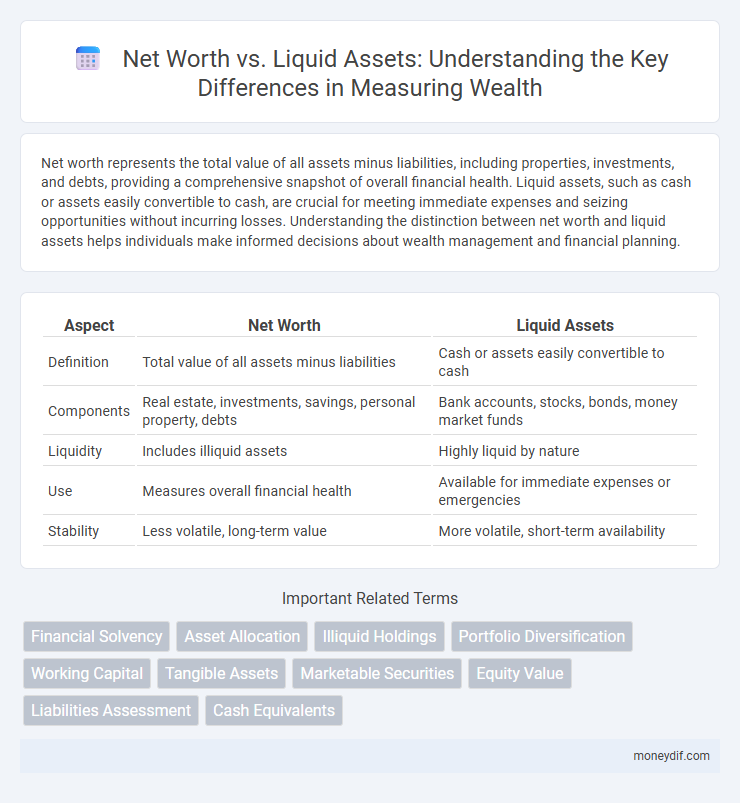

Net worth represents the total value of all assets minus liabilities, including properties, investments, and debts, providing a comprehensive snapshot of overall financial health. Liquid assets, such as cash or assets easily convertible to cash, are crucial for meeting immediate expenses and seizing opportunities without incurring losses. Understanding the distinction between net worth and liquid assets helps individuals make informed decisions about wealth management and financial planning.

Table of Comparison

| Aspect | Net Worth | Liquid Assets |

|---|---|---|

| Definition | Total value of all assets minus liabilities | Cash or assets easily convertible to cash |

| Components | Real estate, investments, savings, personal property, debts | Bank accounts, stocks, bonds, money market funds |

| Liquidity | Includes illiquid assets | Highly liquid by nature |

| Use | Measures overall financial health | Available for immediate expenses or emergencies |

| Stability | Less volatile, long-term value | More volatile, short-term availability |

Understanding Net Worth: A Comprehensive Overview

Net worth represents the total value of an individual's assets minus liabilities, providing a comprehensive snapshot of overall financial health. Liquid assets, such as cash or marketable securities, are a subset of assets that can be quickly converted to cash without significantly affecting their value. Understanding net worth in conjunction with liquid assets is crucial for effective wealth management and financial planning.

Defining Liquid Assets in Wealth Management

Liquid assets in wealth management refer to cash or assets that can be quickly converted to cash without significant loss of value, such as savings accounts, money market funds, and publicly traded stocks. Unlike net worth, which encompasses the total value of all assets including illiquid items like real estate and private investments, liquid assets provide immediate financial flexibility and are crucial for meeting short-term financial obligations. Understanding the distinction helps investors balance liquidity needs with long-term wealth accumulation strategies.

Key Differences Between Net Worth and Liquid Assets

Net worth represents the total value of all assets minus liabilities, encompassing real estate, investments, and personal property, while liquid assets specifically refer to cash or assets easily convertible to cash without significant loss of value. Liquid assets are crucial for immediate financial needs and emergencies, whereas net worth provides a comprehensive snapshot of overall financial health. Understanding the distinction helps in effective wealth management and strategic financial planning.

Why Liquid Assets Matter More in Financial Emergencies

Liquid assets like cash, savings accounts, and marketable securities provide immediate access to funds during financial emergencies, unlike net worth which includes illiquid assets such as real estate or retirement accounts that cannot be quickly converted to cash. Having sufficient liquid assets ensures individuals can cover unexpected expenses or income disruptions without incurring debt or forced asset sales. Financial advisors emphasize maintaining a liquidity reserve equal to three to six months of living expenses to safeguard against crises and maintain financial stability.

Calculating Your Net Worth: Step-by-Step Guide

Calculating your net worth involves listing all your assets, including cash, investments, real estate, and personal property, then subtracting your total liabilities such as mortgages, loans, and credit card debt. Liquid assets, a key component of net worth, refer to cash or assets easily convertible to cash without significant loss in value, providing financial flexibility and emergency funds. Maintaining an updated balance sheet of net worth and liquid assets helps track financial health, plan investment strategies, and set wealth-building goals effectively.

