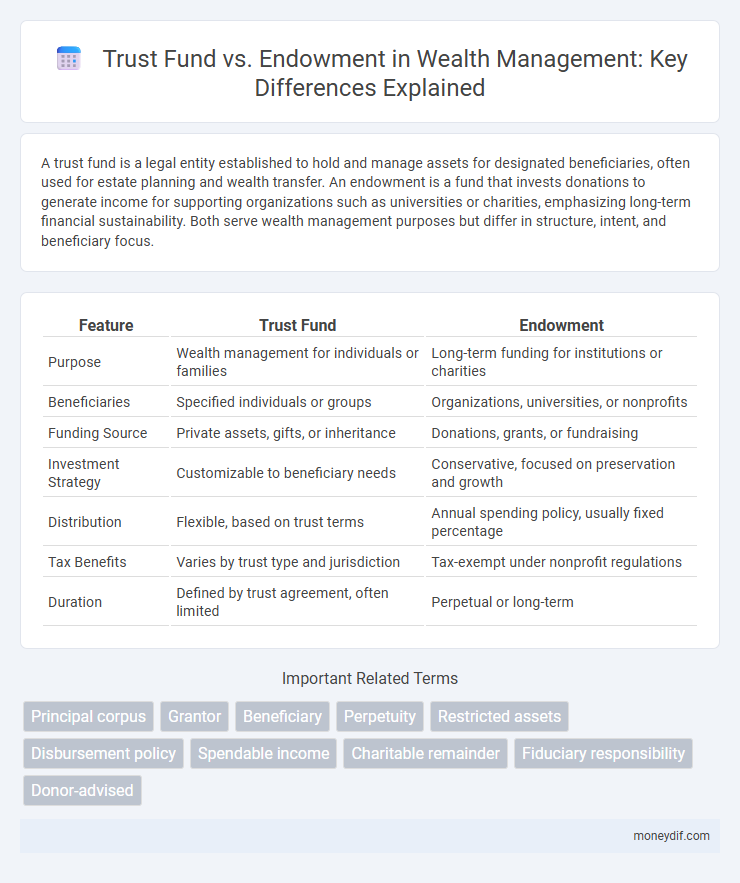

A trust fund is a legal entity established to hold and manage assets for designated beneficiaries, often used for estate planning and wealth transfer. An endowment is a fund that invests donations to generate income for supporting organizations such as universities or charities, emphasizing long-term financial sustainability. Both serve wealth management purposes but differ in structure, intent, and beneficiary focus.

Table of Comparison

| Feature | Trust Fund | Endowment |

|---|---|---|

| Purpose | Wealth management for individuals or families | Long-term funding for institutions or charities |

| Beneficiaries | Specified individuals or groups | Organizations, universities, or nonprofits |

| Funding Source | Private assets, gifts, or inheritance | Donations, grants, or fundraising |

| Investment Strategy | Customizable to beneficiary needs | Conservative, focused on preservation and growth |

| Distribution | Flexible, based on trust terms | Annual spending policy, usually fixed percentage |

| Tax Benefits | Varies by trust type and jurisdiction | Tax-exempt under nonprofit regulations |

| Duration | Defined by trust agreement, often limited | Perpetual or long-term |

Understanding Trust Funds: Key Features and Benefits

Trust funds are legal arrangements that hold and manage assets on behalf of beneficiaries, offering flexibility in distribution and control tailored to individual needs. They provide benefits such as asset protection, estate tax minimization, and financial security for heirs. Unlike endowments, trust funds can be structured for personalized purposes, including charitable giving or family wealth preservation.

What is an Endowment? Structure and Purpose

An endowment is a financial asset, usually in the form of donations, that is invested to generate a steady income for an organization, often a nonprofit or educational institution. Structured to preserve the principal while distributing earnings, endowments provide long-term financial stability and fund specific programs, scholarships, or operational needs. The purpose of an endowment is to ensure sustained support and growth, enabling organizations to achieve their mission over time without depleting the initial capital.

Trust Fund vs Endowment: Core Differences Explained

A trust fund is a legal entity established to hold and manage assets for designated beneficiaries, typically created by an individual or family, while an endowment is a financial asset, often held by institutions like universities or nonprofits, designed to provide a permanent funding source through investment income. Trust funds offer greater flexibility in terms of distributions and purpose, usually catering to personal wealth transfer and specific individual needs, whereas endowments emphasize long-term financial sustainability and support for organizational missions. Understanding these core differences helps in evaluating wealth management strategies aligned with personal legacy goals versus institutional funding stability.

Wealth Preservation: Trust Funds or Endowments?

Trust funds offer personalized wealth preservation by allowing grantors to specify asset distribution and management tailored to individual beneficiaries. Endowments focus on long-term sustainability by investing principal funds to generate consistent income, often supporting institutions or causes. Choosing between trust funds and endowments depends on whether the priority is customized beneficiary control or perpetual financial support.

