Qualified dividends are taxed at the lower long-term capital gains rate, offering significant tax savings compared to nonqualified dividends, which are taxed at ordinary income tax rates. To be considered qualified, dividends must be paid by U.S. corporations or qualified foreign corporations and meet specific holding period requirements. Understanding the distinction between qualified and nonqualified dividends is essential for optimizing after-tax investment returns.

Table of Comparison

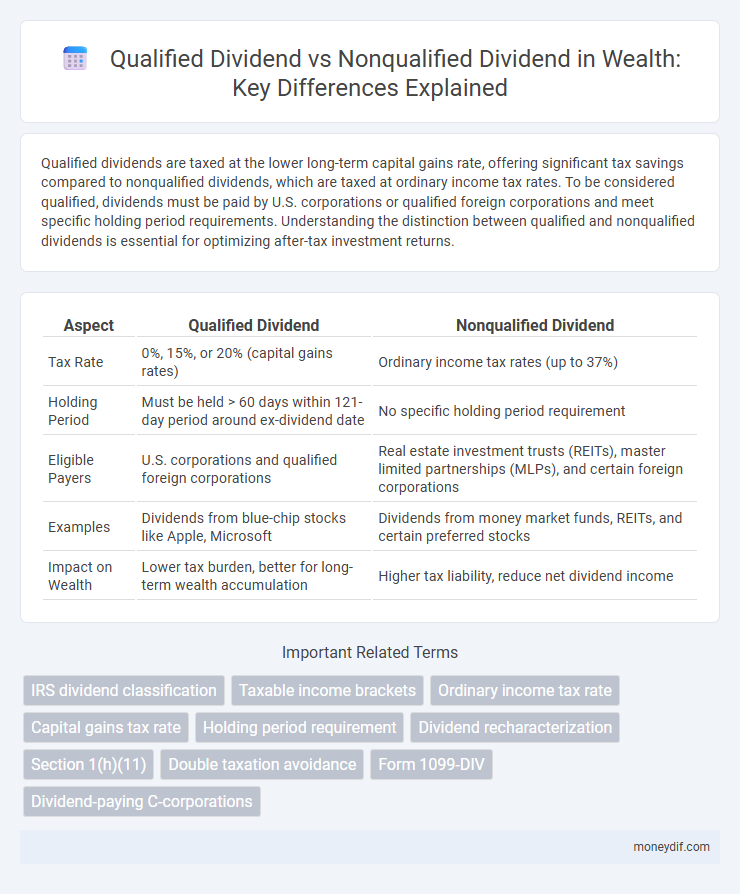

| Aspect | Qualified Dividend | Nonqualified Dividend |

|---|---|---|

| Tax Rate | 0%, 15%, or 20% (capital gains rates) | Ordinary income tax rates (up to 37%) |

| Holding Period | Must be held > 60 days within 121-day period around ex-dividend date | No specific holding period requirement |

| Eligible Payers | U.S. corporations and qualified foreign corporations | Real estate investment trusts (REITs), master limited partnerships (MLPs), and certain foreign corporations |

| Examples | Dividends from blue-chip stocks like Apple, Microsoft | Dividends from money market funds, REITs, and certain preferred stocks |

| Impact on Wealth | Lower tax burden, better for long-term wealth accumulation | Higher tax liability, reduce net dividend income |

Understanding Qualified vs Nonqualified Dividends

Qualified dividends are taxed at the lower long-term capital gains tax rates, typically ranging from 0% to 20%, depending on the taxpayer's income bracket, making them more tax-efficient for investors. Nonqualified dividends are taxed as ordinary income at the investor's federal income tax rate, which can be significantly higher, thus reducing the effective return on investment. Understanding the distinction between qualified and nonqualified dividends is crucial for optimizing tax strategies and maximizing after-tax portfolio income.

Key Differences Between Dividend Types

Qualified dividends are taxed at the lower long-term capital gains rates, typically 0%, 15%, or 20%, depending on the taxpayer's income bracket, while nonqualified dividends are taxed at ordinary income tax rates. To qualify, dividends must be paid by a U.S. corporation or qualified foreign corporation and held for a specific minimum period, usually more than 60 days during the 121-day period surrounding the ex-dividend date. Nonqualified dividends, often from real estate investment trusts (REITs) or certain foreign companies, do not meet these criteria and result in higher tax liabilities.

