Real assets, such as real estate, precious metals, and commodities, provide tangible value and act as a hedge against inflation, preserving wealth over time. Financial assets, including stocks, bonds, and mutual funds, offer liquidity and potential for income through dividends and interest. Diversifying between real and financial assets helps balance risk and return, ensuring a resilient and comprehensive investment portfolio.

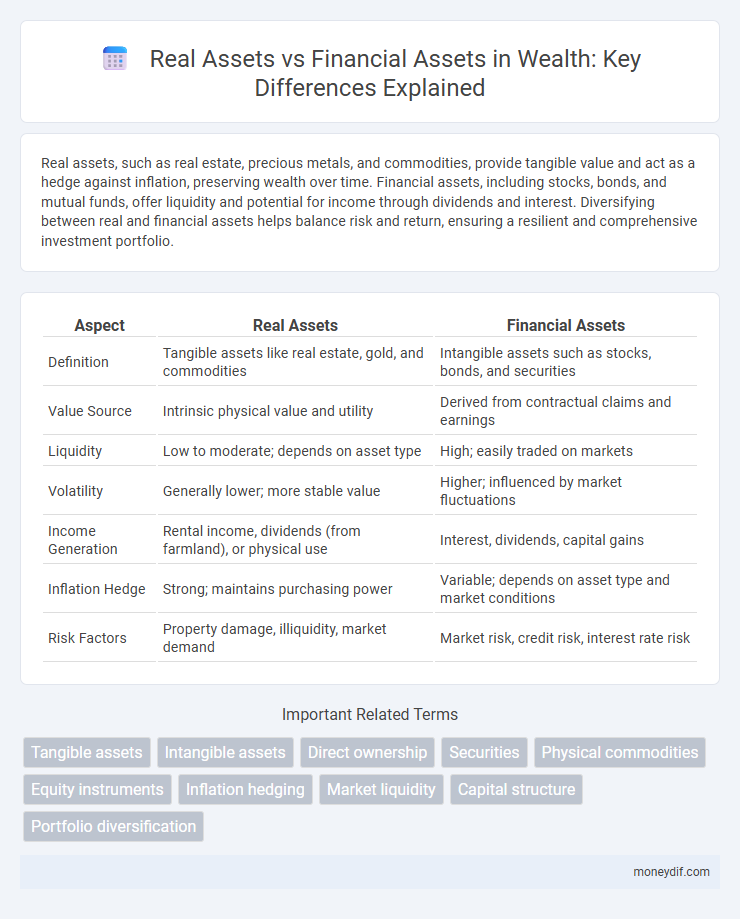

Table of Comparison

| Aspect | Real Assets | Financial Assets |

|---|---|---|

| Definition | Tangible assets like real estate, gold, and commodities | Intangible assets such as stocks, bonds, and securities |

| Value Source | Intrinsic physical value and utility | Derived from contractual claims and earnings |

| Liquidity | Low to moderate; depends on asset type | High; easily traded on markets |

| Volatility | Generally lower; more stable value | Higher; influenced by market fluctuations |

| Income Generation | Rental income, dividends (from farmland), or physical use | Interest, dividends, capital gains |

| Inflation Hedge | Strong; maintains purchasing power | Variable; depends on asset type and market conditions |

| Risk Factors | Property damage, illiquidity, market demand | Market risk, credit risk, interest rate risk |

Definition and Key Characteristics of Real Assets

Real assets are physical or tangible assets such as real estate, infrastructure, and commodities that hold intrinsic value due to their substance and utility. These assets provide a hedge against inflation and typically offer stable cash flows through rental income or usage rights. Unlike financial assets, real assets are less volatile and not directly dependent on financial market fluctuations, making them a crucial component in diversified wealth portfolios.

Understanding Financial Assets: An Overview

Financial assets represent ownership of value in non-physical form, including stocks, bonds, and bank deposits, which offer liquidity and potential income through dividends or interest. These assets facilitate wealth accumulation by providing market-driven returns while carrying varying degrees of risk influenced by market volatility and economic conditions. Unlike real assets such as property or commodities, financial assets are intangible and rely on contractual claims for future financial benefits.

Tangibility: Real Assets vs Financial Assets

Real assets, such as real estate and commodities, possess physical tangibility, providing intrinsic value and protection against inflation. Financial assets, including stocks and bonds, represent ownership or claims without physical form, relying on the issuer's creditworthiness and market conditions. The tangible nature of real assets often attracts investors seeking stability and long-term value preservation compared to the more liquid but intangible financial assets.

Role of Real Assets in Wealth Preservation

Real assets such as real estate, commodities, and precious metals play a critical role in wealth preservation by providing tangible value that typically withstands inflation and market volatility better than financial assets like stocks and bonds. These assets offer diversification benefits, reduce portfolio risk, and often generate steady income streams through rent or dividends. Investors seeking long-term security frequently allocate a portion of their wealth to real assets to safeguard purchasing power and achieve stable growth.

Liquidity Comparison: Real vs Financial Assets

Financial assets like stocks and bonds offer high liquidity, allowing investors to quickly convert holdings into cash with minimal transaction costs. Real assets such as real estate or commodities typically have lower liquidity due to longer transaction times and higher costs associated with selling. The liquidity difference impacts portfolio flexibility and risk management, making financial assets more suitable for short-term needs while real assets serve long-term wealth preservation.

