Capital flight occurs when investors move their assets out of a country to avoid economic or political instability, often resulting in reduced domestic investment and slowed economic growth. Wealth migration, however, typically involves high-net-worth individuals relocating to countries offering better lifestyle, tax benefits, and financial opportunities, positively impacting the host nation's economy. Understanding the distinctions between these phenomena is crucial for policymakers aiming to attract sustainable investments and foster economic development.

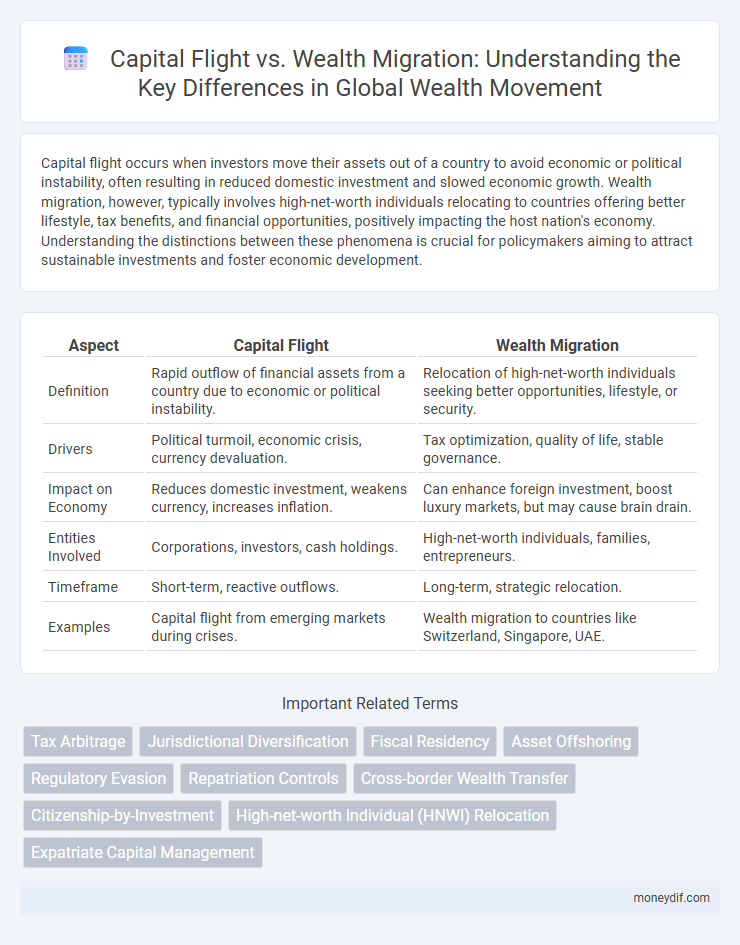

Table of Comparison

| Aspect | Capital Flight | Wealth Migration |

|---|---|---|

| Definition | Rapid outflow of financial assets from a country due to economic or political instability. | Relocation of high-net-worth individuals seeking better opportunities, lifestyle, or security. |

| Drivers | Political turmoil, economic crisis, currency devaluation. | Tax optimization, quality of life, stable governance. |

| Impact on Economy | Reduces domestic investment, weakens currency, increases inflation. | Can enhance foreign investment, boost luxury markets, but may cause brain drain. |

| Entities Involved | Corporations, investors, cash holdings. | High-net-worth individuals, families, entrepreneurs. |

| Timeframe | Short-term, reactive outflows. | Long-term, strategic relocation. |

| Examples | Capital flight from emerging markets during crises. | Wealth migration to countries like Switzerland, Singapore, UAE. |

Understanding Capital Flight and Wealth Migration

Capital flight refers to the rapid movement of large sums of money out of a country, often driven by economic instability, political risk, or unfavorable tax policies, causing reduced domestic investment and slower economic growth. Wealth migration involves high-net-worth individuals relocating their assets and residency to countries with more favorable financial environments, impacting local economies through changes in real estate markets and tax revenues. Understanding these phenomena requires analyzing factors such as regulatory frameworks, geopolitical risks, and the attraction of stable financial hubs that influence both capital flight and wealth migration patterns.