Tax Implications of Qualified Dividends

Qualified dividends are subject to favorable tax rates, typically ranging from 0% to 20%, depending on the taxpayer's income bracket, significantly lower than the ordinary income tax rates applied to nonqualified dividends. These dividends must meet specific criteria, including being paid by a U.S. corporation or a qualified foreign corporation and held for a minimum period, to qualify for the reduced tax rate. Nonqualified dividends, on the other hand, are taxed at ordinary income rates, which can result in a higher tax burden for investors receiving these payments.

Tax Treatment for Nonqualified Dividends

Nonqualified dividends are taxed as ordinary income, subject to the investor's marginal tax rate which can be significantly higher than the rate applied to qualified dividends. Unlike qualified dividends that benefit from preferential long-term capital gains tax rates, nonqualified dividends do not meet the holding period or issuer criteria, leading to higher tax liabilities. Investors receiving nonqualified dividends should consider the impact on their overall tax bracket and plan dividend income strategically to optimize tax efficiency.

Eligibility Criteria for Qualified Dividends

Qualified dividends must be paid by a U.S. corporation or a qualified foreign corporation and meet specific holding period requirements, such as holding the stock for more than 60 days during the 121-day period surrounding the ex-dividend date. Nonqualified dividends, also known as ordinary dividends, fail to meet these criteria and are taxed at ordinary income tax rates. Understanding the eligibility criteria for qualified dividends is essential to optimize tax efficiency and maximize after-tax returns on investment portfolios.

Impact on Investment Returns

Qualified dividends receive favorable tax treatment at long-term capital gains rates, typically ranging from 0% to 20%, which can significantly enhance after-tax investment returns. Nonqualified dividends are taxed as ordinary income at higher rates, often up to 37%, reducing the net yield of dividend-paying investments. Investors seeking to maximize wealth accumulation should prioritize stocks with qualified dividends to optimize tax efficiency and improve overall portfolio performance.

Strategies to Maximize Qualified Dividends

Maximizing qualified dividends involves investing in stocks of U.S. corporations or qualified foreign corporations that meet holding period requirements, typically more than 60 days within the 121-day period around the ex-dividend date. Tax-efficient strategies include focusing on dividend-paying blue-chip companies and utilizing tax-advantaged accounts like IRAs or 401(k)s to shield qualified dividends from higher ordinary income tax rates. Monitoring dividend payout ratios and reinvesting qualified dividends can enhance long-term wealth accumulation by leveraging preferential tax treatment, which incentivizes holding periods and portfolio allocation aligned with qualified dividend criteria.

How to Identify Your Dividend Type

Identify your dividend type by reviewing the dividend classification on your Form 1099-DIV issued by your brokerage or company. Qualified dividends typically come from U.S. corporations or qualified foreign corporations and meet specific holding period requirements, usually held for more than 60 days within the 121-day period around the ex-dividend date. Nonqualified dividends, often referred to as ordinary dividends, fail to meet these criteria and are taxed at your ordinary income tax rates.

IRS Rules on Dividend Classification

The IRS classifies dividends into qualified and nonqualified categories based on specific holding periods and the type of payer, with qualified dividends taxed at the lower long-term capital gains rates. To qualify, the dividend must be paid by a U.S. corporation or a qualified foreign corporation, and the shareholder must hold the stock for more than 60 days during the 121-day period surrounding the ex-dividend date. Nonqualified dividends, including those from certain real estate investment trusts (REITs) or dividends failing holding period requirements, are taxed at ordinary income tax rates according to IRS rules on dividend classification.

Long-Term Wealth Planning With Dividends

Qualified dividends benefit from lower long-term capital gains tax rates, making them a strategic component in wealth accumulation and preservation. Nonqualified dividends are taxed at higher ordinary income rates, potentially diminishing overall investment returns when held long-term. Incorporating qualified dividends into a diversified portfolio enhances tax efficiency, contributing significantly to sustained wealth growth and optimized estate planning.

