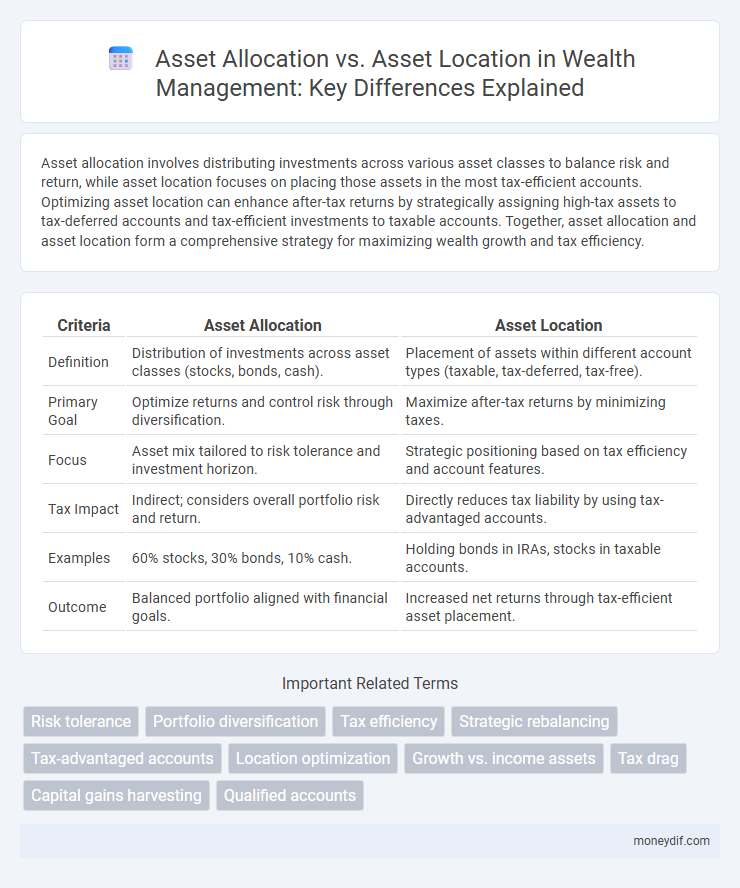

Asset allocation involves distributing investments across various asset classes to balance risk and return, while asset location focuses on placing those assets in the most tax-efficient accounts. Optimizing asset location can enhance after-tax returns by strategically assigning high-tax assets to tax-deferred accounts and tax-efficient investments to taxable accounts. Together, asset allocation and asset location form a comprehensive strategy for maximizing wealth growth and tax efficiency.

Table of Comparison

| Criteria | Asset Allocation | Asset Location |

|---|---|---|

| Definition | Distribution of investments across asset classes (stocks, bonds, cash). | Placement of assets within different account types (taxable, tax-deferred, tax-free). |

| Primary Goal | Optimize returns and control risk through diversification. | Maximize after-tax returns by minimizing taxes. |

| Focus | Asset mix tailored to risk tolerance and investment horizon. | Strategic positioning based on tax efficiency and account features. |

| Tax Impact | Indirect; considers overall portfolio risk and return. | Directly reduces tax liability by using tax-advantaged accounts. |

| Examples | 60% stocks, 30% bonds, 10% cash. | Holding bonds in IRAs, stocks in taxable accounts. |

| Outcome | Balanced portfolio aligned with financial goals. | Increased net returns through tax-efficient asset placement. |

Understanding Asset Allocation: Building a Strong Portfolio Foundation

Understanding asset allocation involves strategically distributing investments among asset classes such as stocks, bonds, and cash to balance risk and return based on financial goals and risk tolerance. This foundational approach helps optimize portfolio diversification, enhances potential growth, and mitigates market volatility impacts. Effective asset allocation serves as the cornerstone for long-term wealth accumulation and portfolio resilience.