Key Differences Between Capital Flight and Wealth Migration

Capital flight refers to the rapid outflow of financial assets from a country due to economic or political instability, aiming to protect wealth from potential devaluation or seizure. Wealth migration involves high-net-worth individuals relocating to countries with favorable tax laws, political stability, and better quality of life to legally optimize their wealth and lifestyle. Key differences lie in capital flight's emergency-driven, non-transparent nature versus wealth migration's strategic, often legal planning focused on long-term benefits.

Drivers Behind Capital Flight

Capital flight is primarily driven by political instability, economic uncertainty, and unfavorable regulatory environments that prompt investors to move assets out of a country to safeguard wealth. Tax evasion concerns, currency devaluation risks, and weak property rights also accelerate the outflow of financial capital. In contrast, wealth migration involves high-net-worth individuals relocating physically to optimize tax regimes, lifestyle, and security, focusing on personal rather than purely financial considerations.

Motivations for Wealth Migration

Wealth migration is primarily driven by motivations such as seeking political stability, favorable tax regimes, and improved quality of life, contrasting with capital flight which is often spurred by economic or financial instability. High-net-worth individuals prioritize jurisdictions offering robust legal protections, privacy, and investment opportunities when relocating assets internationally. The strategic movement of wealth combines personal security and long-term growth prospects, reflecting a proactive approach rather than reactive asset liquidation.

Economic Impact on Home Countries

Capital flight drains financial resources from home countries, weakening domestic investment and limiting economic growth potential. Wealth migration, involving the physical relocation of affluent individuals, affects local economies by reducing tax revenues and consumer spending, often leading to diminished public services. Both phenomena exacerbate economic instability, as capital and talent outflows undermine the fiscal foundations and long-term development of originating nations.

Implications for Host Countries

Capital flight involves rapid, often illicit, movement of assets abroad, undermining host countries' financial stability and reducing tax revenues. Wealth migration typically entails high-net-worth individuals relocating legally, potentially boosting local economies through increased investments and consumption. Host countries must balance regulatory measures to prevent capital flight while creating attractive conditions to retain and attract wealthy migrants for sustainable economic growth.

Policy Responses to Capital Flight

Policy responses to capital flight often include tighter regulatory frameworks, enhanced financial transparency, and anti-corruption measures to deter illicit outflows. Governments may implement capital controls, strengthen tax enforcement, and foster international cooperation to monitor cross-border financial movements effectively. Such strategies aim to stabilize domestic economies by curbing excessive capital flight and encouraging wealth retention and reinvestment.

Regulation and Management of Wealth Migration

Wealth migration involves the strategic relocation of assets and individuals to optimize financial growth and stability, requiring robust regulatory frameworks to ensure transparency and compliance across jurisdictions. Effective management of wealth migration demands coordinated policies that balance capital attraction with risk mitigation, preventing illicit flows and safeguarding national economic interests. Regulatory measures such as enhanced due diligence, international cooperation, and tax compliance monitoring play a crucial role in controlling the movement of wealth while fostering sustainable economic development.

Case Studies: Global Trends and Examples

Capital flight involves rapid, often unregulated transfer of assets from one country to another in response to economic or political instability, exemplified by Venezuela's massive capital outflows amid hyperinflation. Wealth migration, on the other hand, reflects a strategic relocation of high-net-worth individuals and their assets to jurisdictions offering favorable tax regimes and quality of life, with Singapore and Dubai becoming prime hubs attracting global elites. Global trends indicate a rise in both phenomena, with empirical data showing that capital flight can exacerbate economic crises, while wealth migration reshapes investment landscapes and property markets in host countries.