Risk and Return Profiles: A Comparative Analysis

Real assets, such as real estate and commodities, typically offer lower liquidity but provide tangible value and inflation hedging, resulting in moderate risk with potential for steady returns. Financial assets, including stocks and bonds, exhibit higher liquidity and market volatility, which can lead to greater short-term returns but also increased risk exposure. Investors often balance portfolios by combining real assets' stability with the growth potential of financial assets to optimize risk-adjusted returns.

Inflation Hedge Potential: Which Asset Wins?

Real assets such as real estate and commodities often outperform financial assets during periods of high inflation due to their intrinsic value and limited supply, making them effective inflation hedges. Financial assets like stocks and bonds may lose purchasing power as inflation erodes fixed income returns and dampens corporate profits. Historical data shows real assets provide more stable wealth preservation when inflation rates surge beyond central bank targets.

Portfolio Diversification with Real and Financial Assets

Portfolio diversification combining real assets such as real estate, commodities, and infrastructure with financial assets like stocks and bonds enhances risk-adjusted returns by reducing overall portfolio volatility. Real assets provide inflation protection and low correlation to traditional financial markets, stabilizing wealth during market downturns. Incorporating both asset types creates a balanced investment strategy that leverages the growth potential of financial assets and the tangible value of real assets.

Ownership Structure and Control Implications

Real assets represent tangible ownership of physical property such as real estate or commodities, providing direct control and influence over the asset's use and management. Financial assets, including stocks and bonds, signify claims against an entity with ownership rights mediated through contractual agreements, often limiting direct control for investors. This distinction in ownership structure critically impacts decision-making authority, risk exposure, and potential for influence over asset performance.

Choosing the Right Mix for Long-Term Wealth Building

Real assets, such as real estate and commodities, provide tangible value and inflation protection, while financial assets like stocks and bonds offer liquidity and potential for income generation. Balancing these asset types in a diversified portfolio helps mitigate risk and enhance long-term wealth growth. Investors should consider their risk tolerance, investment horizon, and economic conditions when selecting the optimal mix of real and financial assets.

Important Terms

Tangible assets

Tangible assets are physical, real assets such as land, buildings, and machinery, providing intrinsic value and often used in production or investment. Unlike financial assets, which represent ownership or claims without physical substance, tangible assets offer direct utility and are less susceptible to market volatility.

Intangible assets

Intangible assets, unlike real assets such as property or equipment, represent non-physical resources like intellectual property, trademarks, and patents that contribute to a company's value and competitive advantage. Financial assets, including stocks and bonds, differ from intangible assets by being tradable securities reflecting ownership or claims, whereas intangible assets are internally generated or acquired rights that enhance revenue potential without physical substance.

Direct ownership

Direct ownership in real assets involves holding tangible property such as real estate, infrastructure, or natural resources, providing physical control and potential income through usage or leasing. In contrast, direct ownership in financial assets pertains to holding securities like stocks or bonds, which represent claims on earnings or assets without physical possession, emphasizing liquidity and market-driven valuation.

Securities

Securities represent financial assets such as stocks and bonds, which derive value from contractual claims rather than physical ownership, contrasting with real assets like real estate and commodities that hold intrinsic value. Investors often balance portfolios by combining securities, offering liquidity and income potential, with real assets that provide inflation protection and tangible equity.

Physical commodities

Physical commodities such as gold, oil, and agricultural products represent tangible real assets that provide intrinsic value and can serve as a hedge against inflation, unlike financial assets which are intangible claims like stocks and bonds reliant on market performance. Real assets offer direct ownership and utility, often maintaining value during economic downturns, whereas financial assets depend on issuer solvency and market conditions for returns.

Equity instruments

Equity instruments represent ownership interest in financial assets such as stocks, offering claims on company profits and capital appreciation, unlike real assets which include physical properties like real estate and commodities. These financial equity instruments provide liquidity and marketability, whereas real assets typically involve tangible value and potential for income generation through rents or usage.

Inflation hedging

Real assets such as real estate, commodities, and infrastructure typically provide a stronger inflation hedge compared to financial assets like stocks and bonds due to their intrinsic value and ability to adjust prices with inflation. The tangible nature and limited supply of real assets help preserve purchasing power during inflationary periods, whereas financial assets often suffer from declining real returns when inflation rises.

Market liquidity

Market liquidity for real assets such as real estate and commodities tends to be lower compared to financial assets like stocks and bonds due to higher transaction costs, longer transaction times, and less standardized valuation methods. Financial assets benefit from centralized exchanges and electronic trading platforms, enabling faster execution and easier conversion to cash, which enhances their overall liquidity.

Capital structure

Capital structure decisions influence the balance between real assets, such as property, equipment, and infrastructure, and financial assets like stocks, bonds, and cash equivalents within a company's portfolio. Optimizing this structure enhances firm value by managing asset liquidity, risk exposure, and investment returns aligned with strategic financial objectives.

Portfolio diversification

Portfolio diversification reduces risk by allocating investments between real assets, such as real estate and commodities, and financial assets like stocks and bonds, enhancing stability and returns. Real assets provide inflation protection and tangible value, while financial assets offer liquidity and income generation.

Real assets vs financial assets Infographic

moneydif.com

moneydif.com