Important Terms

IRS dividend classification

Qualified dividends must meet specific IRS criteria, including being paid by a U.S. corporation or qualified foreign corporation and held for a minimum period, allowing them to be taxed at reduced long-term capital gains rates. Nonqualified dividends, which do not satisfy these requirements, are taxed at ordinary income tax rates, often resulting in a higher tax burden for investors.

Taxable income brackets

Taxable income brackets determine the tax rates applied to qualified dividends, which are taxed at long-term capital gains rates of 0%, 15%, or 20% depending on income level, whereas nonqualified dividends are taxed as ordinary income at rates ranging from 10% to 37%. For 2024, taxpayers with taxable income up to $44,625 (single) or $89,250 (married filing jointly) pay 0% on qualified dividends, while higher brackets face increased rates, but nonqualified dividends consistently follow regular income tax brackets regardless of filing status.

Ordinary income tax rate

Ordinary income tax rates apply to nonqualified dividends, which are taxed at rates ranging from 10% to 37% based on the taxpayer's income bracket, whereas qualified dividends benefit from preferential tax rates of 0%, 15%, or 20%, aligned with long-term capital gains tax rates. The distinction hinges on holding periods and the type of stock, with qualified dividends requiring shares to be held for more than 60 days within the 121-day period surrounding the ex-dividend date.

Capital gains tax rate

Capital gains tax rates for qualified dividends align with long-term capital gains rates, typically 0%, 15%, or 20% based on income brackets, offering a lower tax burden compared to nonqualified dividends, which are taxed at ordinary income tax rates ranging from 10% to 37%. Qualified dividends require the stock to be held for more than 60 days during the 121-day period surrounding the ex-dividend date, ensuring favorable capital gains treatment, whereas nonqualified dividends do not meet these criteria and are taxed at the higher ordinary rates.

Holding period requirement

Holding period requirements mandate investors to hold stock for more than 60 days during the 121-day period surrounding the ex-dividend date to qualify for lower tax rates on qualified dividends; dividends failing to meet this criterion are classified as nonqualified and taxed at ordinary income rates. This distinction affects tax planning, as qualified dividends receive a preferential tax rate ranging from 0% to 20%, while nonqualified dividends are subject to standard federal income tax brackets.

Dividend recharacterization

Dividend recharacterization involves reclassifying dividends from qualified to nonqualified status, impacting tax rates and investor returns. Qualified dividends meet specific IRS criteria, including holding period requirements, to qualify for lower long-term capital gains tax rates, while nonqualified dividends are taxed as ordinary income.

Section 1(h)(11)

Section 1(h)(11) of the Internal Revenue Code defines qualified dividends as those paid by U.S. corporations or qualified foreign corporations, held for a specific minimum period to receive preferential tax rates. Nonqualified dividends, which include dividends from certain foreign corporations, money market funds, or paid on short-held stock, are taxed at ordinary income tax rates according to this section's provisions.

Double taxation avoidance

Double taxation avoidance treaties help reduce or eliminate taxes on qualified dividends, which are subject to lower preferential tax rates under the Internal Revenue Code; nonqualified dividends, however, are taxed at ordinary income tax rates and generally do not benefit from such treaty protections. Investors should review applicable tax treaties and IRS guidelines to optimize after-tax returns by differentiating between qualified dividend income and nonqualified dividend income.

Form 1099-DIV

Form 1099-DIV reports dividends, categorizing them into qualified dividends, which are taxed at lower long-term capital gains rates, and nonqualified dividends, subject to ordinary income tax rates. Investors use this form to accurately report dividend income on tax returns, distinguishing between these types to optimize tax liabilities.

Dividend-paying C-corporations

Dividend-paying C-corporations distribute earnings to shareholders in two primary forms: qualified dividends, which are taxed at the lower long-term capital gains rates, and nonqualified dividends, subject to higher ordinary income tax rates. The classification depends on holding periods and the type of shares held, impacting investors' after-tax returns and corporate dividend strategies.

Qualified dividend vs Nonqualified dividend Infographic

moneydif.com

moneydif.com