Roth IRAs offer tax-free withdrawals in retirement since contributions are made with after-tax dollars, while Traditional IRAs provide tax-deductible contributions with taxes deferred until withdrawal. Choosing between a Roth and Traditional IRA depends on your current tax bracket and expected tax rate in retirement. Maximizing retirement savings requires understanding how each account's tax treatment aligns with your long-term financial goals.

Table of Comparison

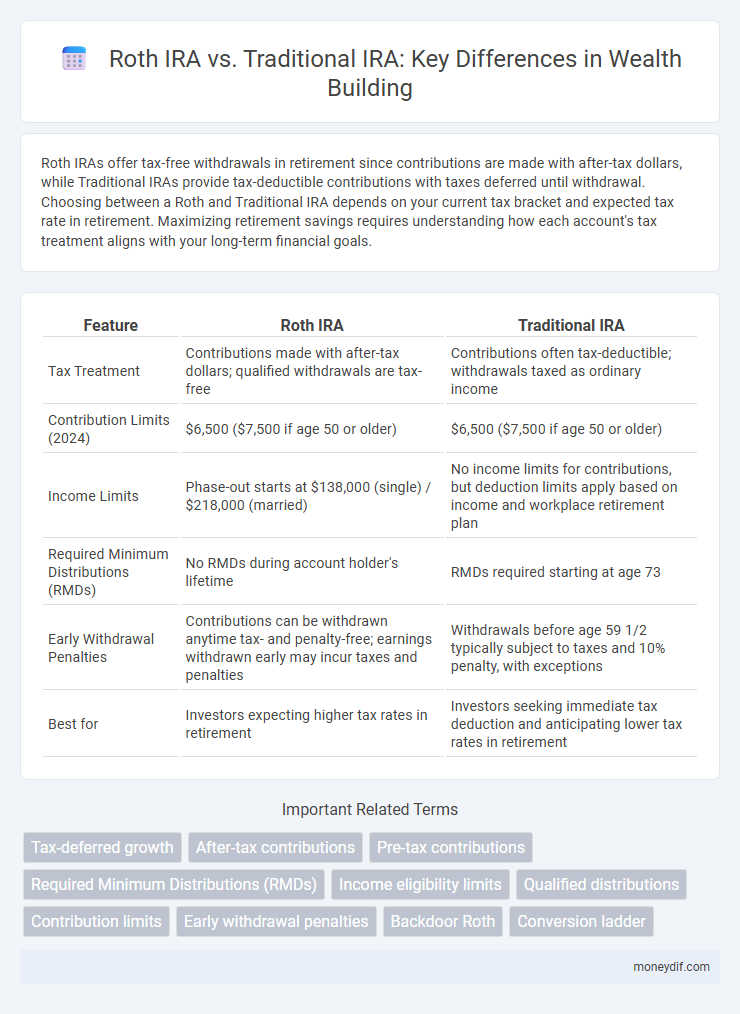

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Tax Treatment | Contributions made with after-tax dollars; qualified withdrawals are tax-free | Contributions often tax-deductible; withdrawals taxed as ordinary income |

| Contribution Limits (2024) | $6,500 ($7,500 if age 50 or older) | $6,500 ($7,500 if age 50 or older) |

| Income Limits | Phase-out starts at $138,000 (single) / $218,000 (married) | No income limits for contributions, but deduction limits apply based on income and workplace retirement plan |

| Required Minimum Distributions (RMDs) | No RMDs during account holder's lifetime | RMDs required starting at age 73 |

| Early Withdrawal Penalties | Contributions can be withdrawn anytime tax- and penalty-free; earnings withdrawn early may incur taxes and penalties | Withdrawals before age 59 1/2 typically subject to taxes and 10% penalty, with exceptions |

| Best for | Investors expecting higher tax rates in retirement | Investors seeking immediate tax deduction and anticipating lower tax rates in retirement |

Understanding Roth IRA and Traditional IRA

Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement, while Traditional IRA contributions may be tax-deductible, but withdrawals are taxed as ordinary income. Roth IRAs have no required minimum distributions (RMDs) during the account holder's lifetime, offering greater flexibility in retirement planning. Traditional IRAs require account holders to start taking RMDs at age 73, impacting long-term wealth accumulation strategies.