Tax Implications: Trust Fund vs Endowment

Trust funds generally offer more flexibility in tax planning, allowing income to be distributed to beneficiaries who may be in lower tax brackets, potentially reducing overall tax liability. Endowments are often subject to specific tax regulations depending on whether they are part of a nonprofit organization, with earnings typically reinvested to preserve the principal and reduce taxable income. Understanding the distinct tax treatments of trust funds and endowments is crucial for effective wealth management and ensuring compliance with relevant tax codes.

Who Should Choose a Trust Fund?

Individuals seeking personalized control over asset distribution and flexible terms often choose a trust fund, especially when managing family wealth or providing for specific beneficiaries. Trust funds are suitable for people who want to protect assets from creditors, reduce estate taxes, or set conditions on inheritance based on milestones like age or education. High-net-worth families and professionals typically prefer trust funds to ensure privacy and tailored financial planning.

Who Benefits Most from an Endowment?

Endowments primarily benefit nonprofit organizations, educational institutions, and cultural entities by providing a stable, long-term source of funding through invested principal that generates ongoing income. Beneficiaries of endowments include university students, researchers, faculty, museum visitors, and community programs supported by the institution. Unlike trust funds, which often serve individual or family wealth management, endowments sustain public missions and drive societal impact.

Flexibility and Control: Trust Funds Compared to Endowments

Trust funds offer greater flexibility and direct control to beneficiaries or trustees, allowing customized distributions based on specific needs and goals. Endowments typically have more rigid structures with funds invested to generate income for long-term institutional use, limiting individual access or adjustments. The adaptable nature of trust funds makes them preferable for personalized wealth management compared to the more fixed framework of endowments.

Growth and Investment Strategies: Endowment vs Trust Fund

Endowments typically pursue diversified, long-term investment strategies designed to generate steady growth and preserve capital for perpetuity, often allocating assets in equities, bonds, real estate, and alternative investments. Trust funds, while also focused on growth, may adopt more flexible investment approaches based on the beneficiaries' needs and the trust's terms, balancing risk and liquidity to provide income or principal distributions. Both leverage professional portfolio management but differ in their horizon and spending policies influencing asset allocation and risk tolerance.

Which Option Best Fits Your Wealth Legacy Plan?

Trust funds offer personalized control and flexibility in asset distribution, ideal for individuals seeking tailored wealth transfer to specific beneficiaries. Endowments provide a structured, perpetually managed funding source, best suited for charitable organizations or long-term institutional wealth preservation. Choosing between them depends on your legacy goals, whether prioritizing customized family wealth management or sustainable philanthropic impact.

Important Terms

Principal corpus

The principal corpus in a trust fund represents the original assets invested, which remain intact while income generated is distributed to beneficiaries, contrasting with an endowment where the principal is often preserved to provide ongoing income. Trust funds maintain the principal for future growth or preservation, whereas endowments focus on long-term financial sustainability by balancing income distribution with principal preservation.

Grantor

A grantor establishes a trust fund by transferring assets to a trustee for beneficiaries, whereas an endowment is a fund typically created by a grantor to provide ongoing support for an institution, with principal preserved and income used for designated purposes.

Beneficiary

A beneficiary in a trust fund receives assets managed by a trustee according to the terms of the trust, often for specific purposes such as education or living expenses. In contrast, beneficiaries of an endowment benefit from income generated by invested principal, which is preserved to provide perpetual funding typically for institutions like universities or charities.

Perpetuity

Perpetuity in trust funds ensures indefinite asset management and income distribution, while endowments focus on preserving principal to generate sustainable funding for specific purposes.

Restricted assets

Restricted assets in trust funds are legally designated for specific purposes defined by donors or grantors, whereas endowment restricted assets are permanently invested to generate income while preserving the principal.

Disbursement policy

Disbursement policy for trust funds typically allows more flexible withdrawals to support ongoing operations, whereas endowment funds mandate stricter spending limits to preserve principal and generate long-term income.

Spendable income

Spendable income from a trust fund typically depends on the trust's terms and principal preservation, while endowment spendable income is calculated based on a fixed spending policy, often a percentage of the average market value.

Charitable remainder

A Charitable Remainder Trust (CRT) allows donors to receive income for life or a term of years before the remainder transfers to a designated charity, providing tax advantages and estate planning benefits. Unlike an endowment, which is a permanent fund generating income exclusively for a nonprofit's ongoing use, a CRT combines charitable giving with potential income streams for the donor or beneficiaries.

Fiduciary responsibility

Fiduciary responsibility requires trustees to prudently manage trust funds with specific beneficiary instructions, whereas endowment managers must preserve principal while generating sustainable income for institutional purposes.

Donor-advised

Donor-advised funds offer flexible, donor-controlled philanthropy with tax benefits, differing from trust funds that provide more rigid asset management and legal oversight. Unlike endowments designed to preserve principal and generate income perpetually, donor-advised funds allow immediate grant recommendations without long-term investment restrictions.

trust fund vs endowment Infographic

moneydif.com

moneydif.com