Direct indexing offers personalized portfolio customization by allowing investors to own individual securities that replicate an index, potentially enhancing tax efficiency and aligning investments with personal values. Index funds provide a simplified, cost-effective way to achieve broad market exposure through pooled assets, minimizing management effort and fees. Choosing between the two depends on an investor's preference for customization, tax optimization, and cost considerations in wealth management.

Table of Comparison

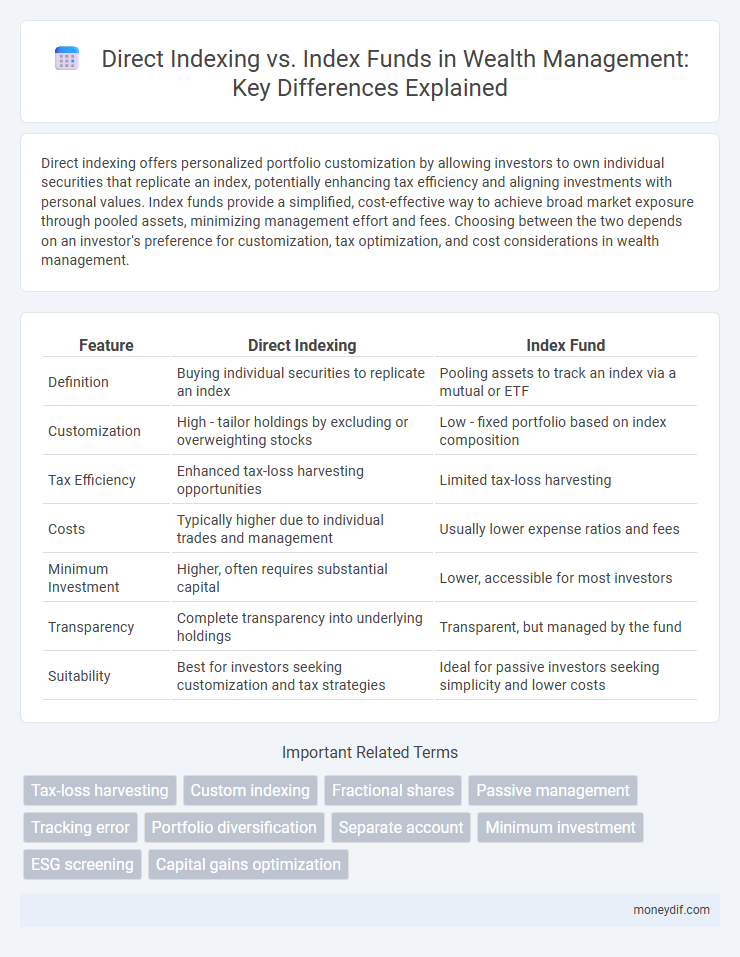

| Feature | Direct Indexing | Index Fund |

|---|---|---|

| Definition | Buying individual securities to replicate an index | Pooling assets to track an index via a mutual or ETF |

| Customization | High - tailor holdings by excluding or overweighting stocks | Low - fixed portfolio based on index composition |

| Tax Efficiency | Enhanced tax-loss harvesting opportunities | Limited tax-loss harvesting |

| Costs | Typically higher due to individual trades and management | Usually lower expense ratios and fees |

| Minimum Investment | Higher, often requires substantial capital | Lower, accessible for most investors |

| Transparency | Complete transparency into underlying holdings | Transparent, but managed by the fund |

| Suitability | Best for investors seeking customization and tax strategies | Ideal for passive investors seeking simplicity and lower costs |

Overview: Understanding Wealth Building Strategies

Direct indexing allows investors to own individual securities within an index, offering customization and potential tax advantages tailored to personal financial goals. Index funds pool investor money to purchase a diversified portfolio that mimics a market index, providing simplicity and broad market exposure with lower management fees. Comparing these wealth building strategies highlights trade-offs between personalized control and convenience in constructing an investment portfolio.

What is Direct Indexing?

Direct indexing is an investment strategy that allows investors to buy the individual stocks of an index rather than purchasing a traditional index fund or ETF. This approach provides greater customization, tax-loss harvesting opportunities, and the ability to exclude specific securities based on personal preferences or values. Direct indexing typically requires higher account minimums and more active management compared to standard index funds.

What are Index Funds?

Index funds are mutual funds or exchange-traded funds (ETFs) designed to replicate the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio of the index's constituent stocks. These funds offer broad market exposure, low operating expenses, and passive management, making them a cost-effective investment choice. Investors benefit from automatic diversification and reduced risk compared to selecting individual stocks, aligning with long-term wealth-building strategies.

Key Differences: Direct Indexing vs Index Funds

Direct indexing offers customized portfolios by allowing investors to buy individual securities within an index, providing tax-loss harvesting opportunities and greater control over asset selection. Index funds pool investor capital to replicate the performance of a specific index through collective ownership, offering simplicity, broad diversification, and lower management requirements. Direct indexing typically involves higher complexity and costs compared to the passive, cost-effective nature of index funds, making each suitable for different investor goals and tax strategies.

Costs and Fees Comparison

Direct indexing typically incurs higher costs due to individual stock ownership, trading fees, and potential account minimums, while index funds benefit from pooled investments that reduce expense ratios. Index funds generally have lower management fees, often ranging from 0.03% to 0.10%, compared to direct indexing platforms that may charge 0.20% or more annually. Investors should weigh the trade-off between the customization advantages of direct indexing and the cost-efficiency of traditional index funds when optimizing portfolio expenses.