Eligibility Criteria for Roth and Traditional IRAs

Roth IRA eligibility requires individuals to have earned income below specific IRS income limits, which currently phase out at modified adjusted gross incomes of $138,000 to $153,000 for single filers and $218,000 to $228,000 for married couples filing jointly. Traditional IRAs impose no income limits for contributions but offer tax-deductible benefits based on income levels and participation in employer-sponsored retirement plans, with phase-outs starting at $73,000 for single filers and $116,000 for married couples filing jointly in 2024. Both accounts require contributors to be under age 70 1/2 for Traditional IRAs, while Roth IRAs have no age limits, allowing contributions at any age given eligible earned income.

Tax Advantages: Roth vs Traditional IRA

Roth IRAs offer tax-free growth and tax-free withdrawals in retirement, allowing investors to pay taxes upfront on contributions. Traditional IRAs provide tax-deferred growth, with contributions often tax-deductible, reducing taxable income during the contribution year but taxing withdrawals as ordinary income. Choosing between Roth and Traditional IRAs depends on current versus expected future tax rates, maximizing tax savings either now or in retirement.

Contribution Limits and Rules

Roth IRA contributions for 2024 are capped at $6,500 annually, with a $1,000 catch-up limit for those aged 50 and older, subject to income phase-outs starting at $138,000 for single filers. Traditional IRA contributions share the same limit but may be tax-deductible depending on income, filing status, and workplace retirement plan coverage. Roth IRAs require contributions to be made with after-tax dollars and allow tax-free withdrawals, whereas Traditional IRAs often offer pre-tax contributions with taxable distributions during retirement.

Withdrawal Rules and Penalties

Roth IRA withdrawals are tax-free and penalty-free if the account holder is over 59 1/2 and the account has been open for at least five years, with contributions accessible anytime without penalties. Traditional IRA withdrawals before age 59 1/2 typically incur a 10% early withdrawal penalty and are subject to ordinary income taxes on the amount withdrawn. Required Minimum Distributions (RMDs) apply to Traditional IRAs starting at age 73, whereas Roth IRAs do not have RMD requirements during the account holder's lifetime.

Required Minimum Distributions (RMDs) Comparison

Roth IRAs do not require Required Minimum Distributions (RMDs) during the account holder's lifetime, allowing assets to grow tax-free for a longer period. In contrast, Traditional IRAs mandate RMDs starting at age 73, forcing withdrawals that are taxable as ordinary income. This key difference significantly impacts retirement planning strategies and tax efficiency.

Long-Term Growth Potential

Roth IRAs offer tax-free growth and tax-free withdrawals in retirement, maximizing long-term wealth accumulation for investors expecting higher future tax rates. Traditional IRAs provide upfront tax deductions but require taxable distributions, which can reduce the total compound growth over time. Choosing a Roth IRA can enhance long-term growth potential by allowing earnings to grow without tax drag during retirement.

Ideal Candidates for Each IRA Type

Roth IRAs are ideal for younger investors or those expecting higher future tax rates, as contributions are made with after-tax dollars and qualified withdrawals are tax-free. Traditional IRAs suit individuals seeking immediate tax deductions or those in higher-income brackets currently anticipating lower tax rates in retirement. Understanding eligibility rules, income limits, and retirement goals helps determine the most beneficial IRA type for long-term wealth growth.

Impact on Retirement Income and Planning

Roth IRAs offer tax-free withdrawals during retirement, allowing for greater income flexibility and reduced tax liability when planning distributions. Traditional IRAs provide tax-deferred growth with taxable withdrawals, potentially lowering taxable income during working years but increasing tax exposure upon retirement. Strategic selection based on current tax brackets, expected retirement tax rates, and income needs can optimize long-term retirement income and financial security.

Choosing the Right IRA for Your Wealth Goals

Choosing between a Roth IRA and a Traditional IRA depends on your current tax situation and future income expectations. Roth IRAs offer tax-free withdrawals in retirement, benefiting those who anticipate higher tax rates later, while Traditional IRAs provide immediate tax deductions, ideal if you expect lower taxes during retirement. Aligning your IRA choice with your wealth goals and projected tax brackets maximizes long-term growth and retirement savings.