What Is Asset Location? Maximizing Tax Efficiency

Asset location refers to the strategic placement of investments across different account types, such as taxable, tax-deferred, and tax-exempt accounts, to maximize after-tax returns. Placing tax-inefficient assets like bonds in tax-deferred accounts and tax-efficient assets like stocks in taxable accounts helps minimize tax liabilities and enhance overall portfolio growth. Optimizing asset location complements asset allocation by focusing on tax efficiency rather than just investment diversification.

Key Differences: Asset Allocation vs. Asset Location

Asset allocation involves distributing investments across various asset classes such as stocks, bonds, and cash to balance risk and return, while asset location focuses on placing those investments in different account types like taxable, tax-deferred, or tax-exempt to optimize tax efficiency. Key differences include asset allocation's role in managing overall portfolio risk and performance, whereas asset location targets minimizing tax liabilities and maximizing after-tax returns. Effective wealth management integrates both strategies to enhance growth potential and tax advantages simultaneously.

The Importance of Asset Allocation in Wealth Growth

Asset allocation plays a critical role in wealth growth by strategically distributing investments across asset classes to balance risk and return. Effective asset allocation considers correlations between equities, bonds, and alternative assets to maximize portfolio diversification and enhance long-term returns. Prioritizing asset allocation over asset location ensures investors optimize growth potential while managing market volatility and economic cycles.

Asset Location Strategies for Tax-Advantaged Investing

Effective asset location strategies optimize the placement of investments across taxable, tax-deferred, and tax-exempt accounts to maximize after-tax returns. Prioritizing tax-inefficient assets like bonds or REITs in tax-advantaged accounts such as IRAs or 401(k)s reduces tax drag, while holding tax-efficient assets like index funds in taxable accounts minimizes capital gains taxation. Strategic asset location enhances wealth accumulation by aligning investment types with their ideal tax treatment, ultimately improving portfolio tax efficiency and long-term growth.

Integrating Allocation and Location for Optimal Returns

Integrating asset allocation and asset location strategies enhances portfolio efficiency by balancing risk, return, and tax implications. Strategic asset allocation focuses on distributing investments across asset classes to maximize returns and manage risk, while asset location optimizes the placement of these assets within taxable, tax-deferred, or tax-exempt accounts to minimize tax liabilities. Combining both approaches allows investors to achieve optimal after-tax returns and improve long-term wealth accumulation.

Common Mistakes in Asset Allocation and Location

Common mistakes in asset allocation include failing to diversify across asset classes and neglecting risk tolerance, which can lead to portfolio imbalances and increased volatility. In asset location, investors often overlook tax efficiency by placing taxable bonds in taxable accounts instead of tax-advantaged accounts, reducing after-tax returns. Misalignment between asset allocation and location reduces portfolio growth potential and tax benefits, hindering long-term wealth accumulation.

How Risk Tolerance Influences Asset Allocation Decisions

Risk tolerance significantly influences asset allocation decisions by determining the proportion of equities versus fixed-income investments in a portfolio, balancing potential returns against volatility. Higher risk tolerance typically leads to increased equity exposure for greater growth potential, while lower risk tolerance favors bonds or cash equivalents to preserve capital. Understanding individual risk capacity helps tailor asset allocation strategies that align with financial goals and investment horizons.

Tax Implications: How Asset Location Impacts Wealth

Strategic asset location directly influences tax efficiency by placing investments with higher tax rates into tax-advantaged accounts such as IRAs or 401(k)s, while holding tax-efficient assets like index funds in taxable accounts. This approach can significantly reduce the overall tax burden, enhancing after-tax returns and accelerating wealth accumulation. Optimizing asset allocation within appropriate account types maximizes tax-deferral benefits and minimizes capital gains and dividend taxes, ultimately preserving more wealth over time.