Future Outlook for Wealth Movement and Economic Stability

Capital flight involves rapid, often unrecorded, outflows of assets from a country, posing immediate risks to economic stability and currency valuation, while wealth migration describes the strategic relocation of high-net-worth individuals seeking long-term safety and fiscal advantages. Future outlooks suggest increasing digitalization of wealth and geopolitical uncertainties will intensify both phenomena, challenging policymakers to balance capital controls with incentives for attracting global wealth. Economic stability hinges on adaptive regulation, diversified investment frameworks, and international cooperation to manage cross-border wealth flows effectively.

Important Terms

Tax Arbitrage

Tax arbitrage exploits discrepancies in tax rates across jurisdictions to minimize liabilities, often intersecting with capital flight, where financial assets rapidly exit high-tax regions; wealth migration, however, involves the deliberate, long-term relocation of affluent individuals seeking favorable tax environments and lifestyle benefits. Both phenomena underscore strategic responses to fiscal policies, impacting global capital distribution and economic dynamics.

Jurisdictional Diversification

Jurisdictional diversification mitigates risks associated with capital flight by distributing assets across multiple legal and regulatory environments, enhancing financial security and stability. Wealth migration leverages jurisdictional diversification to optimize tax efficiency and safeguard assets against political or economic instability in a single country.

Fiscal Residency

Fiscal residency determines tax obligations based on an individual's or entity's primary place of residence, influencing decisions in capital flight and wealth migration. Understanding tax treaties, residency criteria, and asset declaration laws is crucial to navigate fiscal residency and mitigate risks associated with illicit capital movement or legal wealth relocation.

Asset Offshoring

Asset offshoring involves relocating financial assets to foreign jurisdictions to protect wealth from economic or political instability. Unlike capital flight, which often implies sudden withdrawal due to crisis, asset offshoring strategically facilitates wealth migration by optimizing tax efficiency and regulatory advantage.

Regulatory Evasion

Regulatory evasion involves strategies to bypass financial laws, often contributing to capital flight, where large sums of money are rapidly transferred out of a country to avoid taxes or restrictions. Wealth migration, by contrast, refers to the relocation of high-net-worth individuals seeking favorable legal, tax, or lifestyle conditions, which can indirectly facilitate regulatory evasion by shifting assets across jurisdictions.

Repatriation Controls

Repatriation controls regulate the flow of capital by imposing restrictions on transferring funds across borders, aiming to curb illicit capital flight that undermines domestic economies. These controls contrast with wealth migration, where affluent individuals legally relocate assets and investments internationally to optimize financial security and tax advantages.

Cross-border Wealth Transfer

Cross-border wealth transfer involves the movement of financial assets across countries, often driven by capital flight, where funds are moved rapidly to avoid economic or political instability, contrasting with wealth migration, which reflects the strategic relocation of high-net-worth individuals seeking favorable tax regimes, investment opportunities, or improved quality of life. Understanding the distinctions between capital flight and wealth migration is crucial for policymakers aiming to regulate financial flows, prevent illicit transfers, and attract legitimate wealth inflows.

Citizenship-by-Investment

Citizenship-by-Investment programs attract high-net-worth individuals seeking legal avenues for wealth migration, often viewed as a strategic alternative to capital flight by facilitating cross-border asset mobility and residence diversification. These programs balance national economic incentives with regulatory frameworks aimed at preventing illicit financial flows while promoting global investor mobility.

High-net-worth Individual (HNWI) Relocation

High-net-worth individual (HNWI) relocation often intersects with capital flight, where significant wealth exits a country due to economic or political instability, contrasting with wealth migration, which emphasizes strategic moves to optimize lifestyle, taxation, and investment opportunities. Understanding this distinction helps governments develop policies to attract and retain affluent residents, balancing national economic growth against the risks of capital drain.

Expatriate Capital Management

Expatriate Capital Management focuses on strategic relocation of high-net-worth individuals' assets to optimize tax efficiency and safeguard wealth amid capital flight restrictions. The firm leverages wealth migration trends to legally transfer capital across jurisdictions, balancing regulatory compliance with asset protection.

Capital Flight vs Wealth Migration Infographic

moneydif.com

moneydif.com