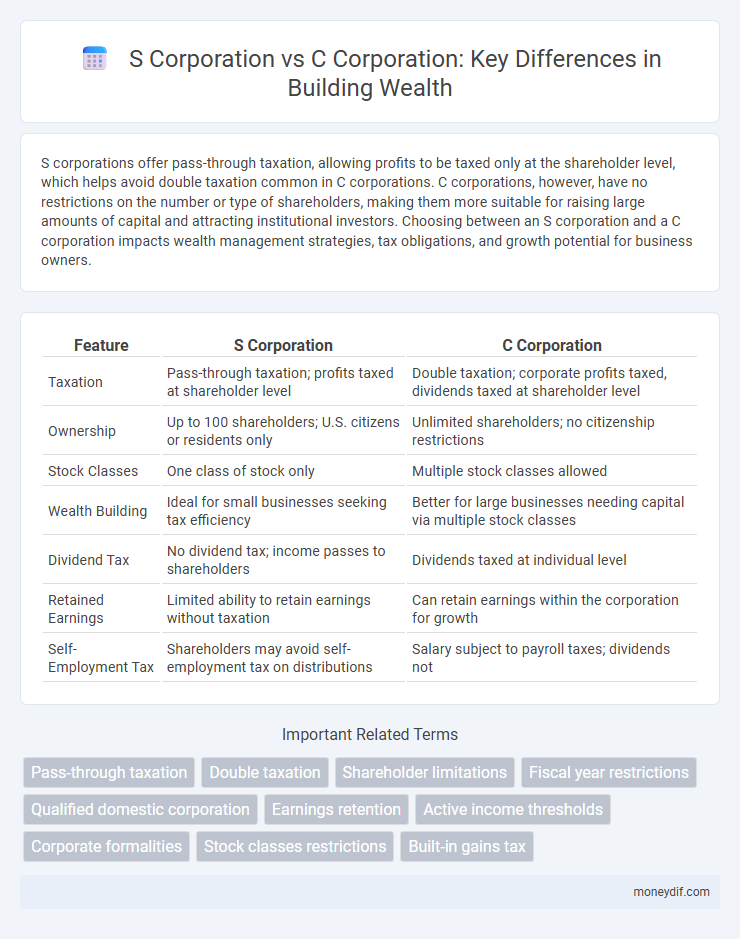

S corporations offer pass-through taxation, allowing profits to be taxed only at the shareholder level, which helps avoid double taxation common in C corporations. C corporations, however, have no restrictions on the number or type of shareholders, making them more suitable for raising large amounts of capital and attracting institutional investors. Choosing between an S corporation and a C corporation impacts wealth management strategies, tax obligations, and growth potential for business owners.

Table of Comparison

| Feature | S Corporation | C Corporation |

|---|---|---|

| Taxation | Pass-through taxation; profits taxed at shareholder level | Double taxation; corporate profits taxed, dividends taxed at shareholder level |

| Ownership | Up to 100 shareholders; U.S. citizens or residents only | Unlimited shareholders; no citizenship restrictions |

| Stock Classes | One class of stock only | Multiple stock classes allowed |

| Wealth Building | Ideal for small businesses seeking tax efficiency | Better for large businesses needing capital via multiple stock classes |

| Dividend Tax | No dividend tax; income passes to shareholders | Dividends taxed at individual level |

| Retained Earnings | Limited ability to retain earnings without taxation | Can retain earnings within the corporation for growth |

| Self-Employment Tax | Shareholders may avoid self-employment tax on distributions | Salary subject to payroll taxes; dividends not |

Overview: S Corporation vs C Corporation

S Corporations offer pass-through taxation, allowing income to be reported on shareholders' personal tax returns, avoiding double taxation faced by C Corporations. C Corporations provide greater flexibility in issuing multiple classes of stock and attracting investors but are subject to corporate income tax and potential double taxation on dividends. Choosing between S and C Corporations impacts tax liability, ownership structure, and compliance requirements for business owners.

