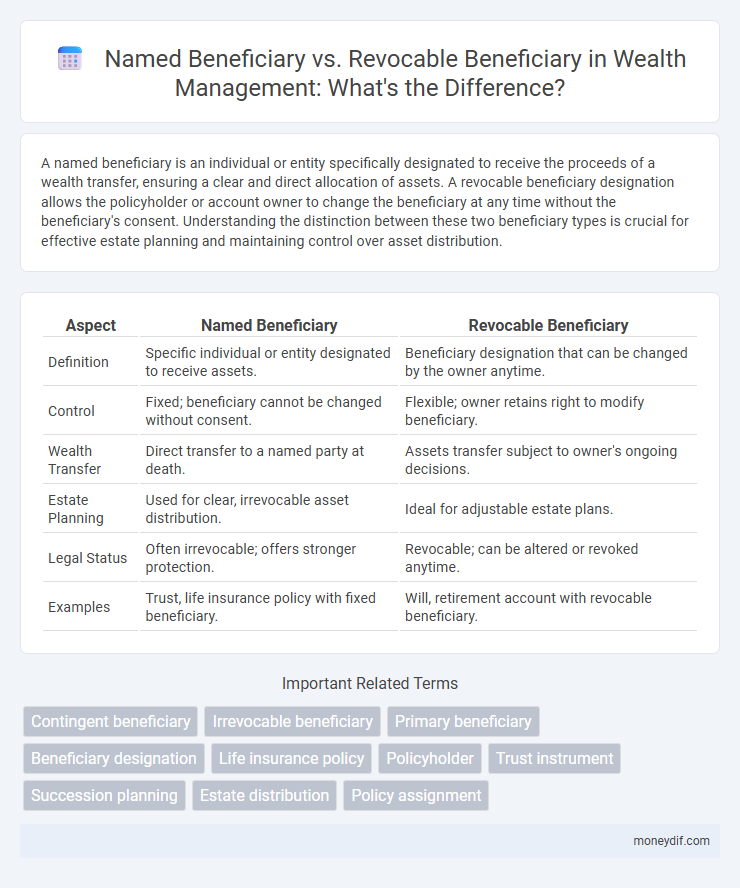

A named beneficiary is an individual or entity specifically designated to receive the proceeds of a wealth transfer, ensuring a clear and direct allocation of assets. A revocable beneficiary designation allows the policyholder or account owner to change the beneficiary at any time without the beneficiary's consent. Understanding the distinction between these two beneficiary types is crucial for effective estate planning and maintaining control over asset distribution.

Table of Comparison

| Aspect | Named Beneficiary | Revocable Beneficiary |

|---|---|---|

| Definition | Specific individual or entity designated to receive assets. | Beneficiary designation that can be changed by the owner anytime. |

| Control | Fixed; beneficiary cannot be changed without consent. | Flexible; owner retains right to modify beneficiary. |

| Wealth Transfer | Direct transfer to a named party at death. | Assets transfer subject to owner's ongoing decisions. |

| Estate Planning | Used for clear, irrevocable asset distribution. | Ideal for adjustable estate plans. |

| Legal Status | Often irrevocable; offers stronger protection. | Revocable; can be altered or revoked anytime. |

| Examples | Trust, life insurance policy with fixed beneficiary. | Will, retirement account with revocable beneficiary. |

Understanding Named Beneficiaries in Wealth Management

Named beneficiaries in wealth management specify exact individuals entitled to receive assets from accounts like IRAs, life insurance policies, or trusts, ensuring precise distribution according to the owner's wishes. Unlike revocable beneficiaries, who can be changed by the account holder at any time, named beneficiaries provide clearer legal standing for asset transfer upon the owner's death. Properly designating named beneficiaries helps avoid probate, reduce estate taxes, and ensures efficient wealth transfer aligned with estate planning goals.

What Is a Revocable Beneficiary?

A revocable beneficiary is a designated individual or entity who can receive benefits from a financial account or insurance policy, with the account owner retaining the right to change or remove the beneficiary at any time. This flexibility allows the policyholder to adapt their distribution plans based on life changes such as marriage, divorce, or financial goals. Unlike an irrevocable beneficiary, a revocable beneficiary has no guaranteed claim to the assets until the owner finalizes the transfer upon death.

Key Differences Between Named and Revocable Beneficiaries

Named beneficiaries are specific individuals or entities designated to receive assets directly from a trust or insurance policy, ensuring clear and direct transfer upon the owner's death. Revocable beneficiaries provide flexibility, allowing the policyholder to change or revoke the beneficiary designation at any time without consent, which helps maintain control over asset distribution. Key differences lie in the permanence and control over the beneficiary designation, impacting estate planning strategies and tax implications.

How Beneficiary Designations Impact Wealth Distribution

Named beneficiaries provide a clear directive for wealth distribution by specifying exact individuals or entities to receive assets, ensuring precise allocation according to the owner's wishes. Revocable beneficiaries offer flexibility, allowing the account holder to modify or revoke designations, which can adapt to changing financial or familial circumstances without requiring probate. Understanding the differences between these beneficiary types is crucial for estate planning, as they directly influence how efficiently and accurately wealth passes to heirs or designated parties.

Legal Implications of Selecting a Named Beneficiary

Selecting a named beneficiary directly influences the legal transfer of assets upon the policyholder's death, ensuring clear ownership without probate delays. Unlike revocable beneficiaries who can be changed by the policyholder at any time, named beneficiaries often have a stronger legal claim, potentially complicating estate planning if not regularly updated. Properly designating and reviewing named beneficiaries mitigates disputes and guarantees the intended distribution of wealth.