Customization and Personalization Options

Direct indexing offers unparalleled customization by allowing investors to tailor portfolios to specific preferences such as tax strategies, ESG criteria, and sector exposures. In contrast, index funds provide a fixed basket of securities, limiting individual personalization and preventing adjustments to align with unique financial goals or values. This customization in direct indexing enhances control over risk management and tax efficiency, making it a preferred choice for wealth optimization.

Tax Efficiency and Harvesting

Direct indexing allows investors to hold individual securities within an index, enabling personalized tax-loss harvesting strategies that can offset capital gains and reduce tax liabilities more effectively than traditional index funds. Index funds offer diversification and lower administrative complexity but typically lack the flexibility for tax management at the individual security level. Tax efficiency in direct indexing leverages comprehensive portfolio customization, enhancing after-tax returns through targeted loss realization and strategic gain deferral.

Accessibility and Minimum Investment

Direct indexing offers greater accessibility for investors seeking customization with typically lower minimum investment thresholds compared to traditional index funds, which often require higher entry amounts. Index funds pool investor capital to purchase a broad market portfolio, making them less flexible but accessible through mutual fund accounts or ETFs with modest minimums. Direct indexing platforms increasingly lower barriers by enabling fractional share purchases, expanding direct market exposure to a wider range of retail investors.

Performance Potential and Risk Management

Direct indexing offers enhanced performance potential by allowing investors to customize portfolios and realize tax-loss harvesting opportunities, often leading to better after-tax returns compared to traditional index funds. Index funds provide broad market exposure with lower management costs and reduced complexity, making risk management simpler through built-in diversification. Investors seeking tailored risk profiles and tax efficiency may prefer direct indexing, while those prioritizing lower fees and ease of management might opt for index funds.

Which Strategy Fits Your Wealth Goals?

Direct indexing allows investors to customize their portfolios by owning individual securities that replicate an index, offering potential tax-loss harvesting benefits and greater control over asset allocation. Index funds provide a cost-effective, diversified approach managed by professionals, ideal for those seeking simplicity and lower fees. Choosing between direct indexing and index funds depends on your wealth goals, tax considerations, investment horizon, and desire for portfolio customization.

Important Terms

Tax-loss harvesting

Tax-loss harvesting in direct indexing allows investors to sell individual securities at a loss to offset gains, optimizing tax efficiency. In contrast, index funds offer less flexibility for tax-loss harvesting since trades occur at the fund level rather than the individual security level.

Custom indexing

Custom indexing allows investors to create personalized portfolios mirroring the performance of standard indices while excluding or emphasizing specific holdings based on individual preferences, which differs from traditional index funds that offer a one-size-fits-all approach with fixed compositions. Direct indexing provides tax-loss harvesting opportunities and greater customization compared to passive index funds, potentially enhancing after-tax returns and aligning investments with personal values or financial goals.

Fractional shares

Fractional shares enable investors to own precise portions of stocks within direct indexing, allowing customizable portfolios that closely track individual index components for enhanced tax efficiency and personalization. In contrast, index funds typically purchase whole shares, limiting fractional ownership and reducing flexibility in tailoring holdings or implementing tax-loss harvesting strategies.

Passive management

Passive management through direct indexing offers personalized tax-loss harvesting and customization by directly owning individual securities, whereas traditional index funds provide broad market exposure with lower minimum investments and streamlined portfolio management. Both approaches aim to replicate market performance, but direct indexing enhances flexibility and tax efficiency, especially for investors with specific preferences or tax strategies.

Tracking error

Tracking error measures the deviation between the returns of a portfolio and its benchmark index, often lower in index funds due to full replication of the index. Direct indexing can exhibit higher tracking error because it involves owning a subset of securities, allowing for customization but leading to potential differences from the index's exact performance.

Portfolio diversification

Portfolio diversification enhances risk management by spreading investments across various assets; direct indexing allows personalized tax-loss harvesting and precise asset selection within an index, while index funds offer broad market exposure with lower minimum investments and simplified management. Investors seeking tailored strategies may prefer direct indexing for customization, whereas those prioritizing convenience and lower costs often choose index funds.

Separate account

Separate accounts offer direct ownership of individual securities, enabling customized direct indexing strategies that align with specific investor preferences and tax optimization goals. Unlike traditional index funds that pool assets and track benchmarks passively, separate accounts provide transparency and flexibility to tailor portfolios based on distinct tax and investment considerations.

Minimum investment

Minimum investment requirements for direct indexing typically exceed those of traditional index funds, often starting at $25,000 or more to enable personalized portfolio customization and tax-loss harvesting opportunities. In contrast, index funds generally require lower minimum investments, sometimes as little as $1, making them more accessible for retail investors seeking broad market exposure without customization.

ESG screening

ESG screening in direct indexing allows investors to customize portfolios by excluding companies based on environmental, social, and governance criteria while maintaining tax efficiency and personalization compared to traditional index funds. Index funds offer ESG exposure through pre-built screens but lack the flexibility for individual adjustments and tax-loss harvesting benefits present in direct indexing strategies.

Capital gains optimization

Capital gains optimization in direct indexing allows investors to selectively harvest tax losses by customizing individual securities within an index, enhancing after-tax returns compared to traditional index funds that aggregate assets in fixed proportions. Unlike index funds, direct indexing offers granular control over capital gains realization, enabling tailored tax management strategies that can significantly improve portfolio tax efficiency.

Direct indexing vs Index fund Infographic

moneydif.com

moneydif.com