Taxation Differences Between S Corp and C Corp

S Corporations benefit from pass-through taxation, meaning income is only taxed at the shareholder level, avoiding double taxation typical of C Corporations, where income is taxed at both corporate and dividend levels. C Corporations face corporate income tax rates, and shareholders also pay taxes on dividends received, resulting in a higher overall tax burden. The choice impacts tax strategy significantly, with S Corps suited for avoiding double taxation, while C Corps offer advantages in reinvestment and fringe benefits deductions.

Eligibility Requirements for S Corporations

S corporations must meet specific eligibility requirements, including having no more than 100 shareholders who are all U.S. citizens or residents, and only one class of stock is permitted. They cannot be owned by partnerships, corporations, or non-resident aliens, making the structure ideal for small to medium-sized businesses seeking pass-through taxation. These restrictions distinguish S corporations from C corporations, which have no limitations on shareholders or stock classes but face double taxation.

Formation Process: S Corp vs C Corp

Forming an S corporation requires submitting Form 2553 to the IRS after incorporating as a C corporation or LLC, ensuring eligibility criteria like having 100 or fewer shareholders and only one class of stock are met. In contrast, forming a C corporation involves filing Articles of Incorporation with the state and complying with state-specific regulations without restrictions on ownership or stock classes. The S corporation election offers pass-through taxation benefits, whereas C corporations face double taxation but have more flexibility in raising capital and structuring ownership.

Ownership Structure and Shareholder Limitations

S corporations limit ownership to a maximum of 100 shareholders, all of whom must be U.S. citizens or residents, enabling pass-through taxation that avoids double taxation. C corporations impose no restrictions on the number or nationality of shareholders, allowing for unlimited ownership diversity but subjecting profits to corporate income tax and potential double taxation on dividends. The ownership structure of S corporations suits small businesses seeking simplified tax treatment, while C corporations accommodate larger enterprises requiring broad capital-raising opportunities.

Profit Distribution and Dividend Taxation

S corporations distribute profits directly to shareholders, avoiding double taxation by passing income through to individual tax returns, where it is taxed at personal income tax rates. C corporations face double taxation, with profits taxed at the corporate level and dividends taxed again at the individual level. Shareholders of S corporations receive profits as distributions without additional corporate tax, while C corporation shareholders pay dividend taxes on profit distributions.

Corporate Formalities and Compliance Obligations

S corporations and C corporations both require strict adherence to corporate formalities such as holding annual meetings, maintaining detailed minutes, and filing necessary documentation with state authorities. S corporations face unique compliance obligations to maintain their tax status, including restrictions on the number and type of shareholders, while C corporations have more flexibility but encounter double taxation and additional regulatory reporting. Failure to comply with these requirements can lead to loss of corporate status, personal liability, and significant financial penalties.

Fundraising and Investment Opportunities

C corporations have an advantage in fundraising and investment opportunities due to their ability to issue multiple classes of stock and attract venture capitalists and institutional investors. S corporations face limitations with shareholder numbers and types, restricting access to broader equity financing. Consequently, C corporations offer greater scalability for wealth accumulation through diverse funding sources.

Conversion Process: Switching Between S Corp and C Corp

Converting between S corporation and C corporation status requires filing IRS Form 2553 to elect S corporation status or revoking that election to revert to C corporation. The conversion process demands careful timing, as S corporation election must be made within 2 months and 15 days of the beginning of the tax year to be effective for that year. Shareholder eligibility, corporate structure, and tax implications are critical factors in the conversion decision, with potential impacts on income taxation and distributions.

Wealth Building Strategies with S Corp and C Corp

S corporations offer wealth-building advantages by allowing profits to pass through directly to shareholders, avoiding double taxation and maximizing after-tax income for reinvestment or distribution. C corporations provide greater flexibility in raising capital and retain earnings within the company, which can be strategically reinvested to fuel business growth and long-term wealth accumulation. Choosing between S corp and C corp structures depends on factors like shareholder goals, income levels, and plans for profit distribution or capitalization to optimize tax efficiency and wealth growth.

