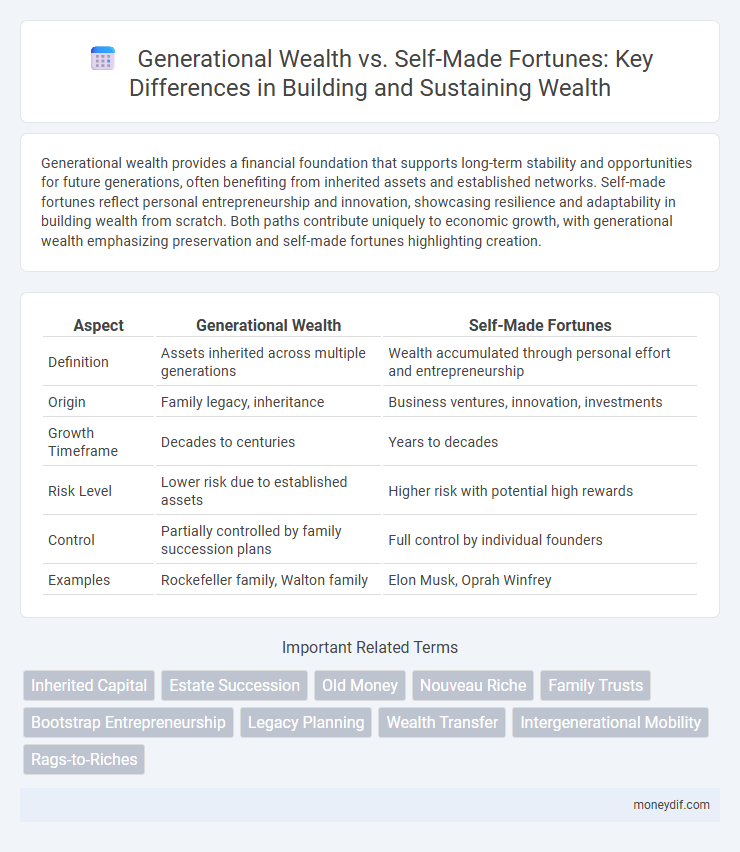

Generational wealth provides a financial foundation that supports long-term stability and opportunities for future generations, often benefiting from inherited assets and established networks. Self-made fortunes reflect personal entrepreneurship and innovation, showcasing resilience and adaptability in building wealth from scratch. Both paths contribute uniquely to economic growth, with generational wealth emphasizing preservation and self-made fortunes highlighting creation.

Table of Comparison

| Aspect | Generational Wealth | Self-Made Fortunes |

|---|---|---|

| Definition | Assets inherited across multiple generations | Wealth accumulated through personal effort and entrepreneurship |

| Origin | Family legacy, inheritance | Business ventures, innovation, investments |

| Growth Timeframe | Decades to centuries | Years to decades |

| Risk Level | Lower risk due to established assets | Higher risk with potential high rewards |

| Control | Partially controlled by family succession plans | Full control by individual founders |

| Examples | Rockefeller family, Walton family | Elon Musk, Oprah Winfrey |

Generational Wealth: Inheritance and Legacy

Generational wealth provides a financial foundation through inheritance, enabling families to preserve and grow assets across multiple generations. This form of wealth often includes real estate, investments, and business ownership, creating a legacy that supports long-term financial stability. Strategic estate planning and wealth transfer are crucial for maintaining and expanding generational wealth, ensuring it benefits heirs and sustains family prosperity.

The Self-Made Millionaire: Building Wealth from Scratch

Self-made millionaires demonstrate the power of strategic investing, disciplined saving, and entrepreneurial innovation to build significant wealth from zero. Unlike generational wealth, which benefits from inherited assets and financial legacies, self-made fortunes rely heavily on individual resilience, financial literacy, and market opportunities. Key factors such as leveraging technology, diversifying income streams, and continuous skill development are critical in transforming modest beginnings into substantial financial success.

Key Differences Between Generational and Self-Made Wealth

Generational wealth stems from assets and investments passed down through multiple family generations, often providing financial stability and long-term growth opportunities. Self-made fortunes are typically acquired through entrepreneurship, innovation, or career achievements, requiring significant risk-taking and strategic decision-making. Key differences include the origin of capital, with generational wealth benefiting from legacy advantages, while self-made wealth relies heavily on individual effort and market adaptability.

The Role of Family Values in Wealth Accumulation

Family values play a crucial role in wealth accumulation by fostering financial literacy, disciplined saving, and long-term investment mindsets across generations. Generational wealth often benefits from inherited attitudes toward money management, estate planning, and entrepreneurial risk-taking embedded within family culture. In contrast, self-made fortunes frequently rely on individual innovation and resilience but can establish new family values that propagate ongoing wealth building for future generations.

Economic Mobility and Barriers to Entry

Generational wealth provides a significant economic mobility advantage by offering established financial resources, inherited assets, and social capital that reduce barriers to entry in investment and business opportunities. In contrast, self-made fortunes often require overcoming systemic obstacles such as limited access to education, capital, and networks, which can hinder upward mobility. Understanding the disparities between these wealth-building paths highlights the persistent challenges in achieving equitable economic advancement.

