A family office offers personalized wealth management services solely for one ultra-high-net-worth family, ensuring tailored investment strategies, estate planning, and philanthropy coordination. In contrast, a multifamily office serves multiple families, pooling resources to reduce costs while maintaining access to comprehensive financial expertise and diversified services. Both structures prioritize wealth preservation and growth but differ in customization, scale, and cost-efficiency.

Table of Comparison

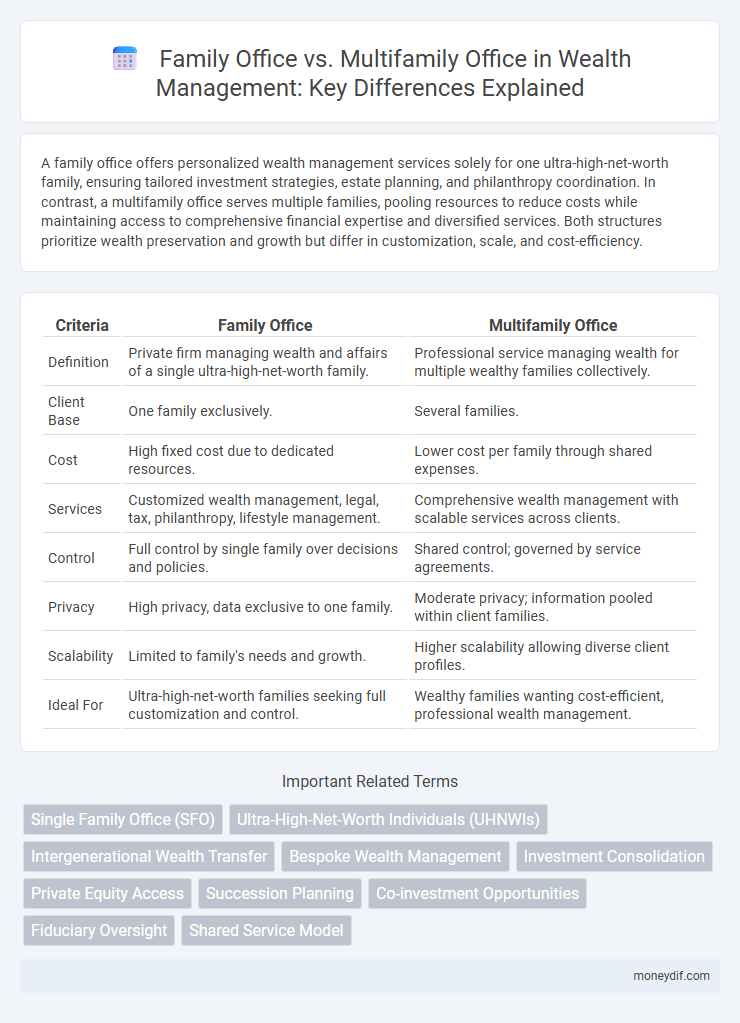

| Criteria | Family Office | Multifamily Office |

|---|---|---|

| Definition | Private firm managing wealth and affairs of a single ultra-high-net-worth family. | Professional service managing wealth for multiple wealthy families collectively. |

| Client Base | One family exclusively. | Several families. |

| Cost | High fixed cost due to dedicated resources. | Lower cost per family through shared expenses. |

| Services | Customized wealth management, legal, tax, philanthropy, lifestyle management. | Comprehensive wealth management with scalable services across clients. |

| Control | Full control by single family over decisions and policies. | Shared control; governed by service agreements. |

| Privacy | High privacy, data exclusive to one family. | Moderate privacy; information pooled within client families. |

| Scalability | Limited to family's needs and growth. | Higher scalability allowing diverse client profiles. |

| Ideal For | Ultra-high-net-worth families seeking full customization and control. | Wealthy families wanting cost-efficient, professional wealth management. |

Defining Family Offices and Multifamily Offices

Family offices manage the wealth and financial affairs of a single ultra-high-net-worth family, offering personalized services such as investment management, estate planning, and tax optimization. Multifamily offices provide similar comprehensive wealth management services but cater to multiple families, sharing resources to achieve economies of scale while maintaining tailored strategies for each client. Both types prioritize asset protection, legacy planning, and customized financial solutions to preserve and grow family wealth across generations.

Key Differences Between Family Offices and Multifamily Offices

Family offices provide personalized wealth management services exclusively for a single ultra-high-net-worth family, focusing on tailored investment strategies, estate planning, and private concierge services. Multifamily offices serve multiple wealthy families, leveraging economies of scale to offer a broader range of standardized financial services, including tax optimization, risk management, and consolidated reporting. The key differences lie in their client base, customization level, and operational costs, with family offices offering bespoke solutions and multifamily offices emphasizing collaborative expertise and cost efficiency.

Wealth Management Services Offered

Family offices provide personalized wealth management services tailored to a single ultra-high-net-worth family, including investment management, estate planning, tax advisory, and philanthropic coordination. Multifamily offices offer these comprehensive services to multiple families, leveraging shared resources to reduce costs while maintaining customizable strategies for each client. Both structures emphasize asset preservation, risk management, and succession planning to ensure long-term financial security across generations.

Cost Structures and Fee Arrangements

Family offices typically incur higher fixed costs due to their bespoke services tailored exclusively for a single wealthy family, often involving a dedicated team managing investments, estate planning, and tax strategies. Multifamily offices spread operating expenses across multiple clients, offering more cost-effective fee arrangements that usually combine a percentage of assets under management with fixed fees, providing scalable wealth management solutions. This difference in cost structures means family offices require significant capital commitment while multifamily offices present a more accessible, flexible option for affluent families seeking comprehensive financial oversight.