Crafting a Personalized Asset Allocation and Location Plan

Crafting a personalized asset allocation and location plan involves strategically distributing investments across various asset classes to balance risk and return while optimizing tax efficiency by selecting appropriate accounts, such as taxable, tax-deferred, or tax-exempt. Effective asset allocation focuses on diversification among stocks, bonds, and alternative investments based on an investor's risk tolerance and financial goals. Asset location complements this by placing high-growth, tax-inefficient assets in tax-advantaged accounts and tax-efficient investments in taxable accounts to maximize after-tax wealth.

Important Terms

Risk tolerance

Risk tolerance influences asset allocation by determining the proportion of equities, bonds, and cash within a portfolio to optimize returns versus volatility. Asset location complements this by strategically placing investments in taxable, tax-deferred, or tax-exempt accounts to enhance after-tax returns while aligning with the investor's risk profile.

Portfolio diversification

Portfolio diversification enhances risk management by spreading investments across various asset classes, while asset allocation focuses on the strategic distribution of these assets based on risk tolerance and financial goals. Asset location optimizes tax efficiency by placing specific investments in tax-advantaged or taxable accounts, complementing asset allocation to maximize after-tax returns.

Tax efficiency

Tax efficiency in investment strategies improves when asset location complements asset allocation by placing tax-inefficient assets like bonds in tax-advantaged accounts and tax-efficient assets like stocks in taxable accounts. This approach minimizes taxable distributions and capital gains, enhancing after-tax returns and optimizing portfolio performance.

Strategic rebalancing

Strategic rebalancing involves periodically adjusting the proportions of different asset classes within a portfolio to maintain a target allocation, enhancing risk management and long-term returns. Asset allocation focuses on the distribution of investments across asset categories, while asset location optimizes the placement of these assets in various account types to maximize tax efficiency and overall portfolio performance.

Tax-advantaged accounts

Tax-advantaged accounts such as IRAs and 401(k)s enhance asset location strategies by housing tax-inefficient investments like bonds to minimize taxable income, while tax-efficient assets like index funds perform well in taxable accounts, optimizing overall portfolio after-tax returns. Balancing asset allocation across different account types maximizes tax benefits and growth potential, leveraging tax deferral and avoidance mechanisms inherent to each account.

Location optimization

Location optimization maximizes after-tax returns by strategically placing assets in tax-advantaged accounts, contrasting with asset allocation that focuses on risk-return balance across asset classes. Proper asset location considers tax efficiency by allocating tax-inefficient assets like bonds to tax-advantaged accounts, while placing tax-efficient assets like equities in taxable accounts.

Growth vs. income assets

Growth assets, such as stocks and real estate, offer potential for capital appreciation and are typically held in tax-advantaged accounts to maximize long-term compounding, while income assets like bonds and dividend-paying stocks provide steady cash flow and are often placed in taxable accounts for favorable tax treatment on interest or dividends. Effective asset allocation balances growth and income assets based on risk tolerance and investment goals, whereas strategic asset location optimizes the placement of these assets across account types to enhance after-tax returns.

Tax drag

Tax drag reduces investment returns by increasing the tax burden on gains and income, significantly impacting portfolio growth when asset allocation decisions do not consider tax-efficient asset location. Placing tax-inefficient investments like bonds in tax-advantaged accounts while holding tax-efficient assets such as index funds in taxable accounts minimizes tax drag and enhances after-tax returns.

Capital gains harvesting

Capital gains harvesting strategically realizes taxable gains to optimize after-tax returns, while asset allocation focuses on distributing investments across asset classes to manage risk and return. Asset location complements this by placing investments in tax-advantaged accounts or taxable accounts based on their tax characteristics, maximizing the benefits of capital gains harvesting within the broader investment strategy.

Qualified accounts

Qualified accounts, such as 401(k)s and IRAs, allow tax-deferred growth, making them ideal for holding assets expected to generate high taxable income, like bonds or REITs. Asset allocation focuses on risk and return balance across asset classes, while asset location optimizes tax efficiency by strategically placing assets within qualified or taxable accounts.

Asset allocation vs Asset location Infographic

moneydif.com

moneydif.com