Gross estate encompasses the total value of all assets owned by an individual at the time of death, including real estate, investments, and personal property. Net estate refers to the remaining value after deducting liabilities, debts, and expenses such as funeral costs and taxes. Understanding the difference between gross and net estate is crucial for accurate estate planning and tax calculation.

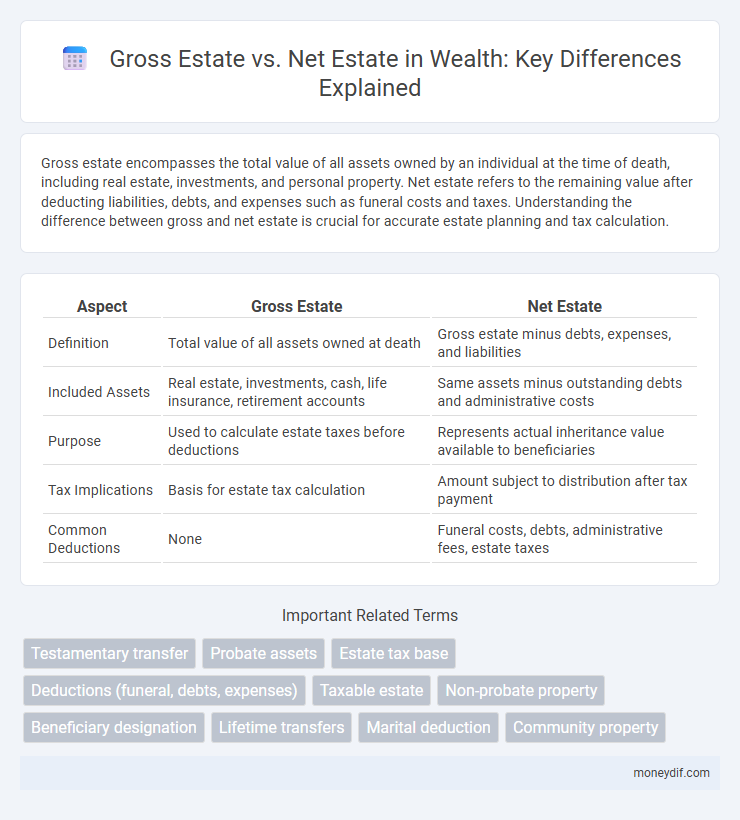

Table of Comparison

| Aspect | Gross Estate | Net Estate |

|---|---|---|

| Definition | Total value of all assets owned at death | Gross estate minus debts, expenses, and liabilities |

| Included Assets | Real estate, investments, cash, life insurance, retirement accounts | Same assets minus outstanding debts and administrative costs |

| Purpose | Used to calculate estate taxes before deductions | Represents actual inheritance value available to beneficiaries |

| Tax Implications | Basis for estate tax calculation | Amount subject to distribution after tax payment |

| Common Deductions | None | Funeral costs, debts, administrative fees, estate taxes |

Understanding Gross Estate: Definition and Components

The gross estate encompasses the total value of all assets owned by an individual at the time of death, including real estate, investments, cash, retirement accounts, and life insurance proceeds. It serves as the foundational figure for calculating estate taxes and determining the overall wealth subject to probate. Understanding the components of a gross estate is essential for accurate estate planning and effective wealth transfer strategies.

Defining Net Estate: What’s Included and Excluded

Net estate represents the total value of an individual's assets after deducting debts, liabilities, and allowable expenses from the gross estate. It typically includes cash, investments, real estate, personal property, and retirement accounts, while excluding outstanding debts, funeral expenses, and administrative costs. Understanding the distinction between gross estate and net estate is crucial for accurate estate tax calculations and effective wealth transfer planning.

Key Differences Between Gross Estate and Net Estate

Gross estate includes the total value of all assets owned by an individual at the time of death, encompassing real estate, investments, cash, and personal property. Net estate is derived after subtracting liabilities such as debts, funeral expenses, and administrative costs from the gross estate, representing the actual value available for distribution to heirs. Understanding the distinction between gross estate and net estate is crucial for accurate estate tax calculations and effective wealth transfer planning.

Importance of Gross Estate in Estate Planning

Gross estate represents the total value of all assets owned at death, including real estate, investments, and life insurance, serving as the foundation for estate tax calculations. Understanding the gross estate is crucial in estate planning to identify potential tax liabilities and implement strategies such as gifting or trust formation to minimize estate taxes. Accurate valuation of the gross estate enables more effective distribution plans, preserving wealth for beneficiaries and ensuring compliance with tax laws.

Calculating Net Estate: Deductions and Allowances

Calculating the net estate involves subtracting allowable deductions and exemptions from the gross estate, which includes the total value of all assets owned at death. Common deductions encompass debts, funeral expenses, administrative costs, and any charitable contributions or spousal transfers. Understanding these allowances is crucial for accurate estate tax assessment and effective wealth transfer planning.

How Gross Estate Impacts Estate Taxes

Gross estate significantly influences estate taxes by determining the total value of all assets before deductions, including real estate, investments, and life insurance proceeds. The IRS uses the gross estate amount to calculate the taxable estate, meaning a higher gross estate results in a larger tax base and potentially increased estate tax liability. Proper valuation and strategic planning can reduce the gross estate, thereby minimizing estate taxes owed.