Important Terms

Pass-through taxation

Pass-through taxation allows S corporations to avoid double taxation by passing income, losses, and credits directly to shareholders' personal tax returns, unlike C corporations which are taxed at the corporate level before dividends are taxed again on shareholders' returns. This tax structure makes S corporations advantageous for small businesses seeking to minimize tax liability and simplify reporting, whereas C corporations are subject to corporate income tax and ideal for larger companies intending to reinvest earnings.

Double taxation

Double taxation occurs when C corporations pay corporate income tax on profits and shareholders also pay personal income tax on dividends, whereas S corporations avoid this by passing income directly to shareholders for individual taxation, eliminating the corporate tax layer. This tax structure difference significantly impacts the net income distribution and tax liability for business owners choosing between S corp and C corp classifications.

Shareholder limitations

S corporations restrict ownership to a maximum of 100 shareholders who must be U.S. citizens or residents, prohibiting corporations and partnerships as owners, while C corporations have no limits on the number or type of shareholders and can issue multiple classes of stock. These shareholder limitations impact eligibility for S corporation status and influence taxation and corporate governance structures.

Fiscal year restrictions

Fiscal year restrictions significantly differ between S corporations and C corporations; S corporations must adopt a calendar year as their fiscal year unless they can establish a valid business purpose for a different tax year, while C corporations have the flexibility to choose any fiscal year-end. This constraint on S corporations is designed to prevent income shifting and maintain consistent taxation periods, ensuring compliance with IRS regulations.

Qualified domestic corporation

A qualified domestic corporation (QDC) is a key criterion for an S corporation, which must be a domestic corporation with only allowable shareholders, whereas C corporations face no such restrictions but are subject to double taxation on corporate income. Unlike C corporations, S corporations benefit from pass-through taxation but must meet QDC status to qualify and maintain their tax advantages.

Earnings retention

Earnings retention in S corporations allows profits to pass through to shareholders, avoiding double taxation, whereas C corporations retain earnings at the corporate level and face double taxation on distributed dividends. This distinction affects reinvestment strategies, with S corporations often distributing earnings annually and C corporations retaining earnings to fund growth or pay dividends later.

Active income thresholds

Active income thresholds differentiate tax obligations for S corporations and C corporations, with the IRS defining active income as earnings from material participation in business activities. For S corporations, income is typically passed through to shareholders and taxed at individual rates, subject to thresholds such as the $150,000 phase-out for certain deductions, while C corporations face corporate tax rates on active income above thresholds like the $50,000 limit affecting the Alternative Minimum Tax (AMT).

Corporate formalities

S corporations must adhere to strict corporate formalities such as holding annual meetings and maintaining detailed records to preserve their limited liability status, similar to C corporations. Both entity types require compliance with state-specific filing requirements and shareholder restrictions, but S corporations face additional IRS rules limiting the number and type of shareholders to maintain pass-through taxation benefits.

Stock classes restrictions

S corporation stock classes are limited to one class of stock, restricting shareholders to identical voting and distribution rights, whereas C corporations can issue multiple classes of stock with varied voting rights and dividend preferences. This limitation in S corporations ensures compliance with IRS regulations and impacts equity structure and fundraising flexibility compared to the more flexible stock options in C corporations.

Built-in gains tax

Built-in gains tax applies to S corporations that were previously C corporations and affects the sale of assets held at the time of conversion, taxing the appreciated value realized within a specific recognition period, typically five years. C corporations are not subject to built-in gains tax but face double taxation on corporate earnings and capital gains, contrasting S corporations' pass-through taxation with potential built-in gains tax liability.

S corporation vs C corporation Infographic

moneydif.com

moneydif.com