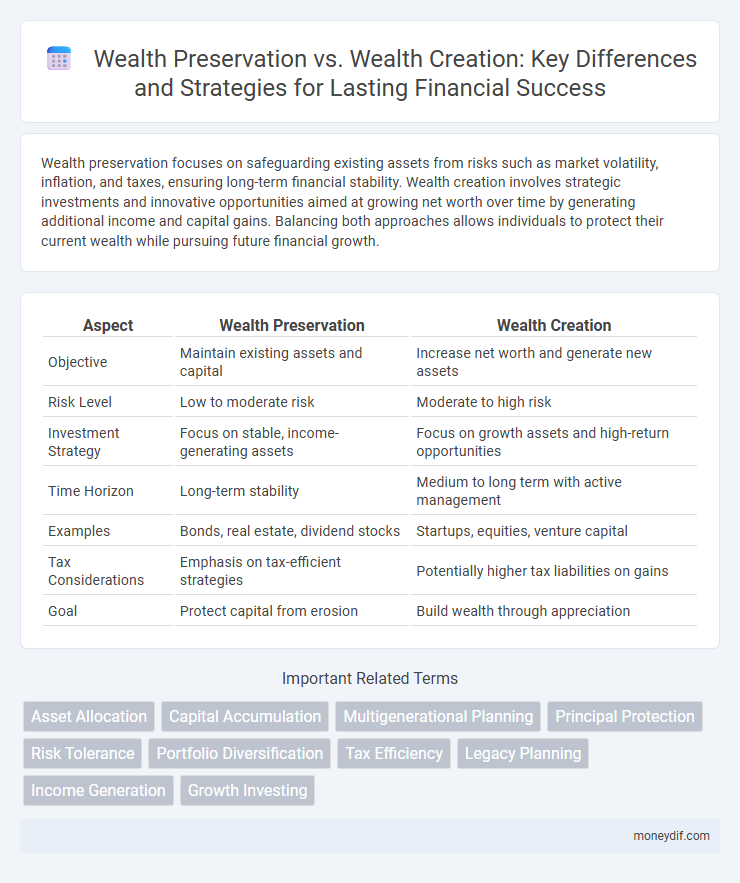

Wealth preservation focuses on safeguarding existing assets from risks such as market volatility, inflation, and taxes, ensuring long-term financial stability. Wealth creation involves strategic investments and innovative opportunities aimed at growing net worth over time by generating additional income and capital gains. Balancing both approaches allows individuals to protect their current wealth while pursuing future financial growth.

Table of Comparison

| Aspect | Wealth Preservation | Wealth Creation |

|---|---|---|

| Objective | Maintain existing assets and capital | Increase net worth and generate new assets |

| Risk Level | Low to moderate risk | Moderate to high risk |

| Investment Strategy | Focus on stable, income-generating assets | Focus on growth assets and high-return opportunities |

| Time Horizon | Long-term stability | Medium to long term with active management |

| Examples | Bonds, real estate, dividend stocks | Startups, equities, venture capital |

| Tax Considerations | Emphasis on tax-efficient strategies | Potentially higher tax liabilities on gains |

| Goal | Protect capital from erosion | Build wealth through appreciation |

Defining Wealth Preservation and Wealth Creation

Wealth preservation involves strategies designed to maintain existing assets and protect them from risks such as market volatility, inflation, and taxes. Wealth creation focuses on generating new financial assets and increasing net worth through investments, entrepreneurship, and income growth. Understanding the distinction helps individuals balance risk management with growth opportunities to secure long-term financial stability.

Key Differences Between Preserving and Creating Wealth

Wealth preservation focuses on protecting existing assets from risks like inflation, market volatility, and taxes to maintain financial stability over time. Wealth creation involves generating new assets through investments, entrepreneurship, or income diversification, aiming for capital growth and increased net worth. Key differences include risk tolerance, time horizon, and strategic objectives, where preservation prioritizes safety and steady returns while creation emphasizes growth and higher potential rewards.

Core Strategies for Wealth Preservation

Core strategies for wealth preservation emphasize risk management through diversified asset allocation, ensuring capital protection during market volatility. Implementing tax-efficient investment vehicles like trusts and retirement accounts minimizes liabilities, thereby maintaining net worth. Furthermore, consistent estate planning safeguards wealth transfer across generations, securing long-term financial stability.

Essential Tactics for Wealth Creation

Effective wealth creation hinges on strategic investment diversification, disciplined saving habits, and leveraging compound interest over time. Prioritizing high-growth assets such as equities and real estate fuels capital appreciation, while continuous financial education enhances decision-making and risk management. Implementing tax-efficient strategies and reinvesting dividends bolster portfolio expansion and long-term wealth accumulation.

Risk Management: Preservation vs. Creation Approaches

Wealth preservation emphasizes safeguarding assets through conservative risk management strategies such as diversification, low-volatility investments, and capital protection techniques to minimize potential losses. Wealth creation involves higher risk tolerance, leveraging growth-oriented investments like equities, real estate, and innovative ventures to maximize returns over time. Balancing these approaches requires assessing individual risk appetite, investment horizon, and market conditions to optimize long-term financial goals.