Common Misconceptions About Gross and Net Estate

Common misconceptions about gross and net estate often confuse the total value of all assets owned at death with the actual amount available to heirs after liabilities. The gross estate includes the full market value of properties, investments, and other assets before debts, taxes, and expenses are deducted, while the net estate reflects the residual value after these obligations. Many believe estate taxes apply to the gross estate, but in reality, taxable estate calculations use the net estate to determine tax liabilities.

Legal Implications: Gross Estate vs Net Estate

Gross estate encompasses the total value of all assets owned by an individual at death, including real estate, investments, and life insurance proceeds, before deductions. Net estate refers to the remaining value after subtracting debts, expenses, and allowable deductions such as mortgages and funeral costs, impacting estate tax liabilities. Legally, the distinction between gross and net estate determines estate tax obligations, creditor claims, and the distribution framework under probate law.

Strategies to Minimize Taxable Estate

Gross estate includes the total value of all assets owned at death, while net estate reflects the remaining assets after deducting debts, expenses, and allowable exemptions. Strategies to minimize taxable estate focus on gifting assets during the grantor's lifetime, utilizing trusts such as irrevocable life insurance trusts (ILITs), and maximizing estate tax exemptions. Proper estate planning with charitable donations and life insurance policies further reduces estate tax liability by lowering the net estate value subject to taxation.

Gross Estate vs Net Estate: Which Matters Most for Heirs?

Gross estate includes the total value of all assets owned at death before debts and expenses, while net estate represents what remains after liabilities are deducted. Heirs benefit most from understanding the net estate since it determines the actual inheritance received after taxes and debts are settled. Estate planners emphasize net estate to accurately assess the financial legacy passed on to beneficiaries.

Important Terms

Testamentary transfer

Testamentary transfer refers to the distribution of assets according to a will upon an individual's death, where the gross estate encompasses the total value of all assets before deductions, and the net estate represents the remaining value after debts, taxes, and expenses are subtracted. Understanding the distinction between gross estate and net estate is crucial for calculating estate taxes and determining the actual inheritance beneficiaries receive through testamentary transfer.

Probate assets

Probate assets are those subject to court supervision during the estate settlement process and are included in the gross estate valuation, which encompasses all property owned at death before deductions. The net estate is derived by subtracting liabilities, debts, and allowable expenses from the gross estate, reflecting the actual value of the estate available for distribution to heirs.

Estate tax base

The estate tax base is calculated by determining the gross estate, which includes the total value of all assets and property owned by the decedent at death, before any deductions. Subtracting allowable deductions, such as debts, expenses, and certain transfers, from the gross estate results in the net estate, which is the taxable amount subject to estate tax.

Deductions (funeral, debts, expenses)

Deductions such as funeral expenses, outstanding debts, and administrative costs are subtracted from the gross estate to determine the net estate value for estate tax purposes. These allowable deductions reduce the overall taxable amount, ensuring that only the net estate is subject to taxation after settling liabilities and necessary expenses.

Taxable estate

The taxable estate is the value of the gross estate minus allowable deductions such as debts, funeral expenses, and charitable donations, determining the amount subject to estate tax. Gross estate includes all assets owned at death, while net estate reflects the remaining value after deductions used to calculate the taxable estate.

Non-probate property

Non-probate property, such as jointly held assets, life insurance proceeds, and retirement accounts with designated beneficiaries, bypasses the probate process and is excluded from the gross estate calculation but still impacts the net estate by potentially reducing assets subject to estate taxes. Understanding the distinction between gross estate--which includes all assets owned at death--and net estate--which is the gross estate minus allowable deductions--is crucial in estate planning to minimize tax liabilities and optimize asset distribution.

Beneficiary designation

Beneficiary designation directly affects the distribution of assets by bypassing probate, which can reduce the gross estate value subject to estate taxes, while only the net estate reflects assets remaining after debts and expenses are deducted. Properly structured beneficiary designations can optimize estate tax efficiency and ensure targeted transfer of wealth outside the probate process.

Lifetime transfers

Lifetime transfers impact the calculation of both the gross estate and net estate, as assets given away during a person's lifetime may be subject to estate tax inclusion under certain thresholds and timeframes. The gross estate includes the total value of all assets owned or transferred, while the net estate reflects the remaining value after deductions, including lifetime gifts and applicable debts.

Marital deduction

The marital deduction allows the transfer of assets between spouses without incurring federal estate tax, effectively reducing the gross estate by the value of qualifying property passed to the surviving spouse. This deduction directly impacts the calculation of the net estate by lowering the taxable estate subject to estate tax, thereby optimizing estate planning strategies.

Community property

Community property laws affect the calculation of gross and net estate by including half of the community property owned by the decedent in the gross estate for estate tax purposes. The net estate is determined after subtracting allowable deductions such as debts, expenses, and the surviving spouse's share of community property from this gross estate value.

Gross estate vs Net estate Infographic

moneydif.com

moneydif.com