Assessing the True Value of Your Liquid Assets

Net worth represents the total value of all assets minus liabilities, while liquid assets specifically refer to cash or assets easily convertible to cash without significant loss. Accurately assessing liquid assets requires evaluating bank accounts, stocks, and bonds for their immediate availability and market volatility. Understanding the distinction helps in financial planning by highlighting accessible funds versus overall wealth tied up in less liquid investments like real estate or retirement accounts.

Net Worth Growth vs. Liquidity: What Should You Prioritize?

Net worth represents the total value of all assets minus liabilities, reflecting long-term financial health, while liquid assets are cash or assets that can be quickly converted to cash, offering immediate financial flexibility. Prioritizing net worth growth builds sustainable wealth through investments and asset appreciation, but maintaining sufficient liquidity ensures readiness for emergencies or opportunities. Balancing between growing net worth and preserving liquidity depends on individual financial goals, risk tolerance, and life circumstances.

Common Misconceptions About Net Worth and Liquid Wealth

Many individuals mistakenly equate net worth with liquid assets, overlooking that net worth includes non-liquid holdings like real estate and retirement accounts. Liquid assets, such as cash and marketable securities, represent immediate financial resources readily accessible for expenses or investments. Understanding the distinction between net worth and liquid wealth is crucial for accurate financial planning and effective wealth management.

Impact of Illiquid Assets on Financial Stability

Net worth includes all assets, both liquid and illiquid, while liquid assets represent readily accessible funds like cash and marketable securities. Illiquid assets such as real estate or private equity can inflate net worth but limit immediate financial flexibility, impacting short-term financial stability. High proportions of illiquid assets may create challenges in covering urgent expenses or seizing investment opportunities due to restricted liquidity.

Strategies to Improve Both Net Worth and Liquid Asset Holdings

Increasing net worth and liquid assets requires strategic financial planning involving diversified investment portfolios, regular asset reallocation, and disciplined savings habits. Prioritizing assets with high liquidity, such as stocks and cash equivalents, enhances liquid asset holdings without sacrificing long-term net worth growth driven by appreciating real estate or retirement accounts. Leveraging tax-advantaged accounts and minimizing unnecessary debt further optimizes overall wealth accumulation and financial flexibility.

Important Terms

Financial Solvency

Financial solvency is determined by the relationship between net worth and liquid assets, where net worth represents total assets minus liabilities, indicating overall financial health. Liquid assets, including cash and marketable securities, provide immediate funds necessary to meet short-term obligations, making their sufficiency critical for maintaining solvency.

Asset Allocation

Asset allocation strategically balances investments among various asset classes, directly impacting net worth growth and liquidity management. Prioritizing liquid assets within an allocation enhances financial flexibility, enabling timely access to funds without compromising long-term wealth accumulation.

Illiquid Holdings

Illiquid holdings, such as real estate, private equity, and collectibles, contribute significantly to an individual's net worth but are excluded from liquid assets due to their difficulty in rapid conversion to cash. Understanding the distinction between net worth and liquid assets is crucial for accurate financial planning and assessing immediate financial flexibility.

Portfolio Diversification

Portfolio diversification enhances financial stability by balancing net worth between liquid assets and non-liquid investments, reducing risk exposure. Allocating a strategic proportion of liquid assets ensures flexibility for immediate needs while leveraging non-liquid holdings supports long-term wealth growth.

Working Capital

Working capital, calculated as current assets minus current liabilities, is a key indicator of a company's short-term financial health and operational efficiency, directly influencing liquidity management. Net worth reflects the total equity available after liabilities, while liquid assets represent the most readily convertible resources to cash, both crucial for maintaining optimal working capital levels and ensuring solvency.

Tangible Assets

Tangible assets, such as real estate, machinery, and vehicles, significantly contribute to an individual's or company's net worth but are not considered liquid assets due to their low convertibility to cash without value loss. While liquid assets like cash, stocks, and bonds provide immediate financial flexibility, tangible assets represent long-term wealth and stability within the overall net worth portfolio.

Marketable Securities

Marketable securities are financial instruments that can be quickly converted into cash at a reasonable price, significantly enhancing an individual's liquid assets compared to overall net worth, which includes all non-liquid assets such as real estate and personal property. Their high liquidity makes marketable securities a crucial component in assessing an investor's financial flexibility and short-term solvency.

Equity Value

Equity value represents the ownership interest in a company, calculated as net worth which equals total assets minus total liabilities, whereas liquid assets refer to cash or assets that can be quickly converted into cash without significant loss of value, impacting the company's ability to meet short-term obligations. Net worth provides a broader measure of financial health while liquid assets specifically indicate immediate financial liquidity.

Liabilities Assessment

Liabilities assessment focuses on evaluating outstanding debts and obligations to determine their impact on net worth, which represents total assets minus total liabilities. Comparing net worth to liquid assets highlights financial flexibility, as liquid assets such as cash and marketable securities can quickly cover liabilities, ensuring solvency and risk management.

Cash Equivalents

Cash equivalents, such as treasury bills, money market funds, and short-term government bonds, are highly liquid assets that contribute directly to an individual's or company's liquid assets rather than net worth alone. These instruments provide immediate liquidity and can be quickly converted to cash without significant loss of value, distinguishing them from other components of net worth like fixed assets or investments with lower liquidity.

Net Worth vs Liquid Assets Infographic

moneydif.com

moneydif.com