Time Horizon: Long-Term Value vs. Immediate Growth

Wealth preservation emphasizes safeguarding assets over decades through low-risk investments like bonds and real estate, ensuring long-term value retention. Wealth creation targets higher returns with riskier, short-term strategies such as stocks and startups, aiming for immediate growth and significant portfolio expansion. Balancing these approaches depends on individual time horizons and financial goals, as preservation prioritizes stability while creation seeks rapid capital appreciation.

Asset Allocation for Wealth Preservation and Creation

Effective asset allocation plays a crucial role in balancing wealth preservation and wealth creation by distributing investments across diversified asset classes such as equities, bonds, real estate, and cash. For wealth preservation, emphasis is placed on low-risk, income-generating assets like government bonds and high-grade corporate bonds to protect capital and maintain purchasing power. In contrast, wealth creation strategies favor higher-growth assets such as equities and alternative investments, which offer greater potential returns but come with increased volatility and risk.

Role of Diversification in Sustaining and Building Wealth

Diversification plays a critical role in sustaining and building wealth by spreading investments across various asset classes, thus mitigating risks associated with market volatility. It balances wealth preservation by protecting capital from significant losses while enabling wealth creation through exposure to multiple growth opportunities. Strategic diversification enhances portfolio resilience, ensuring long-term financial stability and growth potential.

Tax Implications: Maintaining vs. Growing Wealth

Wealth preservation often prioritizes tax-efficient strategies such as utilizing trusts, tax-deferred accounts, and gifting to minimize estate and income taxes, thereby safeguarding existing assets. Wealth creation focuses on growth-oriented investments, which may trigger higher capital gains taxes and income taxes due to active trading and reinvestment. Strategic tax planning balances these implications to optimize after-tax returns whether maintaining or growing wealth.

Choosing the Right Approach for Your Financial Goals

Wealth preservation emphasizes safeguarding existing assets through strategies like diversification, tax planning, and risk management, ensuring long-term financial stability. Wealth creation focuses on growing capital via investments in stocks, real estate, or entrepreneurial ventures aligned with high returns and active portfolio management. Selecting the appropriate approach depends on individual financial goals, risk tolerance, and time horizon to balance growth potential against security.

Important Terms

Asset Allocation

Asset allocation balances risk and return by distributing investments across asset classes to achieve wealth preservation and wealth creation goals. Conservative allocations favor bonds and cash for preserving capital, while aggressive portfolios prioritize equities and alternative assets to drive long-term wealth growth.

Capital Accumulation

Capital accumulation focuses on systematically increasing assets to enhance future earning potential, directly influencing wealth creation by investing in growth opportunities and income-generating ventures. In contrast, wealth preservation emphasizes maintaining existing capital through risk management and asset protection strategies, ensuring long-term financial stability without significant depletion.

Multigenerational Planning

Multigenerational planning integrates strategies for wealth preservation and wealth creation to ensure financial security across multiple family generations, balancing risk management with growth opportunities. Emphasizing trusts, estate planning, and diversified investment portfolios, this approach safeguards assets while generating sustainable wealth for heirs.

Principal Protection

Principal protection focuses on preserving the original investment amount, minimizing risk to safeguard wealth, which contrasts with wealth creation strategies that prioritize higher returns through increased exposure to market volatility and growth opportunities. Investors aiming for wealth preservation typically choose low-risk assets or principal-protected instruments, whereas wealth creation involves active portfolio growth via equities, real estate, or alternative investments.

Risk Tolerance

Risk tolerance determines an investor's ability to withstand market volatility, influencing the balance between wealth preservation and wealth creation strategies. Higher risk tolerance typically aligns with aggressive wealth creation through growth assets, while lower risk tolerance favors conservative approaches focused on protecting principal and minimizing losses.

Portfolio Diversification

Portfolio diversification reduces risk by allocating assets across various investment categories, balancing wealth preservation strategies that focus on minimizing losses with wealth creation tactics aimed at maximizing returns. Effective diversification combines low-volatility instruments for capital protection and growth-oriented assets to enhance long-term portfolio appreciation.

Tax Efficiency

Tax efficiency plays a critical role in wealth preservation by minimizing liabilities and protecting existing assets from erosion, while in wealth creation it focuses on strategic investment choices that maximize after-tax returns and compound growth. Balancing tax-efficient strategies such as tax-deferred accounts, loss harvesting, and income splitting enhances long-term financial stability and capital accumulation.

Legacy Planning

Legacy planning focuses on wealth preservation by ensuring assets are protected and efficiently transferred to future generations, minimizing tax liabilities and legal risks. While wealth creation emphasizes accumulating financial resources through investments and business growth, legacy planning prioritizes sustaining and safeguarding that wealth over time.

Income Generation

Income generation focuses on producing consistent cash flow through investments like dividend stocks, bonds, or rental properties, supporting wealth preservation by maintaining capital stability. Wealth creation emphasizes growth through higher-risk assets such as equities or startups, aiming to expand net worth over time while accepting potential volatility.

Growth Investing

Growth investing focuses on capital appreciation by targeting companies with high potential for earnings expansion, often prioritizing wealth creation over immediate income. This strategy contrasts with wealth preservation typically associated with conservative investments, as growth investing involves higher risk to achieve substantial financial gains over time.

Wealth Preservation vs Wealth Creation Infographic

moneydif.com

moneydif.com