing industries like technology and biotech. Value investing seeks undervalued companies trading below their intrinsic worth, focusing on stable businesses with strong fundamentals and attractive dividend yields. Both strategies involve distinct risk profiles and investment horizons, appealing to investors based on preferences for growth potential versus margin of safety.

Mutual Funds vs ETFs

Mutual funds and ETFs are popular investment vehicles with key differences in structure and trading flexibility. Mutual funds are actively managed and priced once daily, while ETFs trade like stocks throughout the day on exchanges, offering greater liquidity. Expense ratios for ETFs tend to be lower, making them cost-efficient options for long-term wealth accumulation.

Gold vs Cryptocurrency

Gold offers a tangible asset with a long history as a store of value and hedge against inflation, while cryptocurrency provides a digital, decentralized alternative with high volatility and potential for significant returns. Investors often consider gold for portfolio stability and risk aversion, whereas cryptocurrencies attract those seeking rapid growth and blockchain innovation. Market liquidity and regulatory environments further differentiate gold's traditional appeal from the evolving, often speculative nature of cryptocurrency markets.

Saving vs Investing

Saving emphasizes preserving capital in low-risk accounts such as savings accounts or CDs, offering liquidity and stability but limited growth potential. Investing involves allocating funds to assets like stocks, bonds, or real estate, aiming for higher returns through market appreciation and dividends, albeit with increased risk. Balancing saving for emergencies and investing for long-term wealth accumulation is crucial for effective financial management.

DIY Wealth Management vs Financial Advisor

DIY wealth management offers complete control over investment decisions and typically incurs lower fees compared to hiring a financial advisor. Financial advisors provide personalized strategies, professional expertise, and behavioral coaching that can optimize portfolio performance and mitigate emotional biases. Investors seeking cost efficiency and autonomy may prefer DIY approaches, while those valuing tailored guidance and risk management often rely on financial advisors.

High-Risk Assets vs Low-Risk Assets

High-risk assets, such as cryptocurrencies and volatile stocks, offer the potential for substantial returns but come with greater volatility and the possibility of significant losses. Low-risk assets, including government bonds and savings accounts, provide more stability and predictable income, making them ideal for preserving capital and minimizing risk. Diversifying wealth across both asset types helps balance growth opportunities with financial security.

Short-Term Wealth Goals vs Long-Term Wealth Goals

Short-term wealth goals prioritize immediate financial needs such as emergency funds, debt repayment, and short-term investments, emphasizing liquidity and quick returns. Long-term wealth goals focus on building sustainable financial security through retirement planning, real estate investments, and diversified portfolios that grow over decades. Balancing short-term liquidity with long-term growth strategies is essential for comprehensive wealth management.

Important Terms

Income vs. Net Worth

Income represents the flow of money earned regularly through salaries, wages, or investments, while net worth calculates the total value of assets minus liabilities, reflecting overall financial health. Understanding the distinction between income and net worth is essential for effective wealth management and long-term financial planning.

Liquid Assets vs. Fixed Assets

Liquid assets, such as cash and marketable securities, provide immediate access to funds for emergencies or investment opportunities, enhancing financial flexibility. Fixed assets, including real estate and machinery, contribute to long-term wealth accumulation through appreciation and productive use but lack liquidity for rapid conversion to cash.

Gross Wealth vs. Net Wealth

Gross wealth represents the total value of all assets owned before deducting any liabilities, while net wealth reflects the actual financial standing by subtracting debts from gross wealth. Understanding net wealth offers a clearer picture of an individual's or household's true economic position compared to gross wealth.

Capital Gains vs. Earned Income

Capital gains represent profits from the sale of assets such as stocks or real estate, typically taxed at lower rates than earned income, which includes wages, salaries, and tips subject to standard income tax brackets. Understanding the differential tax treatments of capital gains versus earned income is crucial for effective wealth management and tax planning strategies.

Active Income vs. Passive Income

Active income requires direct effort such as wages or freelance work, generating earnings tied to time and productivity, while passive income stems from investments like rental properties or dividends, providing revenue with minimal ongoing involvement. Understanding the balance between active income and passive income is crucial for building sustainable wealth and achieving financial independence.

Estate Planning vs. Succession Planning

Estate planning focuses on the legal management and distribution of an individual's assets after death, aiming to minimize taxes and probate complications. Succession planning centers on the strategic transfer of leadership and ownership within family businesses or organizations to ensure continuity and preserve wealth across generations.

Traditional IRA vs. Roth IRA

Traditional IRA contributions are tax-deductible, reducing taxable income upfront, while Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement. Choosing between a Traditional IRA and Roth IRA depends on current versus expected future tax rates, income eligibility, and retirement planning goals.

Wealth Preservation vs. Wealth Accumulation

Wealth preservation focuses on protecting existing assets through strategies like diversification, tax optimization, and risk management to maintain financial stability over time. Wealth accumulation emphasizes growth by leveraging investments, compounding returns, and income generation to increase net worth and achieve long-term financial goals.

Diversification vs. Concentration

Diversification disperses investments across various asset classes to reduce risk and enhance long-term portfolio stability, while concentration focuses capital in fewer, high-conviction assets aiming for higher returns but increased volatility. Wealth management strategies balance diversification to mitigate market fluctuations and concentration to capitalize on strong growth opportunities within specific sectors or securities.

Family Office vs. Private Bank

Family offices offer highly personalized wealth management and estate planning services tailored to ultra-high-net-worth individuals, focusing on multi-generational legacy preservation and bespoke investment strategies. Private banks provide comprehensive financial services with a broader client base, emphasizing customized banking solutions, credit facilities, and investment advisory within a traditional banking framework.

Sure! Here is a list of niche "term1 vs term2" comparisons in the context of wealth: Infographic

moneydif.com

moneydif.com