Psychological Impact: Inherited vs. Earned Wealth

Inherited wealth often brings a complex psychological impact, including feelings of entitlement or pressure to uphold family legacy, influencing financial decision-making and personal identity. In contrast, self-made fortunes typically foster a stronger sense of accomplishment and resilience, reinforcing individual agency and confidence in wealth management. Understanding these psychological differences is crucial for advisors tailoring strategies that support long-term financial well-being and emotional fulfillment.

Wealth Preservation Strategies Across Generations

Generational wealth preservation relies heavily on strategic estate planning, trust funds, and tax-efficient asset management to ensure wealth continuity across multiple generations. Self-made fortunes often require implementing disciplined financial education, diversified investments, and proactive risk management to maintain and grow wealth over time. Leveraging professional advisory services and modern wealth management tools plays a crucial role in safeguarding assets and transferring wealth effectively between heirs.

Cultural Perceptions of Old Money vs New Money

Cultural perceptions of old money emphasize heritage, stability, and understated wealth, often associating generational wealth with privilege and social status maintained over decades. New money, or self-made fortunes, is frequently viewed through the lens of innovation, risk-taking, and rapid financial success, sometimes attracting skepticism or envy due to the abrupt rise in economic power. These differing views influence societal attitudes toward financial behavior, lifestyle choices, and intergenerational wealth transfer strategies.

Tax Implications: Passing Down vs Earning Wealth

Generational wealth often benefits from favorable estate tax exemptions and stepped-up basis rules, reducing capital gains tax liabilities for heirs, whereas self-made fortunes may face higher income and capital gains taxes during the accumulation phase. Trust structures and gifting strategies are crucial in preserving wealth across generations by minimizing estate taxes. Tax planning for self-made individuals concentrates on income tax optimization and capital gains management, while generational wealth transfer focuses on inheritance tax efficiency.

Shaping the Future: Educating Heirs vs Empowering Entrepreneurs

Generational wealth creates a foundation for future generations by educating heirs on financial literacy, estate planning, and responsible asset management to preserve and grow inherited assets. Self-made fortunes emphasize empowering entrepreneurs with skills in innovation, risk-taking, and business acumen, driving economic growth through new ventures and job creation. Balancing both approaches ensures sustainable wealth by combining legacy knowledge with dynamic, entrepreneurial adaptability.

Important Terms

Inherited Capital

Inherited capital often provides a financial foundation that accelerates wealth preservation and growth across generations, contrasting with self-made fortunes which typically result from entrepreneurial risk-taking and innovation. Studies show that generational wealth enables access to superior education, investment opportunities, and networks, while self-made wealth emphasizes individual effort and resilience in market-driven economies.

Estate Succession

Estate succession planning ensures the efficient transfer of generational wealth, preserving family assets and minimizing tax liabilities across multiple heirs. In contrast, self-made fortunes often require tailored strategies focused on asset protection and wealth growth to sustain financial independence and legacy for future generations.

Old Money

Old Money refers to wealth inherited across multiple generations, often associated with established family estates and long-term financial stability, contrasting sharply with self-made fortunes that arise from individual entrepreneurship, innovation, and rapid economic mobility. Generational wealth typically offers sustained social status and access to exclusive networks, while self-made wealth emphasizes personal achievement and dynamic wealth accumulation in modern markets.

Nouveau Riche

Nouveau Riche individuals often showcase wealth acquired rapidly, contrasting with generational wealth that accumulates over multiple generations through inherited assets and legacy investments. Self-made fortunes emphasize entrepreneurial success and innovative ventures, highlighting personal effort and risk-taking rather than inheritance.

Family Trusts

Family trusts serve as strategic tools to preserve generational wealth by safeguarding assets, minimizing estate taxes, and ensuring smooth wealth transfer across multiple generations. In contrast, self-made fortunes often rely on entrepreneurial ventures and individual financial strategies, facing greater risks without the protective structure and long-term planning benefits that family trusts provide.

Bootstrap Entrepreneurship

Bootstrap entrepreneurship emphasizes building businesses with minimal external funding, fostering resourcefulness and financial discipline essential for self-made fortunes. This approach contrasts with generational wealth, which provides inherited capital and support, often reducing initial financial risks faced by entrepreneurs.

Legacy Planning

Legacy planning focuses on structuring assets to ensure generational wealth sustains across multiple family members and future generations, often involving trusts, estates, and tax strategies. Self-made fortunes prioritize wealth accumulation through entrepreneurship and investment, requiring distinct legacy planning approaches to preserve and transition these independently acquired assets.

Wealth Transfer

Wealth transfer involves passing assets from one generation to the next, often emphasizing the strategic preservation and growth of generational wealth through trusts and estate planning. Self-made fortunes rely on individual entrepreneurship and innovation, yet leveraging established generational wealth can accelerate wealth accumulation and sustainability across lifetimes.

Intergenerational Mobility

Intergenerational mobility is influenced by the balance between generational wealth and self-made fortunes, where inherited assets often provide a significant advantage in education, housing, and investment opportunities. Studies show individuals relying on self-made wealth face greater socioeconomic barriers, resulting in slower upward mobility compared to those benefiting from established family wealth.

Rags-to-Riches

Rags-to-riches stories highlight individuals who build self-made fortunes through innovation and entrepreneurship, often overcoming significant socioeconomic barriers. In contrast, generational wealth provides financial stability and opportunities passed down through family inheritance, influencing long-term wealth accumulation and economic mobility.

Generational Wealth vs Self-Made Fortunes Infographic

moneydif.com

moneydif.com