Important Terms

Tax-deferred growth

Tax-deferred growth in a Traditional IRA allows investments to grow without taxes until withdrawals begin, typically at retirement, whereas a Roth IRA offers tax-free growth with contributions made after-tax, enabling tax-free withdrawals under qualified conditions. Understanding these differences is crucial for optimizing retirement savings strategies based on current tax brackets and future tax expectations.

After-tax contributions

After-tax contributions to a Roth IRA grow tax-free and qualified withdrawals are tax-exempt, while Traditional IRA contributions may be tax-deductible but withdrawals are taxed as ordinary income. Roth IRA after-tax funds offer more flexible withdrawal options without required minimum distributions (RMDs), unlike Traditional IRAs, which mandate RMDs starting at age 73.

Pre-tax contributions

Pre-tax contributions to a Traditional IRA reduce taxable income in the year of the contribution, enabling tax-deferred growth until withdrawals begin, whereas Roth IRA contributions are made with after-tax dollars and grow tax-free. Choosing between the two depends on current versus expected future tax rates, with Traditional IRAs favored for immediate tax savings and Roth IRAs preferred for tax-free distributions during retirement.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) apply to Traditional IRAs starting at age 73, mandating annual withdrawals that are taxable as ordinary income, whereas Roth IRAs do not require RMDs during the original account holder's lifetime, allowing tax-free growth and withdrawals. This key difference makes Roth IRAs advantageous for those seeking to minimize taxable income and preserve assets for beneficiaries.

Income eligibility limits

Income eligibility limits for Roth IRA contributions in 2024 begin to phase out at $138,000 for single filers and $218,000 for married filing jointly, whereas Traditional IRA contributions have no income limits but deductibility phases out starting at $73,000 for single filers covered by a workplace retirement plan and $116,000 for married couples filing jointly. Understanding these income thresholds is critical for maximizing tax benefits and contribution strategies between Roth IRAs, which offer tax-free withdrawals, and Traditional IRAs, which allow tax-deductible contributions.

Qualified distributions

Qualified distributions from a Roth IRA are tax-free and penalty-free if the account is held for at least five years and the account holder is over age 59 1/2, while distributions from a Traditional IRA are taxed as ordinary income upon withdrawal and may incur a 10% penalty if taken before age 59 1/2 without an exception. Roth IRAs do not require minimum distributions (RMDs) during the account owner's lifetime, whereas Traditional IRAs mandate RMDs starting at age 73 under current IRS rules.

Contribution limits

Roth IRA contribution limits for 2024 are $6,500 annually, or $7,500 if you're age 50 or older, with eligibility phased out starting at $138,000 modified adjusted gross income (MAGI) for single filers, while Traditional IRA contribution limits match Roth's but allow tax-deductible contributions depending on income and participation in employer retirement plans. Unlike Traditional IRAs, Roth IRAs do not have required minimum distributions (RMDs) during the account holder's lifetime, making contribution phase-outs and tax treatment key factors in choosing between the two.

Early withdrawal penalties

Early withdrawal penalties for Roth IRAs typically apply to earnings withdrawn before age 59 1/2 and before the account is five years old, resulting in a 10% IRS penalty plus income taxes on earnings, while contributions can be withdrawn tax- and penalty-free at any time. Traditional IRA early withdrawals before age 59 1/2 usually incur a 10% penalty on the amount withdrawn along with ordinary income taxes, except for qualified exceptions such as first-time home purchase or higher education expenses.

Backdoor Roth

Backdoor Roth IRA allows high-income earners to contribute indirectly to a Roth IRA by converting non-deductible Traditional IRA contributions, bypassing income limits associated with direct Roth IRA contributions. This strategy leverages the tax-free growth and withdrawal benefits of Roth IRAs, contrasting with Traditional IRAs that offer tax-deferred growth but taxable withdrawals in retirement.

Conversion ladder

The conversion ladder strategy involves systematically converting funds from a Traditional IRA to a Roth IRA over several years to minimize tax impact while allowing tax-free withdrawals in retirement. This approach capitalizes on the Roth IRA's advantages, such as no required minimum distributions (RMDs) and tax-free growth, making it a strategic move for those seeking flexible, tax-efficient retirement income.

Roth IRA vs Traditional IRA Infographic

moneydif.com

moneydif.com