Client Personalization and Privacy

Family offices offer highly personalized wealth management services tailored specifically to the unique needs and preferences of a single ultra-high-net-worth family, ensuring maximal privacy through exclusive, dedicated resources. Multifamily offices provide consolidated services for multiple families, balancing cost efficiency with personalized solutions while maintaining strict confidentiality protocols to protect client data. Both structures prioritize client privacy but differ in the degree of customization, with single-family offices delivering deeper bespoke solutions compared to the broader, standardized approach of multifamily offices.

Scalability and Resource Allocation

Family offices typically serve a single high-net-worth family, allowing for highly personalized wealth management but limited scalability due to dedicated resources. Multifamily offices manage multiple families' assets, leveraging shared resources and technology to achieve greater scalability and cost efficiency. This pooled approach enables broader access to investment opportunities and specialized services, optimizing resource allocation across a diverse client base.

Governance and Decision-Making Processes

Family offices typically offer centralized governance with decision-making concentrated among a few family members or a dedicated executive team, enabling streamlined and personalized wealth management. Multifamily offices implement more structured governance frameworks to accommodate multiple families, often involving advisory boards or committees that ensure balanced representation and collaborative decision-making. Both models emphasize transparency and accountability but differ in scope, with multifamily offices striving for standardized processes to address diverse family interests.

Investment Strategies and Access

Family offices offer tailored investment strategies focused on individual family goals with direct access to exclusive private equity, venture capital, and alternative assets. Multifamily offices leverage pooled resources to provide diversified, cost-efficient investment opportunities across multiple families, often gaining broader market access and institutional-grade research. Both structures prioritize risk management and wealth preservation but differ in customization level and scalability of investment services.

Succession Planning and Legacy Preservation

Family offices specialize in tailored succession planning and legacy preservation for a single ultra-high-net-worth family, ensuring personalized wealth transition strategies aligned with unique family values. Multifamily offices serve multiple families, offering scalable succession frameworks and diversified legacy solutions while optimizing cost-efficiency and professional governance. Prioritizing intergenerational wealth transfer, both models integrate estate planning, philanthropic advisory, and tax optimization to safeguard family wealth across generations.

Choosing the Right Office Structure for Your Family’s Wealth

Selecting the appropriate office structure for managing family wealth depends on factors such as the size of assets, complexity of financial needs, and desired level of personalized service. A single-family office offers tailored solutions exclusively for one family's wealth management but typically requires substantial resources and capital commitment. Multifamily offices provide shared services to multiple families, reducing costs while benefiting from collective expertise and diversified investment opportunities.

Important Terms

Single Family Office (SFO)

A Single Family Office (SFO) manages the wealth and affairs of one affluent family, offering personalized investment, estate planning, and concierge services, whereas a Multifamily Office (MFO) serves multiple families by providing scaled financial management and administrative support.

Ultra-High-Net-Worth Individuals (UHNWIs)

Ultra-High-Net-Worth Individuals (UHNWIs) often prefer single-family offices for personalized wealth management tailored to their unique financial goals and legacy planning. Multifamily offices provide a cost-effective alternative by pooling resources from multiple UHNWIs, offering diversified investment opportunities and comprehensive fiduciary services.

Intergenerational Wealth Transfer

Intergenerational wealth transfer ensures the seamless preservation and growth of assets across multiple generations, with family offices providing tailored, centralized management for a single family's financial legacy. Multifamily offices expand these services by optimizing operational efficiencies and fostering shared resources, enabling multiple families to collaboratively safeguard and enhance their wealth over time.

Bespoke Wealth Management

Bespoke wealth management tailors financial strategies to the unique needs of high-net-worth families, often through a family office that provides personalized services such as estate planning, tax optimization, and investment management. In contrast, a multifamily office serves multiple affluent families, offering shared resources and cost efficiencies while maintaining customized wealth solutions tailored to each family's specific goals and values.

Investment Consolidation

Investment consolidation in family offices streamlines asset management and reporting, while multifamily offices leverage consolidated investments to optimize cost efficiencies and diversified strategies across multiple client families.

Private Equity Access

Private Equity access in a Family Office typically offers tailored investment strategies with direct control and customized risk profiles, whereas Multifamily Offices leverage pooled assets from multiple families to provide diversified deal flow and reduced individual expenses. Family Offices emphasize personalized governance and legacy planning, while Multifamily Offices benefit from economies of scale and broader market access.

Succession Planning

Succession planning in family offices focuses on preserving wealth and leadership within a single family, while multifamily offices implement diversified strategies to manage and transition assets across multiple families efficiently.

Co-investment Opportunities

Co-investment opportunities in family offices often provide direct access to niche investments and personalized deal flow typically unavailable to multifamily offices that aggregate capital across multiple families, thereby offering diversified risk but potentially diluted influence. Family offices benefit from tailored co-investment ventures aligned with singular family wealth and values, whereas multifamily offices leverage pooled expertise and broader networks to access larger, more syndicated co-investment deals.

Fiduciary Oversight

Fiduciary oversight in a family office involves personalized management of a single family's wealth, ensuring tailored investment strategies and asset protection aligned with their unique goals. In contrast, a multifamily office provides fiduciary oversight to multiple families, leveraging shared resources and diversified expertise to optimize collective financial growth while maintaining individualized service.

Shared Service Model

The shared service model in family office versus multifamily office structures optimizes operational efficiency by centralizing administrative, financial, and investment management functions across multiple client families to reduce costs and enhance service quality.

family office vs multifamily office Infographic

moneydif.com

moneydif.com