Flexibility and Control With Revocable Beneficiary Status

A revocable beneficiary designation offers greater flexibility and control over wealth distribution, allowing account holders to change beneficiaries at any time without consent. Named beneficiaries provide clarity and specificity but lack the adaptability that revocable status grants during changing financial or personal circumstances. This flexibility is crucial for estate planning, ensuring assets can be reallocated swiftly to reflect evolving priorities and relationships.

Tax Considerations for Named vs Revocable Beneficiaries

Named beneficiaries have ownership rights that often bypass probate, potentially reducing estate taxes and providing direct asset transfer benefits. Revocable beneficiaries, typically changeable by the policy owner, may not offer the same tax advantages due to lack of irrevocability, impacting estate inclusion and possible tax liabilities. Understanding the tax implications in estate planning is crucial, particularly concerning gift taxes, estate taxes, and income tax obligations tied to beneficiary designations.

Protecting Wealth Through Strategic Beneficiary Choices

Choosing a named beneficiary ensures precise asset distribution by directly specifying who inherits your wealth, reducing legal disputes and probate delays. A revocable beneficiary designation allows flexibility to change beneficiaries as financial situations or family dynamics evolve, providing adaptive control over the estate plan. Strategic beneficiary selections safeguard wealth by aligning asset transfer with long-term financial goals and minimizing tax burdens.

Common Mistakes in Designating Beneficiaries

Common mistakes in designating beneficiaries include confusing named beneficiaries with revocable beneficiaries, leading to unintended asset distribution. Named beneficiaries are specifically identified individuals or entities entitled to receive assets, while revocable beneficiaries allow the grantor to change the designation without consent. Failing to update revocable beneficiary designations after life changes, such as marriage or divorce, can cause disputes and delays in wealth transfer.

Best Practices for Updating Beneficiary Designations

Updating beneficiary designations regularly ensures your wealth transfers align with your current intentions and family dynamics. Named beneficiaries provide specific individuals or entities, while revocable beneficiaries offer flexibility, allowing changes without court approval. Best practices include reviewing designations after major life events and confirming alignment with estate planning documents to avoid conflicts or unintended disinheritance.

Important Terms

Contingent beneficiary

A contingent beneficiary receives assets if the named beneficiary is unable to inherit, serving as a secondary recipient in estate planning. Unlike a revocable beneficiary whose designation can be changed by the policyholder at any time, a contingent beneficiary's claim activates only upon the prior beneficiary's death or disqualification.

Irrevocable beneficiary

An irrevocable beneficiary in a life insurance policy cannot be changed or removed without their consent, offering greater protection to the beneficiary compared to a revocable beneficiary, whose designation the policyholder can alter at any time. Named beneficiaries specify exact individuals or entities, ensuring clear distribution of benefits, whereas revocable beneficiaries provide flexibility for the policyholder to update their choices.

Primary beneficiary

A primary beneficiary is the individual or entity designated to receive assets from an insurance policy or retirement account upon the policyholder's death, holding priority over named contingent or secondary beneficiaries. Unlike a revocable beneficiary, a primary beneficiary's designation can be changed by the policyholder at any time, whereas a named beneficiary specifically refers to a person explicitly identified in the policy documents, regardless of priority or revocability status.

Beneficiary designation

A named beneficiary is explicitly identified in a policy or account document, ensuring clarity in asset distribution upon the owner's death. A revocable beneficiary designation allows the owner to change or revoke the beneficiary without the beneficiary's consent, providing flexibility in estate planning.

Life insurance policy

A life insurance policy's named beneficiary is the individual or entity explicitly designated to receive the death benefit, whereas a revocable beneficiary allows the policy owner to change or revoke the designation at any time without the beneficiary's consent. Understanding this distinction is crucial for estate planning, as named beneficiaries provide clarity, while revocable beneficiaries offer flexibility in managing beneficiary designations.

Policyholder

A policyholder designates a named beneficiary to receive insurance proceeds, ensuring precise allocation of benefits, while a revocable beneficiary status allows the policyholder to modify or revoke the beneficiary designation without prior consent. This flexibility in revocable beneficiary arrangements helps maintain control over the policy's distribution, contrasting with irrevocable beneficiaries, whose consent is typically required for changes.

Trust instrument

A trust instrument delineates the legal framework for asset management, specifying roles including named beneficiaries who have a fixed entitlement, contrasting with revocable beneficiaries whose interests can be altered or revoked by the grantor. Understanding the distinctions between named and revocable beneficiaries is crucial for estate planning, ensuring clarity in asset distribution and maintaining control over beneficiary designations.

Succession planning

Succession planning involves designating a named beneficiary who receives assets directly upon the owner's death, ensuring a clear transfer without probate, while a revocable beneficiary designation allows changes during the asset owner's lifetime, providing flexibility but potentially complicating the succession process. Clear differentiation between named and revocable beneficiaries is critical for tax implications, asset protection, and estate distribution efficiency.

Estate distribution

Estate distribution involving a named beneficiary ensures assets transfer directly to the individual specified, bypassing probate and expediting the process, whereas a revocable beneficiary can be changed or revoked by the account holder during their lifetime, providing flexibility but potentially complicating final asset allocation. Clear designation and understanding of named versus revocable beneficiaries are crucial for effective estate planning and avoiding disputes.

Policy assignment

A policy assignment transfers ownership rights of an insurance policy to another party, impacting beneficiary designations by prioritizing the assignee's interests over named beneficiaries. Revocable beneficiaries can be changed by the policy owner without consent, whereas named beneficiaries have specific claims that may be affected by the assignment depending on the policy type.

Named beneficiary vs revocable beneficiary Infographic

moneydif.com

moneydif.com